From Ledger to Global Computer: Harnessing Blockchain’s Computational Power and Consensus for Trustless Innovation

Abstract

Blockchain technology has evolved far beyond its origins as a distributed ledger for cryptocurrencies, emerging as a powerful programmable compute layer capable of executing complex logic securely and transparently. This transformation is driven by smart contracts, decentralized applications (dApps), and computational environments like the Ethereum Virtual Machine (EVM), Supported by robust consensus mechanisms such as Proof of Work (PoW) and Proof of Stake (PoS). This article explores how blockchain functions as a global compute platform, the critical role of consensus in ensuring trustless integrity, and real-world applications in Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs). By examining these elements, we highlight blockchain’s potential to redefine trust, automation, and decentralization across industries.

Introduction: Blockchain’s Evolution

Since Bitcoin’s inception in 2008, blockchain technology has transcended its initial role as a distributed ledger for digital currencies, evolving into a revolutionary platform for secure, transparent, and immutable computation (arXiv). Rooted in Distributed Ledger Technology (DLT), which enables simultaneous access, validation, and updating across networked databases, blockchain distinguishes itself through its cryptographically chained, inherently immutable structure (Investopedia). Unlike broader DLTs, which may vary in form and immutability, blockchains are typically public, permissionless, and always tamper-proof due to their decentralized, cryptographically secured design.

This foundational shift has transformed blockchain into a programmable platform, capable of supporting complex computational logic far beyond simple value transfers. Platforms like Ethereum and HyperLedger exemplify this evolution, enabling applications from tokenizing assets to automating intricate business processes (Investopedia). This article delves into blockchain’s role as a sophisticated compute layer, exploring how smart contracts, dApps, and the EVM establish its computational prowess, and how consensus mechanisms like PoW and PoS ensure network integrity and participation. By examining real-world applications, we underscore blockchain’s potential to reshape industries through programmable trust.

Blockchain as a Programmable Compute Layer

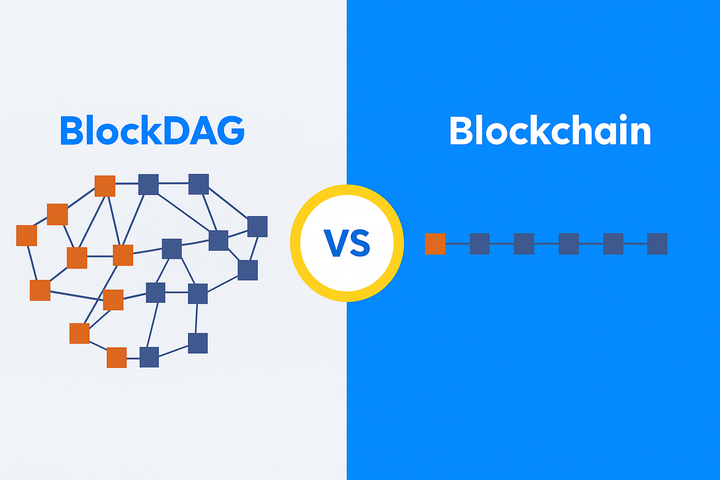

From DLT to Programmable Platforms

Distributed Ledger Technology (DLT) provides the infrastructure for simultaneous access, validation, and updating across networked databases, maintained by nodes that hold identical ledger copies (Investopedia). While all blockchains are DLTs, not all DLTs are blockchains. Blockchains employ a linear, cryptographically chained structure of “blocks,” ensuring inherent immutability, unlike DLTs, which may lack this guarantee by default (Investopedia). This immutability, combined with distributed consensus, advanced cryptography, and incentive structures, creates a trustless system where no central authority is needed (arXiv).

The evolution from static ledgers to programmable platforms, as seen in Ethereum and HyperLedger, marks a paradigm shift. These platforms support complex operations, such as tokenizing physical assets or streamlining manufacturing processes, by leveraging blockchain’s immutable ledger for reliable computation. Immutability ensures that computational logic executed on the blockchain remains tamper-proof, fostering trust in environments without centralized oversight (Investopedia). This reliability transforms blockchain from a passive data repository into an active compute layer, enabling developers to deploy code that executes consistently and securely (arXiv).

Smart Contracts: Automating Trust

Smart contracts are self-executing programs that automate agreements by encoding terms into code, operating on “if-then” logic to execute actions when conditions are met. Conceptualized by Nick Szabo, they function like vending machines, delivering predetermined outputs for specific inputs without intermediaries. Written in languages like Solidity and deployed on blockchains, smart contracts inherit the network’s immutability, security, and transparency, ensuring tamper-proof execution and verifiable audit trails (Aave) (Investopedia).

Smart contracts enable complex operations beyond cryptocurrency transfers, such as managing payment structures, triggering actions based on external events (e.g., flight data for insurance claims), or automating supply chain agreements. When integrated with Artificial Intelligence (AI), they can handle sophisticated tasks like natural language processing or automated vendor assessments (ProfileTree). By eliminating intermediaries, smart contracts reduce costs, minimize errors, and accelerate execution, transforming blockchain into a dynamic compute layer where they act as the executable code defining on-chain computations.

However, smart contracts, while immutable, can harbor vulnerabilities, such as reentrancy attacks, where malicious code exploits logic flaws. Formal verification, audits, and testing have become standard practices to ensure robust code, preserving trust in on-chain computation and mitigating risks that could undermine their reliability.

Decentralized Applications (dApps): User-Friendly Interfaces

Decentralized applications (dApps) are blockchain-based applications powered by smart contracts, designed to deliver user-friendly interfaces for end-users. Unlike traditional applications reliant on centralized servers, dApps leverage blockchain’s distributed backend, enhancing resilience, uptime, and censorship resistance. They translate complex smart contract interactions into intuitive experiences, making blockchain accessible to non-technical users (USDC).

dApps enable diverse use cases across industries. In finance, Uniswap’s dApp facilitates peer-to-peer cryptocurrency trading via automated market-making smart contracts, bypassing central authorities. Aave’s lending protocol automates loan terms, reducing costs and fostering trustless transactions. In insurance, dApps could process claims automatically by verifying external data, such as flight cancellations, for instant payouts. Supply chain dApps enhance transparency by automating payments upon verified delivery (ProfileTree). In gaming, dApps like The Sandbox manage in-game assets (NFTs), facilitate trades, and govern mechanics via DAOs, allowing players to vote on upgrades (NFTevening). Decentralized social media dApps empower users to control and monetize data, bypassing centralized ad models.

Blockchain’s layered architecture supports dApps’ functionality, as shown below:

Layer | Role | Example |

|---|---|---|

Layer 0 | Provides infrastructure (connectivity, hardware) | Polkadot, Cosmos |

Layer 1 | Hosts base protocol and consensus (e.g., EVM, PoS) | Ethereum, Solana |

Layer 2 | Enhances scalability (e.g., rollups, sidechains) | Polygon, Arbitrum |

Layer 3 | Supports user-facing applications (dApps) | Uniswap, Aave |

As the application layer (Layer 3), dApps bridge blockchain’s compute layer to practical utility, driving mainstream adoption by abstracting complexity and delivering tangible services (Cointelegraph).

Ethereum Virtual Machine: The Computational Engine

The Ethereum Virtual Machine (EVM) is a decentralized computation engine, similar to a universal translator, ensuring smart contracts execute identically across Ethereum’s global network of nodes (Coinbase). Operating as a state machine, it computes new valid states block by block, interpreting bytecode from languages like Solidity (Thirdweb). Like a runtime environment (e.g., Java Virtual Machine), the EVM guarantees deterministic execution, producing consistent outcomes regardless of the node, a cornerstone of blockchain’s compute layer (Coinbase).

Key EVM functions include:

- Bytecode Execution: Interprets smart contract code deterministically (Coinbase).

- Gas Fee Management: Prevents abuse by charging for computational resources (Thirdweb).

- Consensus Synchronization: Ensures all nodes agree on network state (Thirdweb).

- Isolated Execution: Protects the network from bugs or malicious code (Thirdweb).

Every node runs the EVM, maintaining consensus, while its Turing completeness enables versatile applications, from DeFi to NFT marketplaces. EVM compatibility extends to networks like Polygon, Arbitrum, and Avalanche, fostering cross-chain development and standardizing decentralized computation (Coinbase).

Scalability is critical for the EVM’s computational efficiency. Layer 2 solutions like Polygon reduce transaction costs, enabling high-throughput dApps, while sharding, planned for Ethereum, distributes computation across nodes, enhancing the compute layer’s capacity for complex logic. These advancements ensure blockchain remains a robust platform for global computation.

Real-World Applications: DeFi, NFTs, and DAOs

Blockchain’s compute layer powers transformative applications in Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Decentralized Autonomous Organizations (DAOs), demonstrating its ability to execute complex, trustless logic (ChangeHero).

- Decentralized Finance (DeFi): DeFi platforms leverage smart contracts for transparent financial interactions without intermediaries. Aave automates lending terms, locking funds as liquidity and enforcing repayments. Uniswap and PancakeSwap enable peer-to-peer trading via automated market-making algorithms. DeFi supports microtransactions, money streaming, and liquidity provision, offering alternatives to traditional finance (ChangeHero).

- Non-Fungible Tokens (NFTs): NFTs assign unique, verifiable ownership to digital assets like art, in-game items, or virtual land. Smart contracts on platforms like Fractional.art manage authentication, transfers, and royalties, while DeFi integration enables fractional ownership, democratizing investment. NFTs highlight blockchain’s ability to embed value and trust in digital assets.

- Decentralized Autonomous Organizations (DAOs): DAOs use smart contracts to automate governance, enforcing rules and decisions without human intervention. Uniswap DAO governs fee structures via UNI token voting, while Compound DAO adjusts lending protocols through COMP token holders. DAOs manage NFT communities, venture investing, and philanthropy, as seen in UkraineDAO . They exemplify blockchain’s capacity for transparent, code-driven coordination.

These applications shift trust from intermediaries to immutable code, enabling efficient, transparent, and censorship-resistant systems (99Bitcoins). Blockchain’s compute layer, powered by the EVM and consensus mechanisms, delivers “programmable trust,” redefining economic, social, and governance models.

Consensus Mechanisms: Ensuring Integrity

The Role of Consensus: Maintaining Trustless Systems

Consensus mechanisms are the protocols enabling blockchain participants to agree on transaction validity and sequence, creating a trustless environment where no single authority dictates truth. They ensure synchronized, tamper-proof ledgers across nodes, preventing double-spending, data tampering, and unauthorized changes (Neosoftech). By validating smart contract execution, consensus mechanisms guarantee consistent, fair outcomes, making blockchain’s compute layer reliable.

In decentralized networks, where participants may be unknown or untrusted, consensus replaces centralized authority, ensuring agreement on ledger states and computations. Robust consensus is critical for immutability and trust, as any compromise would undermine smart contract reliability and the “programmable trust” paradigm (Neosoftech).

Proof of Work (PoW): Security Through Effort

Proof of Work (PoW) requires miners to solve cryptographic puzzles using significant computational power, as seen in Bitcoin’s SHA-256 algorithm (Debut Infotech). Miners compete to find a valid hash, broadcasting solutions to the network, with difficulty adjusting to maintain consistent block production (e.g., every 10 minutes for Bitcoin). Each block links to its predecessor via hashes, creating an immutable chain (Cryptohopper).

PoW’s security stems from the computational cost of altering past transactions, making 51% attacks prohibitively expensive. Miners are incentivized by block rewards and transaction fees, encouraging honest participation and network security. While highly secure and decentralized, PoW’s energy consumption, slower transaction speeds, and hardware costs raise environmental and scalability concerns(Morpher).

PoW’s economic design aligns miners’ self-interest with network integrity through game theory. The cost of attacks outweighs potential gains, while rewards incentivize honest behavior, creating a self-regulating system without trusted intermediaries.

Proof of Stake (PoS): Economic Alignment

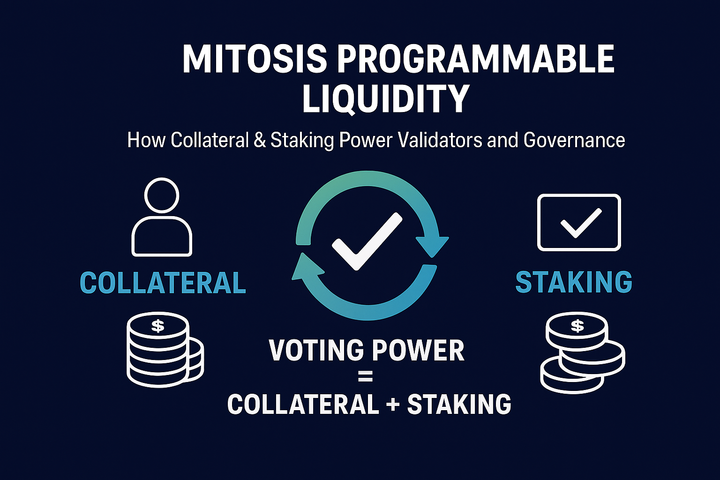

Proof of Stake (PoS) selects validators based on staked cryptocurrency, locked as collateral in smart contracts, similar to a savings account where funds earn interest but face penalties for rule-breaking. Validators propose and verify blocks, with selection probability tied to stake size, ensuring fairness. Slashing penalizes malicious or offline validators by confiscating staked funds, addressing issues like the “Nothing at Stake” problem. Honest validators earn rewards, fostering trust.

PoS is energy-efficient, scalable, and accessible, requiring only cryptocurrency stakes rather than specialized hardware. However, it risks centralization if large stakeholders dominate and has a less proven security track record than PoW. Adopted by Ethereum post-Merge, Solana, and Cardano, PoS prioritizes sustainability and efficiency (Hedera).

By tying security to economic capital rather than computational power, PoS enhances capital efficiency and reduces environmental impact, aligning validators’ financial interests with network health. Slashing mechanisms refine this model, ensuring robust decentralized security (Stakin).

Comparative Analysis: PoW vs. PoS

The choice between PoW and PoS involves trade-offs across security, speed, scalability, and energy efficiency. PoW offers proven security and decentralization but suffers from high energy use and scalability limitations. PoS provides energy efficiency, faster transactions, and scalability, but risks centralization and has a shorter security history (Hedera). The following table compares these mechanisms:

Table 1: Comparing PoW and PoS Consensus Mechanisms

Criterion | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

Mechanism | Miners solve complex cryptographic puzzles to validate transactions and create new blocks, requiring significant computational effort. | Validators are selected based on the amount of cryptocurrency they “stake” as collateral in smart contracts, ensuring economic alignment. |

Energy Consumption | High, due to intensive computational work, leading to significant electricity usage and environmental concerns. | Significantly lower, as no energy-intensive puzzle solving is required, making it a greener alternative. |

Transaction Speed | Slower, due to the time required to solve puzzles and fixed block intervals (e.g., ~10 minutes for Bitcoin). | Faster, due to a more efficient validation process that avoids computational delays. |

Scalability | Lower, as network growth can lead to bottlenecks, limiting transaction throughput. | Higher, better suited for increased transaction throughput and network expansion. |

Decentralization | Generally high, as open competition allows anyone with hardware to participate, fostering broad access. | Potential for centralization if large stakeholders dominate due to stake weight influencing validator selection. |

Security Model | Relies on computational difficulty; 51% attacks are extremely costly due to hardware and energy requirements. | Relies on economic stake; malicious behavior leads to “slashing” of staked funds, deterring dishonesty. |

Barriers to Entry | High, requiring significant investment in specialized mining hardware and ongoing electricity costs. | Lower, primarily requiring staking a certain amount of cryptocurrency, accessible to a broader range of participants. |

Primary Incentive | Block rewards (newly minted cryptocurrency) and transaction fees incentivize miners to secure the network. | Staking rewards (newly minted cryptocurrency or fees) encourage validators to act honestly. |

Key Disadvantage | Environmental impact due to high energy consumption, raising sustainability concerns. | Potential for centralization if wealth concentration occurs among large stakeholders. |

Attack Resistance | Highly resistant to attacks; altering the blockchain requires re-mining all subsequent blocks, an economically irrational task due to high costs. | Resistant through slashing, which penalizes malicious validators, though less tested against large-scale attacks. |

Adoption Maturity | Proven since Bitcoin’s inception in 2009, with a long track record of securing major networks like Bitcoin and Litecoin. | Newer, adopted by Ethereum post-Merge, Solana, Cardano, and Polkadot, with a shorter but rapidly growing history. |

Notable Examples | Bitcoin, Litecoin, demonstrating robust security in established networks. | Ethereum (post-Merge), Solana, Cardano, Polkadot, reflecting modern, scalable blockchain designs. |

Beyond PoW and PoS, emerging mechanisms address specific trade-offs. Delegated Proof of Stake (DPoS), used by EOS, enhances scalability by delegating validation to elected nodes, while Practical Byzantine Fault Tolerance (PBFT), employed in HyperLedger, prioritizes fault tolerance in permissioned networks, offering faster consensus for enterprise use cases. These innovations reflect the ongoing evolution of consensus mechanisms to optimize security, efficiency, and sustainability for diverse blockchain applications(Neosoftech).

Conclusion: Driving Blockchain’s Future with Innovation and Accessibility

Blockchain has evolved from a distributed ledger into a powerful compute layer, driven by smart contracts, dApps, and the EVM, which enable trustless, programmable logic. Consensus mechanisms like PoW and PoS are the “truth engines” ensuring immutability and reliability, with PoW leveraging computational effort and PoS prioritizing economic alignment. Real-world applications in DeFi, NFTs, and DAOs demonstrate blockchain’s transformative potential, shifting trust from intermediaries to verifiable code.

The promise of “programmable trust” extends beyond automation, offering the potential to dismantle centralized institutions like banks and governance bodies while empowering underserved populations with access to DeFi and DAOs. For instance, DeFi platforms enable financial inclusion for unbanked communities, and DAOs facilitate global, transparent collaboration. Realizing this vision requires prioritizing inclusivity through accessible interfaces and sustainable protocols.

To drive mainstream adoption, continued innovation in consensus mechanisms is essential to balance security, scalability, and sustainability. Developing user-friendly dApps is equally critical, making blockchain’s compute layer accessible to diverse audiences. By advancing these areas, blockchain can redefine trust, automation, and decentralization, reshaping industries and empowering a global, inclusive digital economy. The future lies in harnessing “programmable trust” to build systems that are transparent, efficient, and resilient.

References

- arXiv. Blockchain Technology: Core Mechanisms, Evolution, and Future Implementation Challenges. https://arxiv.org/html/2505.08772v1

- Investopedia. Distributed Ledger Technology (DLT): Definition and How It Works. https://www.investopedia.com/terms/d/distributed-ledger-technology-dlt.asp

- ProfileTree. How to Use Smart Contracts and AI in Business Transactions. https://profiletree.com/smart-contracts/

- Aave. Smart Contracts. https://aave.com/help/web3/smart-contracts

- Investopedia. What Are Smart Contracts on the Blockchain and How Do They Work? https://www.investopedia.com/terms/s/smart-contracts.asp

- USDC.Understanding Smart Contracts & dApps: Blockchain Foundations. https://www.usdc.com/learn/understanding-smart-contracts-and-dapps

- Cointelegraph. Understanding Blockchain Layers: A Simple Guide for Beginners. https://cointelegraph.com/learn/articles/a-beginners-guide-to-understanding-the-layers-of-blockchain-technology

- ChangeHero. DeFi Use Cases—Real-World Applications of Decentralized Finance. https://changehero.io/blog/defi-use-casesreal-world-applications-of-decentralized-finance/

- NFTevening. From NFTs to DAO Tokens: How Web3 Gaming Projects Tokenize Value. https://nftevening.com/from-nfts-to-dao-tokens-how-web3-gaming-projects-tokenize-value/

- 99Bitcoins. What is DAO (Decentralized Autonomous Organization). https://99bitcoins.com/education/what-is-a-dao/

- Coinbase. What is the Ethereum Virtual Machine (EVM)? https://www.coinbase.com/learn/crypto-glossary/what-is-the-ethereum-virtual-machine

- Neosoftech. Understanding Blockchain Consensus: Key Mechanisms Behind. https://www.neosoftech.com/blogs/blockchain-consensus-mechanisms/

- Rapid Innovation. Blockchain Consensus Mechanisms: Complete Guide | PoW to Emerging Models. https://www.rapidinnovation.io/post/consensus-mechanisms-in-blockchain-proof-of-work-vs-proof-of-stake-and-beyond

- Morpher. PoW vs PoS: A Comparison of Two Popular Blockchain Consensus Mechanisms. https://www.morpher.com/blog/pow-vs-pos-comparison

- Debut Infotech. Proof of Work: The Backbone of Blockchain Security. https://www.debutinfotech.com/blog/proof-of-work

- Cryptohopper. Proof of Work (PoW) Guide. https://www.cryptohopper.com/blog/proof-of-work-pow-guide-10947

- Hedera. Proof of Stake (PoS) vs. Proof of Work (PoW). https://hedera.com/learning/consensus-algorithms/proof-of-stake-vs-proof-of-work

- Stakin. Understanding Slashing in Proof-of-Stake: Key Risks for Validators and Delegators. https://stakin.com/blog/understanding-slashing-in-proof-of-stake-key-risks-for-validators-and-delegators

Similar Articles

The Ethics of Immutability: "Code is Law" and Its Consequences

🔒 Smart Contracts: Redefining Trust Through Code

From Anarchy to Autonomy: Reimagining Society Through Blockchain and Web3

Navigating GDPR and Public Blockchain: Challenges and Solutions

Privacy vs. Transparency: Balancing Blockchain’s Open Ledgers with Personal Rights

Tokenization of Real World Assets (RWA): How Blockchain Is Opening the Doors to Traditional Finance

The Tokenization of Everything: A New Paradigm for Value, Ownership, and Access

Blockchain as a Catalyst for Societal Change: Utopian Visions vs. Dystopian Realities

Comments ()