EOL 2.0: From Slow Votes to Pro-Level DeFi Liquidity in Mitosis

In crypto, hesitation can cost an entire trend.

EOL v1 learned that the hard way. Now, they’ve redesigned the system to react faster than the market itself.

What is EOL — and Why It Matters

In the Mitosis ecosystem, EOL (Ecosystem-Owned Liquidity) ) is more than just idle funds earning yield.

It’s community-owned capital deployed in DeFi, where contributors share not only in profits but also in decision-making.

The core vision: turn passive liquidity into smart liquidity — adaptive, profitable, and transparent.

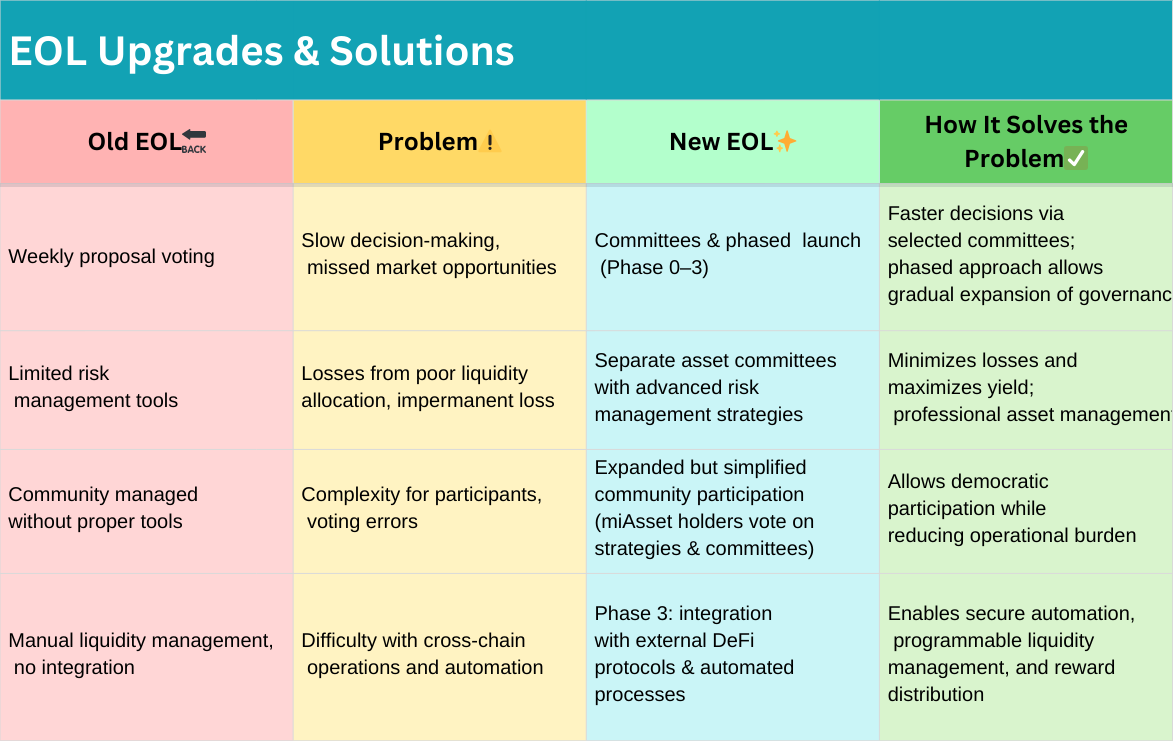

The Problem with EOL v1

When EOL first launched in Q2 2024, the model looked promising:

the community decided where funds went, yields were distributed, and governance was democratic.

In practice, several issues emerged:

- Slow decision-making — Votes often took days. In crypto, that’s long enough for opportunities to disappear.

- Weak risk controls — Few tools existed to quickly react to market drops or protocol risks.

- Execution delays — Even strong ideas lost their edge because they weren’t implemented fast enough.

The takeaway was clear: they needed more speed, better risk management, and professional execution — without losing transparency.

The EOL v2.0 Perspective

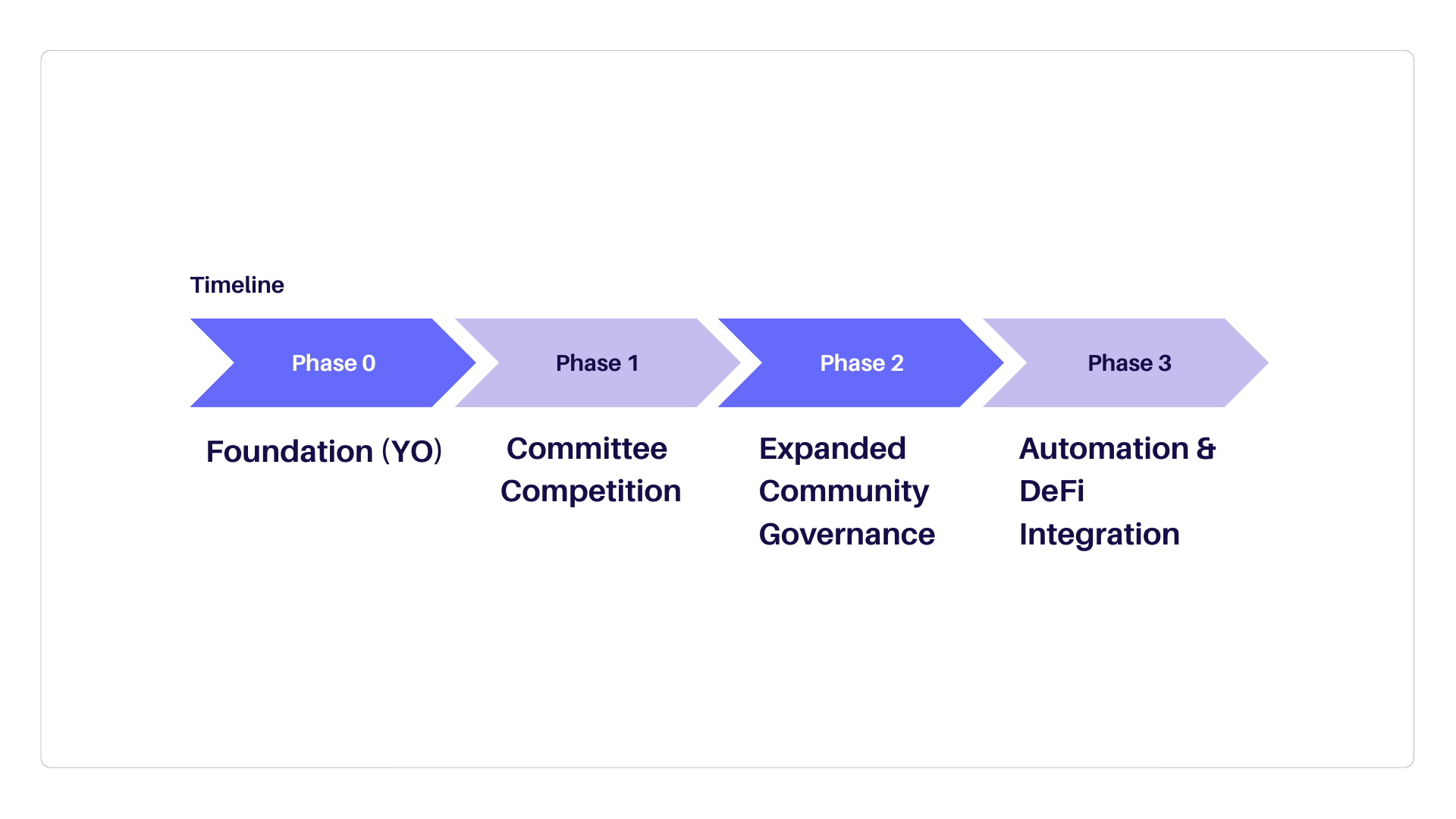

- Phased Approach: EOL now develops in stages to safely scale complex features:

- Phase 0: proven strategies with transparent execution

- Phases 1–3: competition, expanded voting, and automation

- Faster execution: committees can make decisions quickly, instead of waiting for weekly community votes.

- Advanced risk management: separate committees manage assets to minimize losses and maximize yield.

- Competitive asset management: multiple committees can manage a single asset, and the most effective strategies get more capital.

- Expanded community participation: miAsset holders vote not only for committees, but also for strategies and protocols, balancing professionalism and democracy.

- Automation and integration with other DeFi protocols: Phase 3 will allow programmable liquidity management and reward distribution with committee oversight.

Examples:

- Previously, liquidity allocation proposals were reviewed weekly, so if a DeFi protocol suddenly offered high yields, the community could not react quickly.

- Liquidity sometimes flowed into high-risk protocols because there were no tools to assess losses or protect against impermanent loss.

These examples show why faster committees and improved risk management were really needed.

Why these changes matter:

- To speed up decision-making and capture profitable opportunities

- To improve risk and loss management

- To maintain community participation while ensuring professional governance

- To prepare for safe automation and integration with other protocols

Instead of minor fixes, Mitosis introduced a four-phase evolution for EOL governance.

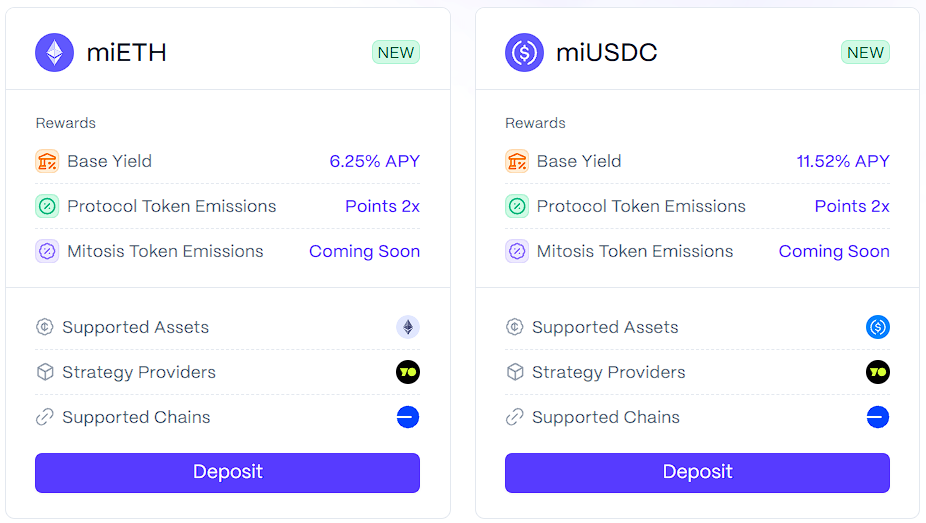

Phase 0 — Foundation (Live Now)

- Managed by strategic partner YO (More on this later) , a professional yield team

- APY from launch: USDC — 11.1%, ETH — 4.95%

- Small, skilled committee — minimal bureaucracy

- Depositors receive miUSDC / miETH, usable across Mitosis EVM apps

- Automatic participation in DNA rewards

Goal: a stable, safe starting point with professional oversight.

Phase 1 — Competitive Committees

- Multiple committees per asset

- Liquidity starts equally split, then miAsset holders vote to allocate more to top performers

- Underperforming teams risk losing capital allocation

- Moderate management & performance fees to sustain operations

Phase 2 — Community Governance

- Community votes on both committees and specific protocols/strategies

- Strict selection process for candidates:

- Proven security and reputation

- Risk management track record

- Verified yield history

- A balance between open participation and professional standards

Phase 3 — Advanced Automation

- Automated deployment, rebalancing, and yield compounding

- Standardized integrations with DeFi protocols

- Emergency pause controls for safety

At this stage, EOL functions like a decentralized investment bank — owned by the community, run with institutional precision.

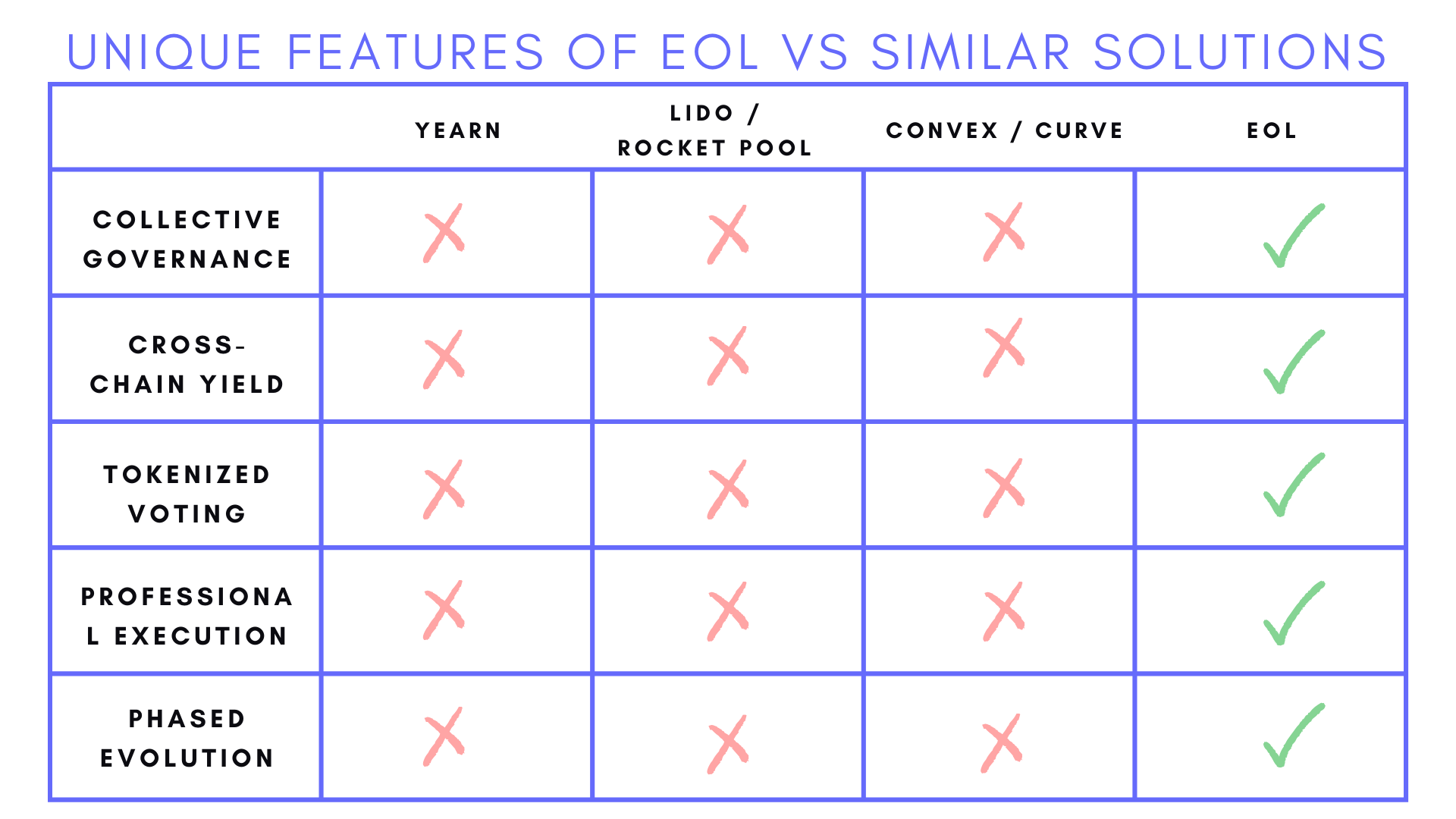

How EOL Differs from Similar Solutions in the DeFi Market

The market already has projects that address certain tasks similar to EOL — for example, yield optimization or collective liquidity deployment. However, EOL is unique and has no direct analogues: no other project combines institutional-grade execution, community participation, and cross-chain yield within a single framework.

Similar solutions:

- Yearn Finance: automated yield strategy optimization, but without community involvement in capital allocation and strategy management.

- Lido, Rocket Pool: collective ETH staking limited to a single asset, with no ability to manage multi-protocol strategies.

- Convex Finance / Curve: liquidity management in pools and automated rebalancing, but without institutional oversight and transparent multi-committee capital management.

What makes EOL unique:

- Hybrid governance framework: miAsset holders participate in voting, while professional committees ensure institutional-grade strategy execution and risk management.

- Cross-chain yield: participants earn profits from multiple networks without manually moving assets.

- Phased governance evolution: from a professional launch with YO (Phase 0) to committee competition (Phase 1), expanded community involvement (Phase 2), and full automation (Phase 3).

- Tokenization of rights and yield (miAssets): tokens simultaneously grant voting rights, participate in revenue distribution, and can be used in DeFi applications on Mitosis EVM.

- Transparency and verifiability: all strategies are auditable, committee decisions are visible to the community, and automation reduces the risk of human error and missed opportunities.

EOL is creating a new category of collective liquidity frameworks, combining institutional execution, community participation, cross-chain yield, and tokenized governance — a unique combination unmatched by any other solution in the market.

Why It Matters for Participants

For regular depositors, the new framework offers:

- Passive yield managed by professionals

- Transparent governance processes

- Voting rights via miAssets

- Access to institutional-grade strategies

- Cross-chain yield without manual asset bridging

Here’s your text translated into English with the same structure, tone, and emphasis:

The Role of YO as a Strategic Partner in Phase 0

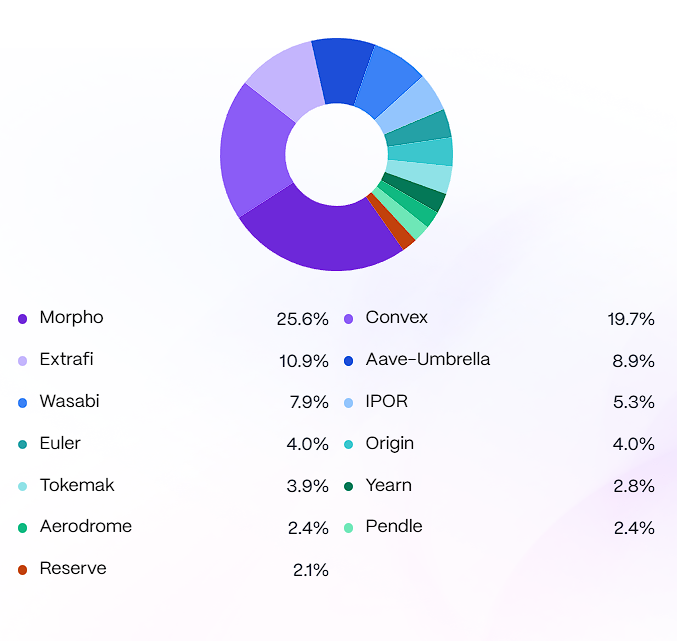

For the launch of Phase 0, the Mitosis team chose YO (@yield) — a key partner setting the standards for professional liquidity management.

Who is YO?

YO (Yield Optimizer) is a unified layer that connects capital with the best DeFi strategies in terms of risk/reward. It’s positioned as “the last vault you’ll ever need”: users simply deposit funds, and YO automatically optimizes their allocation, redistributing across protocols for maximum yield. Funds are automatically allocated across the most efficient pools in different protocols and chains, balancing risk and reward. Assets are spread across 15 yield-generating protocols and continuously rebalanced.

YO is also the implementation of the first feature in MLGA. Learn more below ⬇️

Why YO?

- Proven performance: USDC strategy yields 11.1% APY, ETH 4.95% APY

- Transparency & oversight: all YO activity is auditable and managed under EOL committee supervision

- Prestigious backing: built by the exponential.fi team, raised $14M from Paradigm, Haun, Hack VC, Solana, and Circle

- Easy participation: Mitosis depositors automatically receive miUSDC and miETH on Mitosis mainnet, usable in Mitosis EVM apps

What does partnering with YO in Phase 0 bring?

- Earn YO points ×2

- MITO token rewards coming soon

- Transparent, professional asset management without manual monitoring

- Participation in the DNA rewards program for all VLF liquidity contributors

- Building a sustainable infrastructure where initial deposits become part of a long-term capital management mechanism

- Audited by Zellic ✅

Importance for EOL:

YO sets the benchmark for future teams and strategies. Through YO, Phase 0 showcases how collective capital can be managed effectively and securely at a professional level while preserving democratic principles and transparency.

Learn more about YO: yo.xyz | Documentation: https://docs.yo.xyz/

Observations as an Outside Reviewer

From an outside perspective, the upgrade from v1 to v2 addresses critical bottlenecks.

In v1, long voting periods often meant missing profitable market entries.

With Phase 0, execution is near-instant, while the roadmap ensures governance rights return to the community in a structured way.

Looking ahead

EOL 2.0 represents a shift from a promising idea to a clear, executable plan:

- Phase 0 — Professional management and a stable start

- Phase 1 — Performance-driven competition

- Phase 2 — Balanced community and expert governance

- Phase 3 — Fully automated, secure capital management

If the first version was an experiment, the second is a well-defined blueprint for a community-owned DeFi investment engine.

💡 Conclusion

EOL 2.0 shows how decentralized capital can evolve from slow collective decision-making into an efficient, professional, yet still community-owned system.

It’s a significant step toward bridging the gap between retail DeFi participation and institutional-grade liquidity management.

For more detailed information, check out:

- Mitosis App | EOL Deposit 👉 https://app.mitosis.org/eol/opportunities

- Mitosis Documentation 👉 https://docs.mitosis.org/learn/introduction/what-is-mitosis

- Mitosis X👉 https://x.com/MitosisOrg

- YO X👉 https://x.com/yield

- Official Website Mitosis👉 https://mitosis.org/

Welcome to the heart of Mitosis. 💙

Join us on Discord — and start your own journey to recognition.

Follow the author on Twitter 👉 https://x.com/mEden2452

Comments ()