Exploring Theo Network: Funding Rates, Delta Neutrality, and Its Impact on DeFi

Decentralized Finance (DeFi) has created new opportunities for earning income, but high returns often come with significant risks. The Theo Network offers a different approach by providing stable yields through its unique use of funding rates and a focus on delta neutrality. In this article, I will explain how Theo collects funding rates, compare its strategy to a competitor like Ethena, and highlight what makes Theo unique in the DeFi space. By the end, you will understand how Theo balances innovation and stability, and why it may be worth considering as a DeFi participant.

Understanding Funding Rates and How Theo Collects Them

Funding rates are an important part of perpetual futures contracts. They help keep prices in line with the spot market. Payments are made between traders who hold long and short positions based on market trends—long positions pay shorts when prices go up, and shorts pay longs when prices go down. This creates a dynamic system, and Theo uses it to create a steady income stream.

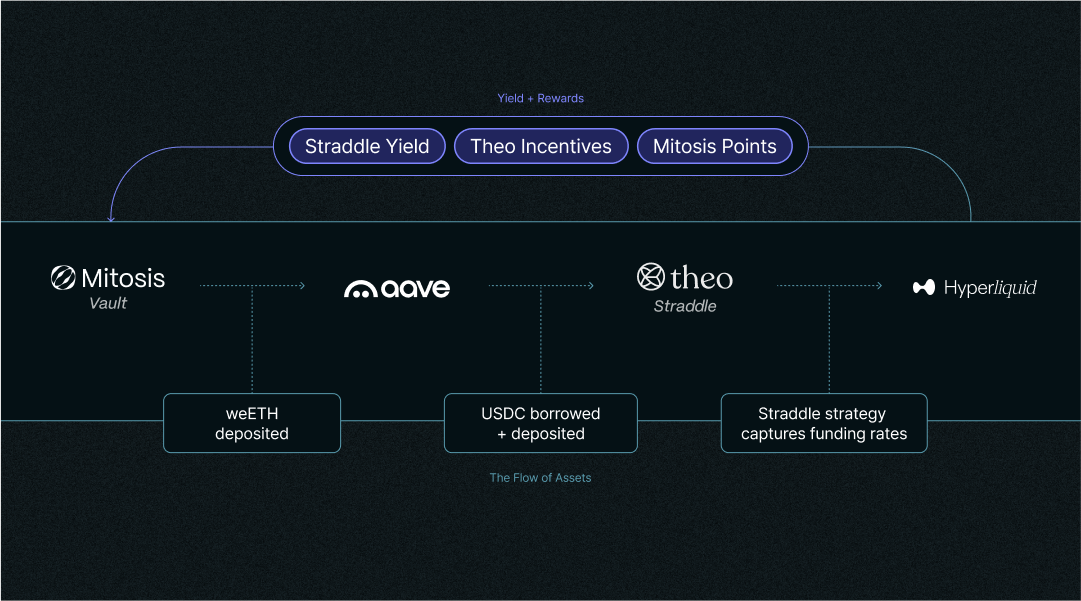

With its Straddle Vault, Theo takes assets like wrapped Ether (weETH) from users, borrows USDC against it on Aave, and then opens short positions using Hyperliquid. This strategy balances the long exposure of the collateral, keeping the portfolio neutral while collecting funding payments from traders who are betting on price increases. What’s great is that Theo automates this process with smart contracts, making it easy and efficient for users who don’t want to manage their investments closely.

Comparing Theo and Ethena: Two Paths to Neutrality

To understand Theo’s strategy better, let’s look at Ethena, another DeFi platform that also avoids market risk. Ethena pairs its USDe synthetic dollar with staked Ethereum (stETH) and short ETH futures. This combination helps it earn staking rewards and funding rates to stay stable. While both platforms aim to reduce market risk, they have different methods.

Ethena uses centralized exchanges like Binance for its hedging, which adds some risk from other parties. In contrast, Theo uses Hyperliquid, a decentralized platform, which fits better with the principles of DeFi. Ethena offers returns from a mix of staking (usually 3-5% per year) and funding rates, which can increase during bullish markets. On the other hand, Theo focuses only on funding rates, giving users more flexibility when staking isn’t enough.

Additionally, Ethena requires a 7-day waiting period to unstake its sUSDe, while Theo provides a smoother experience with initiatives like the Matrix Vault and extra token incentives. Ethena has a large scale, with billions in total value locked, but Theo’s connection with Mitosis gives it a special advantage, especially for early users looking for customized opportunities.

The Power of Delta Neutrality and Theo’s Unique Advantage

Delta neutrality is a way to reduce risk from price changes, letting platforms like Theo focus on steady returns, no matter how the market moves. In the Straddle Vault, long positions in weETH are balanced by short positions. This means that whether Ethereum goes up or down, the results depend on funding rates, not on guessing prices. This method is great for cautious investors, but Theo has some extra features that make it stand out.

First, Theo automatically adjusts collateral and borrowing, which lowers the risk of losing money if the market changes suddenly. Second, unlike Ethena, which focuses on stablecoins, Theo helps liquidity providers who want to earn more, filling a specific need in the DeFi world.

Conclusion

The Theo Network takes a smart approach to DeFi by using funding rates and delta neutrality to provide steady returns with low risk. Its Straddle Vault, supported by partnerships with Mitosis, offers a strong alternative to Ethena’s wider stablecoin model, focusing on decentralization and flexibility for users. As someone interested in DeFi, I see Theo as a good way to earn consistent returns. Do you think strategies like this could become an important part of DeFi, or will they stay a choice for people who want to take less risk? I’d love to hear your thoughts—check out Theo’s ecosystem and let me know what you think!

Useful Links:

- Mitosis Blog: Introducing Straddle Supply Opportunity with Mitosis – Learn the details of Theo’s Straddle Vault and how it integrates with Mitosis.

- Mitosis University: Mitosis and Theo Collaboration – Explore the partnership between Mitosis and Theo for exclusive liquidity opportunities.

- Theo Docs: Overview – Dive into the technical workings of Theo’s Straddle vaults and funding rate strategies.

Comments ()