Ethereum’s 2025 Surge & Regulatory Clarity: Catalysts Transforming Crypto and Powering Mitosis

Introduction

Ethereum’s blockchain is busier than ever. In early August 2025, the 7-day average of daily transactions on Ethereum hit 1.74 million – eclipsing the previous peak set during the 2021 bull run. This surge in network activity signals a renewed wave of adoption and comes alongside a major rally in ETH’s price (up over 160% since April). What’s driving this impressive uptick? Two key forces are at play: skyrocketing staking participation on Ethereum, and a more favorable regulatory climate that’s easing investor concerns. In the U.S., regulators have finally started providing the clarity crypto markets have craved – from the SEC’s blessing of certain liquid staking programs to new laws defining digital assets. These developments are supercharging institutional interest and public confidence, helping crypto break out of its post-winter caution.

Crucially, these trends don’t just boost Ethereum and Bitcoin – they uplift the entire crypto ecosystem, including emerging networks like Mitosis. Mitosis is a next-generation Layer-1 known as “the network for programmable liquidity,” purpose-built to unify liquidity across multiple blockchains. In a world where Ethereum is thriving and regulations encourage mainstream participation, Mitosis’s role becomes ever more valuable. By design, it can channel the new capital and users flowing into crypto, providing the cross-chain bridges and liquidity infrastructure to connect all this growth. This article will explore how Ethereum’s transaction boom and regulatory clarity are shaping the market, and how Mitosis’s ecosystem benefits from these shifts.

Ethereum Network Hits Record Activity (and Why It Matters)

Ethereum has long been the backbone of decentralized finance and smart contract activity, but the summer of 2025 marks a new high. Daily transaction counts on Ethereum are now at all-time records, reflecting intense on-chain usage. This activity spike is closely linked to Ethereum’s transition to proof-of-stake and the popularity of staking. As of August, over 36 million ETH – nearly 30% of the entire supply – is locked in staking contracts. In other words, almost one-third of all ETH is now being staked to secure the network and earn yield, a testament to holders’ confidence in Ethereum’s long-term value. By staking their ETH, participants are signaling willingness to forgo liquidity for yield, effectively tightening the available supply on the market and potentially supporting higher prices. This dynamic has been a tailwind for ETH’s price, which recently pushed above $4,000 for the first time since 2024, narrowing its performance gap with Bitcoin.

Several factors explain why Ethereum’s network is busier than ever:

- Staking and Liquid Staking Boom: The Shapella upgrade (completed in 2023) enabled withdrawals of staked ETH, ironically encouraging even more staking as confidence grew. Liquid staking services (where users stake ETH and receive staking receipt tokens for liquidity) gained huge traction. In August 2025, the SEC offered a surprise boost by clarifying that certain liquid staking setups and receipt tokens “do not constitute securities” under U.S. law. This regulatory green light removed a major risk for exchanges and platforms offering staking. As a result, institutional investors and platforms are piling into ETH staking, knowing they can earn yield without unexpected legal hurdles. More than half a million ETH (>$1.8B worth) was staked in just the first half of June alone – a sign of rising confidence and reduced liquid supply. Staking not only secures the network but also diminishes sell pressure (staked coins are off the market), contributing to the positive price momentum.

- DeFi, NFTs, and Layer-2 Growth: Ethereum’s transaction surge also reflects broad-based demand from decentralized applications. DeFi activity has rebounded sharply in 2025 – the total value locked (TVL) in DeFi recently hit $153B (a three-year high), with Ethereum-based protocols capturing the majority share. Yield farming, lending, and liquidity pools on Ethereum are attracting users seeking returns in a low-rate environment. Meanwhile, NFT markets saw a revival, with new gaming and metaverse platforms driving token volumes. Additionally, Ethereum’s ecosystem has expanded via Layer-2 networks (like Optimism and Arbitrum), which settle thousands of transactions back on Ethereum. This L2 adoption effectively funnels more activity onto Ethereum’s base layer, contributing to the record transaction counts.

- Corporate and Institutional Adoption: Perhaps most intriguingly, public companies and institutions have started using Ethereum directly, adding a new class of transactions. A growing number of firms now hold ETH in their corporate treasuries. In fact, publicly-disclosed “crypto treasury” companies collectively hold about $11.8 billion of ETH on their balance sheets. Major examples include BitMine Immersion Technologies, which has accumulated over 833,000 ETH (worth ~$3.2B), and SharpLink Gaming with ~$2B in ETH holdings. These companies aren’t just passively holding – many actively stake their ETH or deploy it in DeFi to earn yield. BitMine’s CEO (a Wall Street veteran) has gone so far as to describe an “arms race” for Ethereum supply, noting Wall Street is getting “ETH-pilled” as they recognize Ethereum’s long-term value. Other firms like BitDigital have shifted treasury strategies from Bitcoin to Ethereum, citing ETH’s programmable yield and crucial role in the future of finance. Even traditional crypto players like Coinbase hold significant ETH (around 90k ETH as of 2025) to align with the “cryptoeconomy” growth. And beyond direct holdings, companies like Circle – though their treasuries are in cash – owe much of their success to Ethereum: USDC stablecoin runs largely on Ethereum, so as USDC’s adoption grows (a trend supercharged by Circle’s 2025 IPO), it drives more transactions and fees on Ethereum. Every time a stablecoin like USDC is transacted, a bit of ETH is used for gas, linking Ethereum’s utility to the rise of digital dollars. In short, Ethereum is becoming embedded in corporate strategies and institutional portfolios – a profound shift that validates Ethereum as an essential infrastructure layer. This wave of adoption is adding transactions (for treasury moves, on-chain audits, etc.) and boosting overall network demand.

From a market perspective, Ethereum’s record usage is hugely significant. It demonstrates that even after the ups and downs of cycles, fundamental network demand is growing. High throughput indicates more users, more smart contracts running, and more value being transferred on-chain – all healthy signs of an ecosystem maturing. It’s also a bullish indicator: heavy network use has historically correlated with price appreciation, as it suggests Ethereum is delivering real-world utility (from powering stablecoins to enabling complex DeFi trades). Little wonder that ETH’s price rally has coincided with these on-chain highs. Investors see that Ethereum is not just speculative vapor – it’s generating fees, facilitating commerce, and now even securing corporate funds. This strengthens the narrative of ETH as a “digital oil” underpinning Web3 finance, in contrast to Bitcoin’s “digital gold” analogy.

Implications for Mitosis: Ethereum’s explosive growth bodes well for Mitosis, which is designed to extend Ethereum’s liquidity and functionality across chains. Mitosis is a Layer-1 network that acts as a cross-chain liquidity hub, meaning it enables value on Ethereum to seamlessly flow into other blockchains and vice versa. The more activity and value concentrate on Ethereum, the more demand there is for solutions to relieve congestion and spread liquidity to other ecosystems – exactly Mitosis’s mission. Think of Ethereum’s current status as the hub of DeFi and crypto activity; Mitosis serves as a bridge and scalability layer that can take some of that load and replicate Ethereum’s liquidity on multiple networks. As noted by Mitosis University researchers, “Mitosis is a Layer-1 designed to unify liquidity across networks, effectively acting as a cross-chain liquidity and scalability layer for Ethereum and beyond. The more value and activity that concentrates on Ethereum, the more demand there will be for solutions to extend that liquidity to other chains – exactly what Mitosis was built to do.”. In practical terms, as Ethereum gets busier (and potentially more expensive per transaction), Mitosis can route transactions through cheaper chains, connect Ethereum users to opportunities on other networks, and prevent liquidity from getting siloed. Mitosis’s miAsset technology even lets users deposit ETH and receive a cross-chain representation (like miETH) that can be used on multiple chains simultaneously. This makes an institution’s ETH more powerful, turning a static treasury holding into an actively utilized asset across the crypto universe. In summary, Ethereum’s success creates spillover effects – and Mitosis captures those, by supercharging Ethereum’s reach into a multi-chain future.

Regulatory Clarity Fuels Confidence and Inflows

Running parallel to Ethereum’s on-chain boom is another critical trend: regulatory clarity is finally emerging, and it’s changing the game for crypto. Over the past year, lawmakers and regulators in key jurisdictions have rolled out guidelines that remove much of the uncertainty hanging over digital assets. For an industry long plagued by a “gray area” legal status, this shift cannot be overstated – clear rules are unlocking a flood of new money and participation.

In the United States, 2025 has seen landmark legislative progress. Two pieces of federal legislation in particular are heralding a new era of clarity:

- The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins): Passed in mid-2025 with bipartisan support, this law establishes the first U.S. federal framework for stablecoins – cryptocurrencies pegged to fiat like the dollar. GENIUS mandates that stablecoin issuers maintain 100% reserves in safe assets (e.g. cash or U.S. Treasuries) and submit to strict audits and disclosures. By creating uniform standards and consumer protections, it ends the patchwork of state-by-state rules that previously governed stablecoins. Importantly, GENIUS effectively legitimizes dollar-backed stablecoins as part of the financial system, with President Trump touting it as a magnet for “massive investment and innovation” in the U.S.. For crypto markets, this act has been a game-changer: it provides certainty that major stablecoins (like USDC, USDT) are here to stay and won’t be suddenly outlawed. Institutions that were once wary of stablecoins (concerned about opaque reserves or legal status) now have the green light to integrate them for payments, settlements, and treasury functions. Stablecoin usage is exploding as a result, bringing more mainstream dollars into crypto. Every one of those dollars often finds its way onto Ethereum (the primary network for stablecoin transactions), further boosting Ethereum’s utility. Greater stablecoin adoption thus means greater demand for Ethereum – something savvy investors anticipated. In fact, companies accumulating ETH are essentially betting on this trend, reasoning that as regulated stablecoins go mainstream, Ethereum’s importance and ETH’s value will rise in tandem.

- The Digital Asset Market “CLARITY” Act: Moving through Congress in 2025, the aptly named CLARITY Act tackles the broader crypto market structure. Its goal is to finally delineate what counts as a security vs. a commodity in crypto. Essentially, if passed, this law would set clear criteria: sufficiently decentralized or utility-driven tokens would be classified like commodities (regulated by the CFTC), whereas tokens that behave like investment contracts would fall under securities law (SEC oversight). This distinction is something the industry has long yearned for, after years of uncertainty and enforcement-by-lawsuit. The impact of CLARITY would be huge – by setting transparent standards in law, Congress would eliminate the fear that, say, a top 20 altcoin could randomly be deemed a security after years of trading. Institutional adoption is expected to accelerate once this passes, as funds and companies gain confidence that the assets they’re handling are legally well-defined. Wall Street, which largely sat on the sidelines due to regulatory ambiguity, is now showing enthusiasm; analysts have called the CLARITY Act a potential “game changer” that could bring major investors off the bench. Firms like Galaxy Digital and Coinbase, which have built out crypto services awaiting clear rules, are poised to benefit from the act’s passage. Moreover, the U.S. taking the lead on clarity might make it a more attractive hub for crypto business (countering the brain drain to friendlier jurisdictions abroad).

Meanwhile, across the Atlantic, Europe’s MiCA (Markets in Crypto-Assets Regulation) has already come into effect (2024). MiCA established a comprehensive EU-wide framework for crypto, covering everything from exchange licensing to stablecoin issuance. It was one of the first major regimes to provide continent-level uniformity, preventing regulatory arbitrage in Europe. MiCA’s requirements (like reserve mandates for stablecoins and business conduct rules for crypto service providers) set a high standard for investor protection and market integrity. This gave European crypto firms a head start in compliance, but now the U.S. is catching up fast with its own clarity. In fact, JPMorgan strategists suggest that if the CLARITY Act passes, the U.S. may become even more enticing than MiCA for crypto ventures. In other words, regulatory clarity is going global – and as the U.S. and EU implement these frameworks, confidence to engage in crypto is rising worldwide.

Concrete numbers bear out the impact of these regulatory tailwinds. Capital is pouring back into crypto markets in a way not seen since the last bull run. A recent JPMorgan report highlighted that digital asset inflows reached $60 billion in 2024-2025 year-to-date, a dramatic resurgence of capital. That’s about 50% higher than the level earlier in the year, marking a sharp reversal from the doldrums of 2022. This $60B figure includes institutional investments, venture capital, and trading inflows, indicating broad participation. Clearly, the improving regulatory climate is a prime catalyst – by addressing the legal uncertainties, it has flipped the market sentiment to bullish. Institutional investors who were cautious are now tiptoeing (or even rushing) back in as rules crystallize, and retail traders feel emboldened by rising prices and friendlier policies. Venture capital, for instance, is heating up again: blockchain startups raised ~$13.6B in 2024, up from $10B in 2023, with projections of $18B+ in 2025 VC funding – a rebound attributed in part to regulatory clarity restoring investors’ “green light” to back innovative crypto projects.

Public markets tell a similar story. Circle’s IPO in June 2025 – the first major stablecoin company to go public – was a smashing success, with the stock doubling on debut and heavy demand from Wall Street. This would have been unthinkable a couple of years ago, when stablecoins were under a cloud of skepticism. But thanks to frameworks like the GENIUS Act validating Circle’s model, mainstream investors now see regulated stablecoins as a legitimate (even hot) sector. The IPO not only raised capital for Circle but also served as a symbolic bridge between TradFi and crypto, proving that a crypto firm can meet public-company standards and thrive. Likewise, the wave of new crypto ETF filings – including Ethereum and even Solana ETFs with built-in staking rewards – reflects optimism that regulators will permit more than just Bitcoin exposure. It’s telling that in 2025, U.S. investors are finally getting access to ETFs for assets like ETH or SOL, something that signals growing regulatory comfort beyond just Bitcoin. Each of these developments – whether it’s a law passed, an IPO, or a new ETF – builds a narrative that crypto is integrating with the traditional financial system under the watch of regulators, rather than operating in a legal vacuum. That narrative does wonders for investor confidence.

Implications for Mitosis: A clarified regulatory landscape is hugely beneficial for the Mitosis ecosystem and DeFi at large. Mitosis, being an Ecosystem-Owned Liquidity platform and cross-chain protocol, thrives in an environment where participants can engage openly without fear of uncertain legal status. For one, Mitosis’s governance and community stand to grow stronger. DeFi projects in the past often worried that their governance tokens or DAOs might inadvertently run afoul of regulators. With clearer guidelines (e.g. distinguishing utility tokens from securities in laws like the CLARITY Act), Mitosis community members can more confidently hold and use the $MITO token for governance without legal trepidation. As noted in an internal analysis, “with laws differentiating utility tokens from securities, community members can feel more confident engaging with Mitosis’s $MITO token and governance process… As regulations validate such decentralized models, we can expect more stakeholders to actively participate in Mitosis’s governance without fear.”. This means higher forum activity, more proposal diversity, and even institutional players potentially joining the governance process (e.g. venture funds or DAO treasuries voting their stakes). In essence, regulatory clarity builds community trust, inviting a broader base of users and investors to contribute to Mitosis’s development.

Moreover, the wave of new capital inflows from institutional investors can directly fuel Mitosis’s mission. With tens of billions entering crypto funds and stablecoins now explicitly safe, more institutions will be holding digital assets and looking for ways to earn yield on them. Mitosis provides an attractive solution: it allows an institution to deposit, say, USDC or ETH, and have that liquidity deployed across multiple chains automatically for yield. Instead of manually chasing DeFi opportunities on each chain – a technical and compliance headache – institutions can rely on Mitosis’s Matrix Vaults and unified liquidity layer to do it seamlessly. For example, an asset manager that now feels comfortable holding USDC (thanks to GENIUS Act protections) might allocate a large sum into Mitosis vaults, which in turn distribute that capital into yield farms on Ethereum, Polygon, Solana, etc., wherever returns are highest. This not only benefits the institution (maximizing yield across chains), but also strengthens Mitosis – more liquidity increases the network’s fee revenue and security, and deepens the pools that everyone in the ecosystem can draw from. It’s a virtuous cycle: clarity -> more capital in crypto -> more liquidity for Mitosis to unify -> better yields and utility -> attracts even more users.

Another angle is partnerships and integrations. In the fog of unclear regulation, many TradFi institutions steered clear of DeFi, and even crypto projects hesitated to collaborate deeply for fear of legal risk. Now, with rules defined, we’re likely to see a surge in TradFi–DeFi collaborations. Mitosis can act as the “connective tissue” in these partnerships. Consider the burgeoning interest in tokenized real-world assets (RWAs) – from on-chain treasury bills to tokenized real estate. As institutions tokenize assets on compliant platforms, they’ll need ways to circulate that value across the crypto ecosystem. Mitosis’s cross-chain protocols could, for instance, route a tokenized bond from a permissioned chain onto various public chains’ DeFi pools, while respecting compliance checks. Additionally, many new Layer-1 chains and Layer-2 rollups launching now bake in regulatory compliance from day one. These new networks will want to tap into the liquidity floating around in the larger crypto space. By partnering with Mitosis, they can avoid the “cold start” problem of fragmented liquidity, since Mitosis can bridge assets and liquidity to their chain on day one. With legal doubts fading, forging these cross-chain links becomes far easier – no more lengthy legal reviews to ensure a bridge or integration doesn’t inadvertently trigger a violation. Mitosis’s team has emphasized being chain-agnostic and collaboration-friendly, working with Ethereum rollups and others to create a “Superchain” of interconnected liquidity. Now they can accelerate this work under the blessing of regulators, paving the way for a more unified, interoperable DeFi landscape.

How Mitosis Benefits: A Cross-Chain Booster in the New Crypto Landscape

Bringing it all together, the twin trends of Ethereum’s resurgence and regulatory clarity set the stage for a crypto renaissance – and Mitosis is poised to be a key beneficiary and enabler of this next chapter. Here are the main ways these developments positively impact the Mitosis ecosystem:

- Explosive Cross-Chain Volume: With Ethereum hitting record activity and millions of new users entering crypto, liquidity is flowing across many chains as people seek the best opportunities (be it a yield farm on BSC or an NFT market on Polygon). Higher usage on Ethereum often means spillover demand on other networks due to capacity and cost issues on the main chain. Mitosis’s bridges and liquidity pools stand to see surging volume, as users and protocols leverage it to move assets seamlessly between chains in search of yield or utility. In a bull cycle fueled by institutional and retail inflows, we could witness record bridging and swapping volumes through Mitosis, reinforcing its role as a “liquidity highway” spanning the entire Web3 ecosystem. This cross-chain renaissance aligns perfectly with Mitosis’s capabilities – it was built to handle exactly this kind of omni-chain liquidity movement.

- Deeper Liquidity & Yield Opportunities: The influx of capital (e.g. that $60B+ in new inflows) means larger pools of assets circulating in crypto. Stablecoin supplies are growing, and more ETH and BTC are being tokenized or bridged into DeFi. For Mitosis, more liquidity is fuel for its engine. Its model of Ecosystem-Owned Liquidity (where the community/treasury provides sticky liquidity across chains) could expand dramatically as the pie grows. Imagine much larger stablecoin pools on Mitosis-connected networks, enabling tighter spreads and more efficient trades. Yield farming strategies on Mitosis will also flourish: with abundant liquidity, Mitosis can deploy assets into multiple protocols for optimized returns, enhancing yield for its users. In essence, a high-liquidity environment makes Mitosis’s promise of “omni-sourced yield” even more powerful – users can trust that whatever chain or protocol has the best return, Mitosis will tap into it for them. And as more people realize they can earn passive income on their assets safely (thanks to regulatory clarity around doing so), participation in Mitosis’s vaults and liquidity programs is likely to swell.

- Institutional-Grade Credibility: Post-regulation, large players are entering crypto in a big way – and they bring expectations of security, compliance, and reliability. Mitosis stands to gain by being ahead of the curve in security and transparency, positioning itself as a “institution-ready” DeFi platform. For example, Mitosis’s architecture avoids centralized bridge vulnerabilities by using secure message passing (via Hyperlane) for transfers, a design choice likely to reassure risk-averse institutions. Also, with clarity that its governance token is a utility, Mitosis could potentially get listed on U.S. exchanges or be held by funds, increasing its liquidity and legitimacy. Institutional DeFi participants, such as fintech firms exploring on-chain settlement, could choose Mitosis for cross-chain liquidity precisely because it operates within the now well-defined legal bounds. Essentially, Mitosis can market itself as a compliant, robust gateway to cross-chain DeFi, attracting partnerships with TradFi institutions that wouldn’t have happened in the Wild West days. This boost in credibility and integration can accelerate Mitosis’s growth and entrench it as critical infrastructure in the multi-chain future.

- Community Growth & Innovation: A final but important benefit is the empowerment of the Mitosis community and developers. With regulators no longer casting a shadow of doubt, community members are free to organize, build, and evangelize Mitosis openly. We may see more community-led initiatives – local meetups, hackathons, educational programs (many of which Mitosis University supports) – now that participants know they won’t step on legal landmines. Talented developers from traditional tech or finance, who were on the fence, might be drawn to contribute to Mitosis since the industry’s outlook is more secure. Even other DeFi protocols are now more likely to collaborate or integrate with Mitosis (e.g. sharing liquidity or co-developing cross-chain products) because the stigma of regulatory risk is fading. All this translates to a richer ecosystem around Mitosis: more governance engagement, more innovative cross-chain apps built on it, and generally a higher profile in the crypto community. The clarity essentially lets Mitosis shine on its merits – a robust solution to liquidity fragmentation – without extraneous fears, which should invite a wave of creativity and growth around the platform.

Conclusion

Ethereum’s recent surge in transactions and the wave of regulatory clarity are inflection points for the crypto industry. We’re witnessing Ethereum cement its status as critical financial infrastructure – handling record volumes of value – at the same time that governments are finally giving digital assets an official nod of legitimacy. For crypto at large, this combination is fostering a more mature, liquid, and inclusive market. It’s pulling in institutions that previously sat out, invigorating retail enthusiasm, and driving real technological adoption (from stablecoins to tokenized assets).

For Mitosis, these trends couldn’t be more auspicious. The platform finds itself in a sweet spot where its core strengths directly map to the market’s emerging needs: connecting chains, maximizing liquidity, and enabling participation in a compliant way. As Ethereum grows, Mitosis extends that growth across the multi-chain universe. As rules become clearer, Mitosis provides the pathways for traditional finance and new users to engage with DeFi confidently. In a sense, Mitosis is a beneficiary of the current boom but also a facilitator – it will help ensure that the influx of value and users can be distributed throughout the crypto ecosystem efficiently, rather than bottlenecking on a single chain.

In conclusion, Ethereum’s 2025 revival and the regulatory breakthroughs are paving the way for the next evolution of DeFi and cross-chain finance. The crypto landscape is being shaped into something more sustainable and widely accessible, with speculation giving way to utility and clarity. Networks like Mitosis stand ready to accelerate this evolution, turning increased activity and trust into tangible solutions that make crypto work better for everyone. If the current trends hold, we are on the cusp of a new era where mainstream finance and decentralized finance blend, and where liquidity flows freely across chains. Mitosis, as a network for programmable liquidity, is set to play a pivotal role in this era – empowering users to ride the wave of growth with the tools of cross-chain interoperability, and helping the crypto ecosystem realize its vision of an interconnected, borderless financial system.

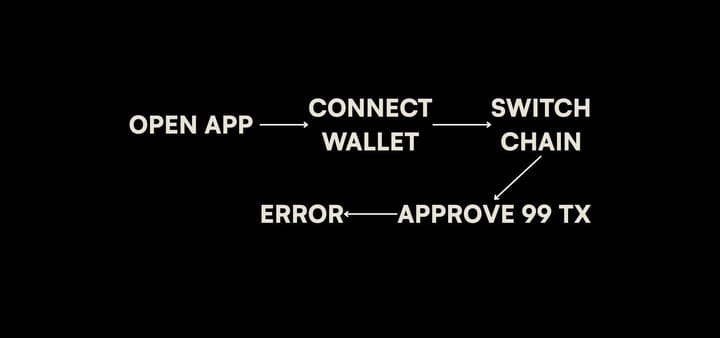

Glossary & Internal Links: For more on Mitosis and crypto concepts: Cross-Chain Liquidity, Cross-Chain Bridge, What is Mitosis?, Ecosystem-Owned Liquidity.

Useful links:

Comments ()