Germany’s Bitcoin Liquidation: Unpacking the 1,000 BTC Transfer to Coinbase Amid Ongoing Sell-Off

Introduction

In early July 2024, the German government made headlines by transferring 1,000 Bitcoin (BTC) to Coinbase and other locations, as part of a larger strategy to liquidate seized cryptocurrency assets. This transaction, which was worth about $55.8 million at the time, represents another chapter in Germany’s ongoing sell-off that kicked off in mid-June 2024. This move has significant implications for both the management of the national treasury and the global cryptocurrency landscape..

For our readers, we will:

- Provide context on Germany’s historical Bitcoin holdings and the legal framework behind the sell-off.

- Dive into the details of the July 8, 2024 transfer and its immediate effects on the market.

- Explore expert opinions and market reactions to shed light on what this means for the future of state-owned crypto assets.

By the time you finish this article, you’ll have a well-rounded understanding of Germany’s crypto divestment strategy and its impact on broader market dynamics.

1. Historical Context: How Germany Accumulated 50,000 BTC

Seizure from Movie2k

Earlier in 2024, German authorities took down Movie2k, a well-known film piracy site. During this operation, they seized nearly 50,000 BTC from the site’s operators, instantly making Germany one of the largest state-controlled Bitcoin holders in the world. This seizure was made possible by legal powers granted under Germany’s anti-piracy and criminal asset forfeiture laws. As Bitcoin’s value soared, these holdings grew into billions of dollars. BitqueryCointelegraph

Legal Mandate to Liquidate

By mid-June 2024, Germany found itself under a legal obligation—stemming from international guidelines on managing seized assets—to convert these Bitcoins into fiat currency within a set timeframe. The Saxony Central Office for the Custody and Utilisation of Virtual Currencies, working alongside Bankhaus Scheich Wertpapierspezialist AG, managed this process, ensuring everything was in line with global financial regulations. CCN.comBitquery

Initial Sell-Off: June 19, 2024

On June 19, 2024, the government made a significant move by transferring 6,500 BTC, which was valued at over $425 million at that time, to various exchanges. This action marked the beginning of a planned sale. Analysts observed that these transfers were strategically spread across several platforms—like Kraken, Coinbase, Bitstamp, and OTC desks—to ensure liquidity while avoiding a drastic price drop. However, some critics pointed out that the execution could have been better optimized, potentially missing out on greater profits.CointelegraphCCN.com

By July 12, 2024, Germany had sold approximately 49,858 BTC for around $2.89 billion, averaging about $57,900 per coin. This gradual liquidation strategy aimed to strike a balance between quickly meeting legal requirements and minimizing market disruption. Bitquery

2. The July 8, 2024 Transfer: Breaking Down the 1,000 BTC Move

Transaction Details

On July 8, 2024, the blockchain analytics firm Arkham Intelligence noted another significant transfer: 1,000 BTC, roughly valued at $55.79 million, was sent to Coinbase, Bitstamp, and an unidentified address labeled “139Po…”. Specifically:

- 250 BTC went to Coinbase.

- 250 BTC moved to Bitstamp.

- 500 BTC was sent to an unknown address marked “139Po…ybVu.” CoingapeCointelegraph

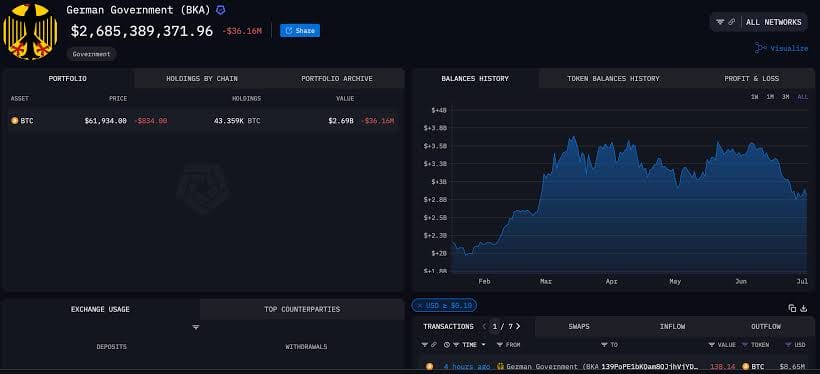

At that point, Germany's remaining holdings were around 39,826 BTC, worth about $2.15 billion. In the 19 days following the June 19 sell-off, authorities had transferred a total of 11,032.3 BTC to various exchanges and wallets. CoingapeCointelegraph

Why July 8, 2024?

The July 8 transaction came amid an already turbulent period for Bitcoin:

- Mt. Gox Creditor Distribution: About $9 billion worth of BTC and Bitcoin Cash were set to be returned to former Mt. Gox creditors, which sparked concerns about increased selling pressure. The BlockCoingape

- Broader Market Volatility: Spot Bitcoin exchange-traded funds (ETFs) were seeing significant outflows, adding to the negative sentiment in the market. CoingapeBlockworks

In light of this, the government seemed to take advantage of a brief moment of relative calm to sell off another portion of its holdings, choosing liquidity over the possibility of higher long-term gains.

Immediate Market Impact

Within 24 hours of the transfer:

- Bitcoin’s price fell below $55,000 but then bounced back into the $55,000–$56,000 range. CoingapeCoingape

- On July 4, the government had already moved 3,000 BTC, which led to a temporary dip that saw Bitcoin trading below $60,000 before confidence returned to the market. The BlockCointelegraph

Overall, since June 16, Germany had shifted over $2 billion in BTC to trading platforms, creating a wave of selling pressure that many linked to the government’s actions. However, some analysts argue that the market may have overreacted to these headline-making “whale moves.” BlockworksCointelegraph

3. Market Reactions, Criticism, and Strategic Debates

Institutional and Investor Response

When it comes to large-scale transfers by a sovereign entity, market anxiety is almost a given.

- Heightened Volatility: Traders were on edge, bracing for more sell-offs that could worsen the already shaky market conditions. On July 14, Bitcoin found itself hovering around the $60,000 mark again, as the government’s labeled wallet ran out of coins, which briefly calmed fears of additional downward pressure. CointelegraphBlockworks

- Speculation on OTC Sales: The transfer of 500 BTC to an unknown address led to chatter that Germany might be engaging in over-the-counter (OTC) sales—possibly to avoid slippage by keeping it off the public order book. CCN.comCoingape

Political Pushback: “Hasty” vs. “Strategic Reserve”

One of the most vocal critics was German MP and Bitcoin supporter Joana Cotar. On July 4, 2024, she publicly slammed the government’s “hasty disposal” of state-owned Bitcoin, advocating for its retention as a strategic reserve asset. Her main points included:

- Diversification of Treasury Assets: Keeping BTC could protect Germany from the devaluation of fiat currency and inflationary pressures. CointelegraphCryptoSlate

- Promoting Innovation: A significant Bitcoin reserve could ignite fintech development and draw in global talent, giving a boost to Germany’s digital economy. CointelegraphX (formerly Twitter)

- Long-Term Value Appreciation: By selling at an average of $57,900, Germany may have missed out on over $2.3 billion in unrealized gains as Bitcoin soared past $104,700 by May 2025. CointelegraphYahoo Finance

Cotar recommended alternative strategies:

- Issuance of Bitcoin-denominated bonds.

- Development of a national Bitcoin strategy, leveraging state energy resources for mining.

- Crafting pro-crypto regulations to foster a favorable legal environment for digital assets. CointelegraphCoin Edition

Counterarguments: Liquidity Needs and Market Realities

Proponents of the liquidation emphasize:

- Legal Requirements: Under World Bank guidelines, seized assets must be converted to fiat within a set timeframe. Delays could invite international censure. CCN.comBitquery

- Public Finance Objectives: The proceeds—over $2.89 billion by mid-July—can fund critical public projects, debt reduction, and social programs more immediately than speculative long-term holding. BitqueryLinkedIn

- Market Activity: Some analysts argue that on-chain wallet inflows do not directly equate to market dumps; in certain cases, funds temporarily move between exchanges before returning to government wallets, suggesting not all transfers represent outright sales. BlockworksCointelegraph

Thus, while political voices call for a strategic reserve approach, fiscal realities and regulatory frameworks have so far tipped the balance toward liquidation.

Strategic Implications for Governments and Markets

Evolving Role of Crypto in Sovereign Treasury

Germany’s experience raises an important question: Should countries start viewing cryptocurrencies as essential components of their reserves? Here are some emerging perspectives:

- Reserve-Side Case: Bitcoin can act as a hedge against currency debasement, especially when global inflationary pressures mount.

- Market-Driven Case: From a Market Insights perspective, frequent large-scale sell-offs can introduce volatility, potentially deterring mainstream adoption until regulatory clarity arrives.

Lessons for Other Jurisdictions

- Legal Frameworks: Countries looking to implement crypto seizures need to create clear protocols regarding timing, methods, and how they report asset sales. Germany's gradual approach—utilizing multiple exchanges—offers a valuable example of how to balance compliance with market effects.

- Stakeholder Communication: Government entities should connect with lawmakers, industry experts, and the public to explain the reasoning behind such asset sales. The public disagreement between Joana Cotar and German ministries illustrates how quickly political dynamics can alter strategies.

- Opportunity Cost Analysis: If Germany had held onto its assets, Arkham Intelligence estimates they could have gained an extra $2.3 billion as Bitcoin surged from $57,900 to over $104,700. This “missed profit” highlights the importance of having flexible, data-driven asset management strategies. CointelegraphLinkedIn

Conclusion

Germany's recent transfer of 1,000 BTC to Coinbase and other addresses on July 8, 2024, is just one part of a much larger story involving legal responsibilities, financial priorities, and changing attitudes toward digital assets. Critics, including MP Joana Cotar, are urging authorities to treat Bitcoin as a strategic reserve. However, the need for regulatory compliance and immediate cash flow has led to a sell-off of over 49,000 BTC in just a few weeks.

As governments around the globe wrestle with the blend of traditional finance and new digital currencies, Germany's situation provides important insights:

- Legal Compliance vs. Strategic Opportunity: Finding the right balance between quick conversions from crypto to fiat and the potential for long-term benefits.

- Market Impact Awareness: Understanding that high-profile transfers can increase market volatility, even if some of those assets stay under government control.

- The Growing Consensus on Crypto Policy: Ongoing discussions about holding crypto as reserves suggest a significant shift—one that governments need to manage with strong frameworks and support from all stakeholders.

Glossary Links

Internal Links:

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

References

- Seizure details and sale data: BitqueryCointelegraph

- Initial 6,500 BTC transfer: CointelegraphCCN.com

- July 8, 2024 1,000 BTC move: CoingapeCointelegraph

- Joana Cotar’s critique: CointelegraphCryptoSlate

- Market analysis and price context: BlockworksCointelegraph

Comments ()