EVM vs SVM- Based Blockchains

As blockchain technology evolves, so too do the mechanisms that underpin decentralized applications (dApps). Two of the most prominent blockchain virtual machines (VMs) driving these dApps are EVM (Ethereum Virtual Machine) and SVM (Solana Virtual Machine). While both systems serve as execution environments for smart contracts, they differ in many aspects, including their underlying architecture, scalability, programming languages, and more. Understanding the key differences between these two models can help developers and blockchain enthusiasts choose the platform best suited for their needs.

What is the Ethereum Virtual Machine (EVM)?

The Ethereum Virtual Machine (EVM) is the execution environment for all smart contracts on the Ethereum blockchain. It is responsible for executing the code of decentralized applications (dApps) and ensuring that all nodes on the Ethereum network reach consensus on the state of the blockchain. The EVM is what allows Ethereum to process and validate transactions in a secure, decentralized manner.

Ethereum’s EVM is a stack-based virtual machine, meaning that operations are performed using a stack structure where data is pushed and popped as computations happen. One of the key features of the EVM is that it is Turing-complete, meaning it can run any computational task, as long as it’s written in a compatible programming language.

What is the Solana Virtual Machine (SVM)?

The Solana Virtual Machine (SVM) is the execution environment used by the Solana blockchain, which is known for its incredibly high throughput and low transaction fees. Solana uses a novel consensus mechanism called Proof of History (PoH), which combined with Proof of Stake (PoS), allows it to process thousands of transactions per second.

Unlike Ethereum’s EVM, the SVM is designed to support parallel processing, which means multiple smart contracts can be executed simultaneously. This parallelism is a key factor in Solana’s high performance, as it allows the network to scale and process a massive number of transactions without bottlenecks.

Smart contracts (or programs) on Solana are typically written in Rust, C, or C++, compiled into bytecode, and executed by the SVM. This is a stark contrast to Ethereum, where smart contracts are primarily written in Solidity.

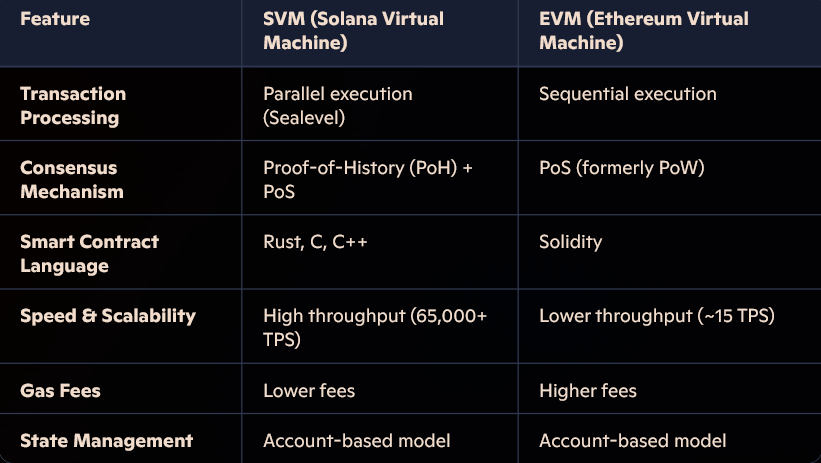

Key Differences Between EVM and SVM-Based Blockchains

While both the EVM and SVM are designed to execute smart contracts, their underlying architectures, performance capabilities, and ecosystems differ significantly. Below, we compare these two systems across several crucial dimensions.

- Architecture and Consensus Mechanism

EVM: Ethereum uses Proof of Stake (PoS) as its consensus mechanism (following the Ethereum 2.0 upgrade), though it previously relied on Proof of Work (PoW). The EVM runs on a single-threaded execution model, meaning each smart contract is processed sequentially. [PoS vs PoW]

SVM: Solana’s Proof of History (PoH), combined with Proof of Stake (PoS), allows the network to process transactions quickly and efficiently. The SVM is designed to support parallel execution of smart contracts, enabling multiple operations to occur simultaneously.

- Performance and Scalability

EVM: Ethereum’s EVM is capable of processing around 15-30 transactions per second (TPS), which can lead to congestion and high gas fees during periods of heavy use. Ethereum’s scalability is often enhanced using Layer 2 solutions like Optimism or Arbitrum.

SVM: Solana’s design enables the blockchain to handle 50,000+ transactions per second (TPS). This exceptional throughput is one of Solana’s biggest selling points, and it allows the network to maintain low fees and rapid transaction processing.

- Transaction Fees

EVM: Ethereum’s gas fees can fluctuate dramatically depending on network congestion and the complexity of the transaction. High demand can lead to expensive transaction fees, which has been a significant pain point for users and developers on Ethereum.

SVM: Solana is known for its low transaction fees, often costing a fraction of a cent per transaction. This is due to the network’s high throughput and efficient architecture, which can handle a large volume of transactions without driving up fees.

- Security and Maturity

EVM: Ethereum is the longest-standing blockchain platform, with a robust and mature ecosystem. Its security and reliability have been tested over many years, making it a trusted platform for smart contracts and decentralized finance (DeFi) applications.

SVM: Solana is a newer platform (launched in 2020) and has faced some network outages and security concerns. While Solana continues to improve, its relatively short track record means it’s still working to prove its reliability under heavy usage.

Conclusion

In the battle between EVM and SVM, both systems have their strengths and weaknesses. EVM-based blockchains like Ethereum focus on decentralization, security, and a mature ecosystem, but face scalability challenges and high transaction fees. On the other hand, SVM-based blockchains like Solana excel in speed, scalability, and low transaction costs, though they may sacrifice some decentralization in the process.

When choosing between the two, developers and users must consider the trade-offs: Ethereum offers a more established ecosystem with a focus on decentralization, while Solana provides cutting-edge performance and lower fees, making it an attractive option for high-volume applications.

Ultimately, the future of blockchain technology may not lie in choosing one over the other, but in the evolution and integration of both systems to cater to the growing demand for decentralized applications.

Comments ()