How Do DeFi Protocols Make Money and Stay Afloat?

DeFi, or Decentralized Finance, is a system that emerged as an alternative to traditional banking. It enables users to conduct financial transactions directly—without intermediaries—powered by smart contracts. These systems offer decentralized lending, borrowing, trading, and more.

But here arises a critical question: How do DeFi protocols generate revenue? How are developers and protocol owners financing these systems? Do platforms rely solely on user interest, or is there a sustainable economic model behind them?

In this article, we'll explore the revenue streams of DeFi protocols, how they function, and whether they are sustainable in the long run.

How Do DeFi Protocols Work?

DeFi protocols are blocks of code running on the blockchain. These are executed through smart contracts operating on networks like Ethereum, Binance Smart Chain, or Avalanche.

To use a DeFi protocol, users typically need to:

- Get a crypto wallet (e.g., MetaMask)

- Fund the wallet with cryptocurrency

- Connect to the protocol's interface

- Perform actions such as swaps, staking, or borrowing

The standout feature of DeFi systems is their permissionless nature—no need to open an account. The code is open and accessible to all.

How Do These Protocols Generate Revenue?

Revenue models in DeFi vary depending on the type of service offered. Below are the most common revenue sources:

1. Trading Fees

Decentralized exchanges (DEXs) charge small fees for every token swap. This fee is usually a percentage of the trade volume.

Example: Uniswap charges a 0.3% trading fee on every token swap. A large portion of this goes to liquidity providers (LPs), while the rest flows into the protocol treasury.

These fees are used to:

- Cover development and maintenance costs

- Distribute to token holders or stakers

- Fund new features or incentive programs

2. Interest from Lending/Borrowing

Lending protocols allow users to lend or borrow crypto assets. These protocols act as intermediaries and take a cut from the interest paid.

Example:

Protocols like Aave or Compound charge borrowers interest. A portion goes to liquidity providers, while another goes directly to the protocol.

Interest rates here are determined by supply and demand—as demand for a token increases, interest rates go up.

3. Token Emissions & Incentives

Some DeFi protocols distribute their native tokens as rewards to attract users. This is commonly known as liquidity mining or yield farming.

However, it's important to note that this model does not generate direct revenue. It's mainly used as a short-term incentive to attract users and grow liquidity. Long-term sustainability still depends on trading fees and interest income.

Why Is Revenue Important?

Generating revenue is not just about staying operational—it’s essential for delivering value to users. Here’s why:

- Developer Sustainability: Funding is needed for coding, audits, updates, and user support.

- Rewards for Stakers and LPs: Revenue can be shared with users, creating an incentive for participation.

- Investor Confidence: A revenue-generating protocol is perceived as more reliable and sustainable.

- Token Value: Earning revenue can increase a protocol’s token value, especially if it's tied to governance or revenue-sharing.

A Circular Economy: The Link Between Revenue and Liquidity

As a DeFi protocol becomes more popular, it attracts more users, leading to increased trading volume and higher revenue. If some of this revenue is distributed to liquidity providers, the system becomes even more attractive.

A simple cycle:

Higher revenue → Better rewards → More liquidity → Lower slippage & faster trades → More users → Higher volume → Back to start

As long as this cycle is sustainable, the protocol can thrive long term.

Real-World Examples

Example 1: Uniswap

Uniswap charges a 0.3% fee per swap. 0.25% goes to liquidity providers, and 0.05% to the protocol treasury. This helps keep the platform running while rewarding users.

Example 2: Aave

A user borrowing USDC on Aave might pay 3% interest. Out of this, 2.8% goes to liquidity providers, and 0.2% goes to the protocol. Aave also uses part of its revenue for its Safety Module, which ensures platform security.

How Can We Track DeFi Revenues?

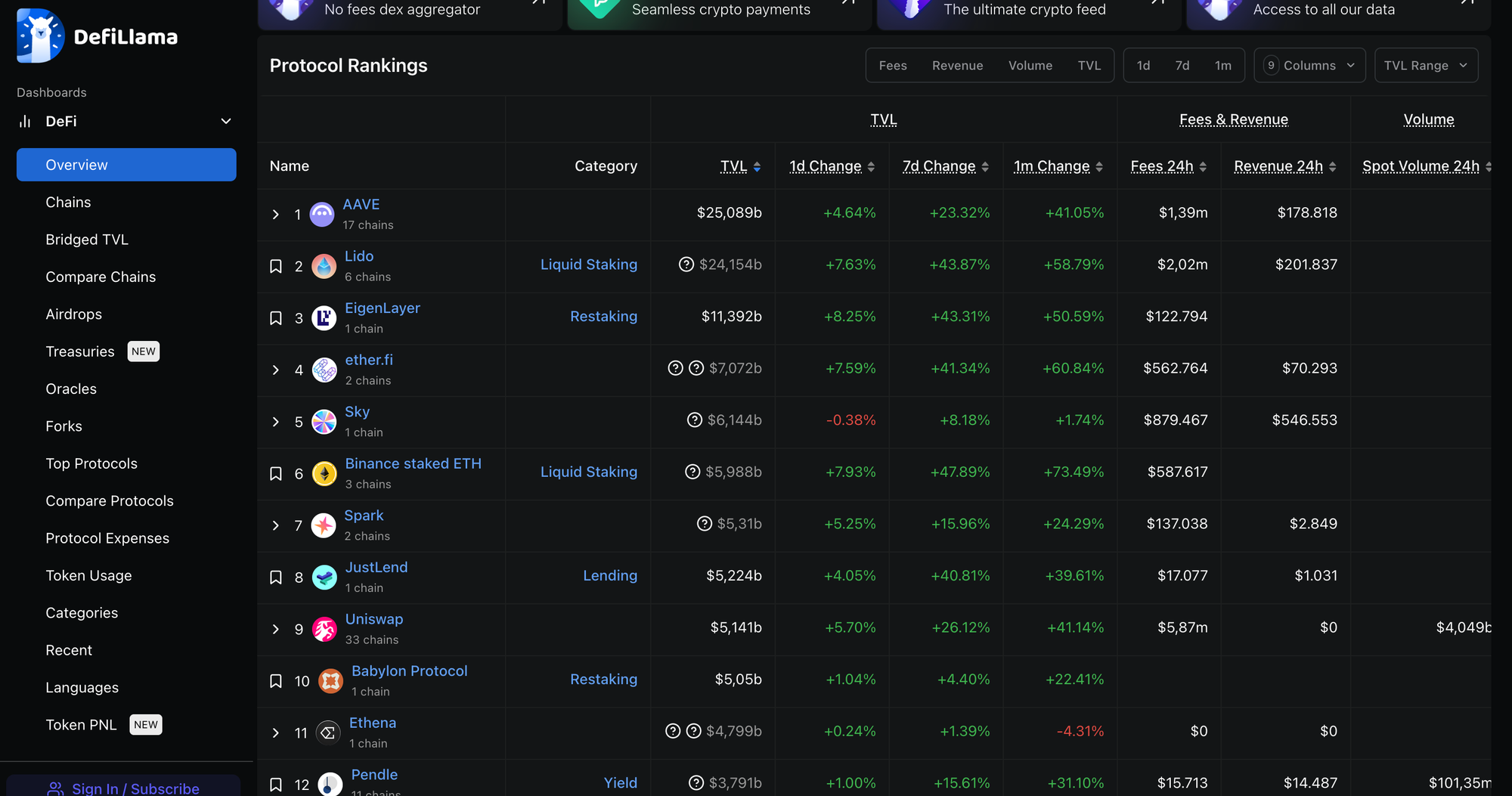

On-chain data is publicly available, but analyzing it can be challenging. Thankfully, some platforms simplify this process:

- Token Terminal: Provides revenue and usage data for DeFi protocols

- DeFiLlama: Offers metrics like TVL (Total Value Locked), revenue, and user numbers

- Dune Analytics: Custom dashboards for revenue, user behavior, and performance analysis

These tools help you analyze a project before investing.

Conclusion: A Win-Win Model Is Essential

To survive, DeFi protocols must generate revenue—just like a traditional business. That revenue is not only vital for developers but also for the broader community and investors.

Before investing in a DeFi project, ask yourself:

- How much revenue does this protocol generate?

- Is the revenue shared with users?

- Is the revenue model sustainable?

Protocols that provide clear answers to these questions have a higher chance of long-term success.

Remember: DeFi is not just a high-yield game—it’s the art of choosing the right project

Comments ()