EOL Meets RWA: Can Ecosystem-Owned Liquidity Power Real-World Asset Markets in 2025?

Introduction

Tokenized real-world assets (RWAs) are quickly becoming a pillar of DeFi’s next growth wave. But even the most sophisticated RWA platforms struggle with one core challenge: sustainable, reusable liquidity.

Mitosis introduces a new liquidity layer with its Ecosystem-Owned Liquidity (EOL) model. In this article, we’ll explore how EOL, together with Matrix Vaults and Vanilla Assets, could offer a native solution for the capital demands of the RWA sector in 2025.

The Rise of RWAs and Their Liquidity Problem

By the end of 2025, the total market size of tokenized RWAs is projected to surpass $10 billion, according to KuCoin Research.

Despite this growth, protocols like Ondo, Apollo, Centrifuge, and Goldfinch face persistent limitations:

- Locked or permissioned liquidity pools

- Fragmented cross-chain capital

- Difficulty attracting native DeFi liquidity

- High opportunity cost for LPs

RWA overview from Mitosis University highlights these as critical blockers for the sector’s maturity.

🔀 What Is Ecosystem-Owned Liquidity (EOL)?

As described in the official Mitosis LP guide, EOL is a modular liquidity system where the ecosystem — not mercenary capital — owns and routes funds. This model uses:

- Matrix Vaults: Intent-aware smart contracts that manage cross-chain flow

- Vanilla Assets: 1:1 native-wrapped tokens that retain origin chain logic

- Morse: Cross-chain message router with composable validation

This framework provides composable, long-term liquidity that can serve both native DeFi and permissioned RWA markets.

How EOL Could Integrate with RWA Protocols

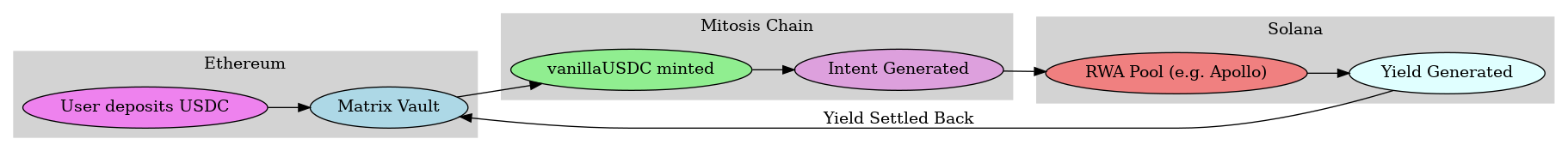

Imagine a protocol tokenizing short-term treasuries on Solana.

- A user deposits USDC into a Matrix Vault from Ethereum

- Mitosis mints

vanillaUSDC - An intent routes liquidity into an RWA yield pool (e.g., Apollo or Centrifuge)

- Yield flows back to Matrix Vault participants after programmable settlement

This process enables:

- Composable RWA access

- Real-time allocation across chains

- Transparent yield routing

Liquidity Routing Flow

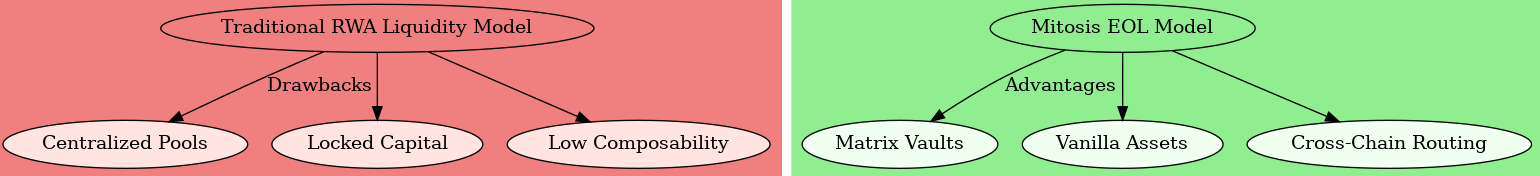

EOL vs Traditional RWA LP Models

| Feature | Traditional LPs | Mitosis EOL |

|---|---|---|

| Liquidity Ownership | Centralized | Ecosystem-owned |

| Deployment Speed | Manual | Automated via intents |

| Token Reusability | Low | High (via Vanilla) |

| Chain Composability | Limited | Cross-chain native |

| Capital Alignment | Temporary | Long-term by design |

Model Comparison

Considerations & Challenges

Even with EOL’s advantages, adoption into the RWA stack requires:

- KYC-Compliant Routing: RWA protocols often use permissioned vaults

- Oracle Integration: Accurate off-chain yield reporting is critical

- Standardization: EOL must integrate with external custody and reporting frameworks

As Imperator’s analysis explains, Mitosis is built not just for bridging — but for orchestrating intent-driven liquidity in a modular, chain-agnostic environment.

Conclusion

RWA tokenization is here — but it needs capital that behaves differently.

Mitosis, through EOL, Matrix Vaults, and Vanilla Assets, offers that capital: sticky, modular, cross-chain, and programmatic.

As real-world finance meets DeFi, Mitosis could provide the missing liquidity logic for a truly interoperable financial future.

Comments ()