How Mitosis is Reinventing DeFi with Money Legos

You like money legos? You enjoy stacking juicy yields while keeping your tokens safe and sound on-chain, right?

Now imagine this: what if besides earning on-chain yields, you could also build up a fat stack of airdrop legos on the side?

Yeah, I'm talking about a system where your LRTs work for you, your positions stay liquid and composable, and your airdrop bags grow passively.

Sounds like your kind of playground?

Lets dive in.

Mitosis is building a Network for Programmable Liquidity

Think of it as a modular DeFi backend where liquidity is not just parked — it’s programmable, composable, and multi-chain native.

While the devs have launched campaigns on Ethereum and some major L2s, their final form is still loading:

→ A custom-built L1 focused 100% on liquidity infra and money legos design.

In this mainnet, you’ll be able to tokenize your liquidity positions and use them across different dApps and strategies.

Let’s run a practical example...

Say you’re holding $weETH from Ether.fi in your wallet. It’s already earning yield, sure — but you’re ready for more.

On Mitosis, you can deposit that $weETH into the EOL (Ecosystem-Owned Liquidity).

In return, you receive a miAsset — a fully composable, tokenized receipt of your deposit.

Now that you hold $miweETH, the lego-building begins:

➢ Use it as collateral in a lending protocol

➢ Provide liquidity in a DEX like miweETH/USDC

➢ Bundle into LP vaults or explore other yield strategies

And the best part?

You’re stacking multiple yield layers simultaneously:

➢ Base LRT yield from Ether.Fi

➢ Yield from EOL (Mitosis ecosystem incentives)

➢ Yield from the dApp you plug into (DEXs, money markets, etc.)

One asset. Three+ revenue streams.

That’s money legos done right by Mitosis.

But wait — there’s more. We know you’re not just here for promises.

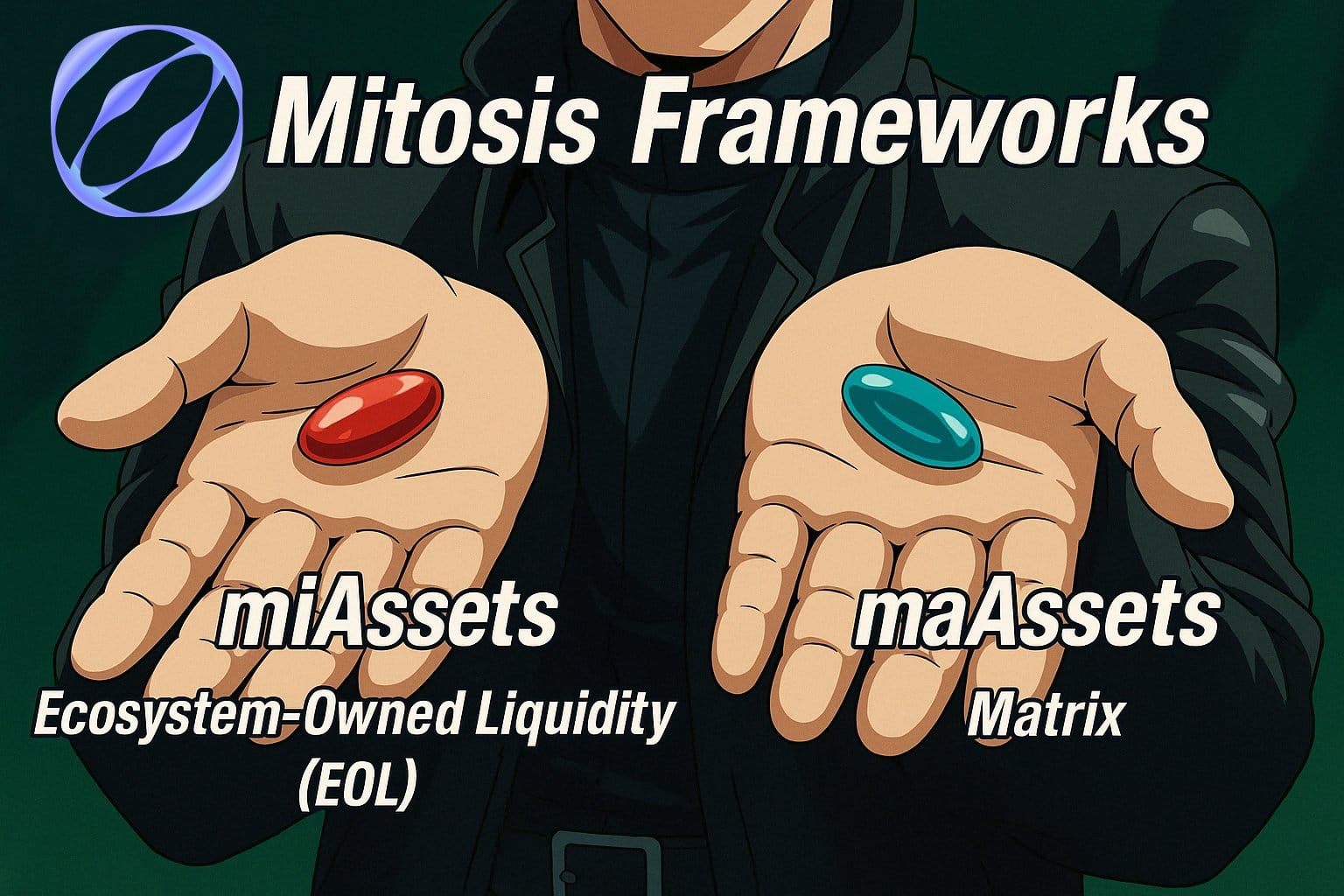

miAssets vs maAssets on Mitosis: Pick Your Lego Wisely

Degens want action now. And while the Mitosis L1 is still cooking (ETA somewhere between June and August 2025 depending on market conditions), you don’t have to wait to get involved.

Right now, there are two live campaigns happening on Ethereum and major L2s that let you stack rewards:

➢ Mitosis Expedition Campaign

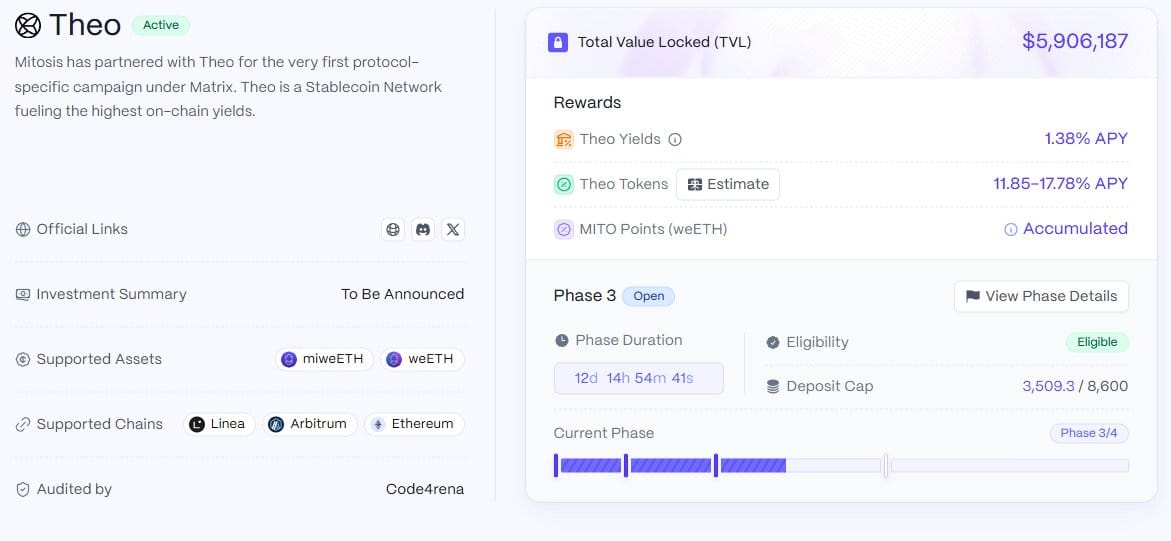

➢ Matrix Vaults, in collaboration with Theo Network

The Expedition Campaign has been live for nearly a year — you probably already aped in.

So let’s talk about the new hotness: Matrix Vaults.

It’s where money legos meet airdrop legos. This one’s spicy.

Matrix Vaults are Mitosis’ take on Curated Liquidity Campaigns

Aprotocol-native vaults that let you deploy capital with purpose. They’re different from the passive EOL valuts. With Matrix Vaults, you choose exactly how and where your liquidity works, without hard lockups.

Here’s what makes them powerful:

➢ Withdraw anytime (you lose rewards, but hey, freedom)

➢ maAssets = tokenized positions you can use across DeFi

➢ Cross-chain liquidity routes (no more siloed assets)

➢ Programmable yield streams = flexible incentives

And the campaign with Theo Network adds a whole new flavor:

➢ You deposit weETH

➢ You earn Ether.fi base yield

➢ You earn Theo yield (~14.7% APY)

➢ You earn $Theo airdrop (11% ~ 18% APY)

➢ You earn MITO Points = future $MITO airdrop

One move. Five streams of value.

That’s money + airdrop legos in a single vault.

Did you enjoy this content?

If it helped you in any way, I’d really appreciate your support!

Feel free to connect with me on Twitter/X, and if you’d like to send a Praise, my Discord is open too. 🙏

Thanks in advance for your trust and support — it means a lot! 🙌

Follow me on Twitter/X: febarce |DeFi

My Dircord: febarce |DeFi

Check out my other articles

References:

• Announcing the Inaugural Matrix Vault - Theo Straddle

• Matrix Vaults: Reimagining Liquidity Opportunities

• Theo Network Documentation

• Mitosis Documentation

Comments ()