Ethereum’s Pectra Upgrade: What It Means for Developers, Investors, and Validators

Introduction

Ethereum isn’t standing still — it’s evolving.

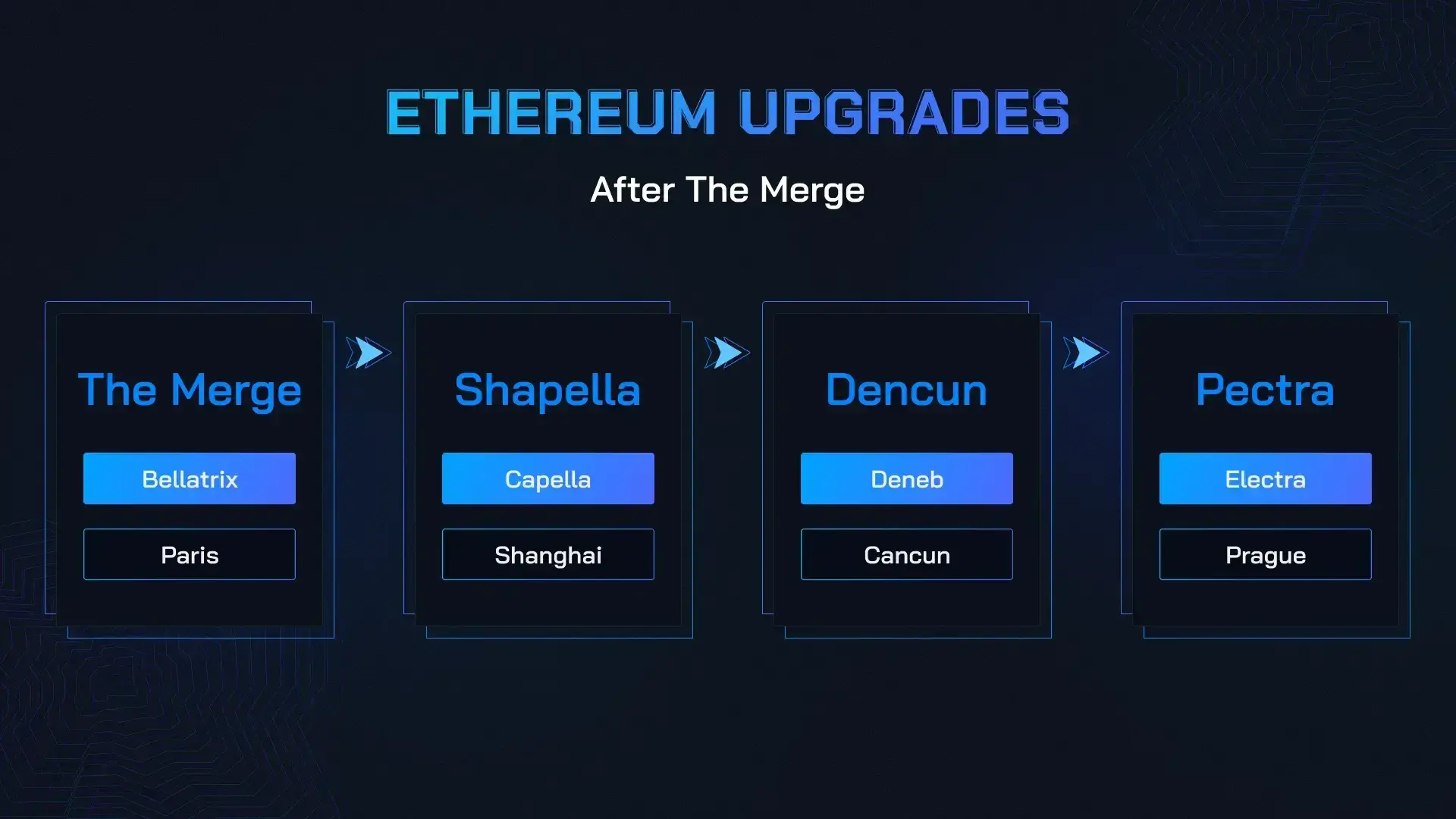

Since The Merge and the Shanghai upgrade, Ethereum has been in a relentless phase of refinement. Each upgrade brings us closer to a network that’s faster, more secure, and more scalable not just in theory, but in practice. And now, all eyes are on its next milestone: Pectra.

Pectra isn’t just a technical update tucked away in GitHub proposals — it’s a statement. It represents Ethereum’s maturing architecture, designed to improve the experience for developers, validators, and investors alike. It signals that Ethereum is preparing for the next generation of decentralized applications and global adoption.

But what exactly is Pectra? And why should anyone whether you’re building, validating, or investing care?

This article will break it all down, exploring how the Pectra upgrade will reshape the ecosystem in 2025 and why those paying attention now will be best positioned to benefit

What Is the Pectra Upgrade?

The Pectra upgrade is Ethereum’s next major protocol update, expected to be implemented in late 2025. It’s the successor to the Dencun upgrade and brings significant improvements to both Ethereum’s execution and consensus layers.

“Pectra” is a blend of two code names:

- “Prague” – the execution layer (where smart contracts live)

- “Electra” – the consensus layer (where validators and staking happen)

This dual-layer upgrade reflects Ethereum’s new modular era — one where optimization isn’t just about speed, but scalability, security, and sustainability.

Here are some of the key proposals and changes in Pectra:

EIP-7251: MaxEB (Maximum Effective Balance)

This EIP proposes raising the cap on the effective staking balance from 32 ETH to 2048 ETH.

For validators, this means fewer validator keys, improved performance, and reduced operational overhead — especially for large node operators and institutions.

EOF (EVM Object Format)

The Pectra upgrade introduces the long-awaited EVM Object Format (EOF), which restructures how smart contracts are deployed and executed on Ethereum.

EOF improves code readability, static analysis, and forward compatibility — a huge quality-of-life improvement for developers.

More Technical Improvements:

- Enhanced signature aggregation for faster consensus

- Reduced data footprint for validators

- Continued rollup-centric optimization (supporting Ethereum’s “rollup-first” scaling strategy)

Impact on Developers

For developers, the Pectra upgrade doesn’t just mean cleaner code — it means a more powerful, future-proof Ethereum to build on.

Here’s how Pectra changes the game for smart contract engineers and dApp builders:

a. EVM Object Format (EOF) Simplifies Smart Contract Architecture

The introduction of the EVM Object Format is arguably the biggest win for developers in this upgrade. EOF is a structural rework of how contracts are stored and executed on Ethereum.

Benefits:

Improved contract validation: Easier to analyze and audit bytecode.

Modular deployment: Contracts become more reusable and maintainable.

Forward compatibility: Ethereum becomes easier to upgrade without breaking deployed contracts.

This shift lays the foundation for a more modern and developer-friendly Ethereum Virtual Machine — one that encourages best practices without sacrificing performance.

b. Cleaner Tooling & Developer Experience

With EOF and other Pectra upgrades, dev tooling becomes more powerful. Expect updates to compilers, debuggers, and static analyzers that make building, testing, and deploying dApps more streamlined.

Think of it as a quiet but meaningful shift — like moving from jumbled spaghetti code to a cleaner, typed framework that future developers will thank you for.

c. Future-Proofing for L2s and Modularity

As Ethereum moves further into a modular architecture (with rollups and blobs leading the charge), Pectra helps developers think long-term.

By improving contract structure and execution efficiency:

L2 developers gain a stronger base layer to build on.

Gas optimization becomes easier.

Future upgrades (like Verkle trees or stateless clients) will be less disruptive to existing apps.

Impact on Validators

While developers get cleaner tooling, validators get something just as critical: efficiency and scalability.

Pectra introduces changes that make Ethereum's consensus layer more sustainable for both solo stakers and institutional node operators.

a. EIP-7251: Raising the Maximum Effective Balance

The headline change for validators is EIP-7251, which increases the maximum effective balance per validator from 32 ETH to 2048 ETH.

Here’s why that matters:

Fewer validator keys needed for large operators like exchanges and staking services.

Reduced infrastructure complexity — managing fewer nodes means lower cost and easier monitoring.

Better rewards tracking — since fewer validators mean less fragmentation of rewards.

For solo stakers, the 32 ETH minimum still holds, but for operators managing thousands of validators, this change could streamline operations dramatically.

b. Optimized Signature Aggregation

Pectra also includes improvements to signature aggregation, which helps reduce network congestion and boost block finality speeds.

This is a win for validators because:

Less bandwidth is required to transmit signatures.

Faster aggregation reduces missed attestations and rewards penalties.

It makes the network more resilient under load.

c. Laying Groundwork for More Decentralization

While raising the max balance might seem like a move toward centralization, the net effect — when paired with client diversity, restaking innovations, and slashing protections — is a stronger, more robust validator set.

Pectra helps pave the way for a multi-tiered staking ecosystem, where solo stakers, restakers, and operators can all coexist with clearer economic and technical incentives.

Impact on Investors

Ethereum upgrades don’t just shape the code — they shape the market.

With the Pectra upgrade, investors should be paying attention not just to what’s changing, but to why it’s changing. Beneath the technical improvements lie several key signals for long-term ETH holders and ecosystem investors.

a. Increased Institutional Confidence

One of the biggest institutional frictions with Ethereum staking has been the validator limit — the 32 ETH cap created operational inefficiencies at scale.

With EIP-7251 allowing much larger validator balances, Pectra:

Makes it easier for institutions to manage large staking positions.

Reduces validator sprawl, lowering the risk of key mismanagement.

Improves staking yield aggregation and reward optimization.

This might seem subtle, but it quietly removes a barrier for larger players — hedge funds, custodians, and DAOs — to participate more deeply in the network.

b. Reinforcing ETH as Yield-Bearing Infrastructure

With more efficient staking, Pectra strengthens Ethereum’s case as a global yield-bearing settlement layer.

For long-term investors:

More predictable validator economics = better yield modeling.

A smoother consensus layer = stronger chain reliability = less slashing risk.

All this = higher confidence in ETH as a productive, staked asset.

In short, ETH isn’t just digital gold — it’s evolving into digital infrastructure, and Pectra pushes that thesis forward.

c. Market Sentiment and Upgrade Cycles

Ethereum’s upgrade cadence plays a direct role in investor sentiment. Each successful upgrade — from The Merge to Dencun, and now Pectra — builds narrative momentum.

Historically, major upgrades tend to:

Generate pre-upgrade accumulation (buy-the-rumor).

Lead to post-upgrade stability (hold-the-proof).

While short-term price action is unpredictable, the broader story is clear: Ethereum is shipping. That narrative builds conviction — and capital follows conviction.

Risks, Challenges, and What to Watch

No upgrade is without friction. Pectra is a step forward — but like every complex protocol change, it carries risks that developers, validators, and investors must understand.

a. Validator Centralization Risks

Raising the maximum effective balance to 2048 ETH might simplify operations for large staking entities, but it also raises the specter of validator centralization.

If large players consolidate too much power:

It may reduce Ethereum’s censorship resistance.

Smaller stakers could feel disincentivized to participate.

Political and regulatory risk increases if stake is concentrated in a few hands.

The Ethereum community must continue pushing for client diversity, permissionless staking services, and slashing accountability to maintain decentralization.

b. Developer Migration and Compatibility

With EOF restructuring contract architecture, there’s a risk of:

Tooling lag — dev environments, debuggers, and compilers need to catch up.

Contract incompatibility — older contracts may not benefit, creating a split ecosystem.

Dev fatigue — smaller teams may be overwhelmed by constant change.

The core Ethereum dev community will need to support education and clear upgrade paths to avoid ecosystem fragmentation.

c. Upgrade Coordination and Delays

Pectra introduces major changes across both the execution and consensus layers — a recipe that demands smooth coordination among:

Client teams

Node operators

Infrastructure providers

Exchanges and wallets

Missed deadlines, unforeseen bugs, or governance disputes could delay rollout or create turbulence — especially for staking services that rely on near-perfect uptime.

d. Market Complacency

On the investor side, the biggest risk might not be panic — but complacency.

Each successful upgrade may lower perceived risk, but Ethereum remains experimental, permissionless, and under active development. Investors should remain vigilant about:

Regulatory shifts

Security audits of staking platforms

Rollup integration risks

Closing Thoughts

Ethereum’s Pectra upgrade won’t grab headlines like The Merge — but that’s exactly why it matters.

In 2025, Ethereum isn’t trying to prove it can evolve — it’s showing that it can evolve reliably. Pectra is less about flashy transformations and more about thoughtful refinement:

- Developers get cleaner, more scalable tooling.

- Validators get more efficient and flexible operations.

- Investors get stronger infrastructure beneath their capital.

This is what real technological maturity looks like — not sudden reinvention, but iterative trust-building. Every upgrade like Pectra chips away at complexity, lowers friction, and strengthens the foundation of Ethereum as a global platform for decentralized coordination.

If you're building, validating, or investing in Ethereum, this is the time to lean in — not tune out.

Because in a network as ambitious as Ethereum, the quiet upgrades are often the ones that matter most.

Useful links

Comments ()