Ecosystem-Owned Liquidity (EOL): Demarketizing Access to Preferential Yield

Introduction:

Ecosystem-Owned Liquidity (EOL) represents a new financial model in which decentralized protocols manage liquidity instead of relying on external market participants. This approach diminishes dependence on traditional market makers and institutional investors, democratizing access to preferential yields and making high-yield financial opportunities available to a wider audience.

Key Concepts Covered in This Content :

1) MLFs

2) Mitosis vault infrastructure

3) Dissecting EOL

4) Understanding Preferential Yield & Gatekeeping

5) conclusion

1) MLFs

Mitosis,a network that transform decentralized finance [deFi] liquidity into a programmable primitive. MLFs that's is, Mitosis liquidity frameworks is the established mechanism for deploying users capital within the Mitosis ecosystem through structured framework. It this way establishes the terms of the relationship between mitosis LPs [liquidity providers] and liquidity campaigns run by the participating deFi protocols, including rewards accrual and distribution details,campaigns durations and lock up requirements. Each MLF operate it own MLF asset. miAsset for EOL and maAssets for matrix

• Asset Deposit process

The deposit process serves as the fundamental entry point into Mitosis ecosystem. Through Mitosis Vaults, user can securely deposit asset and receive corresponding vanilla asset representations on the Mitosis chain.

2) Mitosis Vault infrastructure

Mitosis vault are smart contracts deployed across supported blockchain protocols. The vault system maintains modular architecture to support multiple asset types and ensure seamless integration with various DeFi protocols

• Asset Deposit process

The deposit process serves as the fundamental entry point into Mitosis ecosystem. Through Mitosis Vaults, user can securely deposit asset and receive corresponding vanilla asset representations on the Mitosis chain.

• Deposit process

I.e Arb Eth -> deposit -> mitosis eth(vanillani asset) ~> eol/matrix -> mieth/maeth

▪︎ Asset receptor: The vault contracts receive and secure the deposited asset

▪︎ Bridge communication: Deposit information tranmits to the assets manager on the Mitosis chain via an arbitrary message bridge

▪︎ Vanilla asset minting: Asset manager mints equivalent vinalla asset in a 1:1 ratio

▪︎ User distribution: Newly minted vanilla asset transferred to user address on the Mitosis chain.

• Asset withdrawal process:

withdrawal request: User initiates withdrawal through asset manager

Vanilla asset burning: Asset manager burns the specified quantity of user's vanilla Asset

Bridge communication: withdrawal instructions relayed to the appropriate vault

Asset release: Vault transfers deposited asset to user on deposit chain.

3) DISSECTING EOL

The EOL framework is a governance - driven approach of liquidity allocations. EOL enables collective management of pooled assets through democratic processes with governance proportional to the participants stake in the system.

• Vanilla Assets

vanilla assets(weETH, cmETH) refer to a standard, unmodified component or element within the game. This means it is an original asset that has not been altered, customized, or enhanced by third-party content. For example, user A deposited monad Eth into Mitosis vault, the asset manager mints equivalent vanilla asset at a 1:1 ratio

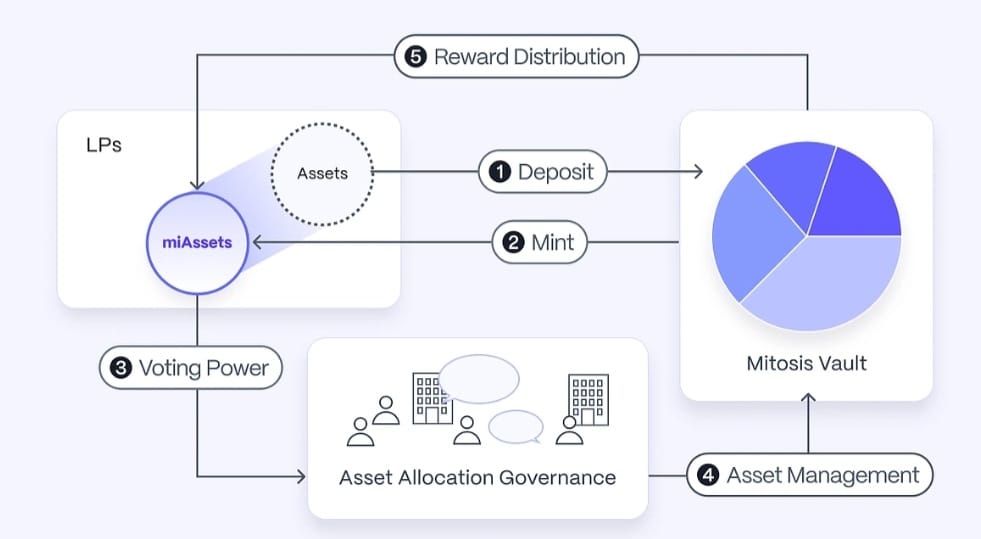

• miAsset

When a user provides a vanilla asset to EOL, the system mints [miAsset] for the user on the Mitosis chain. MiAsset grants economic rights to the underlying assets, including yield and governance rights over liquidity allocation decisions within the EOL MLF. MiAsset holders can use their voting power to make critical decisions that drive EOL's operations.

• EOL Governance Structure

EOL operations rely on miAsset holders actively participating in governance. The EOL governance system utilizes a two-phase process to oversee the selection of approved protocols and the allocation of liquidity;

■ Initiation: this integrates new DeFi protocol into the EOL to become eligible to receive the the Mitosis LPs liquidity.

■ Gauge: Governance periodically determine how much liquidity should be to each approved protocols in the EOL system and execute liquidity rebalancing based on these votes.

• Benefit of EOL system over traditional models

Traditional Model: ◇ Liquidity Provisions (LPs) → Rent-seeking → Control over yield ◇ Protocols → Pay high rewards to retain LPs

• EOL system

Protocol-Owned Liquidity → Self-sustaining yield Community benefits

4) Understanding Preferential Yield & Gatekeeping

Preferential Yield refers to above-average returns on investments typically accessible to institutional investors, hedge funds, or other privileged market participants. These yields arise from:

◇ Exclusive access to liquidity pools

◇High-frequency trading strategies

◇ Arbitrage opportunities not available to retail investors • How Traditional Finance Restricts Yield In centralized financial systems: 🚧 Institutions have control over high-yield opportunities 🚧 Retail investors are burdened with high fees and limited access 🚧 Market makers profit through spreads and fees.

• How EOL Demarketizes Access to Preferential Yield

EOL challenges the traditional model by providing open, fair, and community-driven access to yield generation.

🔹 Decentralized Control: Liquidity is managed by protocols, not institutions 🔹 Yield Shared with the Community: Rather than being concentrated among a few large players 🔹 Reduced Reliance on External Market Forces: Minimizing volatility and promoting long-term sustainability.

• Benefits of EOL & Open Yield Access

✅ Financial Inclusivity: Accessible to all participants, not just institutional players

✅ Reduced Liquidity Dependence: Minimizing reliance on volatile third-party liquidity

✅ Protocol Sustainability: Yield generated through ecosystem-owned assets

✅ Decentralized Governance: Decisions driven by the community.

• Conclusion

Ecosystem-Owned Liquidity (EOL) makes preferential yield accessible to everyone by shifting liquidity control from centralized entities to decentralized communities. Through protocol-owned assets, bonding mechanisms, and decentralized yield distribution, EOL fosters a fair, sustainable, and transparent financial ecosystem.

Read more on EOL and how it demarketizes access to preferential yield in Mitosis lightpaper

Mitosis X.com

Mitosis discord.gg

Comments ()