Ethereum Enters Corporate Treasuries: Implications for Mitosis and DeFi’s Future

Introduction

Ethereum is no longer just a platform for developers and decentralized finance – it’s becoming a strategic asset on corporate balance sheets. In recent months, a wave of companies have begun adding ether (ETH) to their treasuries, echoing the playbook once reserved for bitcoin. Firms like BitMine Immersion, Bit Digital, Coinbase, and even Circle (the company behind USDC stablecoin) are betting big on Ethereum’s future. This trend signals growing institutional conviction that Ethereum’s infrastructure – from tokenized assets to DeFi and stablecoins – will underpin the next era of finance. It also bodes well for scalability solutions like Mitosis, which aim to amplify Ethereum’s liquidity across chains. In this article, we explore how corporate ETH adoption and regulatory clarity intersect with the Mitosis ecosystem, and why this convergence could accelerate innovation in decentralized finance.

Institutions Are Betting on Ethereum’s Infrastructure Value

Not long ago, corporate crypto treasuries were synonymous with holding bitcoin. Now Ethereum is rapidly gaining traction as a treasury reserve asset. Consider the following high-profile examples:

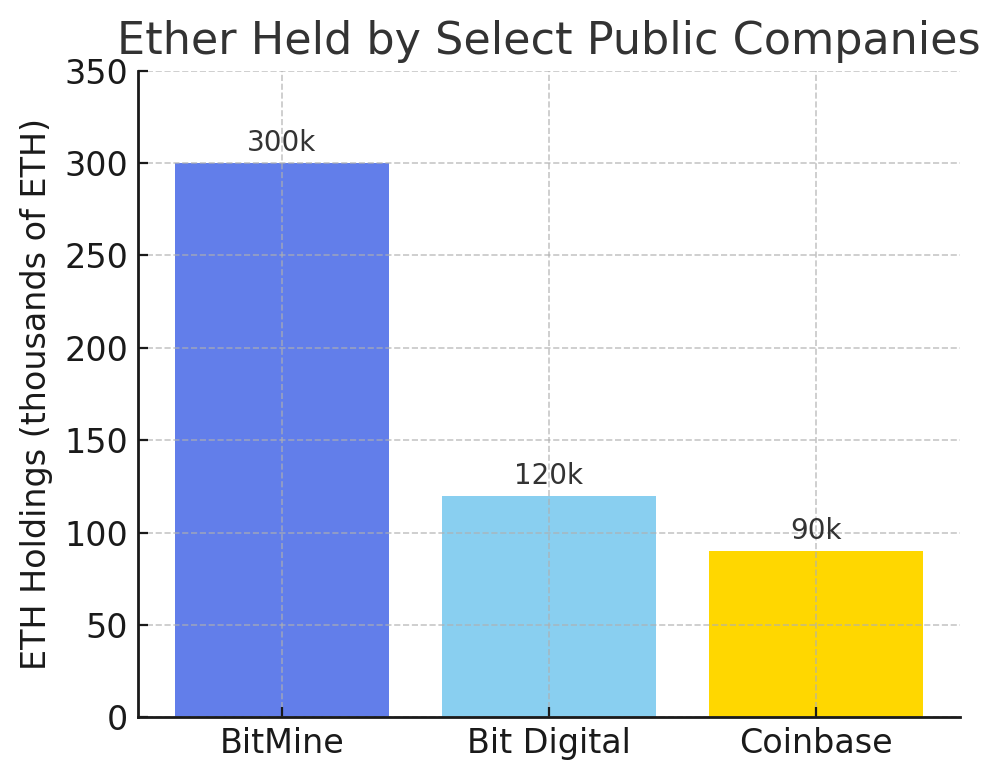

- BitMine Immersion Technologies (BMNR): Pivoted from mining to an “ETH-first” treasury strategy. BitMine has amassed over 300,000 ETH (worth ~$1+ billion) in pursuit of holding 5% of all ETH. Led by Wall Street veteran Tom Lee, BitMine even stakes ETH to earn yield and likens its strategy to a crypto “arms race” for Ethereum supply. As BitMine’s chairman noted, “Wall Street is getting ‘ETH-pilled’,” seeing long-term value in owning a piece of Ethereum’s network.

- Bit Digital (BTBT): A Nasdaq-listed firm that shifted its entire treasury from Bitcoin to Ethereum in 2025. After raising $172 million, Bit Digital acquired over 100,000 ETH (now holding ~120,000 ETH) and began focusing on Ethereum staking rather than BTC mining. CEO Sam Tabar explains this bold move:

- “We believe Ethereum can rewrite the entire financial system. Its programmable nature, growing adoption, and staking yield represent the future of digital assets”.

In short, Bit Digital sees ETH not just as an investment, but as infrastructure for the next generation of finance.

- Coinbase (COIN): The major crypto exchange became the first publicly traded company to hold Ethereum and DeFi tokens on its balance sheet. In a landmark 2021 policy update, Coinbase committed to invest $500 million of cash (plus 10% of quarterly profits) into a portfolio of crypto assets – explicitly including ETH and proof-of-stake assets alongside Bitcoin. By doing so, Coinbase signaled confidence that Ethereum-based assets would be core to the “cryptoeconomy” it’s building. (As of 2025, filings suggest Coinbase’s own holdings include roughly 90,000 ETH.) This treasury strategy aligns Coinbase’s corporate fate with the success of the Ethereum network and DeFi at large.

- Circle (CRCL): While Circle’s treasury is primarily in cash reserves backing USDC, the company’s fortunes are tightly linked to Ethereum’s growth. USDC stablecoin largely runs on Ethereum, so Circle’s rising stock price (up over 600% since its mid-2025 IPO) reflects investor optimism in stablecoin adoption and Ethereum’s role as a transactional backbone. Circle’s success underscores how stablecoins have become a killer use-case for Ethereum, driving demand for ETH (for fees and staking) as dollar liquidity floods onto the blockchain. In fact, one crypto fund CIO noted that stablecoin growth – boosted by Circle’s IPO – is “the standout proposition” behind institutions accumulating ETH. Simply put, Ethereum is the biggest beneficiary of stablecoin usage, which hasn’t been lost on companies now holding ETH.

Ether held by select public companies (in thousands of ETH). Major players like BitMine and Bit Digital have pivoted to Ethereum-focused treasury strategies, signaling strong conviction in ETH’s long-term value. Coinbase also holds a significant ETH reserve following its 2021 policy change. Smaller pioneers like BTCS (not pictured at scale) began accumulating ETH as early as 2021.

Why are these companies so bullish on Ethereum’s infrastructure? The common thread is conviction in Ethereum’s multi-faceted utility:

- Programmable Yield & DeFi: By staking ETH or deploying it in DeFi, companies can earn yield on a productive asset. For example, BitMine and Bit Digital don’t just hold ETH – they actively stake and participate in validator operations, turning treasury holdings into revenue streams. This speaks to Ethereum’s unique value proposition as a yield-generating, programmable asset (unlike idle cash or even Bitcoin). The ability to deploy capital in lending markets, liquidity pools, or restaking protocols has made ETH attractive for corporate treasuries seeking productive long-term holdings.

- Stablecoin Settlement Demand: Ethereum serves as the primary rails for major stablecoins (USDC, USDT), which institutions increasingly use for payments and liquidity. As noted, stablecoin usage has exploded, with over half of the ~$250 billion stablecoin supply circulating on Ethereum. Every USDC that moves on Ethereum requires a bit of ETH for gas – effectively tying Ethereum’s value to the growth of digital dollars. The passage of the U.S. GENIUS Act in July 2025 (Guiding and Establishing National Innovation for U.S. Stablecoins) provides a clear legal framework for stablecoins like USDC. This regulatory clarity is a game-changer: it gives traditional institutions confidence to integrate stablecoins for cross-border payments, on-chain settlement, and treasury use within a defined federal framework. In turn, greater stablecoin adoption means greater demand for Ethereum’s network. Companies holding ETH are essentially front-running this adoption curve, betting that as stablecoins go mainstream, Ethereum’s importance (and ETH’s price) will rise. As Fundstrat’s Tom Lee quipped, stablecoins have created a “ChatGPT moment” for crypto – a viral use-case resonating with banks and merchants – and Ethereum is the chain positioned to capture that value.

- Tokenization of Real-World Assets (RWA): Another pillar of Ethereum’s infrastructure value is its dominance in tokenizing real-world assets. From tokenized Treasuries and stocks to real estate funds, Ethereum has become the settlement layer for asset tokenization. Lee points out that Wall Street is converging on crypto and “wants to find a big [compliant] chain where there’s already a lot of real-world assets” – a description that increasingly fits Ethereum. Whether it’s bond ETFs moving on-chain, private credit, or even tokenized real estate, many of these experiments use Ethereum for its mature tooling and liquidity. This trend is accelerating: 2024 saw multiple tokenized funds launch (U.S. Treasury bill ETFs, real estate trusts, etc.), proving that serious assets can live on Ethereum rails. By 2025, analysts at Mitosis University projected real-world asset tokens could become as common in DeFi as stablecoins, fundamentally widening participation in on-chain finance. When firms like BitMine and Bit Digital accumulate ETH, they’re effectively investing in the base-layer of a tokenized economy – one where trillions of dollars of real assets may eventually settle on Ethereum. Little surprise then that Bit Digital’s CEO highlights Ethereum’s “programmable nature and staking model” as key, or that Tom Lee expects ETH to outperform “digital gold” in coming years precisely because institutions will tokenize financial assets on Ethereum.

In short, corporate adopters see Ethereum not just as a reserve commodity, but as critical infrastructure. Public statements from these companies exude a long-term vision: Ethereum will form the backbone of web3 capital markets, so holding ETH is a bet on the network’s growth in utility. As one CEO put it, acquiring ETH now – when it’s arguably undervalued – is “a really good use of a treasury” if you believe the token’s value can 10× with mainstream adoption. This conviction is further validated by the market’s reaction: shares of ETH-holding firms have soared (many outperforming Bitcoin-focused peers) as investors recognize the upside. For example, after Bit Digital announced its Ethereum pivot, its stock spiked 10% in a day, and when BTCS unveiled a $100M ETH accumulation plan, shares doubled. Clearly, Wall Street is waking up to Ethereum’s pivotal role – and rewarding those who embrace it early.

Mitosis: Scaling Ethereum’s Reach Across Chains

This institutional embrace of Ethereum is good news for the Mitosis ecosystem. Mitosis is a Layer-1 designed to unify liquidity across networks, effectively acting as a cross-chain liquidity and scalability layer for Ethereum and beyond. The more value and activity that concentrates on Ethereum, the more demand there will be for solutions to extend that liquidity to other chains and applications – exactly what Mitosis was built to do.

How does the Ethereum treasury trend validate Mitosis’s role? In essence, if Ethereum is becoming the trusted base-layer (for tokenization, stablecoins, etc.), then Mitosis becomes critical as the connector that makes Ethereum’s liquidity work everywhere. Here are a few key points:

- Relieving Ethereum’s Congestion: As companies and institutions drive more usage on Ethereum (settling stablecoins, trading RWAs, running DeFi strategies), Ethereum’s base layer will face capacity and cost constraints. Mitosis complements Ethereum by providing a scalable cross-chain liquidity layer where assets can move freely and transactions can occur more efficiently. Mitosis’s design embeds a liquidity marketplace within each supported network, allowing assets to be deployed across multiple chains simultaneously. This means value originating on Ethereum (e.g. USDC liquidity, tokenized securities) can be seamlessly utilized on other chains without being siloed. By distributing load and unifying pools of liquidity, Mitosis helps prevent the fragmentation that traditionally plagues multi-chain DeFi. In effect, Mitosis extends Ethereum’s one-network strength into a many-network future – which will be increasingly important as institutional capital flows into various blockchains.

- Cross-Chain Utility for ETH and Tokenized Assets: As more organizations hold ETH and Ethereum-based assets, they will seek ways to maximize yield and utility on those holdings. Mitosis unlocks cross-chain opportunities for such assets. For example, a company holding ETH can deposit it into Mitosis and receive miETH, a tokenized representative that’s interoperable across chains. That miETH can simultaneously earn yield on, say, a Cosmos-chain DEX, be used as collateral on a Layer-2 lending protocol, or participate in a yield strategy on another network – all coordinated through Mitosis. Mitosis’s vaults and programmable liquidity also mean that assets like ETH or tokenized Treasuries can be deployed to multiple DeFi opportunities at once, managed by the protocol’s automation. This is a huge value-add for institutional holders: rather than manually bridging or choosing one chain, they get one-stop access to cross-chain yield. The recent adopters of ETH (BitMine, Bit Digital, etc.) explicitly plan to stake and actively use their ETH to support the network – Mitosis can amplify those efforts by extending ETH’s reach into every corner of the crypto ecosystem. In short, Mitosis makes an institution’s ETH more powerful, turning it into a productive asset across many chains, not just Ethereum mainnet.

- Ecosystem-Owned Liquidity & Reduced Fragmentation: Mitosis introduces an Ecosystem-Owned Liquidity (EOL) model, which aligns well with the long-term mindset of institutional players. Instead of fragmented “mercenary” capital, Mitosis emphasizes protocol-owned and community-owned liquidity that persists across chains. As more real-world value tokenizes on Ethereum, maintaining deep liquidity for those assets on multiple networks will be challenging. Mitosis’s approach – treating liquidity as a programmable primitive managed by the protocol and its community – provides a reliable backbone for these assets to trade and be utilized anywhere. In a scenario where, say, a tokenized bond is issued on Ethereum and investors on various L2s or sidechains want to access it, Mitosis can ensure there is a unified liquid market for that bond across chains. By lowering the friction to move assets and liquidity between Ethereum and other chains, Mitosis essentially supercharges Ethereum’s scalability. The validation here is that if major companies are positioning Ethereum as the core of future finance, then solutions ensuring Ethereum’s liquidity can flow to every network (safely and efficiently) will be in high demand. Mitosis is positioned exactly as that solution – a kind of liquidity operating system for a multi-chain world.

- Real-World Asset Support and Compliance: Many ETH treasury players are also eyeing real-world asset integration (BitMine and Bit Digital talk about participating in governance, staking, and even running validators to support Ethereum’s infrastructure). As RWA tokenization grows, it will require not just Ethereum’s base layer, but also networks that can handle compliance, interoperability, and custom logic. Mitosis can complement initiatives like Ethereum’s mainnet and enterprise chains by providing programmable liquidity vaults and Matrix campaigns that could, for instance, pool tokenized real estate or bond tokens and allocate them to yields across DeFi. Because Mitosis can incorporate guardrails (through its vault logic or by integrating compliance oracles), it’s an ideal environment to manage tokenized regulated assets bridging between traditional finance and DeFi. The recently passed GENIUS Act is a perfect example of why this matters: with clear laws, we’ll see more institutional-grade assets (and money) coming on-chain, from bank-issued stablecoins to tokenized funds. Those assets will need networks like Mitosis to scale and connect them. In fact, Mitosis was highlighted alongside Centrifuge in a Mitosis University analysis as “building the plumbing” for RWA liquidity, helping bring the $15–17 trillion asset market on-chain in a compliant way. The takeaway is that Ethereum’s institutional adoption creates a rising tide that lifts Mitosis – the more value anchors on Ethereum, the more critical cross-chain liquidity becomes.

Conclusion

The trend of companies adding ETH to their balance sheets is more than just a bullish signal for one cryptocurrency – it’s a strong validation of Ethereum as an essential public infrastructure for the decentralized economy. These firms are effectively voting with their treasury dollars, affirming that Ethereum’s role in stablecoin settlement, DeFi, and asset tokenization will only deepen. Crucially, this isn’t happening in a vacuum. Supportive regulation like the GENIUS Act is now providing the legal clarity needed for institutions to confidently expand into stablecoins and on-chain assets, which in turn drives even greater Ethereum usage.

For Mitosis, all of this momentum reinforces the importance of its mission. If Ethereum is the highway, Mitosis is building the multi-lane expressway that runs alongside and beyond it – ensuring traffic can flow freely across the entire network-of-networks. By enhancing Ethereum’s scalability and extending its liquidity across chains, Mitosis stands to benefit directly from every new stablecoin transaction, every tokenized asset issuance, and every institution that comes on-chain. It positions Mitosis as a critical piece in the puzzle: an enabler that amplifies Ethereum’s real-world impact by linking ecosystems and optimizing capital efficiency. As one Mitosis University overview put it, tokenization is opening the doors to traditional finance, but it requires careful bridges between worlds – exactly the kind Mitosis is creating.

In summary, companies embracing ETH in their treasuries are expressing long-term confidence in Ethereum’s value proposition. That confidence extends to projects building on and around Ethereum. Mitosis, with its focus on unified liquidity and cross-chain operability, is poised to ride this wave of adoption. By transforming fragmented capital into a unified, programmable force, Mitosis is turning Ethereum’s growing institutional validation into tangible scalability solutions. The result could be a more efficient, liquid and inclusive DeFi landscape – where real-world assets, stablecoins, and ETH itself flow seamlessly across chains, powering a new era of global finance. The message is clear:

as Ethereum makes its way into Fortune 500 balance sheets, the entire ecosystem – from Layer-1s like Mitosis to everyday DeFi users – stands to gain.

The multi-chain future is arriving, and Ethereum’s institutional rise is lighting the path forward.

Useful links:

Comments ()