Exploring the Mitosis Ecosystem: Redefining Decentralized Finance through Modular Liquidity

Introduction

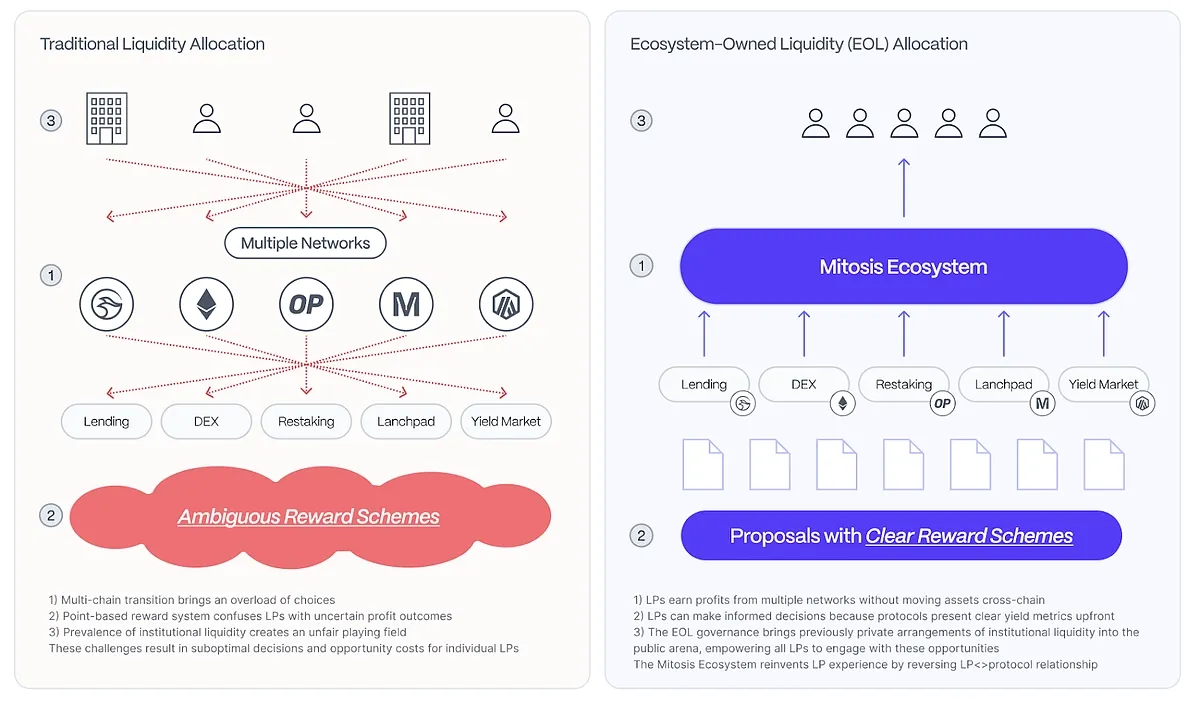

Decentralized Finance (DeFi) has transformed the financial landscape by offering permissionless, transparent, and intermediary-free financial services. However, challenges such as fragmented liquidity, cross-chain inefficiencies, and suboptimal capital utilization have hindered its scalability and adoption. Enter Mitosis, a groundbreaking modular liquidity protocol designed to address these challenging points and redefine how liquidity flows in the DeFi ecosystem. Launched with a vision to optimize capital efficiency and foster seamless cross-chain interactions, Mitosis introduces innovative primitives like the $miAsset and Matrix Vaults also called $ma-aasets, positioning itself as a pioneer in the modular era of blockchain technology.

This article delves into the Mitosis ecosystem, exploring its core components, unique value propositions, and potential to reshape DeFi. By analyzing its technical architecture, economic model, and strategic partnerships, we uncover how Mitosis tackles the "cold start problem" of DeFi liquidity and empowers users and protocols alike. With insights drawn from its public communications and the broader DeFi landscape, we aim to provide a comprehensive understanding of Mitosis’s role in the future of decentralized finance.

The Genesis of Mitosis: Addressing DeFi’s Liquidity Challenges

DeFi’s promise of financial inclusivity is often undermined by liquidity fragmentation across chains and protocols. Users face high slippage, limited asset availability, and complex bridging processes when interacting with multiple blockchains. Mitosis, as introduced in its litepaper and public announcements, aims to solve these issues by creating a unified liquidity network that enhances capital efficiency and user experience which have been shown through the expendition LRTs campaign and Theo & Morph matrix Vaults.

The protocol’s tagline, “The Modular Liquidity Protocol,” reflects its ambition to serve as a foundational layer for DeFi’s modular era, where blockchains are increasingly specialized and interoperable. Mitosis tackles the "cold start problem" the difficulty of bootstrapping liquidity for new protocols by providing a framework where liquidity is programmable, scalable, and accessible across ecosystems. This vision, articulated by Mitosis’s co-founder in public discussions, emphasizes building a decentralized product that prioritizes user empowerment over centralized control.

At its core, Mitosis introduces the concept of programmable liquidity, enabling protocols and users to optimize yield strategies, diversify risk, and streamline cross-chain operations even when LP is provided. By leveraging modular design principles, Mitosis allows for flexible integration with various blockchains, making it a versatile solution for the evolving DeFi landscape.

Core Components of the Mitosis Ecosystem

1. The $miAsset: A Growth Engine for Capital Efficiency

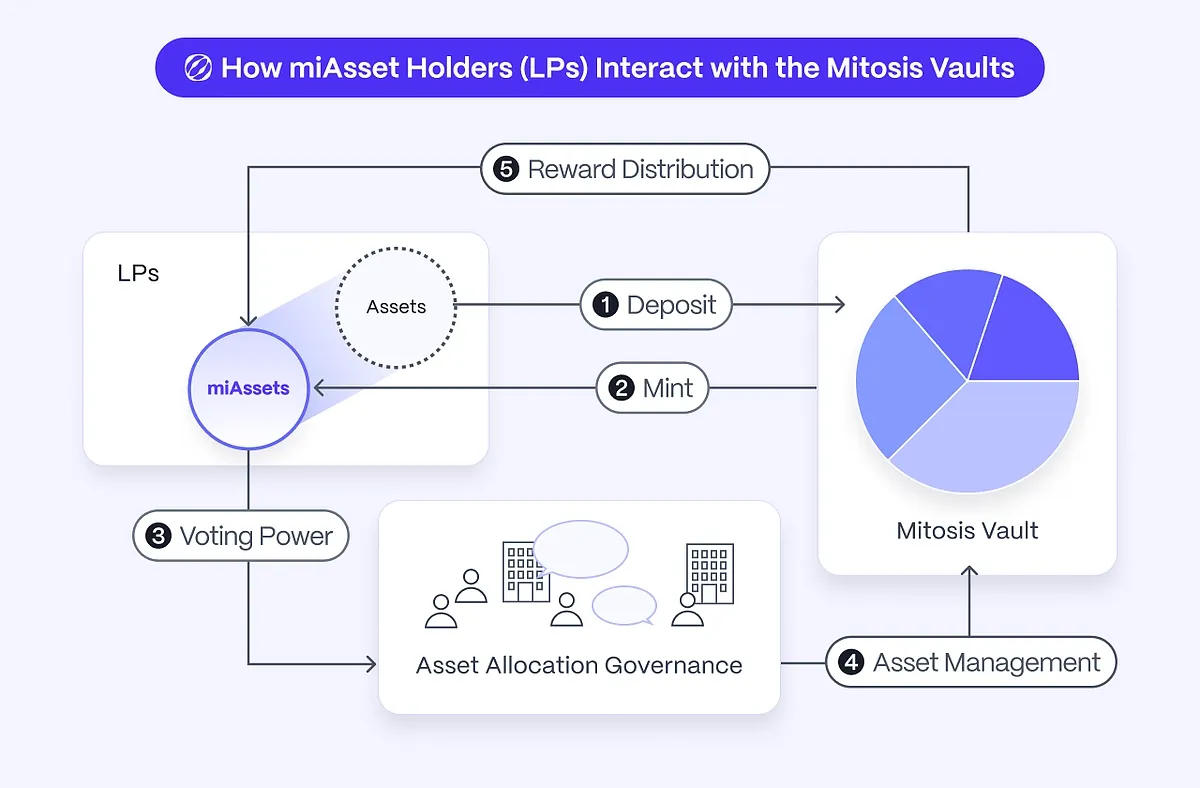

The $miAsset is Mitosis’s flagship primitive, described as the protocol’s “growth engine.” It is a tokenized representation of diversified yield strategies within the Mitosis Vault, designed to accrue value as the ecosystem expands. Unlike traditional DeFi tokens, which often rely on speculative trading, $miAsset is engineered to provide sustainable value through optimized capital allocation and native yield generation.

The $miAsset operates within the Mitosis Vault, a decentralized pool that aggregates liquidity from suppliers and allocates it across multiple yield-generating strategies. By diversifying investments across protocols and chains, the vault minimizes risk while maximizing returns. The $miAsset’s value is tied to the performance of these strategies, creating a dynamic asset that evolves with the ecosystem’s growth. This approach not only incentivizes long-term holding but also aligns the interests of suppliers, protocols, and the Mitosis network.

For example, a user depositing assets into the Mitosis Vault receives $miAsset tokens, which represent their share of the vault’s diversified yield. As the vault optimizes its strategies through partnerships with protocols like Theo Network & Morph or by integrating delta-neutral strategies, the $miAsset appreciates, providing holders with passive income and exposure to DeFi’s most efficient opportunities.

2. Matrix Vaults: Institutional-Grade Yield Optimization

Matrix Vaults are a cornerstone of Mitosis’s value proposition, offering institutional-grade, delta-neutral strategies to liquidity providers. These vaults are designed to balance risk and reward by employing sophisticated financial instruments, such as hedging and arbitrage, to generate stable returns regardless of market conditions. The integration with Theo Network, Mitosis’s first selected partner, exemplifies this approach by bringing professional-grade yield strategies to retail DeFi users.

Matrix Vaults operate as modular liquidity pools that can be customized to suit different risk profiles and investment goals. For instance, a conservative user might opt for a vault focused on stablecoin-based strategies, while a more aggressive investor could choose one targeting high-yield opportunities in volatile markets. This flexibility ensures that Mitosis caters to a broad audience, from retail investors to institutional players.

The vaults also enhance capital efficiency by reducing idle liquidity a common issue in traditional DeFi protocols. By dynamically reallocating assets to the most profitable opportunities, Matrix Vaults maximize the utilization of deposited funds, benefiting both suppliers and the protocols that rely on their liquidity.

3. The Mitosis Flywheel: A Self-Reinforcing Ecosystem

Mitosis’s growth is driven by its flywheel mechanism, a virtuous cycle that amplifies liquidity and value creation. The flywheel operates as follows:

- Liquidity Aggregation: Users deposit assets into the Mitosis Vault, receiving $miAsset in return.

- Yield Optimization: The vault allocates these assets across diversified strategies, generating native yield.

- Value Accrual: As yields accumulate, the $miAsset’s value increases, attracting more users and liquidity.

- Ecosystem Expansion: Increased liquidity enables Mitosis to integrate with more protocols and chains, further enhancing yield opportunities.

This self-reinforcing cycle, highlighted in Mitosis’s education series, ensures that the protocol scales organically while maintaining decentralization and transparency. By contrast, centralized platforms like FTX relied on opaque operations, which Mitosis explicitly avoids, as emphasized by its founder.

Technical Architecture: Building for Modularity and Scalability

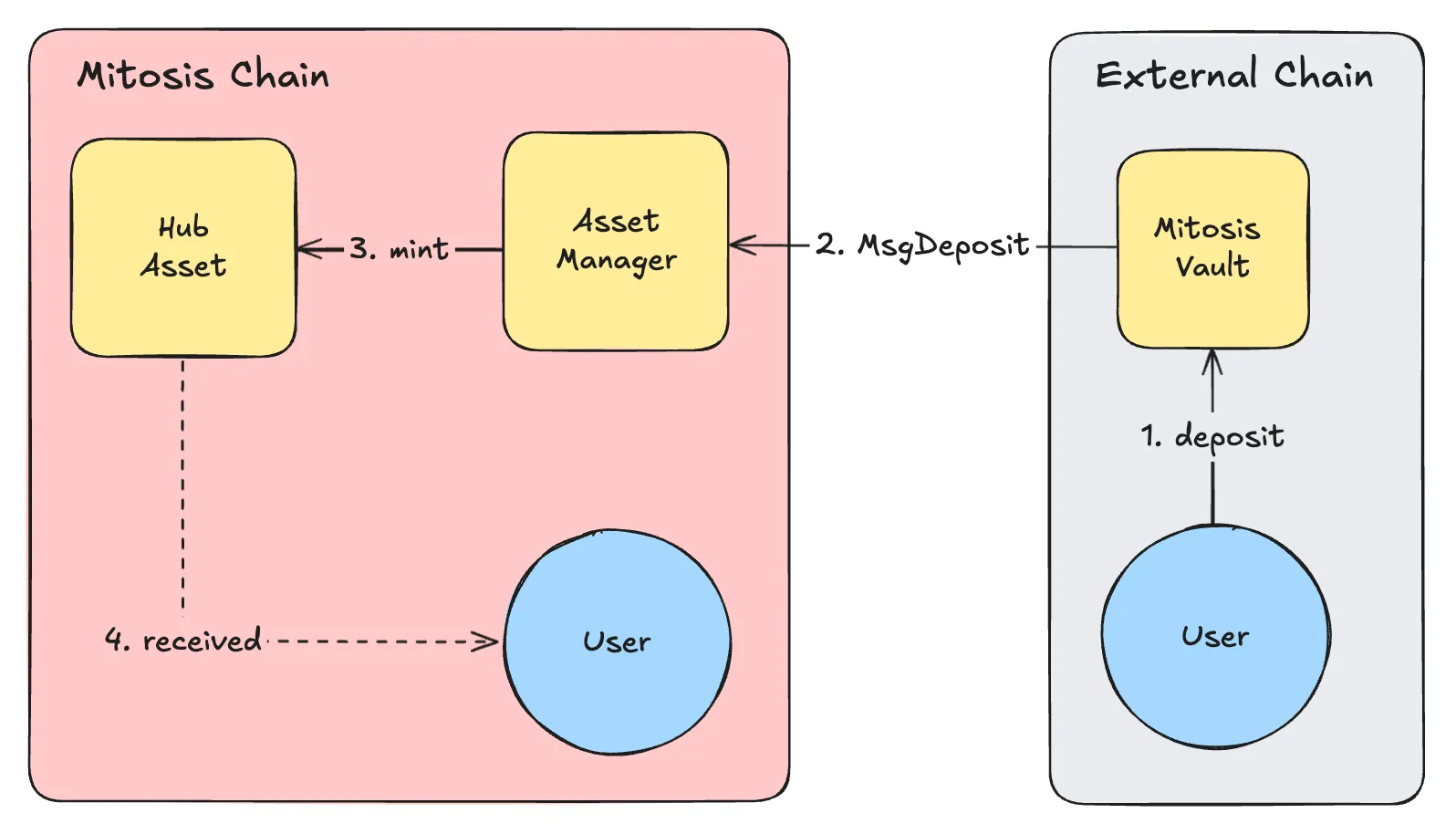

Mitosis’s architecture is designed to support modularity and interoperability, key tenets of the modular blockchain era. Unlike monolithic protocols that are chain-specific, Mitosis operates as a cross-chain liquidity layer, enabling seamless asset transfers and interactions across blockchains like Ethereum, Binance Smart Chain, and emerging Layer 2 solutions.

Cross-Chain Interoperability

Mitosis leverages advanced bridging technologies to facilitate cross-chain liquidity flows. By integrating with existing bridge protocols and developing proprietary solutions, Mitosis ensures low-latency, low-cost asset transfers. This is critical for addressing liquidity fragmentation, as users can access the same liquidity pool regardless of their preferred blockchain.

For example, a user on Ethereum can deposit assets into a Mitosis Vault and receive $miAsset, which can then be used on Polygon or Arbitrum without incurring significant bridging fees. This seamless experience is a significant improvement over traditional DeFi, where cross-chain operations often involve multiple steps and high costs.

Smart Contract Design

At the heart of Mitosis’s technical framework are its smart contracts, which govern the vault, $miAsset, and Matrix Vault operations. These contracts are audited and optimized for gas efficiency, ensuring that users can interact with the protocol without prohibitive costs. The modular design allows developers to plug in new yield strategies or integrate with external protocols without disrupting the core system.

The smart contracts also incorporate robust security measures, such as multi-signature wallets and time-locked upgrades, to protect user funds. This focus on security aligns with Mitosis’s commitment to decentralization, ensuring that no single entity can control the protocol or its assets.

Economic Model: Aligning Incentives for Growth

Mitosis’s economic model is designed to align the incentives of all stakeholders—liquidity providers, protocol partners, and the Mitosis network itself. The $miAsset serves as the primary economic primitive, acting as both a governance token and a yield-bearing asset.

Governance and Decentralization

Holders of $miAsset can participate in the protocol’s governance, voting on key decisions such as vault strategy allocations, partnership integrations, and protocol upgrades. This democratic approach ensures that Mitosis remains community-driven, avoiding the pitfalls of centralized control seen in some DeFi projects.

Governance is further enhanced by the Mitosis Matrix, a framework that allows protocols to integrate with Mitosis Vaults and share in the generated yield. By incentivizing protocol participation, Mitosis creates a network effect where more integrations lead to greater liquidity and higher yields, benefiting all participants.

Tokenomics and Sustainability

While specific details on $miAsset’s tokenomics are not fully disclosed in public sources, Mitosis emphasizes sustainability through native yield generation rather than inflationary token emissions. Unlike many DeFi protocols that rely on high APYs driven by token inflation, Mitosis focuses on real yield derived from diversified strategies. This approach reduces sell pressure on $miAsset and ensures long-term value stability.

The protocol also plans to distribute $miAsset to early participants like participants of the Mitosis expendition program, the miAssets was displayed in the Game of Mito testnet, as a way to bootstrap community engagement.

Participants who earned $MITO And other assets such as Layer 1 assets & $miassets will get a convert-drop on a 70:30 ratio.

The “convert drop” mechanism rewards early adopters while fostering a loyal user base.

Strategic Partnerships: Amplifying Impact

Mitosis’s collaboration with Theo Network & Morph marks a significant milestone in its journey to redefine DeFi liquidity. By integrating institutional-grade, delta-neutral strategies, Theo Network enhances the yield potential of Matrix Vaults, making them attractive to both retail and institutional investors. This partnership demonstrates Mitosis’s ability to attract high-caliber partners and integrate sophisticated financial tools into its ecosystem.

Future partnerships are likely to focus on expanding cross-chain compatibility and integrating with emerging DeFi protocols. By building a network of interoperable partners, Mitosis aims to create a cohesive liquidity ecosystem that transcends individual blockchains and protocols.

The Vision: A World for DeFi Pioneers

Mitosis envisions its ecosystem as a “world for DeFi pioneers,” where users and protocols can explore new financial opportunities without the constraints of traditional DeFi. This vision, articulated in its public communications, emphasizes empowerment, innovation, and accessibility.

For users, Mitosis offers a seamless experience where they can deposit assets, earn diversified yields, and participate in governance all within a single platform. For protocols, Mitosis provides access to a deep liquidity pool, enabling them to scale operations and attract users without the burden of bootstrapping their own liquidity.

This dual focus on users and protocols positions Mitosis as a catalyst for DeFi’s next phase of growth. By addressing the cold start problem and enabling programmable liquidity, Mitosis paves the way for a more efficient, inclusive, and interconnected DeFi ecosystem.

Challenges and Opportunities

While Mitosis’s vision is compelling, it faces several challenges in achieving its goals. The DeFi space is highly competitive, with established protocols like Aave, Uniswap, and Curve dominating liquidity provision. To differentiate itself, Mitosis must continue to innovate and deliver on its promises of capital efficiency and cross-chain interoperability.

Regulatory uncertainty is another hurdle, as DeFi protocols increasingly come under scrutiny from global regulators. Mitosis’s decentralized nature and focus on transparency may mitigate some risks, but navigating the regulatory landscape will require careful planning.

On the opportunity side, the modular blockchain era presents significant growth potential. As blockchains like Ethereum, Solana, and Cosmos continue to specialize, the demand for cross-chain liquidity solutions will grow. Mitosis’s modular architecture and strategic partnerships position it to capitalize on this trend, potentially capturing a significant share of the DeFi market.

Conclusion

Mitosis represents a bold step forward in the evolution of decentralized finance. By introducing primitives like $miAsset and Matrix Vaults, the protocol addresses critical challenges in liquidity provision, capital efficiency, and cross-chain interoperability. Its flywheel mechanism and modular architecture create a self-reinforcing ecosystem that benefits users, protocols, and the broader DeFi landscape.

As Mitosis continues to develop and integrate with partners like Theo Network, it has the potential to redefine how liquidity is managed in DeFi. For pioneers seeking to explore the frontiers of decentralized finance, Mitosis offers a compelling platform to participate in a new era of financial innovation. With its focus on sustainability, decentralization, and user empowerment, Mitosis is poised to become a cornerstone of the modular blockchain ecosystem, driving the next wave of DeFi adoption and growth.

Comments ()