Flip Tricks & Flow: Breaking Down Skatechain and the Projects Tokenomics

In the world of crypto, most projects are playing catch-up, patching bridges, duct-taping DeFi together, and pretending multi-chain is the same as interoperable. Then there’s Skatechain, dropping in like a pro skater on a mega ramp, flipping the game with multi-VM support, a single liquidity curve, and tokenomics that actually make sense.

Welcome to the Skatechain ecosystem, where stateless apps ride across chains, and the $SKATE token fuels it all. Whether you’re a degen at heart (I fit into this one), an infra geek, or a community lurker with point farming ambitions, Skate has something for you.

Let’s break down what makes Skatechain tick, from its tech foundations to the slick $SKATE tokenomics under the hood.

What is Skatechain?

Skatechain is a cross-chain infrastructure protocol designed to let decentralized applications (dApps) run seamlessly across multiple blockchain virtual machines (VMs). One of the greatest things about Skatechain is that it includes both EVM-compatible and altVM chains. That means one dApp, one user base, and one shared liquidity pool… across everything.

Imagine only having to use one wallet to interact with all your favourite chains? No more manually switching / adding chains?

Well this is about to be reality.

The secret sauce? The Skate AMM, a groundbreaking Automated Market Maker that works across multiple chains with a single liquidity curve. That’s right: instead of fragmenting liquidity like most AMMs, Skate lets you provide and access it across the ecosystem. This makes cross-chain swaps smoother than a fresh set of bearings (real life skaters know this feeling)

And behind the scenes, Skate is built on EigenLayer’s AVS (Actively Validated Services), giving stateless apps high trust guarantees, without relying on heavy consensus layers. It’s light, fast, and composable.

How Does It Work?

Skatechain operates on three key pillars:

- Multi-VM Interoperability

Whether your app was built for Ethereum, Solana, or some up-and-coming altVM, Skate enables interoperability between them. It’s like a universal skatepark where every type of board (VM) can ride. - Stateless Applications

Stateless apps don’t need their own chain or consensus, they inherit security from EigenLayer AVS, making them fast, scalable, and cheaper to operate. - The Skate AMM

A multi-chain AMM that uses a single liquidity curve for all trades across all VMs. That means no fractured liquidity, and a much better user experience.

$SKATE Token: The Engine Behind the Movement

Now for the juicy part — SKATE, the native utility and governance token. It’s not just for looks; this token does some serious heavy lifting.

Key Utilities of $SKATE:

- Governance:

Stake $SKATE to vote on protocol upgrades, incentive allocations, and ecosystem decisions. The longer and larger your stake, the more your vote counts. (Diamond hands get the mic.) - Ecosystem Incentives:

LPs in the Skate AMM earn $SKATE rewards, incentivizing users to provide liquidity long term. And builders of stateless apps on altVMs can also earn $SKATE for building the future. - EigenLayer AVS Security:

Operators and restakers securing Skate's infrastructure are paid in $SKATE. Future slashing functionality will keep everyone honest. - Community Contributions:

Meme, yap, code, or contribute - pick your poison. You might just be rewarded with some sweet $SKATE.

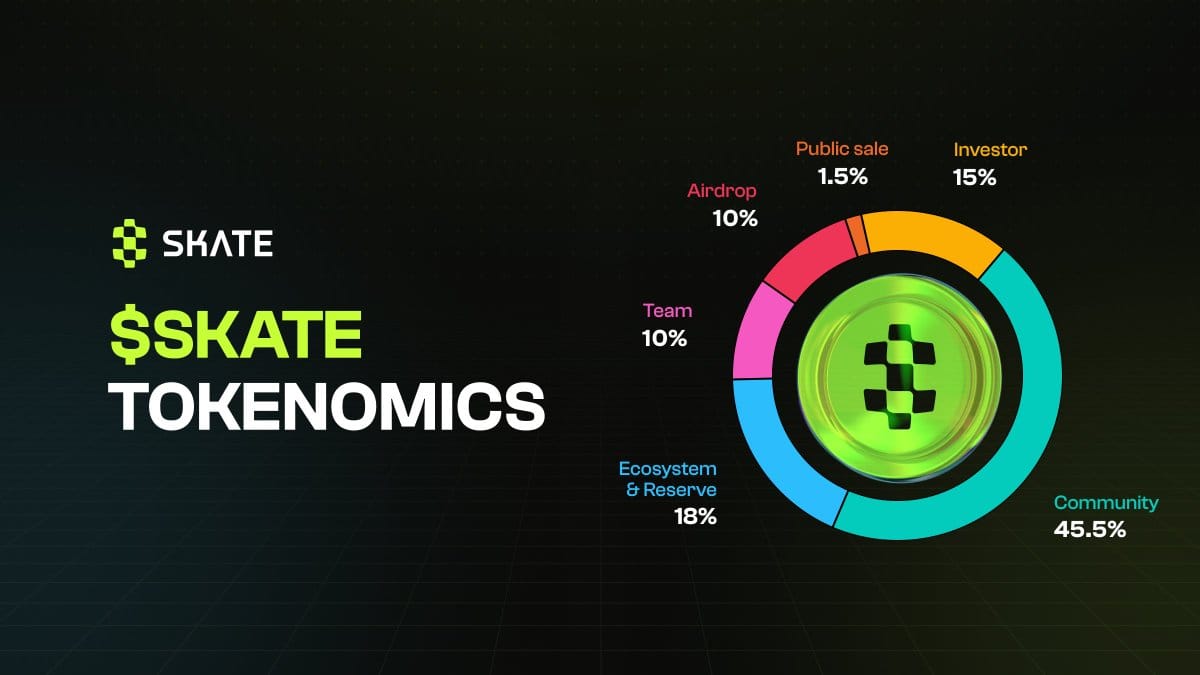

Tokenomics Breakdown: Where Does All the SKATE Go?

Total Supply: 1,000,000,000 $SKATE

Here's how it’s divvied up:

Community: 45.5%

The largest slice of the Skate Pie. Skatechain is all about community-first. This allocation supports:

- EigenLayer AVS operator incentives

- AMM rewards (liquidity mining, trading, etc.)

- Stateless app growth incentives

- Grants, campaigns, marketing, and community initiatives

Investors & Advisors: 15%

Reserved for early believers who provided funding and guidance. Vested over time to ensure alignment.

Team: 10%

For the brilliant minds building this beast. Locked with a 6-month cliff and 3.5 years of linear vesting.

Initial Airdrop: 10%

A massive early thank-you to:

- Ollie point earners

- SkateFi & Range Protocol users

- Kaito community members

- EigenLayer restakers and AVS contributors

And yes, “Claim & Stake” comes with a juicy 30% bonus on your airdrop. Flex your alignment and earn more by helping secure the network.

Ecosystem & Reserves: 18%

This chunk handles liquidity and long-term strategy:

- DEX and market-making liquidity

- Strategic reserves for listings and partnerships

- SKATE LST liquidity bootstrap

- Bonus future airdrops

Public Sale: 1.5%

A small but important slice for open market access and fair distribution.

Vesting Schedule: Slow Drip, Strong Grip

Skatechain isn’t here for the quick flip. The vesting structure is built to ensure long-term alignment:

- Team & Advisors: 6-month cliff, multi-year vesting

- Investors: Same deal. No pump and dumps here.

- Community & Ecosystem: Dynamic schedules tied to actual participation, growth, and milestones.

Built on Trust: Audits, Governance & Transparency

Skate isn’t cutting corners. All core contracts will be audited by top security firms, and decentralized governance will roll out post-TGE. SKATE holders will guide the protocol’s evolution — from parameter changes to ecosystem spending.

Why Skatechain Matters

Here’s the TL;DR:

- Cross-chain? It’s not a feature — it’s the foundation.

- Stateless apps? Built for scale, composability, and efficiency.

- One AMM to rule them all? Yep. A single liquidity curve across every chain you care about.

- SKATE tokenomics? Thoughtful, community-weighted, and growth-aligned.

In short: Skatechain is building Web3’s universal execution layer, backed by real incentives, a powerful security model, and a community-first approach.

Conclusion

Skatechain isn’t just another blockchain, it’s a whole new way to think about infrastructure, liquidity, and cross-chain composability.

Whether you’re a builder looking to launch a stateless app, a restaker contributing to economic security, or a degen chasing that next big airdrop (hey, no judgment), Skatechain gives you a reason to stay!

So go ahead. Check your Ollie points. Get ready to claim and stake. And remember:

This isn’t a bridge. It’s a board. And the whole multichain world? That’s your skatepark.

References

Mitosis University. (n.d.). Liquidity. https://university.mitosis.org/liquidity/

Mitosis University. (n.d.). Automated market makers (AMM). https://university.mitosis.org/amm/

Mitosis University. (n.d.). Circulating supply. https://university.mitosis.org/circulating-supply/

Mitosis University. (n.d.). Cross-chain liquidity. https://university.mitosis.org/cross-chain-liquidity/

Mitosis University. (n.d.). Decentralized exchange (DEX). https://university.mitosis.org/decentralized-exchange-dex/

Mitosis University. (n.d.). EigenLayer. https://university.mitosis.org/eigenlayer/

Mitosis University. (n.d.). Ethereum Virtual Machine (EVM). https://university.mitosis.org/evm/

Mitosis University. (n.d.). Governance token. https://university.mitosis.org/governance-token/

Mitosis University. (n.d.). Interoperability. https://university.mitosis.org/interoperability/

Skate Foundation. (2025, June 7). [Tweet]. X. https://x.com/SkateFDN/status/1930555302417449171

Comments ()