Exploration of Tokenization of Real-World Assets

The financial landscape is undergoing a significant transformation driven by blockchain technology, particularly through the tokenization of real-world assets (RWAs). Tokenization refers to the process of converting ownership rights of tangible or intangible assets, such as real estate, art, commodities, or financial instruments, into digital tokens on a blockchain.

This innovation is not merely a technological novelty but a fundamental shift in how assets are managed, traded, and invested in, with projections suggesting a market opportunity of up to $16 trillion by 2030, according to Boston Consulting Group.

Definition and Process of Tokenization

Real-world assets (RWAs) encompass a wide range of tangible and intangible assets that hold value in the physical world. These include real estate, art, commodities (such as gold or agricultural products), and financial instruments like bonds and stocks. Tokenization involves creating a digital representation of these assets on a blockchain, where each token corresponds to a fraction of the asset or represents ownership rights. For example, a $1 million painting can be tokenized into 1,000 tokens, each worth $1,000, allowing fractional ownership and broader investment access as mentioned here, Real-World Assets (RWAs) Explained.

The process of tokenizing an RWA typically involves several steps, as outlined in the Valuit guide:

- Asset Identification: Selecting a real-world asset for tokenization.

- Legal Structure: Establishing a legal framework to link the digital token to the physical asset, ensuring compliance with regulatory requirements.

- Token Creation: Minting digital tokens on a blockchain that represent ownership or rights to the asset.

- Smart Contract Implementation: Programming smart contracts to automate processes such as dividend payments, voting rights, or transfer of ownership.

- Distribution: Making the tokens available for investment through various platforms, enabling investors to buy, sell, or trade them.

This structured approach ensures that tokenized assets are legally sound and technologically secure, bridging the gap between physical and digital ownership.

Types of Tokenized Assets

The scope of assets that can be tokenized is vast, encompassing various categories:

- Real Estate: Individual properties, Real Estate Investment Trusts (REITs), and commercial portfolios. For instance, a $10 million commercial property can be tokenized into 10,000 tokens, each priced at $1,000, allowing fractional ownership

- Financial Assets: Government bonds, corporate debt, money market funds, and equity shares, which can be tokenized to enhance liquidity and accessibility.

- Commodities: Precious metals like gold and silver, agricultural products, energy resources, and industrial metals, often tokenized to facilitate trading and investment.

- Private Markets: Private equity, venture capital, and private credit, which are traditionally illiquid and inaccessible to many investors, can be tokenized to open new investment opportunities.

This diversity highlights the versatility of tokenization, applicable across multiple asset classes.

Benefits of Tokenization

Tokenization offers transformative advantages for both investors and institutions, as detailed in various sources.

For Investors:

- Enhanced Liquidity: Tokenized assets can be traded 24/7 on a global marketplace, making even traditionally illiquid assets like real estate as liquid as stocks. For instance, a Manhattan skyscraper could be as easily tradable as Apple stock, as noted in the Valuit guide.

- Fractional Ownership: High-value assets can be divided into smaller, more affordable tokens, allowing smaller investors to participate. This is particularly beneficial for assets like art or real estate, where entry barriers are typically high.

- Faster Settlement: Blockchain technology enables instant settlement of transactions, compared to the traditional T+2 settlement cycle, potentially unlocking $100 billion in annual returns globally, as estimated by McKinsey. More info here.

- Transparency and Security: The blockchain provides an immutable audit trail, enhancing transparency and security for all transactions, reducing the risk of fraud and errors.

For Institutions:

- Operational Efficiency: Smart contracts automate processes, reducing overhead costs. For example, BlackRock’s BUIDL fund has achieved over $500 million in assets under management (AUM) with lower operational costs.

- New Revenue Streams: Tokenization allows for the creation of innovative financial products. Franklin Templeton’s FOBXX fund, for instance, enables 24/7 peer-to-peer (P2P) transfers, opening new avenues for revenue.

- Global Reach: Institutions can access a worldwide investor base without needing a physical presence in multiple jurisdictions, enhancing market reach and scalability.

These benefits are supported by practical examples, such as HKMA’s Project Evergreen for digital bond issuance and Goldman Sachs’ end-to-end tokenized asset infrastructure.

Market Size and Growth Projections

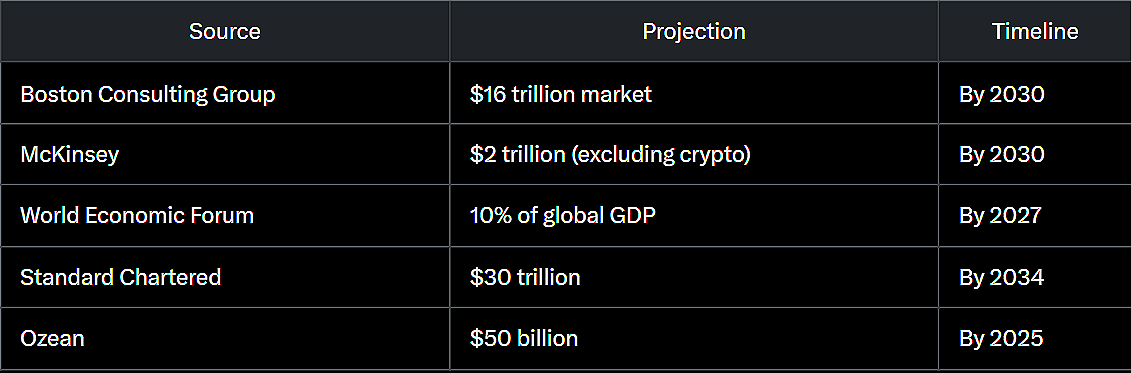

The market for tokenized RWAs is experiencing exponential growth. As of 2024, the total market value stood at $186 billion, including stablecoins, with $13.5 billion excluding them, representing a 32% year-to-date growth, involving over 150 issuers and 20 active blockchains, according to RWA.xyz . Looking ahead, projections are optimistic, as shown in the following table:

For 2025 specifically, CoinDesk predicts the total value of RWAs on-chain (excluding stablecoins) will reach at least $500 billion, up from over $50 billion currently.

Challenges and Risks

Despite its potential, RWA tokenization faces several challenges, as identified in multiple sources:

- Regulatory Complexity: Ensuring that on-chain tokens align with real-world ownership rights and comply with existing regulations is a significant hurdle, particularly given varying global standards.

- Technology Integration: Achieving interoperability between different blockchains and integrating with legacy financial systems requires substantial technological advancements, posing technical challenges.

- Security Concerns: Protecting against fraud and securing smart contracts from vulnerabilities is crucial for the trust and adoption of tokenized assets, with risks like smart contract bugs highlighted by Chainlink.

These challenges may slow adoption, especially in jurisdictions with stringent regulatory environments, but ongoing efforts aim to address them through sandbox environments and regulatory clarity.

Current Use Cases and Examples

Several notable examples illustrate the practical application of RWA tokenization, as detailed in the sources:

- Art: A $1 million painting tokenized into 1,000 tokens, each worth $1,000, enabling fractional ownership.

- Real Estate: Fractional ownership of a $10 million commercial property through tokens, demonstrating enhanced liquidity.

- Financial Assets: BlackRock’s BUIDL fund, which has surpassed $500 million in AUM, and Franklin Templeton’s FOBXX fund, which offers 24/7 P2P transfers.

- Global Initiatives: HKMA’s Project Evergreen for digital bond issuance in February 2023 and multicurrency issuance in February 2024, Goldman Sachs’ end-to-end tokenized asset infrastructure for over a year, and the EIB’s first digital bond in British pounds in January 2023 via HSBC Orion.

Additionally, Chainlink supports projects like Backed, Brickken, Matrixport, Poundtoken, and TUSD, further illustrating the ecosystem’s breadth.

Conclusion

The tokenization of real-world assets represents a paradigm shift in finance, offering unprecedented opportunities for liquidity, efficiency, and inclusivity. While challenges such as regulatory complexity, technology integration, and security concerns remain, the growing adoption by institutions, supportive regulatory developments, and the sheer potential of the market suggest that RWA tokenization is not just a trend but a fundamental evolution in how we manage and invest in assets.

Key Citations

- Real-World Asset Tokenization: The Ultimate Guide 2025

- What 2025 Holds for Tokenized Real World Assets

- Real-World Assets (RWAs) Explained | Chainlink

- How tokenization is transforming finance and investment | World Economic Forum

- Real World Asset Tokenization to Hit $50B in 2025: Ozean

MITOSIS official links:

GLOSSARY

Mitosis University

WEBSITE

X (Formerly Twitter)

DISCORD

DOCS

Comments ()