From Hype to Yield: The Future of SocialFi with Yarm and Mitosis

SocialFi is booming... platforms are popping up everywhere, trading attention for tokens. But what happens when the rewards run out?

That’s where Yarm truly stands out.

By integrating with Mitosis’ Vault Liquidity Framework (VLF), Yarm goes beyond simple buzz marketing. It turns mindshare into real liquidity and content into sustainable yield.

In this article, I’ll break down how Yarm and Mitosis are reshaping the SocialFi landscape, introducing programmable liquidity, real DeFi strategies, and long-term value for both creators and investors.

Let’s dive in.

First of all, what is Yarm?

Imagine a world where your voice gives you access to exclusive DeFi yields. Where your engagement and social presence become a VIP pass to high-performing campaigns, and you can bring your followers along for the ride.

A few months ago, this would've sounded crazy. But with Kaito bringing real insights on content creators’ influence (mindshare), this is now possible.

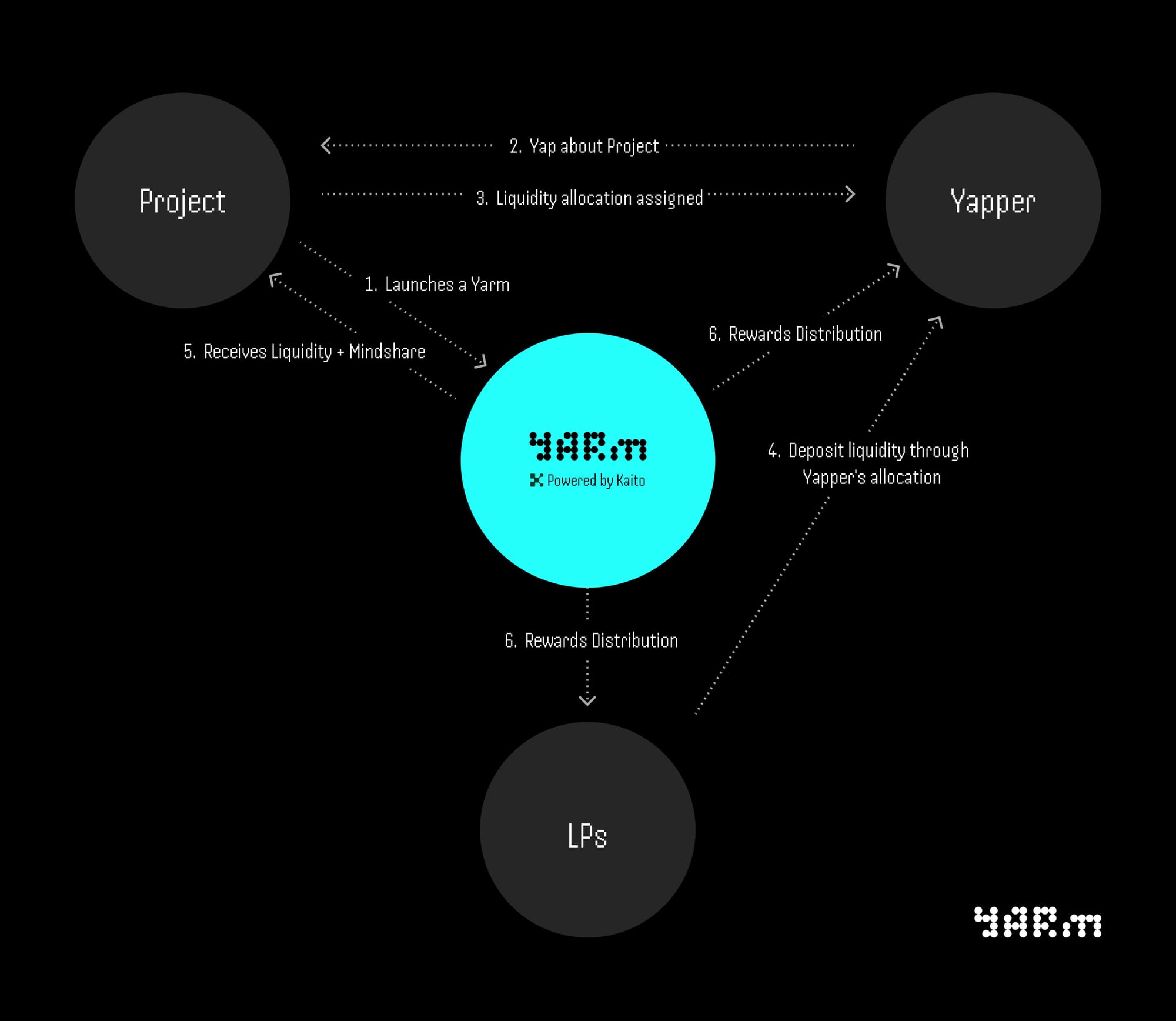

Yarm is a socially-driven liquidity platform that connects influential voices with liquidity providers to unlock superior DeFi yield opportunities.

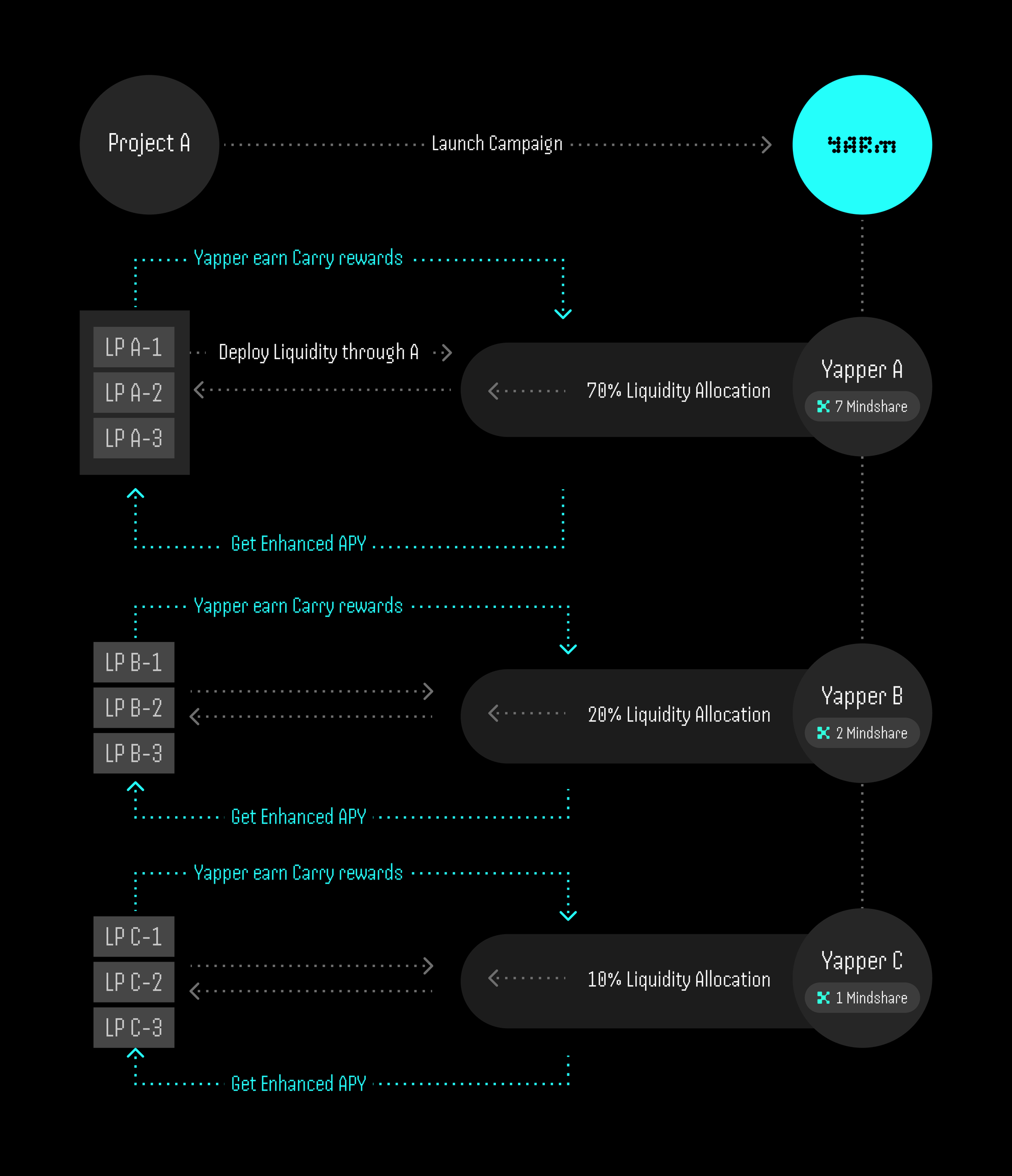

It works by using Kaito’s mindshare data to identify top voices.

When a protocol launches a Yarm campaign, these voices get access to a liquidity allocation, which they help fill and earn a carry % in return.

What makes Yarm different from other SocialFi platforms?

SocialFi platforms have grown fast and are great at creating buzz for crypto projects. But the big question is: is this model truly sustainable?

How long can crypto protocols afford to reward yappers just for talking about them? And more importantly, what happens when the rewards run out?

Traditional InfoFi:

➢ Content → Mindshare → Token rewards

➢ Social activity creates buzz but no real yield value

➢ Limited earnings through one-off campaigns with no long-term sustainability

Now see how Yarm stands out:

➢ Content → Mindshare → Liquidity Allocation → Yield Participation

➢ You don’t just interact, you follow your favorite influencers’ strategies, leverage their alpha, and generate real yield for both parties

➢ High earning potential tied to sustainable value creation in DeFi

Yarm's model is an evolution... A real maturity leap for SocialFi, enabling sustainable yield for yappers, as it’s based on real asset deposits and linked to DeFi performance.

Incentives continue to exist, but now demand deeper involvement from yappers and their communities.

Where does Mitosis come in?

To turn Yarm’s vision into a true socially-driven liquidity layer, it needed a powerful DeFi infra partner: Mitosis — builders of the Programmable Liquidity Network.

Yarm campaigns are executed through Mitosis' Vault Liquidity Frameworks (VLFs), structured systems that connect LPs with curated opportunities while preserving security and user control.

There are two types of VLFs:

➢ Ecosystem-Owned Liquidity (EOL)

➢ Matrix Vaults

But what does Programmable Liquidity mean?

It’s when a liquidity vault uses automated strategies to maximize yield.

These strategies follow predefined rules coded into smart contracts, hence the term “programmable”.

A programmable liquidity pool adapts to market conditions, risk levels, etc., to always pursue the best available strategy.

How Mitosis’ Vault Liquidity Framework (VLF) works?

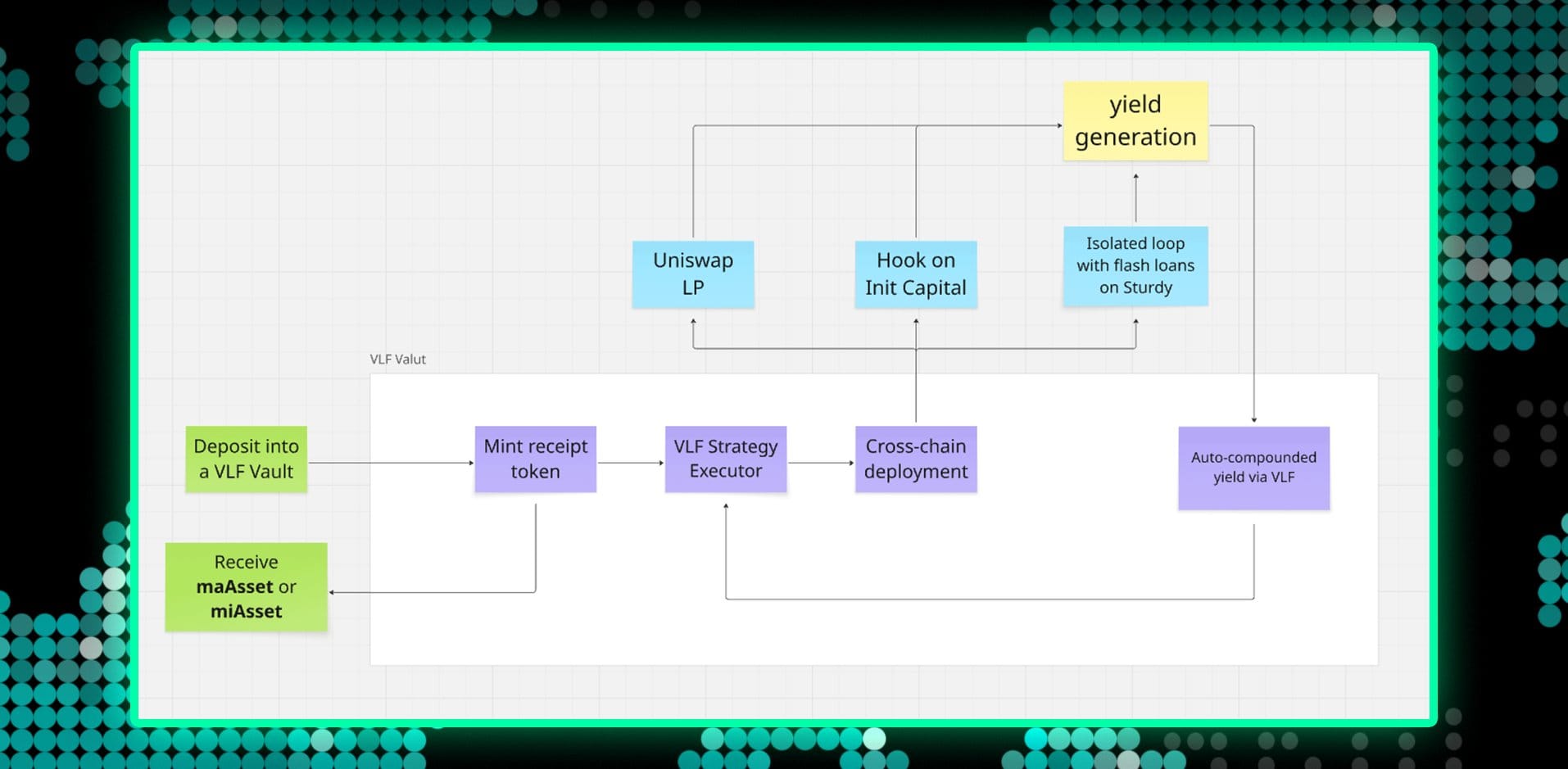

This framework enables the creation of vaults across chains, allowing devs to implement programmable strategies and connect everything to the Mitosis ecosystem.

One key component is the VLF Strategy Executor: a smart contract that optimizes vault deposits by choosing the best yield strategy based on current conditions.

When you deposit, you receive a yield-bearing token (miAsset / maAsset), which acts as a receipt for your deposit, while still keeping you liquid.

In other words:

➢ You deposit into a vault

➢ The vault’s smart contract puts your assets to work for yield

➢ Your assets are constantly seeking the best opportunities until withdrawal

➢ Meanwhile, your receipt token (miAsset / maAsset) can still be used elsewhere, like as collateral on money markets (think Aave)

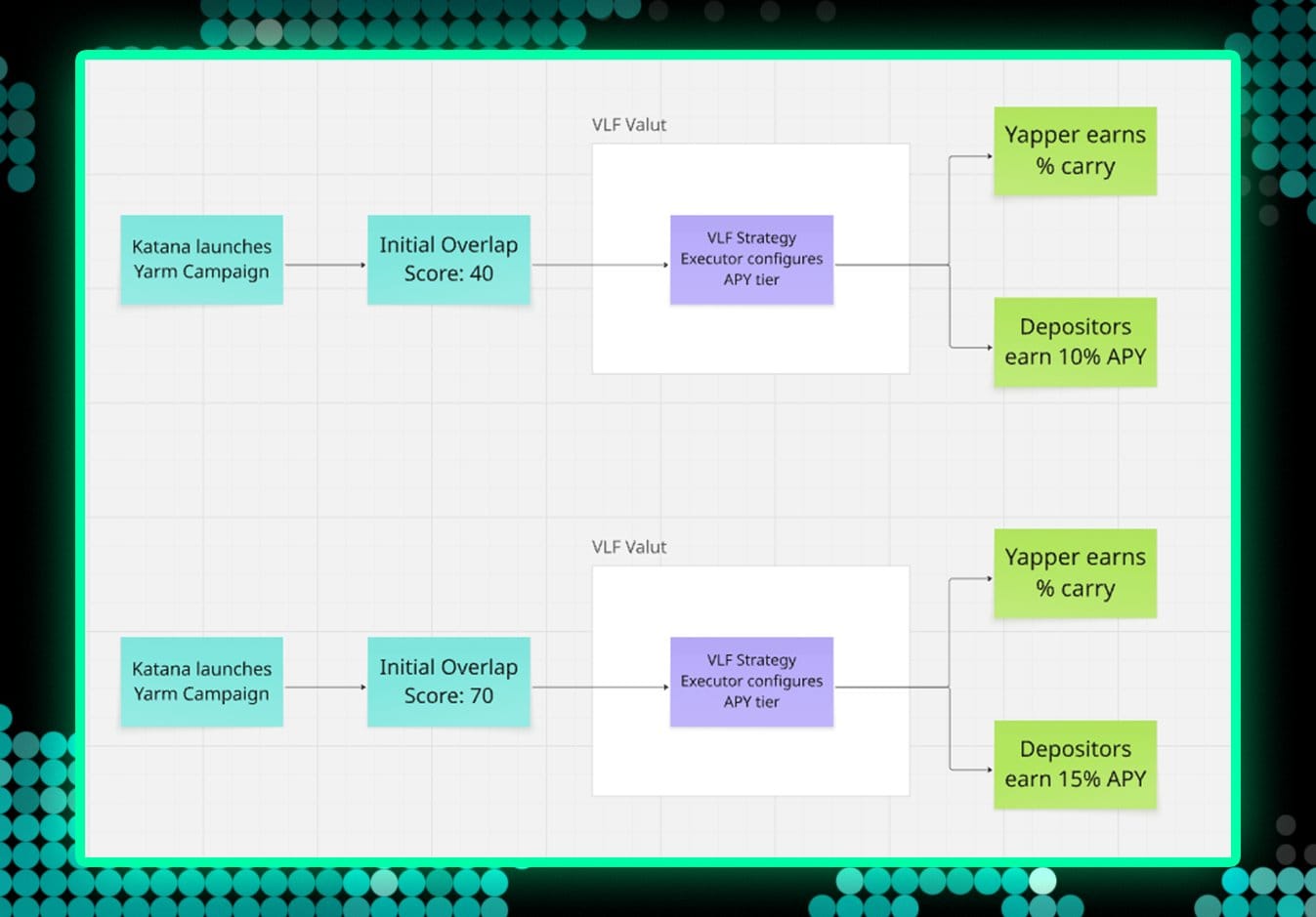

The perfect combo: Yarm Overlap Score (OS) + Mitosis VLF

Overlap Score (OS) is a proprietary Yarm key metric that measures how well a project's mindshare aligns with Yarm’s top contributors.

The higher the OS, the more attractive the vault deal becomes.

The OS is based on two factors:

➢ How many of the top 1,000 Yappers are among a project’s highest mindshare holders

➢ How many of them are also active Yarmers

With this metric, Yarm can program yield boosts via Mitosis VLFs as OS improves.

That means: as the score increases, VLF enables higher yield tiers.

Here’s a hypothetical example of how I believe it will work

Let’s say Katana wants to grow its TVL and sees a Yarm campaign (powered by Mitosis + Kaito) as the way to go, leveraging creators’ influence to drive liquidity.

Here’s how it might go down:

➢ Mitosis creates a vault for deposits on Katana Chain

➢ You deposit a vanilla asset (e.g. ETH) on Katana and mint a hub asset (ETH) to withdraw on Mitosis Chain

➢ On Mitosis chain, a Matrix Vault for Katana’s Yarm campaign is created

➢ Eligible wallets (top content creators — Yarmers) deposit their hub ETH into assigned liquidity slots, taking advantage of the special yield opportunity offered by Katana and Mitosis during the campaign

➢ Yarmers use their influence to attract other depositors into their pool and earn carry % rewards (within their liquidity allocation)

➢ When depositing, a VLF asset is minted: $maETHkatana, a yield-bearing token that acts as a receipt

➢ Holders of $maETHkatana (Yarmers and their followers) enjoy boosted yields from the Yarm campaign while remaining liquid to seize other opportunities within Mitosis’ DeFi ecosystem, using their $maETHkatana token as collateral in a money market like Telo (a protocol similar to Aave), for example.

Did you enjoy this content?

If it helped you in any way, I’d really appreciate your support!

Feel free to connect with me on Twitter/X, and if you’d like to send a Praise, my Discord is open too. 🙏

Thanks in advance for your trust and support — it means a lot! 🙌

Follow me on Twitter/X: febarce |DeFi

My Dircord: febarce |DeFi

Check out my other articles

Comments ()