Governance Token Design in Decentralized Ecosystems: $MITO Challenges

Decentralized ecosystems hinge on governance tokens to empower stakeholders, yet their design must balance operational efficacy with legal pitfalls.

Mitosis, a Layer 1 blockchain advancing Ecosystem-Owned Liquidity (EOL), is preparing to launch $MITO as its governance token, enabling holders to shape liquidity flows, cross-chain messaging, and protocol priorities.

Designed to be the "heartbeat" of a cutting-edge DeFi protocol, $MITO powers governance as well as staking rewards, and incentives across Mitosis protocol.

This article explores $MITO’s design through three key principles—utility, accessibility, and resilience—drawing on blockchain governance research and studies of decentralized autonomous organizations (DAOs) under common legal frameworks.

As of March 31, 2025, $MITO’s pre-mainnet phase offers a canvas to craft a framework that sidesteps pitfalls and sets a new standard.

$MITO’s Governance Blueprint

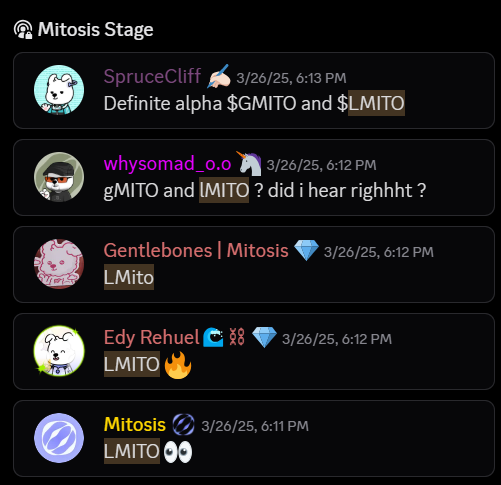

$MITO is slated to guide Mitosis’s modular ecosystem, with staked $MITO (GMITO) set to provide voting rights over liquidity and protocol decisions.

The "Expedition: The Mitosis LP Campaign" (expedition.mitosis.org) ties governance to action, converting MITO Points into tokens at mainnet launch.

This approach aligns with DeFi’s community-driven models, like MakerDAO’s MKR, where tokenholders steer critical functions.

With $MITO still in development, this is a chance to address challenges head-on, leveraging insights from research on centralization, economic stability, and legal risks under typical systems. Success depends on grounding utility, accessibility, and resilience in practical design.

Key Principle 1: Utility – Defining Real Influence

Utility gives a governance token its purpose, ensuring holders can meaningfully impact a protocol.

$MITO’s utility centers on governing EOL, with GMITO holders poised to direct liquidity across chains and validate Hyperlane messaging.

This could mirror MKR’s role in tuning MakerDAO, offering a direct stake in Mitosis’s mission.

Research underscores that utility thrives on clarity—vague mandates can dilute engagement. $MITO has the opportunity to define precise voting scopes, like specific liquidity pool decisions, ensuring influence translates to action.

By sharpening this focus pre-launch, Mitosis can build a system where $MITO drives real outcomes, not just symbolic votes.

Key Principle 2: Accessibility – Spreading the Reach

Accessibility determines who wields governance power, aiming for broad participation. $MITO lays a solid foundation with rewards for Testnet, Expedition, Game of Mito, MORSE, and other various initiatives, distributing tokens to active contributors in a nod to DeFi’s inclusive ethos.

Studies caution that accessibility must persist beyond initial handouts to avoid entrenched elites. Mitosis can extend this principle by planning sustained access—think staking rewards or periodic incentives—keeping $MITO within reach as the ecosystem grows.

This approach can maintain a diverse, engaged governance base over time.

Key Principle 3: Resilience – Weathering the Storms

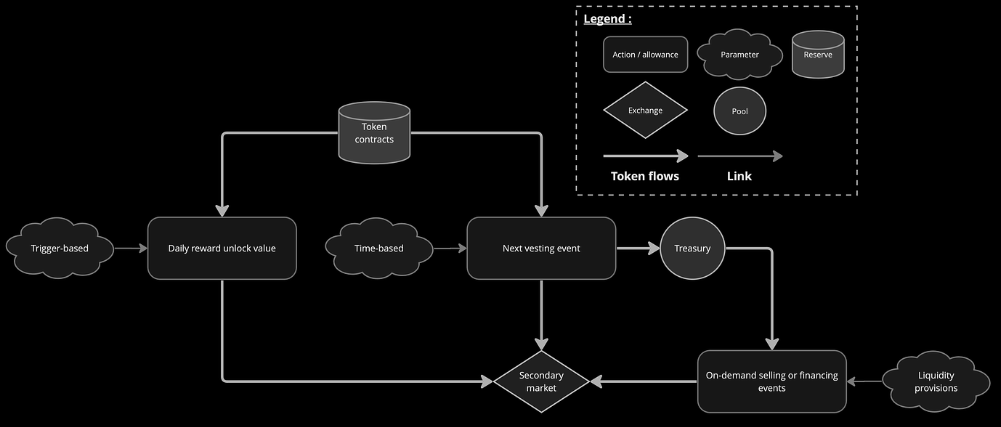

Resilience ensures a token withstands economic, technical, and legal pressures. $MITO’s staking model (gMITO) and its vested version (lMITO) signals a move toward stability, encouraging holders to lock tokens and align with Mitosis’s long-term goals.

Every research highlights this as a trait of durable DeFi systems. Rewarding long-term holders vs mercenary capital.

The pre-mainnet phase offers a window to bolster resilience against volatility, exploits, and legal uncertainties.

Mitosis can embed safeguards—vesting to steady value, secure voting to thwart attacks, and clear legal positioning—ensuring $MITO stands firm amid challenges.

Challenge 1: Centralization and Partnership Shadows

Studies highlight how token concentration can skew power, while DAO analysis warns that developers, tokenholders, or users might form a partnership under generic legal frameworks, tied by a shared profit motive.

$MITO’s testnet and LP rewards shape its early spread, and its DeFi focus could flag it as a “business”.

Mitosis Developers’ teamwork and $MITO’s profit potential (e.g., token value) might suggest a partnership, with tokenholders possibly included if voting binds them to collective aims. Users and validators likely stay separate, chasing their own ends.

Under typical laws, this could mean liability for DAO debts—like a hack’s fallout—especially where jurisdictions enforce such rules.

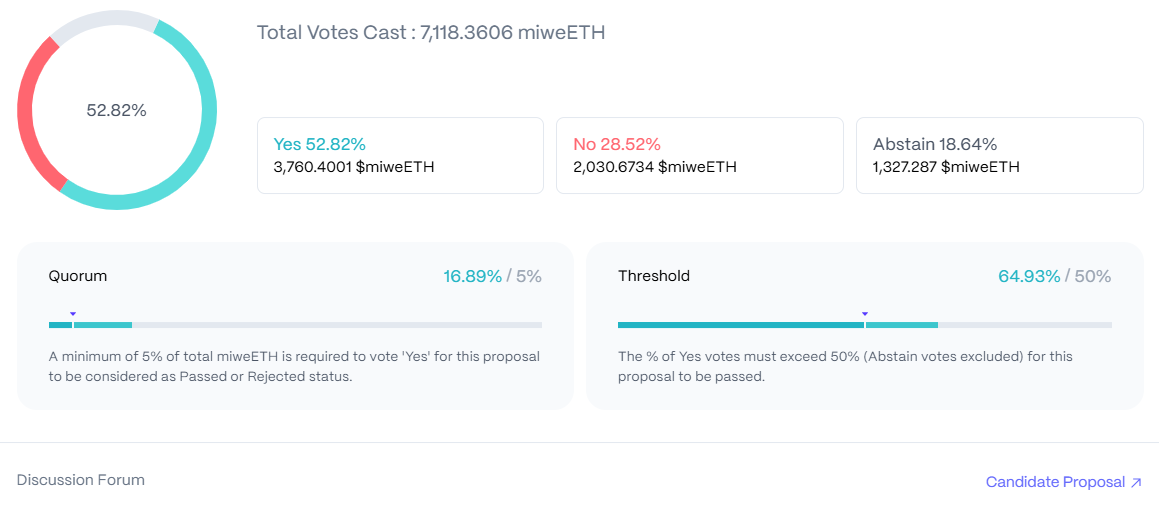

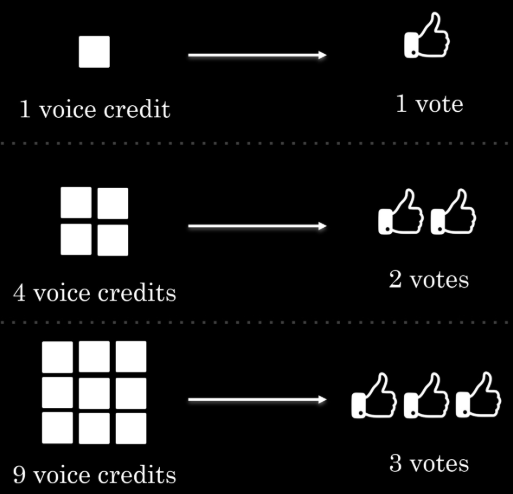

Mitosis could address this by using voting caps or quadratic models to balance power and clarifying intent in its whitepaper to avoid partnership labels and centralization issues.

Challenge 2: Economic Balance and Liability Risks

Research flags token dumps as a stability threat, while legal studies note partnership liability under common systems—joint and several, lingering without creditor opt-out. $MITO’s liquid rewards could spark turbulence, and its structure might expose holders.

A $MITO sell-off could jolt EOL, thinning governance ranks. If seen as a partnership under generic frameworks, a smart contract failure might pin losses on developers or tokenholders, clashing with $MITO’s fluid design (rigid rules like equal profit splits).

Mitosis can counter this with multiple vesting solutions to anchor value and consider incorporation to shield against liability, balancing protection with decentralization.

Challenge 3: Technical Gaps and Regulatory Clarity

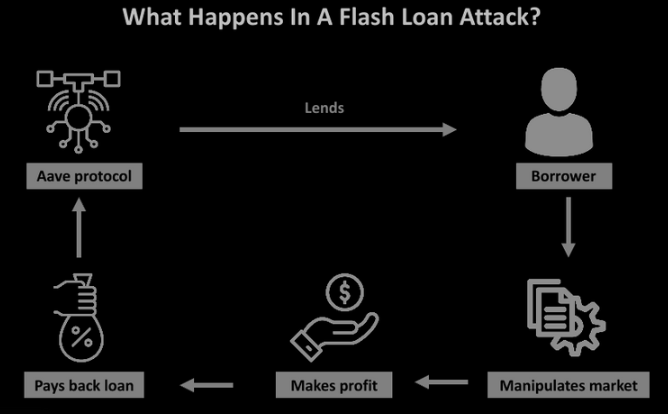

Flash loans could endanger on-chain votes and unstructured setups draw regulatory eyes under typical legal standards.

$MITO’s cross-chain scope raises the stakes.

Borrowed $MITO could tilt liquidity votes, and developers or holders might face claims if common laws apply—e.g., post-hack suits tied to domicile.

Undefined mechanics offer space to strengthen defenses.

Mitosis can implement time-locked snapshot voting to block exploits and use whitepaper terms to adjust partnership defaults, though incorporation could streamline regulatory footing.

$MITO’s Path Forward

$MITO combines utility (liquidity governance), accessibility (campaign rewards), and early resilience (staking). Mitosis can enhance these by ensuring even distribution, economic steadiness, and technical security, all while navigating legal terrain. This pre-launch window is a chance to build thoughtfully.

Conclusion: Blending Code with Caution

$MITO’s journey depends on weaving utility, accessibility, and resilience with strategic foresight. Mitosis can advance EOL governance by tackling centralization, volatility, and legal risks proactively.

As DAOs evolve, $MITO’s mainnet will show whether governance tokens can balance code’s potential with real-world demands.

Comments ()