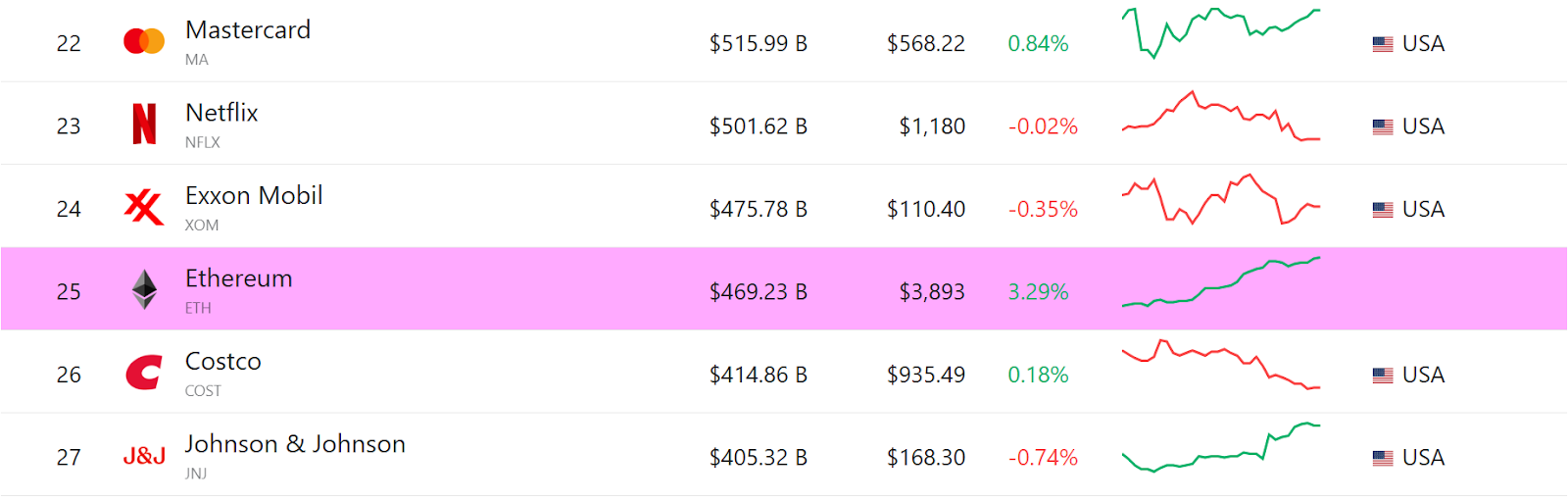

Ethereum’s Price Surpasses $3,900, Flips Costco in Market Cap

Introduction

Ethereum just hit $3,900, pushing its market capitalization north of $470 billion—enough to surpass Costco, one of the most respected and consistently profitable companies in the S&P 500.

This isn’t just a headline flex. It’s a moment that shows how far Ethereum has come—from “just another altcoin” to a serious macro asset on par with publicly traded giants.

And with Ethereum’s roadmap evolving (proto-danksharding live, restaking booming, Layer 2s surging), investors aren’t just betting on a cryptocurrency. They’re buying into an ecosystem that powers the next internet.

Ethereum Flipping Costco: Why It Matters

Costco is a bellwether of American retail—generating over $200 billion in annual revenue and known for loyal customers, tight margins, and recession resilience. Flipping Costco in market cap isn’t about dethroning retail—it’s about signaling Ethereum’s arrival in the same conversation as household-name, blue-chip stocks.

In financial terms, this flip means:

- ETH is no longer “tech speculation” to many—it’s an investable, maturing asset.

- Institutions, hedge funds, and sovereign funds may take ETH allocation more seriously.

- Narratives around ETH’s utility, staking yield, and ecosystem activity are translating into sustained price action.

And unlike Costco, Ethereum isn’t constrained by geography or physical operations—it’s a programmable global economic layer.

Why ETH Is Pumping: The Macro and Micro Mix

Ethereum’s rally didn’t happen in isolation. A mix of macro tailwinds and protocol-level upgrades have created ideal conditions for growth.

Macro catalysts include:

- Spot ETH ETF approval anticipation fueling institutional demand

- Inflation cooling and dovish Fed signals improving risk appetite

- Renewed Bitcoin rally pulling the market upward

On-chain fundamentals:

- EIP-4844 (proto-danksharding) went live, reducing L2 fees and boosting rollup scalability.

- L2 ecosystems (Base, Arbitrum, zkSync) are surging in TVL and daily transactions.

- Restaking via EigenLayer has pushed staking narratives and on-chain yield demand.

This isn’t a meme pump—it’s a convergence of structural improvements and mainstream attention.

ETH as a Yield-Bearing, Deflationary Asset

One major tailwind for ETH’s market cap rise? It’s no longer just “digital oil”—it’s digital infrastructure with yield.

Since the Merge, ETH has been:

- Deflationary, with more ETH burned than issued during periods of high activity

- Staking-enabled, offering real on-chain yield to holders (currently ~3–5% APY)

- Institutional-friendly, with custodianship, insurance, and custody infrastructure maturing fast

The market cap flip signals that investors are starting to price in these characteristics, much like they would dividend-paying stocks or treasury bonds.

Ethereum isn’t just an asset—it’s a yield engine for the decentralized economy.

Is ETH Becoming “Blue Chip”?

The Costco flip invites a provocative question: is ETH becoming a blue-chip financial asset?

While it lacks a CEO or quarterly earnings reports, Ethereum has:

- A clear development roadmap

- Predictable monetary policy (post-Merge issuance + burn)

- A growing and diverse economic base of users, builders, and validators

- Layer 2s and restaking systems that compound its utility and moat

This structural robustness is what makes ETH appealing not just to crypto traders, but to wealth managers and institutional allocators looking for long-term exposure to digital infrastructure.

In that light, flipping Costco may be symbolic—but it’s also a signal of Ethereum’s maturing capital narrative.

The Flippening Revisited?

With Ethereum’s rise back to $3,900+, some are reviving conversations about the Flippening—the day ETH surpasses Bitcoin in market cap.

We’re not there yet. BTC still commands over $1.1 trillion in value, nearly double Ethereum. But the distance is closing, and ETH has:

- Broader use cases (DeFi, NFTs, L2s)

- Deflationary supply mechanics

- Yield-bearing properties post-Merge

Whether the Flippening ever arrives or not, ETH’s trajectory shows that it’s carving out a differentiated place in portfolios, not just as a BTC alternative—but as an asset class in its own right.

Final Thoughts: Market Cap Is Just a Number, Until It Isn’t

Flipping Costco may not change your grocery bill—but it changes how investors think about crypto. Ethereum at $3,900+ means:

- It’s no longer niche—it’s macro-relevant

- Institutional adoption isn’t a prediction—it’s in motion

- The world’s largest smart contract platform is now competing with legacy giants for capital and attention

With the next wave of scaling, restaking, and ETF approvals on the horizon, Ethereum’s market cap momentum may be just getting started.

After all, the Costco flip wasn’t just a headline. It was a milestone.

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()