How Liquidity Management Works in EOL: A Complete Guide with Examples.

In this article we will talk about the EOL system, how assets are managed, how voting and liquidity distribution occurs.

Introduction

EOL is a system that helps distribute liquidity through voting. The more funds a user has invested, the more rights they have in managing the system.

When users contribute regular assets to EOL, they receive special tokens (miAssets) on the Mitosis blockchain in return. These tokens give owners:

- right to income from assets;

- participation in voting;

- influence on the distribution of liquidity.

The value of miAssets changes depending on the effectiveness of strategies and accumulated profits.

EOL management occurs in two stages:

- Initiation Governance Process – selection of new DeFi protocols that can receive liquidity.

- Gauge Governance Process – voting on liquidity distribution between protocols and its redistribution.

This way, users decide for themselves how the system should work and where to direct funds.

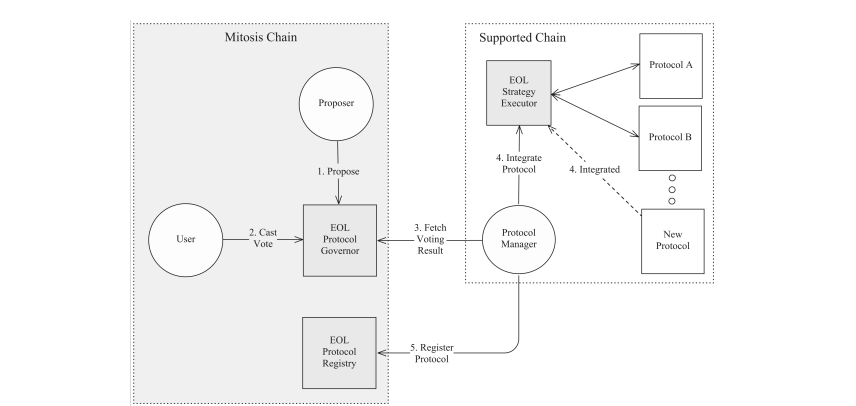

1. Initiation Governance Process

1. Protocol Integration Proposal

What happens at this stage:

- An authorized participant submits an application to add a new DeFi protocol to the EOL system. The application specifies:

- How rewards will be distributed among users.

- What risks are associated with this protocol and how to minimize them.

- What technical requirements are needed for integration.

- What portion of EOL liquidity is proposed to be directed to this protocol.

Example

Let's say someone wants to add a new DeFi protocol called FarmX to EOL, which offers 10% annual interest on deposits. The proposal would state:

- Users who deposit assets into FarmX will be rewarded with YFX tokens.

- Risks (e.g., hacking) are rated at 2/10, and insurance is offered for protection.

- Integration requires compatibility with the Mitosis blockchain.

- It is proposed to allocate 5% of EOL's liquidity to this protocol.

2. Voting Process

What happens at this stage:

- miAssets owners review the application and vote. The weight of their votes depends on the number of miAssets and the time they are held (the longer they are held, the greater the weight).

Example

- Alex has 100 miAssets, but he holds them for only 1 day → his vote = 10 points.

- Maria has 50 miAssets, but she holds them for 7 days → her vote = 50 points.

- John has 200 miAssets, but he holds them for 3 days → his vote = 85 points.

The longer users hold miAssets, the greater their influence on the vote.

3. Vote Aggregation

What happens at this stage:

- After the voting is completed, the system (Protocol Manager) checks the results. If the application has received enough "FOR" votes, it goes further.

Example

If 60% of users vote "FOR" the FarmX integration, the protocol is considered approved.

4. Protocol Integration

What happens at this stage:

- Once approved, the Protocol Manager passes the data to the Strategy Executor, which performs the technical integration of the new protocol into the system.

Example

In the case of FarmX, developers are setting up smart contracts so that liquidity can be delivered through EOL.

5. Registry Update

What happens at this stage:

- After successful integration, information about the new protocol is added to the EOL Protocol Registry, and it becomes available for the next stage - Gauge (liquidity redistribution).

Example

FarmX is now officially in the system, and users will be able to vote on how much liquidity to send to it in the future.

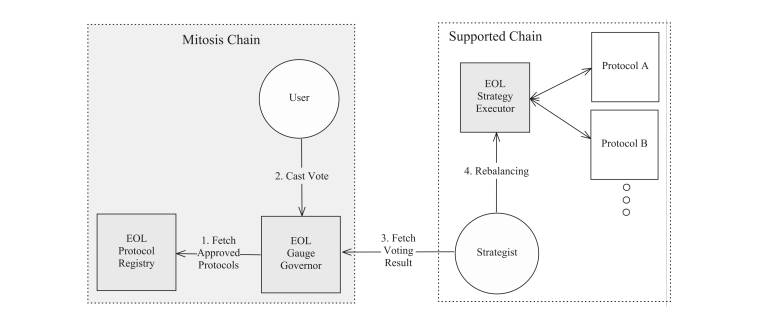

2. Gauge Governance Process

1. Epoch Start

What happens at this stage:

- The EOL Gauge Governor starts a new voting epoch and downloads the list of approved protocols from the EOL Protocol Registry.

Example

Let's say three DeFi protocols were approved in previous votes:

- FarmX (10% per annum)

- LendX (6% per annum, but with low risks)

- SwapX (yield depends on trading volume)

Now users will vote on how much liquidity to direct to each of them.

2. Voting Process

What happens at this stage:

- miAssets holders vote for protocols using their Time Weighted Abundance (TWAB) over the last 7 days. The longer they hold their miAssets, the greater their voting weight.

Example

- Alex holds 100 miAssets for 3 days → his vote = 30 points.

- Maria holds 50 miAssets for 7 days → her vote = 50 points.

- John holds 200 miAssets for 5 days → his vote = 140 points.

They distribute their points between protocols, for example:

- Alex votes 20 points for YieldX, 10 points for LendX.

- Maria votes 30 points for LendX, 20 points for SwapX.

- John votes 100 points for FarmX, 40 points for SwapX.

Accordingly, the more points a protocol collects, the more liquidity will be put there.

3. Vote Aggregation

What happens at this stage:

- The system sums up all the votes and determines how much liquidity each protocol will receive. Strategist then forms a plan for asset redistribution.

Example

- YieldFarmX received 1200 votes (60% liquidity).

- LendPlus received 500 votes (25% liquidity).

- SwapSafe received 300 votes (15% liquidity).

Strategist feeds this data to Strategy Executor.

4. Strategy Execution

What happens at this stage:

- Strategy Executor redistributes liquidity across protocols in accordance with the vote.

Example

If there was 1,000,000 USDC in the EOL pool:

- 600,000 USDC goes to FarmX.

- 250,000 USDC goes to LendX.

- 150,000 USDC goes to SwapX.

5. Monitoring

What happens at this stage:

- The system constantly monitors the effectiveness of each strategy. If a protocol starts to yield less profit or becomes risky, this may affect the next votes.

Example

- A week later, it turns out that SwapX is yielding low returns → in the next era, users can redistribute votes.

- If FarmX shows high returns, then in the next round it can be allocated even more liquidity.

Ultimately, the governance initiation process allows the EOL community to decide which DeFi protocols are worthy of being part of the system and receiving liquidity.

Brief Conclusion

✔ Flexible governance — users decide for themselves which protocols to support and how to distribute liquidity.

✔ Transparency and decentralization — decisions are made through voting by miAssets owners.

✔ Profit optimization — liquidity is distributed dynamically, depending on the efficiency of protocols.

✔ Transparency — all decisions are voted on, and the results can be verified in the blockchain.

Thus, EOL is a system where liquidity is managed by the community, and users have a direct influence on its distribution.

Author - Alexander

Useful links:

Project documentation

Official X

Blog Mitosis

Comments ()