How Mitosis Is Transforming Liquidity: A Deep Dive into EOL, Governance, and the Future of Cross-Chain DeFi

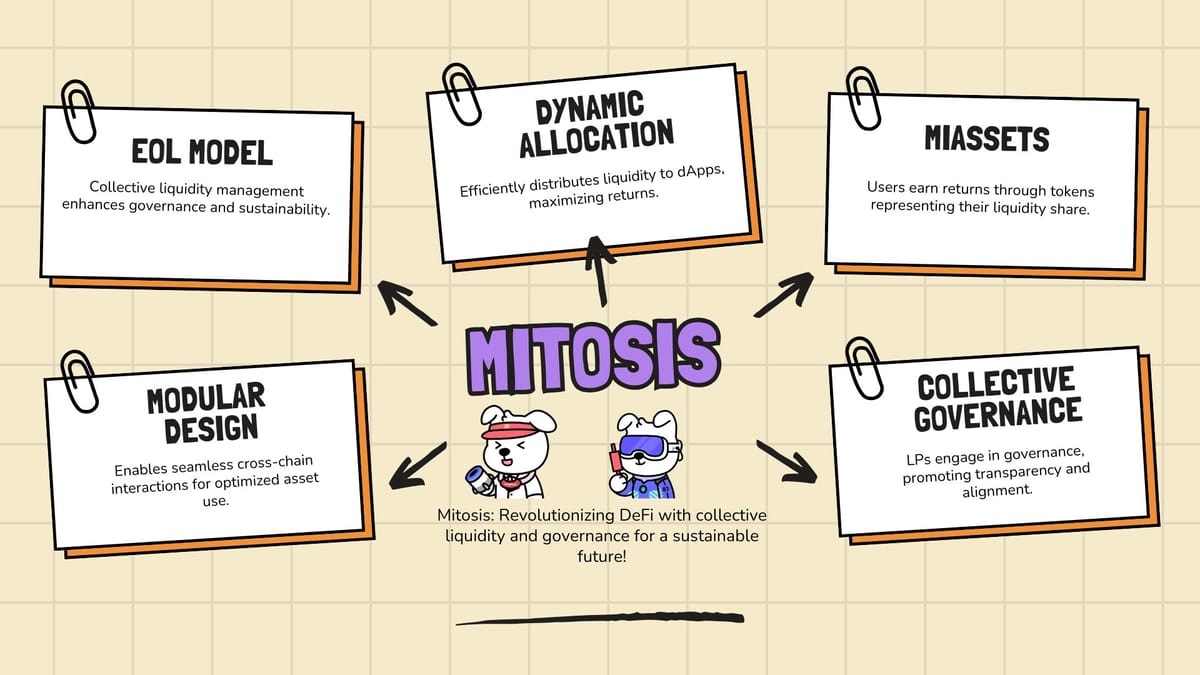

If you’re tired of quick-fix “rent-a-liquidity” schemes that vanish overnight, Mitosis offers a more transparent, collective alternative. At its core, Mitosis combines Ecosystem-Owned Liquidity (EOL) with a dedicated Mitosis L1 chain. Below is a concise overview of why Mitosis is reshaping DeFi Lending, Liquidity Provision, and Cross Chain Yield across multiple Layer 1 networks.

Why Mitosis?

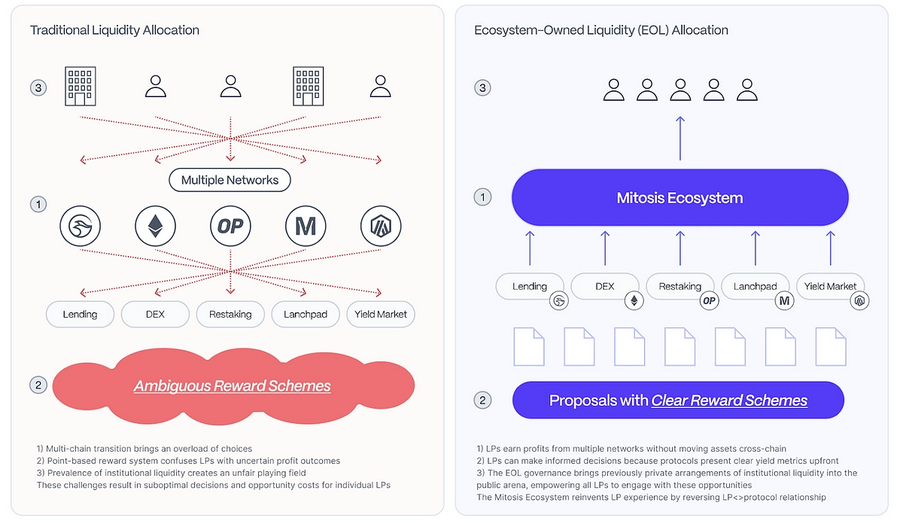

Shifting from Private Deals to Collective Ownership

In traditional DeFi Lending, securing liquidity can often feel like negotiating secret side-deals with large whales or short-term yield hunters who jump ship the moment a better APR appears. Mitosis replaces that dynamic with a collective approach. Rather than relying on a few key players, Mitosis invites the entire community to provide liquidity, pool their assets, and guide how capital is deployed across multiple Layer 1 and Layer 2 networks.

- Fairer Access: Smaller investors and major LPs alike can participate on equal footing—no hidden talks with an exclusive few KOLs, market makers, or private deals.

- Shared Decision-Making: Every liquidity provider has a say in how liquidity is allocated, leading to a more stable and community-driven ecosystem.

EOL & miAssets

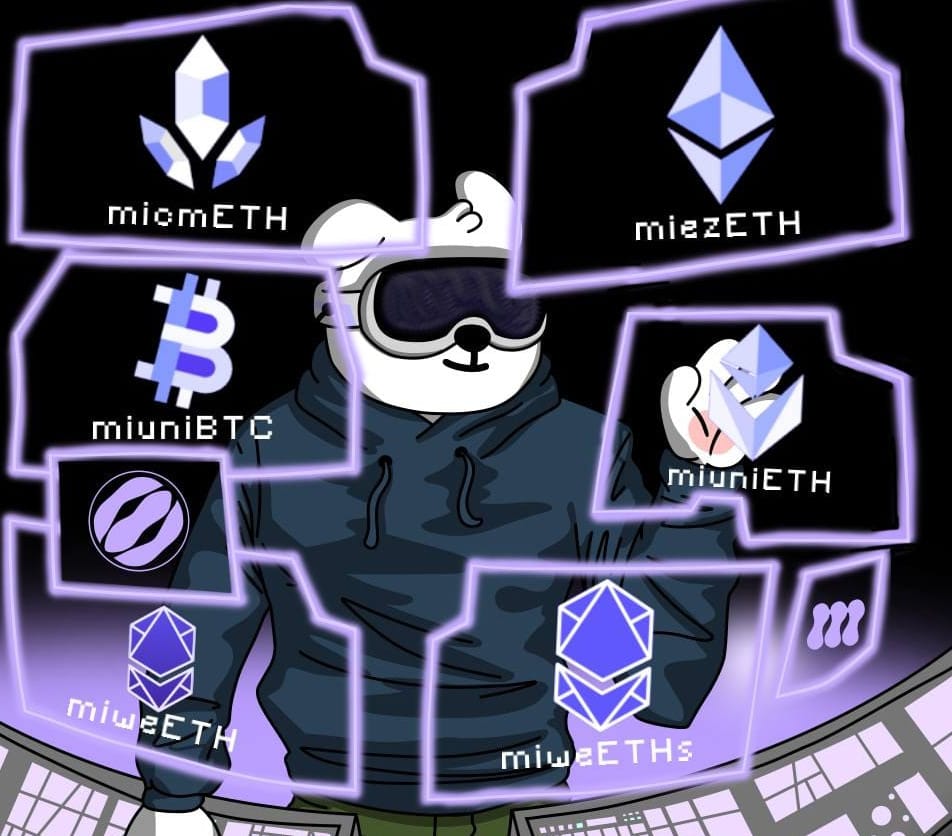

When you deposit assets into Mitosis Vaults on supported chains, you receive 1:1 Vanilla Assets on the Mitosis L1, a Layer 1 blockchain secured by EigenLayer. If you choose to opt into EOL, those Vanilla Assets can be converted into miAssets.

🔹 Deposit weETH → Mitosis LPs deposit weETH into Mitosis and receive miweETH on a 1:1 basis.

🔹 Burn miweETH → Holders can burn miweETH to retrieve the underlying weETH.

Why This is a Game-Changer

- Cross Chain Yield – As miAssets, your tokens benefit from EOL’s multi-chain strategies, potentially boosting returns beyond what you’d get from a single-chain setup.

- Governance Power – Holding miETH lets you vote on which Layer 1 protocols receive ETH liquidity. This aligns incentives and lets you actively shape the DeFi landscape.

No More Obscure Arrangements

Mitosis aims to do away with opaque deals where influential players quietly direct capital to favored projects. Instead, allocation decisions happen through open gauge votes, where every miAsset holder can see and vote on, where the community’s liquidity should go.

How This Creates Fairer Liquidity Distribution

- Transparency: Everyone knows which DeFi Lending protocols are seeking liquidity, what yields they’re offering, and how many votes they receive. By opening up the decision-making, Mitosis creates an environment where better-quality protocols stand out through transparent votes, rather than backroom connections. It also reassures liquidity providers that any shift in allocation is a public, collectively made decision, helping avoid sudden liquidity black holes that can appear when a few major players pull the plug.

- Reduced Risk of Capital Flight: Since Gauge Voting is community-driven, protocols that deliver real value are more likely to retain liquidity, rather than losing it to a single big LP exit.

- Competitive Yet Fair: Projects have to pitch openly for EOL support, encouraging them to refine their offers (better yields, secure smart contracts, etc.) to attract more gauge votes.

How EOL Works

Initiation Voting (New Protocols)

- DeFi projects submit proposals on the Mitosis Forum, detailing why they need EOL liquidity, what they offer in return, and how they’ll use the capital.

- miAsset holders vote on whether these new protocols should enter the EOL “portfolio.”

Gauge Voting (Liquidity Allocation)

- Every week, miAsset holders (e.g., miETH, miUSDT, miUSDC) decide how much of their asset’s liquidity is allocated to approved protocols.

- Voting power is proportional to Time-Weighted Average Balance (TWAB), encouraging long-term participation and active governance.

Mitosis L1: The Coordination Layer

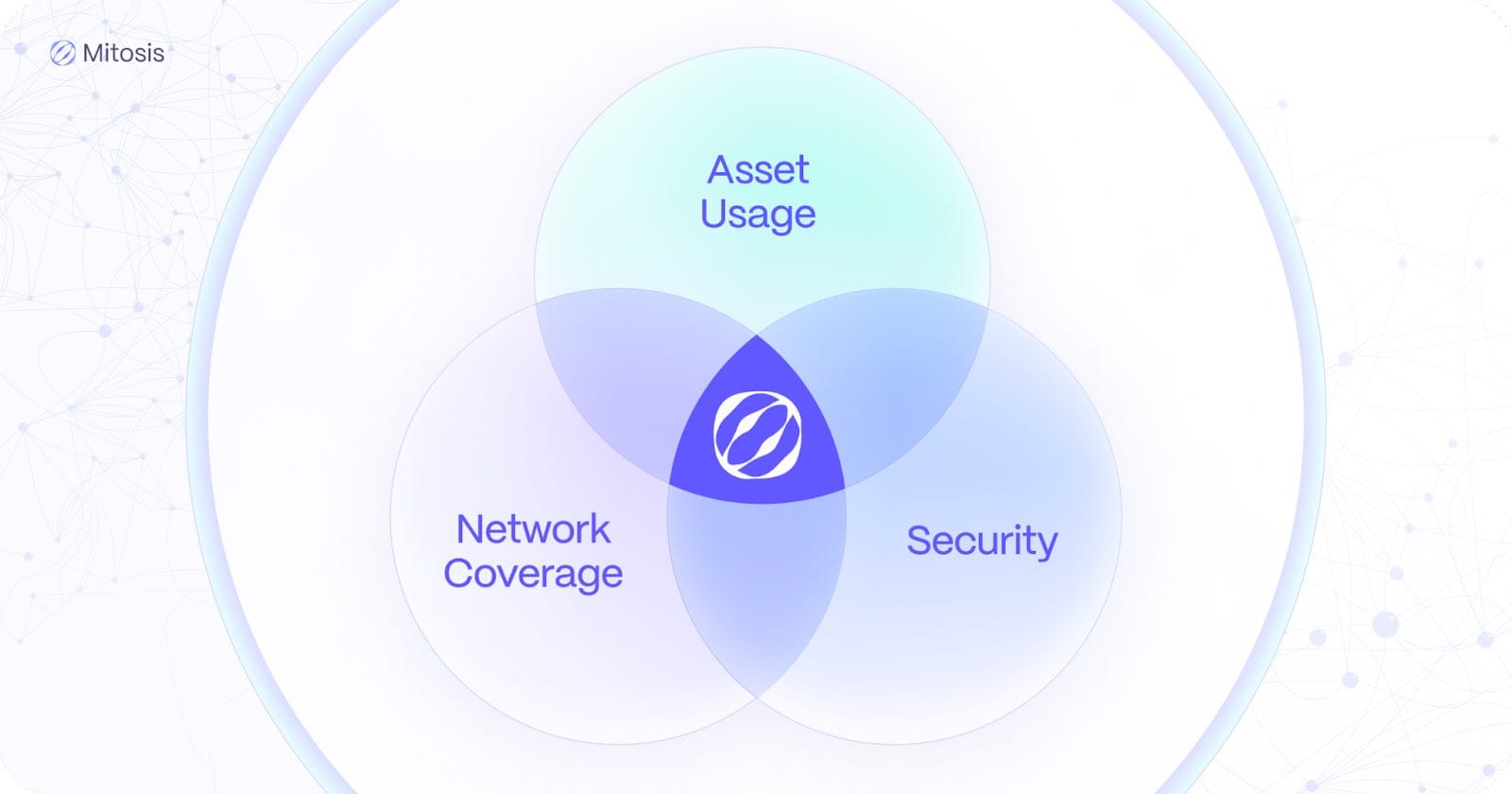

Secured by Ethereum (EigenLayer): The Mitosis L1 chain leverages EigenLayer’s Actively Validated Services, allowing validators to restake ETH while securing Mitosis cross-chain operations.

- Programmable Liquidity: Mitosis L1 enables developers to build custom DeFi Lending apps, modular smart contracts, and advanced liquidity strategies on a unified blockchain.

- miAssets as Building Blocks: Developers can build Layer 2 lending protocols, automated market makers (AMMs), or custom NFT-based financial tools around miAssets.

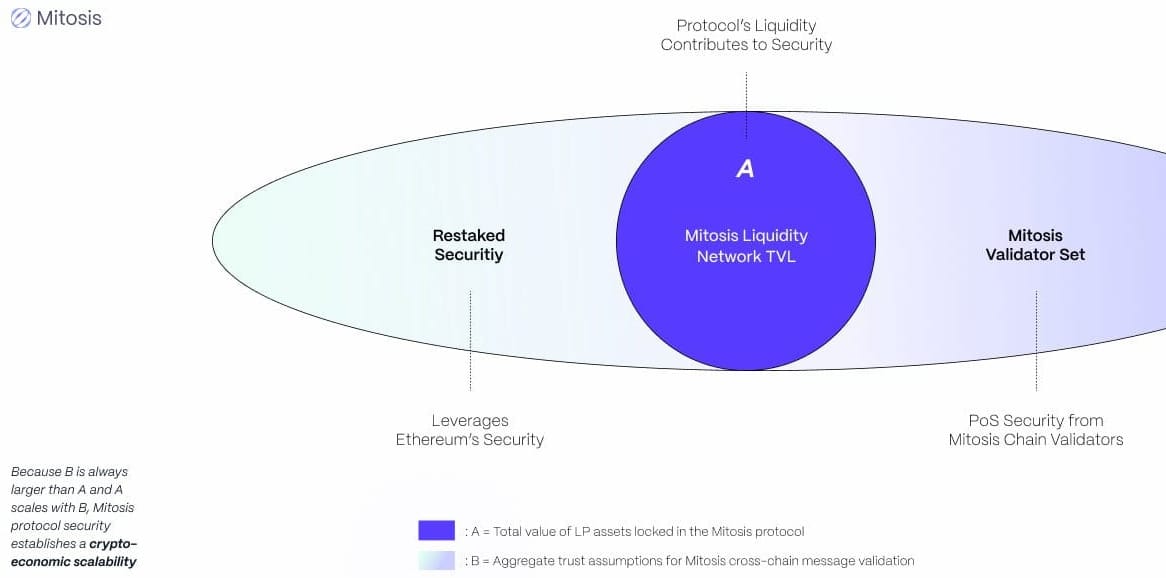

Liquidity as a Security Layer

Beyond just managing liquidity, Mitosis integrates security directly into liquidity provision, reinforcing both its own validator set and Ethereum’s security through restaking mechanisms. This dual-layered approach strengthens trust in crosschain transactions while ensuring that liquidity providers contribute directly to the protocol’s resilience.

In Mitosis, the total value of LP assets locked (TVL) doesn’t just sit idle, it plays an active role in securing the network. As shown in the diagram, Mitosis Liquidity Network TVL (A) is inherently tied to aggregate trust assumptions (B) that scale with the network’s cross-chain validation needs. This ensures that as liquidity grows, so does the cryptoeconomic security of the system. In short, it’s the ultimate cheat code for growth. Growth = More Growth.

By integrating Proof-of-Stake security from its own validator set while inheriting Ethereum’s security guarantees through EigenLayer, Mitosis effectively bridges the gap between capital efficiency and network resilience. This allows for secure and decentralized cross-chain message validation, without relying on centralized intermediaries.

Through this model, liquidity within Mitosis is more than just capital, it becomes a fundamental pillar of the protocol’s security and scalability.

Governance Tools: Expedition, Synthesis, and Forum

- Expedition: A gamified governance layer where users earn XP for voting, proposing ideas, and liquidity contributions.

- Synthesis: A real-time voting dashboard displaying TWAB-based voting power, active proposals, and delegation options.

- Forum: A discussion hub for liquidity proposals, where protocols pitch themselves before formal voting begins.

These tools collectively ensure that EOL decisions remain transparent and community-driven.

Cross-Chain Liquidity Evolution

How Mitosis Strengthens Major Layer 1 Blockchains

1. Binance Smart Chain (BSC)

- TVL Metric:

- Approximately $5.6 billion in Total Value Locked (TVL) as of January 2025 (per DeFi Llama).

- Why Mitosis Matters

- BSC’s high TVL often relies on quick, yield-farming capital that can leave at any moment.

- Reducing reliance on short-term yield chasers through EOL governance while maintaining high-speed transactions on a monolithic blockchain structure.

- miBNB holders would use weekly gauge votes to direct BNB where it’s most effective, rather than chasing rotating APRs.

- Technical Tie-Ins:

- BSC is EVM-compatible, making the bridging process between Mitosis L1 and BSC straightforward in terms of smart contract deployments and token standards (BEP-20 vs. ERC-20).

In the end, more sustainable capital for BSC dApps like PancakeSwap, Venus, and beyond, while retail users see cross-chain yield opportunities they can actively vote on.

2. Avalanche (AVAX)

- Current Metrics:

- Roughly $1.3 billion in TVL , spread across diverse DeFi platforms (Benqi, Trader Joe, etc.).

- Subnet Advantage:

- Avalanche’s subnet architecture allows specialized chains (e.g., gaming or institutional DeFi) to launch under the Avalanche umbrella, leveraging its modular blockchain approach. Unlike monolithic blockchains, which handle execution, consensus, and data availability within a single layer, Avalanche’s subnets separate these functions, enhancing scalability and customization. By tapping into EOL, these subnets can draw from a wider liquidity pool without launching multiple individual bridges, creating a more efficient capital distribution model across chains.

- EOL Synergy:

- AVAX depositors receive miAVAX, which not only yields cross-chain returns but also grants direct influence on where AVAX-based capital goes.

- Weekly gauge votes keep capital allocation transparent and dynamic, letting new subnets propose themselves for additional liquidity.

Impact: Avalanche’s DeFi ecosystem gains more stable liquidity, voted in by the community while Avalanche’s speed and low fees make it attractive for building next-generation dApps that connect to Mitosis.

3. Tron (TRX)

- Stablecoin Volumes:

- Tron consistently processes billions of dollars in USDT transfers daily, thanks to low transaction fees and quick confirmations.

- EOL Connection:

- Tron protocols can propose stable yields to EOL participants. If miTRX holders find the yields compelling, they allocate capital in Tron’s direction during weekly gauge votes.

- This community-driven approach ensures protocols with genuine utility on Tron stand out, rather than those merely offering the highest short-term APR.

- Technical Note:

- While Tron isn’t EVM-compatible by default, bridging solutions already exist to support TRC-20 and wrap them for cross-chain usage. Mitosis vaults can tokenize Tron deposits as Vanilla Assets, which are then converted to miAssets on the Mitosis L1.

Tron’s stablecoin-heavy ecosystem becomes more interoperable with Ethereum, BSC, and Avalanche, while TRX holders gain a more democratic way to move their capital across chains.

4. Solana (SOL)

- Network Throughput:

- Capable of thousands of transactions per second, with a rapidly evolving DeFi and NFT market. Integrating NFT-Fi and high-speed DeFi into cross-chain liquidity pools, with discussions emerging around potential Celestia-based modular integrations to improve data availability.

- Why Mitosis Helps:

- Solana’s non-EVM environment can still plug into Mitosis’s aggregator model, bridging SOL liquidity to multiple chains without juggling numerous one-off bridges.

- miSOL owners can vote on whether certain Solana dApps (especially NFT marketplaces or high-speed DeFi) receive community-governed liquidity.

- Phantom could develop an in-app section for Mitosis if an Collab ever happens.

- Performance Insight

- Solana sees large NFT minting volumes and has a TVL that’s hovered between $8 billion and $12 billion in the past months, depending on market conditions. With Mitosis, that capital can cross-pollinate with EVM ecosystems more seamlessly.

Effect: Solana projects access a broader pool of DeFi capital, while cross-chain investors can harness Solana’s quick DeFi environment through a single aggregator, one that’s run by the community via open gauge votes.

While Polkadot doesn’t operate like a standard L1 (It’s considered a L0), its parachains could also benefit if Mitosis expands to Layer 0 solutions. Each parachain gains direct access to EOL’s pooled capital, skipping the hassle of chain-specific bridging or siloed liquidity. This scenario creates a way for specialized networks, ranging from privacy-focused DeFi to unique NFT games, to tap into one massive liquidity resource.

Why This Matters

Mitosis is more than just a liquidity solution, it’s a new governance model. Instead of whales or private entities controlling liquidity flows, miAsset holders collectively decide capital distribution. Through transparent gauge votes and fair access, DeFi evolves into a more democratic ecosystem where liquidity follows real demand, not private deals.

- Liquidity with a Purpose – Instead of big players making backroom deals, anyone who deposits assets into Mitosis Vaults and holds miAssets gets a say in where liquidity flows. Every week, the community decides how funds are allocated, ensuring capital moves based on real demand, not just hype.

- Transparency & Security First – The Mitosis L1, keeps everything on record. There’s no hidden favoritism, no off-chain agreements, just clear, open governance where every decision is visible.

- A Unified DeFi Ecosystem – Each chain has its strengths, but they often operate in silos. Mitosis brings them together under one system, where liquidity can move freely between them without the usual friction of complex bridges or unstable incentives.

By integrating multiple blockchains into a community-driven liquidity network, Mitosis isn’t just making DeFi more efficient,it’s making it fairer, more stable, and genuinely interconnected in a way we haven’t seen before!

Conclusion: Where Mitosis Fits in DeFi

Key Takeaways

- EOL makes liquidity community-owned and voted on, rather than negotiated behind closed doors.

- The Mitosis L1 (secured by Ethereum) coordinates these decisions and hosts miAssets, the yield earning tokens representing your stake in EOL.

- Expedition, Synthesis, & Forum give smaller protocols and LPs a fair shot, leveling the playing field.

For Protocols: Offer compelling yields, pass Initiation Voting, and earn EOL liquidity in weekly Gauges.

For LPs: Convert your deposits into miAssets to capture cross-chain returns and guide liquidity decisions.

For Builders: Dream up next-level DeFi apps on Mitosis L1, leveraging a collective liquidity pool.

Final Question

Which chain or layer do you think benefits most from EOL, and why? Join the discussion on the Mitosis Forum and help shape the future of multi-chain DeFi. I truly believe Mitosis will be the go-to Omnichain we all been waiting for.

I hope you guys enjoyed this thread about Mitosis. If you have any feedback feel free to hit me a dm on https://x.com/FarmingLegendX

References

[1] “Sushiswap: A Uniswap Fork and DeFi Protocol | Gemini,” Gemini Cryptopedia, 2023. [Online]. Available: https://www.gemini.com/cryptopedia/sushiswap-uniswap-vampire-attack (accessed Jan. 22, 2025).

[2] “EigenLayer: Restaking and Actively Validated Services,” EigenLayer Docs, 2024. [Online]. Available:https://docs.eigenlayer.xyz/eigenlayer/operator-guides/operator-introduction (accessed Jan. 23, 2025).

[3] “Celestia: Modular Blockchain & Airdrop Details,” Celestia Docs, 2024. [Online]. Available: https://blog.celestia.org/genesis-drop-details (accessed Jan. 23, 2025).

[4] “Mitosis: Ecosystem-Owned Liquidity (EOL) and Governance,” Mitosis Docs, 2025. [Online]. Available: https://mitosis.org/docs (accessed Jan. 23, 2025).

[5] “DeFi Llama: Total Value Locked (TVL) in DeFi,” DeFi Llama, 2025. [Online]. Available: https://defillama.com (accessed Jan. 23, 2025).

[6] “Binance Smart Chain Documentation,” Binance Docs, 2024. [Online]. Available: https://docs.bnbchain.org (accessed Jan. 23, 2025).

[7] “Avalanche: Subnet Architecture & Scaling,” Avalanche Docs, 2024. [Online]. Available: https://docs.avax.network (accessed Jan. 23, 2025).

[8] “Solana: High-Speed Blockchain & DeFi Ecosystem,” Solana Docs, 2024. [Online]. Available: https://docs.solana.com (accessed Jan. 23, 2025).

[9] “Tron: TRC-20 Tokens & DeFi Infrastructure,” Tron Docs, 2024. [Online]. Available: https://developers.tron.network (accessed Jan. 23, 2025).

Additional Resources

Comments ()