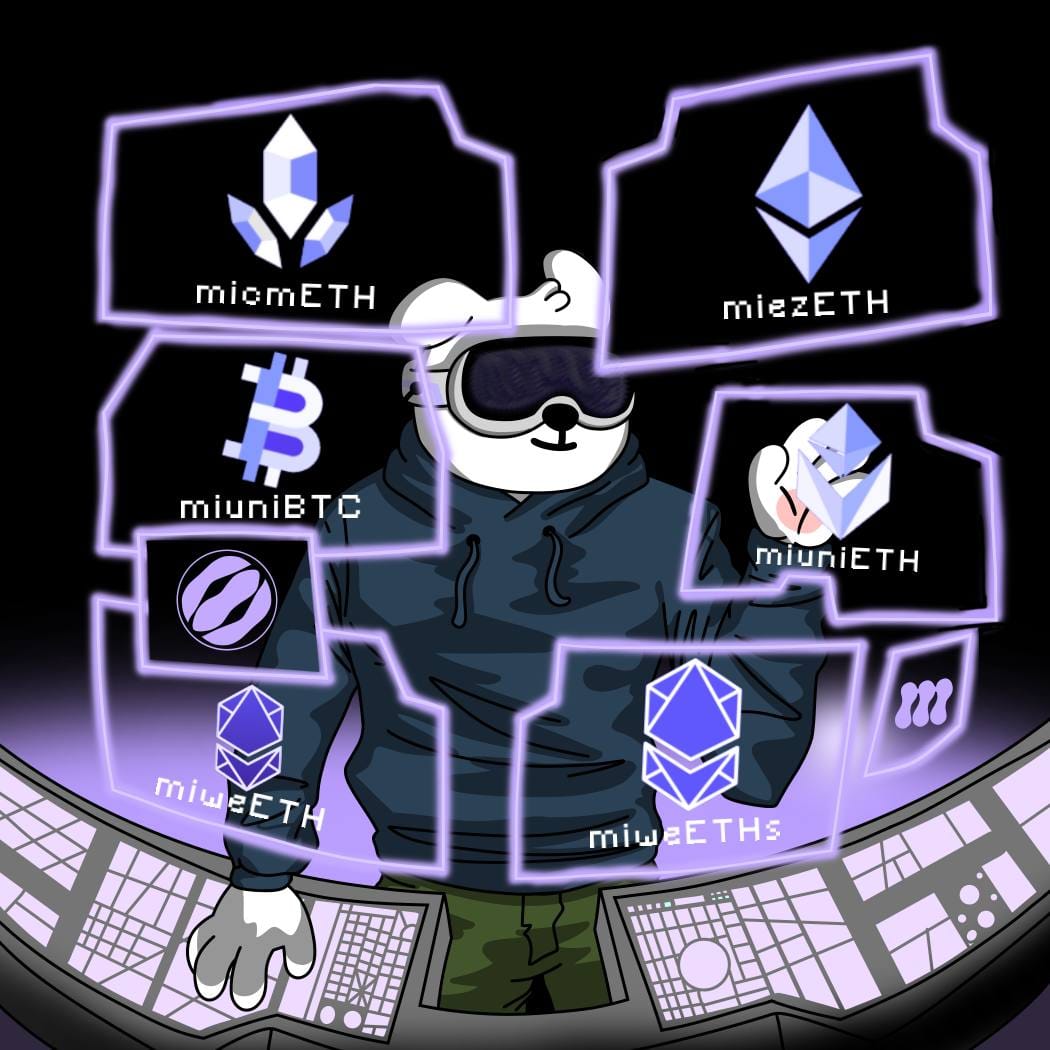

How MiAssets Work In The Mitosis Ecosystem:

First of all what are miAssets? miAssets are tokenized wrappers that represent a user's position inside Mitosis vaults. When you deposit an asset into Mitosis like an LRT (e.g. ezETH, rsETH) you receive a corresponding miAsset, such as miEZETH or miRSETH. This isn’t just a receipt it’s a composable DeFi asset with utility across chains.

———————

How miAssets Work (Step by Step) 1. Deposit You enter a strategy via Matrix or the Expedition campaign Example: You deposit 1 rsETH into a curated vault on Mitosis 2. Minting Mitosis mints 1 miRSETH to represent your position. This token is sent to your wallet and acts as a 1:1 claim on your rsETH vault deposit 3. Utility While held, miRSETH automatically accrues yield based on the strategy

It can also be: -Bridged across chains -Used as collateral (eventually) -Swapped via DEX integrations -Used in future Mitosis native DeFi apps 4. Redemption When you're ready to exit, burn miRSETH to withdraw the underlying + earned yield The vault recalculates value based on performance and sends your rsETH + yield ————————————— Why miAssets Matter Composability: They act like DeFi building blocks similar to aUST or stETH Portability: Designed for cross-chain usage, powered by Mitosis’ Settlement Layer Programmability: miAssets can plug into other protocols for collateral, swaps, or staking Security: Backed 1:1 by underlying assets in smart contract vaults ————————— Future Use Cases for miAssets ■ Collateral in lending/borrowing markets ■ Restaking across different chains using the same asset ■ Yield aggregation in new Mitosis native apps ■ Cross chain stablecoin minting backed by miAssets ————————— Bottom Line miAssets are the proof of liquidity tokens that make Mitosis strategies portable, composable, and DeFi native. They allow users to earn, move, and build on top of their deposits across chains and protocols without breaking or losing liquidity.

Read more about MiAssets here: https://docs.mitosis.org/docs/learn/governance/intro

Join Discord

Comments ()