From Static to Programmable Liquidity: How LSTs & LRTs Are Redefining Liquidity in DeFi

Staking has long been a cornerstone of blockchain networks, enabling token holders to secure the network and earn rewards in return. But in its early form, staking came with a major trade-off: once you staked, your assets were locked, illiquid, and could only generate a single stream of yield. DeFi’s early liquidity was static, with capital sitting idle outside of a protocol’s primary purpose.

Then came Liquid Staking Tokens (LSTs), transforming staked assets into transferable, composable instruments that could move freely across DeFi while still accruing staking rewards. Liquid Restaked Tokens (LRTs) took the concept further, adding extra yield layers, governance power, and cross-protocol utility on top of staking. This shift from static to programmable liquidity has unlocked a new era of capital efficiency.

In this article, we’ll use Mitosis as a case study to demonstrate exactly how this transformation works in practice, from introducing LSTs like weETH and ezETH to new yield pathways in the Mitosis Expedition, to integrating LRTs like weETHs into multi-yield strategies. You’ll learn the key differences between LSTs and LRTs, how Mitosis turns them into multi-layered yield engines, and why this model is setting the blueprint for the next generation of capital efficiency in DeFi.

From Staking to Programmable Liquidity

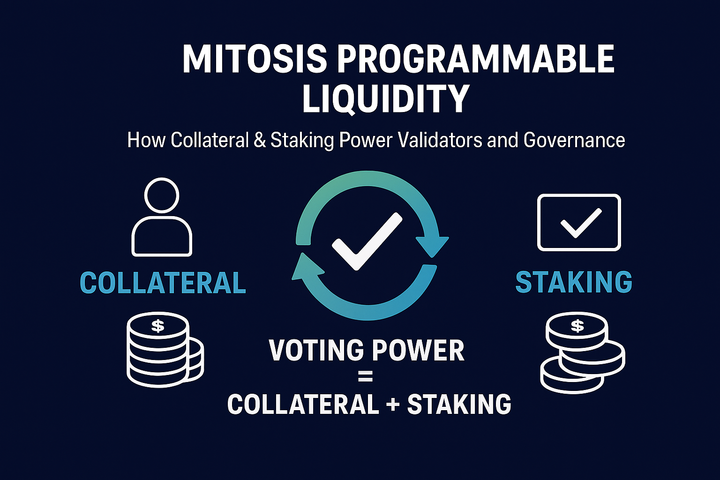

At its heart, staking is about security and alignment. Proof-of-Stake (PoS) blockchains rely on validatorsreceives to secure the network, verify transactions, and produce new blocks. Validators must lock up a certain amount of the network’s native token as collateral; this is the stake. In return for securing the network, they earn rewards, typically paid in the same token they staked.

For the everyday user who isn’t running a validator, staking is often done through a staking service or protocol, which delegates your tokens to validators on your behalf. The rewards are proportional to the amount you stake and the duration you remain staked.

The catch is that traditional staking meant illiquidity. Once your tokens were staked, you couldn’t move them, trade them, or use them in DeFi until the lockup period ended. You were earning staking APR, but your capital was otherwise stuck; what we now call static liquidity.

The Breakthrough: Liquid Staking Tokens (LSTs)

Liquid Staking Tokens solved this. LST is a “receipt token” you get in exchange for staking your crypto. It’s proof you’ve staked, it keeps earning rewards in the background, and unlike traditional staking, you can still move it, trade it, or use it across DeFi while you earn.

When you stake your assets through an LST protocol like Lido, Rocket Pool, Ether.fi, Bedrock, or Renzo, you receive a tokenized representation of your staked position.

For example:

- Stake ETH with Etherfi receive eETH

- Stake with Bedrock receive uniETH

- Stake with Renzo receive ezETH

- Stake BTC via Bedrock’s BTCFi receive uniBTC

These tokens are fully transferable and composable in DeFi.

You can:

- Provide liquidity on DEXes.

- Lend them on money markets.

- Use them as collateral in other protocols.

Meanwhile, they keep accruing staking rewards in the background. This means you no longer choose between earning yield and using your assets. When Mitosis LPs deposit assets like weETH, they receive miweETH in a 1:1 ratio.

The same goes for:

- weETHs receives miweETHs

- uniETH receives miuniETH

- ezETH receives miezETH

- uniBTC receives miuniBTC

- cmETH receives micmETH

The Mitosis Expedition supports multiple LST asset types, each with corresponding derivative tokens for accumulating MITO points.

The Next Level: Liquid Restaked Tokens (LRTs)

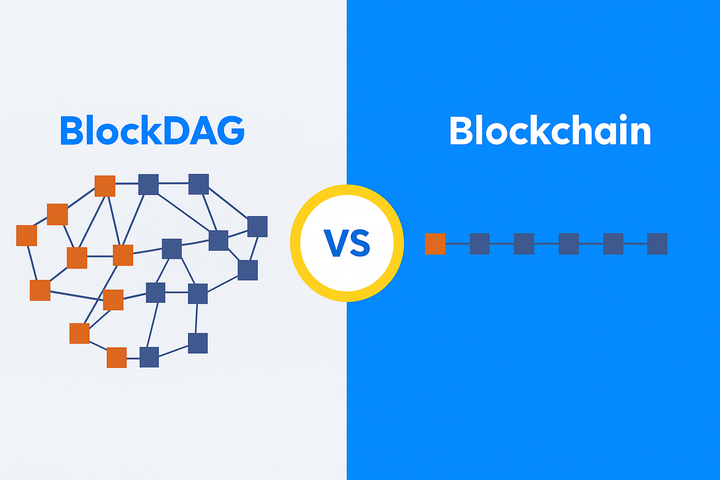

While LSTs unlocked liquidity for staked assets, they still had one main yield stream, staking APR. The introduction of restaking (popularized by EigenLayer) changed the game. Restaking allows your staked assets (or LSTs) to be used to secure additional networks or services called Actively Validated Services (AVSs). In return, you earn restaking APR and potentially more rewards.

Liquid Restaked Tokens (LRTs) take it a step further:

- They represent a position that is already restaked and earning from multiple layers.

- You can still use them in DeFi, just like an LST.

Example

- wETH is an LST from Ether.fi.

- weETHs is the LRT version, already restaked via EigenLayer, earning both staking APR and restaking APR.

So in practice, everything you deposit into Expedition ends up functioning like an LRT once it’s inside the system, because the campaign’s whole point is to stack staking & restaking yields and rewards in one place.

From Static to Programmable Liquidity with Mitosis

This is where Mitosis becomes the perfect case study. Mitosis doesn’t just let you deposit LSTs and LRTs but also turns them into multi-yield engines through its Expedition campaign.

How it works:

1. You deposit your LST or LRT (e.g., weETH, weETHs, uniETH, ezETH, uniBTC, cmETH) into the Mitosis Expedition Vault.

2. If it’s an LST, Mitosis restakes it for you, effectively converting it into an miLRT.

3. If you deposited weETH, you'll earn:

- Staking APR (from the base chain)

- Restaking APR (via EigenLayer)

- EigenLayer points

- Ether.fi loyalty points (for Ether.fi-based assets like weETH/weETHs)

- Mitosis Points (for participating in the campaign)

That’s five simultaneous reward streams from one deposit, across four major chains, without you having to manually bridge, restake, or chase multiple protocols.

The same goes for other LSTs...

What makes this even more powerful is Mitosis’s cross-chain support. You can participate from Ethereum, Arbitrum, Blast, Linea, Mode, or Scroll, moving your LSTs and LRTs seamlessly between ecosystems while keeping your yield streams active. This flexibility means you’re never locked into one network just because you’ve staked or restaked; instead, your capital remains as fluid and productive as you need it to be.

Conclusion: The Future Is Programmable

The journey from static staking to LSTs and LRTs has redefined what’s possible for capital in DeFi. What was once a binary choice between yield and liquidity has evolved into a dynamic system where the same token can work in multiple places, earn from multiple sources, and move across multiple chains, all without breaking its original purpose.

Mitosis demonstrates this future in action. By combining staking, restaking, cross-chain mobility, and multi-point reward systems, it turns simple deposits into programmable liquidity engines. For DeFi users, that means every asset can be maximized, not just for today’s rewards, but for the emerging opportunities of tomorrow’s multi-chain, multi-yield landscape.

In this new paradigm, the question isn’t whether to stake, it’s how far your staked asset can go.

Comments ()