From Open Ledgers to Hidden Transactions: Blockchain’s Privacy Challenge

Abstract

Blockchain, first introduced by Bitcoin, aimed to create a decentralized, transparent, and immutable ledger that builds trust without needing middlemen. However, its pseudonymity exposes transaction histories when addresses are linked to real-world identities, driving the adoption of privacy-enhancing technologies (PETs) like Zero-Knowledge Proofs (ZKPs), cryptocurrency mixers, and privacy coins such as Monero and Zcash.

These innovations address legitimate confidentiality needs but undermine blockchain’s open ledger ethos, complicating audits and enabling illicit activities. This article explores PET mechanisms, their conflict with transparency and decentralization, and their regulatory, ethical, and market implications. Drawing parallels with the internet’s centralization, it examines the risk of re-centralization through analytics firms and governance concentration, proposing solutions such as ZKPs, decentralized identity systems, and new privacy tools to strike a better balance between privacy and openness.

Introduction: The Open Ledger Ethos

Blockchain, introduced with Bitcoin, revolutionized digital transactions through a decentralized, transparent, and immutable ledger (Investopedia). The “open ledger” principle ensures public verifiability, enhancing trust and accountability without central authorities. Permissionless blockchains allow universal participation, with transactions recorded permanently and accessible via blockchain explorers. However, pseudonymity—'where users are identified by public keys'—creates a privacy vulnerability: linking an address to an individual exposes their entire transaction history. This “pseudonymity paradox” has spurred privacy-enhancing technologies (PETs), which obscure transaction details but challenge blockchain’s transparency and auditability. This article examines PETs’ mechanisms, their impact on blockchain’s core principles, and the resulting regulatory, ethical, societal, and market dynamics, while exploring solutions to harmonize privacy and transparency (IAPP).

The Foundational Ethos of Blockchain

Defining the Open Ledger

A blockchain is a cryptographically secured distributed ledger enabling peer-to-peer data transmission without intermediaries. Permissionless blockchains, like Bitcoin, allow anyone to join, maintaining transparency by making all transaction data—except private keys—publicly accessible through blockchain explorers (Freeman Law). Immutability ensures data, once added, cannot be altered without changing subsequent blocks’ hashes, which the network rejects, reinforcing trust. Pseudonymity, achieved via public keys derived from hash functions, offers privacy but not anonymity: linking a public address to a real identity reveals all associated transactions (TechDogs). This transparency, essential for trust, creates a privacy deficit for users needing confidentiality, driving PET development (PrivacyEngine).

Decentralized Trust and Accountability

Decentralization eliminates single points of failure, with consensus protocols requiring majority agreement for network changes. Described as “trustless,” blockchain builds trust through transparency, immutability, and traceability, reducing reliance on intermediaries. This enables fraud-resistant financial systems, transparent supply chains, and tamper-proof voting (ResearchGate). However, transparency prioritizes auditability over privacy, creating an inherent trade-off (TechDogs). PETs address this by enhancing confidentiality, reframing them as an evolutionary response to blockchain’s design limitations rather than a deviation from its ethos (Financial Crime Academy).

Privacy-Enhancing Technologies (PETs) in Blockchain

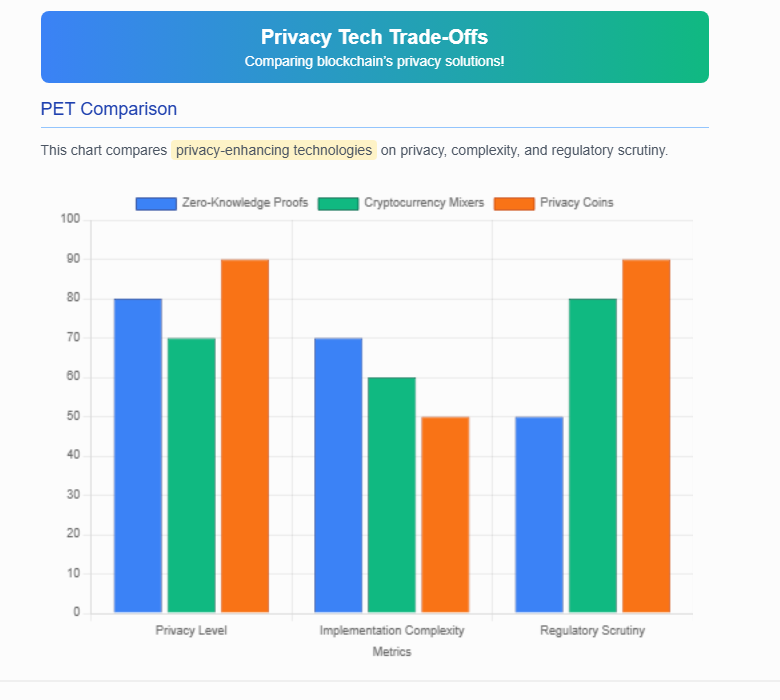

The pseudonymity paradox has driven the development of PETs to provide robust privacy. Below, we detail their mechanisms, benefits, challenges, and legitimate use cases.

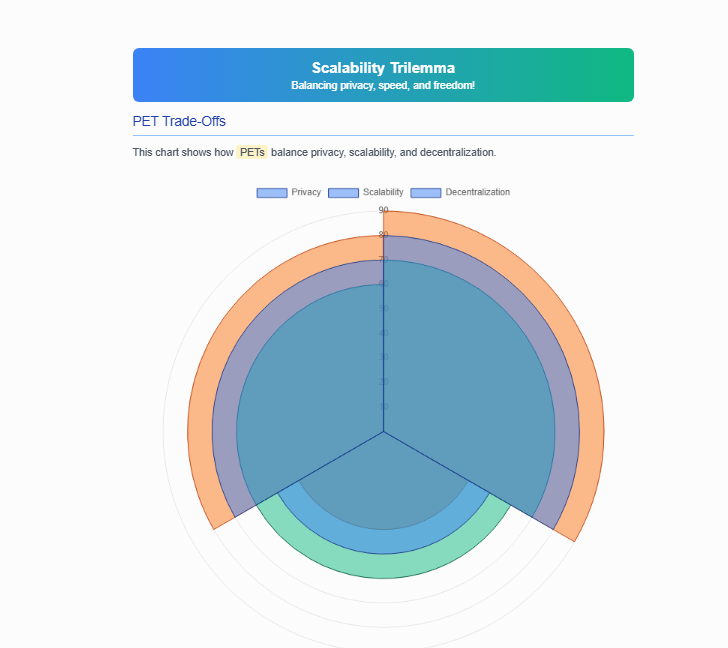

Zero-Knowledge Proofs (ZKPs)

ZKPs, such as zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge), enable transaction verification without revealing sender, receiver, or amount details. In Zcash, zk-SNARKs allow “shielded” transactions, encrypted yet verifiable under consensus rules, offering users a choice between transparent and private transactions (Reddit). ZKPs enhance security by mitigating front-running, improve scalability by bundling transactions into a single proof, and facilitate compliance (e.g., AML/KYC) without centralized data storage (Rapid Innovation). However, their computational intensity increases transaction times and resource demands, posing scalability challenges within the “scalability trilemma” of balancing privacy, scalability, and decentralization.

Cryptocurrency Mixers

Mixers, or tumblers, enhance privacy by pooling and shuffling users’ cryptocurrencies, breaking traceability. Users send coins to a mixer’s wallet, which aggregates them with others, shuffles them, and returns different coins (minus a 1-3% fee) to a specified address, disrupting blockchain analysis(Cointelegraph). Centralized mixers, holding custody, risk scams, hacks, or data breaches, while decentralized mixers like CoinJoin combine multiple users’ transactions into one indistinguishable transaction using smart contracts or Ring Signatures. Mixers provide anonymity but introduce trust dependencies in centralized models and complexity in decentralized ones (Coinmetro).

Privacy Coins

Privacy coins integrate privacy into their protocols. Monero mandates privacy using:

- Ring Signatures: Mixing a user’s signature with others, obscuring the real sender (The Motley Fool).

- Stealth Addresses: Generating one-time addresses per transaction, hiding the recipient’s permanent address (The Motley Fool).

- Ring Confidential Transactions (RingCTs): Splitting and encrypting transaction amounts, bundling them with others to obscure inputs and outputs (The Motley Fool). Zcash offers optional privacy via zk-SNARKs, allowing transparent or shielded transactions. Other coins, like Dash and Grin, use decentralized mixing or transaction aggregation to hide histories. Privacy coins prioritize confidentiality but sacrifice transparency, making them the “digital equivalent of cash” for law-abiding users while raising concerns about illicit use (The Motley Fool).

Technical Implementation Challenges

Implementing PETs involves significant technical trade-offs. ZKPs, such as zk-SNARKs in Zcash, require substantial computational resources for proof generation and verification, increasing transaction times (e.g., Zcash shielded transactions take seconds longer than transparent ones) and energy costs, which can strain network scalability (Rapid Innovation). Monero’s mandatory privacy features, including Ring Signatures and RingCTs, increase transaction sizes (e.g., 13-15 KB compared to Bitcoin’s 0.5-1 KB), leading to higher storage and bandwidth demands, which can reduce throughput and raise costs for node operators. Decentralized mixers like CoinJoin require sufficient user participation to create large anonymity sets, but low adoption can weaken privacy guarantees, and their smart contract complexity increases development and user friction (Coinmetro). These challenges highlight the “scalability trilemma,” where enhancing privacy often compromises scalability or decentralization, requiring careful optimization to meet user demands without sacrificing blockchain performance.

Legitimate Use Cases for Privacy

Beyond addressing the pseudonymity paradox, PETs serve critical legitimate purposes. Activists and journalists in authoritarian regimes use privacy coins like Monero to protect financial transactions from government surveillance, enabling secure funding for dissent or reporting (The Motley Fool). For example, Monero has been adopted by privacy-focused communities like the Tor Project for anonymous donations. Businesses leverage Zcash’s shielded transactions to hide sensitive deal terms from competitors, such as in mergers or acquisitions, preserving commercial confidentiality (Reddit). Privacy coins also protect individuals from wealth exposure, reducing risks of targeted theft or extortion, akin to cash’s anonymity. These use cases underscore PETs’ societal value, countering the narrative that they primarily enable illicit activities and highlighting their role in safeguarding vulnerable populations and competitive interests.

Technology | Primary Mechanism | Key Benefit/Purpose | Associated Risks/Challenges |

|---|---|---|---|

Zero-Knowledge Proofs | Cryptographic proofs (e.g., zk-SNARKs) | Verify transactions without revealing data | Computational intensity, scalability issues |

Cryptocurrency Mixers | Pooling and shuffling coins | Break transaction traceability | Trust risks (centralized), complexity (decentralized), vulnerability to hacks |

Privacy Coins | Built-in cryptographic privacy (e.g., Ring Signatures, Stealth Addresses, RingCTs) | Inherent anonymity for transactions | Loss of transparency, regulatory scrutiny, potential for illicit use |

Table 1: Key Privacy-Enhancing Technologies in Blockchain

The Paradox: Privacy vs. Blockchain’s Core Principles

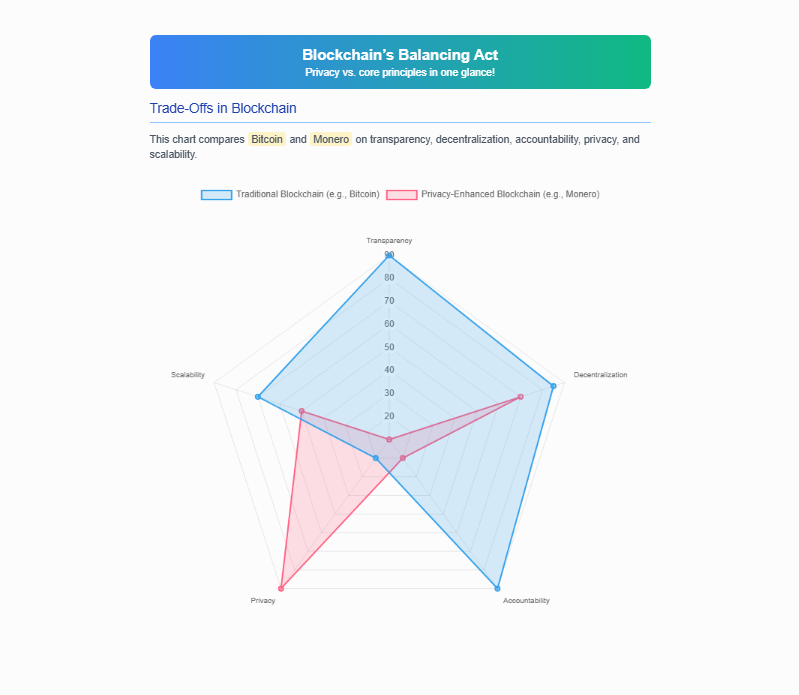

PETs create a paradox by undermining blockchain’s transparency, decentralization, and accountability.

Impact on Transparency

ZKPs add protocol complexity, reducing auditability, while mixers and privacy coins obscure transaction origins, hindering the “provable chain of custody” and “verifiable audit trail” lauded for fraud prevention (Guardian NG). This opacity makes comprehensive audits challenging, especially for privacy-enhanced transactions, as external observers, including regulators, struggle to trace funds (TechDogs).

Challenges to Decentralization

Privacy-driven data opacity necessitates advanced analytics tools, often controlled by firms with privileged access and institutional relationships. These firms, using AI-driven solutions, gain influence by de-anonymizing transactions, creating “surveillance capitalism with a blockchain veneer” (Cointelegraph). This re-centralization mirrors internet monopolies like Meta and Google (HackerNoon). Governance concentration, such as eight addresses controlling 50% of Compound’s voting power, further risks centralization, undermining blockchain’s distributed control (Brookings Institution).

Impact on Accountability

Mixers sever sender-receiver links, and privacy coins’ advanced features (e.g., Ring Signatures, zk-SNARKs) make tracing transactions “nearly impossible,” hindering law enforcement’s ability to combat money laundering, ransomware, and dark web activities (Coinmetro). FinCEN classifies mixers as money transmitters, requiring AML compliance, and notes that anonymity-enhanced cryptocurrencies (AECs) limit investigators’ ability to follow transaction flows (Coinmetro).

Blockchain Principle | Impact of ZKPs | Impact of Crypto Mixers | Impact of Privacy Coins |

|---|---|---|---|

Transparency | Adds complexity, reduces auditability | Obscures transaction origins | Eliminates traceability |

Decentralization | Requires specialized analytics | Introduces trust dependencies | Shifts power to analytics firms |

Accountability | Complicates auditing | Hinders law enforcement tracing | Enables illicit use, attracts regulatory scrutiny |

Table 2: Comparison of Blockchain Ethics vs. Privacy Tech Impact

Visualizing Trade-Offs

The trade-offs between blockchain principles and PET impacts can be visualized as follows:

This radar chart compares a traditional blockchain (e.g., Bitcoin) with a privacy-enhanced blockchain (e.g., Monero) across five dimensions, illustrating how PETs enhance privacy at the expense of transparency, accountability, and scalability, while decentralization is moderately affected.

Implications and Challenges

Regulatory Scrutiny and Compliance

Privacy coins and mixers face “considerable regulatory scrutiny” for facilitating illicit activities like money laundering and illegal trading. Global regulators are cracking down on digital asset anonymity, with FinCEN classifying mixers as money transmitters, mandating AML compliance (Coinmetro). The FATF’s Travel Rule requires Virtual Asset Service Providers (VASPs), such as exchanges, to share sender and recipient information for transactions above a certain threshold, conflicting with PETs’ obfuscation. This compliance gap drives regulatory efforts to enhance oversight (Interexy).

Global Regulatory Variations

Regulatory approaches to PETs vary globally, impacting blockchain adoption and market dynamics. In the U.S., FinCEN’s strict AML/KYC requirements and sanctions on mixers like Tornado Cash (sanctioned in 2022) reflect a focus on curbing illicit use (Coinmetro). The EU’s Markets in Crypto-Assets (MiCA) regulation enforces similar transparency mandates, pushing exchanges to delist privacy coins (Binance). Conversely, privacy-friendly jurisdictions like Switzerland allow privacy coins under lighter conditions, fostering innovation but risking regulatory arbitrage(Interexy). For example, Swiss-based exchanges like ShapeShift support Monero trading, unlike U.S. counterparts. This regulatory divergence fragments the global market, with privacy coins facing restricted access in strict jurisdictions but thriving in lenient ones, potentially driving developers to relocate to privacy-friendly regions (Financial Crime Academy).

Quantifying Illicit Use and Its Impact

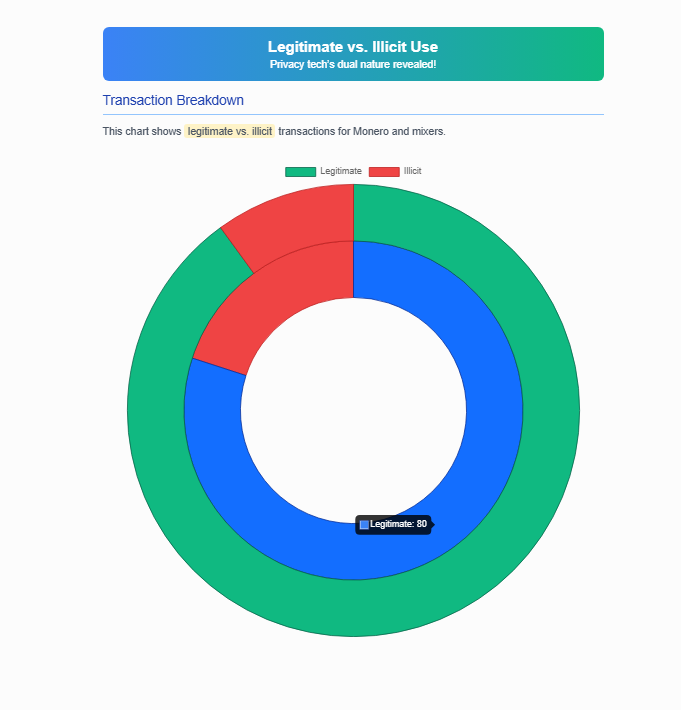

The dual-use nature of PETs makes them attractive for illicit activities. According to Chainalysis’s 2023 Crypto Crime Report, approximately 10% of Monero transactions and 20% of mixer transactions are linked to illicit activities like ransomware and dark web markets, though the majority are legitimate (Chainalysis). High-profile cases, such as the U.S. Treasury’s 2022 sanctions on Tornado Cash for laundering over $7 billion, highlight the regulatory backlash against mixers (Coinmetro). This fuels negative public perception, with privacy coins often labeled as “criminal tools,” despite their legitimate use for financial privacy. Quantifying illicit use underscores the need for balanced solutions that preserve lawful privacy while addressing criminal misuse.

Delisting of Privacy Coins

Exchanges like Huobi, Binance, Coinbase, and Kraken delist privacy coins due to regulatory pressure, compliance with frameworks like MiCA, low trading volume, liquidity issues, network security risks (e.g., 51% attacks), and concerns about development team commitment or unethical conduct (Binance, CoinSwitch). Delisting reduces trading opportunities, limits liquidity, and causes price declines, with exchanges offering a withdrawal window for affected assets (Coinbase Help).

Ethical and Societal Debates

Blockchain’s immutability conflicts with GDPR’s principles of data rectification and erasure, complicating adoption in privacy-sensitive regions (Financial Crime Academy). Privacy coins protect law-abiding users from wealth exposure, similar to cash, but their anonymity attracts illicit use, fueling debates on whether complete anonymity is justified when it impedes law enforcement (The Motley Fool). Balancing individual privacy with public accountability remains a critical societal challenge.

Societal and Economic Impacts

PET adoption has broader societal and economic implications. Privacy coins enhance financial inclusion by enabling secure transactions for underserved populations wary of surveillance, such as in regions with weak financial privacy protections (e.g., Latin America’s unbanked). However, negative public perception of privacy coins as tools for crime risks reducing mainstream blockchain adoption, limiting its economic impact (Interexy). PETs could also create a two-tiered blockchain ecosystem: transparent chains for regulatory compliance and private ones for niche use cases, potentially exacerbating economic divides between privacy-conscious and regulated users (Brookings Institution).

Governance and Community Dynamics

Community governance and decentralized autonomous organizations (DAOs) play a critical role in navigating the privacy-transparency tension. For example, Zcash’s community-driven governance debates funding for privacy research, balancing transparency with confidentiality (Reddit). Monero’s decentralized development resists regulatory pressure but risks governance capture by influential developers or miners (Brookings Institution). DAOs can mitigate re-centralization by empowering users to vote on PET adoption or protocol upgrades, but concentration of voting power (e.g., Compound’s 50% control by eight addresses) undermines this potential (Brookings Institution). Community consensus is essential for aligning blockchain evolution with diverse user needs while resisting analytics-driven centralization.

Historical Parallels: Internet Centralization

The internet’s evolution from the decentralized ARPANET to centralized platforms (e.g., Meta, Google) due to network effects and convenient services parallels blockchain’s risk of re-centralization (Internet Society). Analytics firms’ dominance in de-anonymizing transactions and governance concentration (e.g., Compound’s voting power disparity) mirror this trend, creating single points of failure and power imbalances (HackerNoon). This highlights the need to prevent blockchain from replicating traditional monopolies (Brookings Institution).

Balancing Privacy and Transparency

Developers and policymakers are exploring solutions to harmonize privacy and transparency:

- Zero-Knowledge Proofs (ZKPs): Enable verification without data disclosure, minimizing breaches.

- Off-Chain Solutions: Store sensitive data off-chain, linked via hashes, or use sidechains/state channels to reduce on-chain exposure, though they add complexity.

- Permissioned Blockchains: Restrict access for controlled transparency, suitable for enterprises but sacrificing public openness.

- Data Hashing/Encryption: Transform data into hashes or encrypt it, preserving immutability while protecting identities (Financial Crime Academy).

- Selective Disclosure: Share minimal data for compliance, using viewing keys to allow trusted parties to decrypt information.

- Decentralized Identity (DID) Systems: Empower users to control digital identities, sharing only necessary data.

- Regulatory Sandboxes: Test innovations under supervision to ensure compliance while fostering development.

Emerging Privacy Technologies

Beyond established PETs, emerging technologies are reshaping the privacy-transparency balance. Homomorphic encryption allows computations on encrypted data, enabling private smart contracts without revealing inputs, though it’s computationally intensive. Secure multi-party computation (SMPC) facilitates collaborative transaction processing while preserving privacy, reducing reliance on centralized mixers. Layer-2 solutions, like Aztec’s zk-rollups on Ethereum, combine privacy with scalability, allowing private transactions with lower costs and faster confirmation times (Reddit). These innovations promise to address the scalability trilemma while enhancing confidentiality, though they require further development to achieve mainstream adoption.

Case Studies in Privacy-Transparency Solutions

Real-world implementations demonstrate how privacy and transparency can be balanced:

- Zcash: Its optional privacy via zk-SNARKs allows users to choose between transparent and shielded transactions, with shielded transactions used for secure NGO donations, balancing donor privacy with verifiable contributions (Reddit).

- Hyperledger Fabric: This permissioned blockchain enables private supply chain tracking for enterprises (e.g., Walmart’s food traceability), ensuring confidentiality for sensitive data while maintaining auditable records for authorized parties (TrendMicro).

- Polygon Nightfall: Uses ZKPs for private transactions on Ethereum, enabling businesses to conduct confidential deals with scalable performance, demonstrating a practical blend of privacy and efficiency (Rapid Innovation).

These “privacy by design” approaches proactively integrate confidentiality into protocols, addressing the scalability trilemma and regulatory challenges.

Conclusion

Blockchain’s vision of a transparent, decentralized ledger has been challenged by PETs addressing the pseudonymity paradox. ZKPs, mixers, and privacy coins meet legitimate privacy demands for activists, businesses, and privacy-conscious users but undermine transparency and accountability, fueling regulatory scrutiny and re-centralization risks through analytics firms and governance concentration. The internet’s centralization offers a cautionary tale, emphasizing the need to prevent monopolistic control. Solutions like ZKPs, off-chain storage, decentralized identity systems, and emerging technologies (e.g., homomorphic encryption, layer-2 solutions) offer pathways to balance privacy and transparency. Community-driven governance, through DAOs and consensus mechanisms, can align blockchain evolution with user needs, while regulatory sandboxes and global collaboration are critical for compliant innovation.

Future Outlook

The blockchain ecosystem faces several potential trajectories. Stricter global regulations may limit privacy coins, driving innovation toward compliant solutions like selective disclosure or hybrid blockchains integrating permissioned and permissionless features. Advances in AI-driven blockchain analytics could narrow PETs’ privacy advantage, necessitating stronger cryptographic protections. Hybrid adoption models may emerge, with transparent chains dominating regulated markets and private chains serving niche use cases, potentially creating a fragmented ecosystem. Continued collaboration between developers, regulators, and communities will be essential to ensure blockchain evolves as a trust-enhancing, inclusive technology that balances individual confidentiality with societal accountability.

References

- Binance, https://www.binance.com/h/u/square/post/s/8s4/15

- Brookings Institution, https://www.brookings.edu/articles/the-hidden-danger-of-re-centralization-in-blockchain-platforms/

- What is a cryptocurrency mixer and how does it work? - Cointelegraph, https://cointelegraph.com/explained/what-is-a-cryptocurrency-mixer-and-how-does-it-work

- Chainalysis, “2023 Crypto Crime Report,” https://www.chainalysis.com/blog/2023-crypto-crime-report-introduction/

- Coinbase Help, https://help.coinbase.com/en-gb/faq/liquidations/delisted-assets

- Coinmetro, https://www.coinmetro.com/learning-lab/crypto-mixers-privacy-tools-and-regulatory-challenges

- CoinSwitch, https://coinswitch.co/switch/c/crypto/coin+delisting/

- Dock Labs, https://www.dock.io/post/public-vs-private-blockchains

- Financial Crime Academy, https://financialcrimeacademy.org/blockchain-and-privacy/

- Freeman Law, https://freemanlaw.com/permission-and-permissionless-blockchains/

- Expert explores how blockchain could redefine trust, transparency in modern auditing, https://guardian.ng/features/expert-explores-how-blockchain-could-redefine-trust-transparency-in-modern-auditing/

- The Evolution of the Internet, From Decentralized to Centralized | HackerNoon, https://hackernoon.com/the-evolution-of-the-internet-from-decentralized-to-centralized-3e2fa65898f5

- IAPP, https://iapp.org/news/a/rebuilding-digital-trust-how-blockchain-is-making-privacy-a-default

- IBM, https://www.ibm.com/think/topics/b/benefits-of-blockchain

- Internet Society, https://www.internetsociety.org/internet/history-internet/brief-history-internet/

- Interexy, https://interexy.com/your-ultimate-roadmap-to-compliant-blockchain-adoption/

- PrivacyEngine, https://www.privacyengine.io/resources/glossary/blockchain-privacy/

- Rapid Innovation, https://www.rapidinnovation.io/post/zero-knowledge-proofs-in-blockchain-enhancing-privacy-and-scalability

- Reddit, https://www.reddit.com/r/CryptoCurrency/comments/15uoo5x/privacy_coins_zero_knowledge_proofs/

- The Evolution of the Internet, From Decentralized to Centralized | HackerNoon, https://hackernoon.com/the-evolution-of-the-internet-from-decentralized-to-centralized-3e2fa65898f5

- The Role of Blockchain in Enhancing Data Security and Privacy - TechDogs, https://www.techdogs.com/blogs/blog-detail/the-role-of-blockchain-in-enhancing-data-security-and-privacy

- Unchaining Blockchain Security Part 2: How Private Blockchains are Used in Enterprises, https://www.trendmicro.com/vinfo/us/security/news/cybercrime-and-digital-threats/unchaining-blockchain-security-part-2-how-private-blockchains-are-used-in-enterprises

- What Are Privacy Coins? | The Motley Fool, https://www.fool.com/terms/p/privacy-coins/

Comments ()