How mitosis resolves the Monolithic behavior of Layer 1 blockchain projects

What is mitosis

Mitosis as it implies biologically means the the splitting of a parent cell into various daughter cells to carry out different functions all at once. It is essential for growth and maintenance of multicellular organisms. Now that we have a little insight on what mitosis is biologically all about. The importance of mitosis in Layer 1 blockchain, but first we have to get the full knowledge of what layer 1 projects are.

Layer 1 blockchain

Layer 1 projects i.e Bitcoin (BTC), Ethereum (ETH), Binance smart chain (BSC), Cardano (ADA), Solana (SOL). These are foundational blockchain protocols that operate independently and serve as the primary layer for building decentralized applications [dApps] and services. These blockchain include their own Cryptocurrency and provide the infrastructure, smart contracts and decentralized operations. Their role is crucial to the entire blockchain ecosystem,, however their limitations are 1) Expandability: Many blockchain struggles with flexibility and performance as usage grows 2) Seclusion: Most layer 1 blockchain operate independently making interactions between them difficult

How does Mitosis tend to solve layer 1 Monolithic condition?

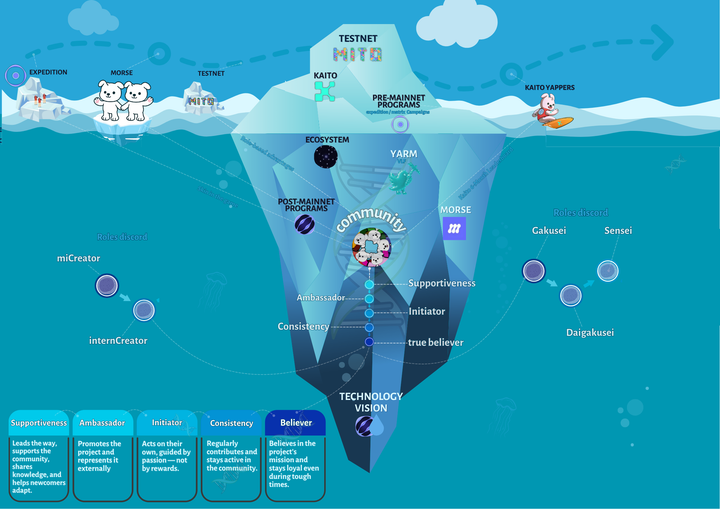

Mitosis is an innovative Layer 1 (L1) blockchain platform designed to unify liquidity provision across multiple blockchains through its unique Ecosystem Owned Liquidity (EOL) model. Mitosis aims to deliver a novel liquidity model to newly created modular blockchains and decentralized applications (dApps), aiming to attract more TVL by leveraging community-owned liquidity. Mitosis is not just a Layer 1 (L1) blockchain nor is it a traditional layer 2 solution which a regular Modular blockchain is but it is a liquidity protocol designed to work across multiple blockchain layers and in which can be the layer one problem solver. You wonder what I mean by that, Let me explain;

1) Modular Liquidity: It functions as a modular system where its components (like the Ecosystem-Owned Liquidity model) can be integrated into different blockchain environments, enhancing liquidity management without being tied to one specific blockchain layer, if you participated in the testnet you should be familiar with EOL.

2) Interoperability Focus: By mitosis being modular in nature, it focuses on interoperability, allowing assets to be used efficiently across different blockchain ecosystems, which is more akin to what one might see with cross-chain bridge technologies or interoperability protocols.

3) Cross-Layer Protocol: Mitosis operates on top of existing blockchains, providing a layer of liquidity management and distribution that can span both Layer 1 and Layer 2 solutions.

4) Scalability: As the number of users and network activity grows, many blockchains face performance issues. Mitosis addresses this with its multi-chain framework. By spreading workloads across multiple networks, it boosts throughput and lowers the risk of bottlenecks, particularly during times of high traffic.

Decentralized finance (DeFi):

Decentralized finance (often stylized as DeFi) provides financial instruments and services through smart contracts on a programmable, permissionless blockchain. This approach reduces the need for intermediaries such as brokerages, exchanges, or banks DeFi platforms enable users to lend or borrow funds, speculate on asset price movements using derivatives, trade cryptocurrencies, insure against risks, and earn interest in savings-like accounts The DeFi ecosystem is built on a layered architecture and highly composable building blocks. While some applications offer high interest rates they carry high risks Coding errors and hacks are a common challenge in DeFi.

The limitation of defi on layer 1 blockchain

1) Low scalability: DeFi platforms are currently hindered by scalability issues, leading to delayed processing times and elevated transaction fees. 2) Processing times: Many DeFi applications are slow because blockchains operate less efficiently than their centralized counterparts, primarily due to their complex structure. 3) Transaction fees: Layer 1 blockchains validate and process transactions independently, without relying on another network. Additionally, high transaction fees can stem from limited scalability.

How does Mitosis solve the defi issue on layer 1 blockchains?

Mitosis takes a distinct approach to DeFi liquidity through its Ecosystem-Owned Liquidity (EOL) model. Here's how it works:

• Unified liquidity pool: Mitosis consolidates all assets into a single liquidity pool, improving capital efficiency and reducing fragmentation.

• Derivative tokens: Instead of locking up assets, liquidity providers (LPs) deposit them into smart contracts that mint derivative tokens representing their contribution, which can be freely traded on the Mitosis network.

• Instant finality: Utilizing a Proof-of-Stake consensus mechanism, Mitosis ensures fast and secure transaction processing.

Alos applying the concept of mitosis to Layer 1 blockchains can help resolve issues like scalability, congestion, and performance that are common in NFTs and GameFi applications. By creating parallel chains or sub-networks dedicated to specific tasks, such as handling NFTs or GameFi, the blockchain can process more transactions at once, boosting scalability and reducing network bottlenecks. This method also improves efficiency, ensuring smoother user experiences by preventing delays in activities like purchasing NFTs or engaging in games. Mitosis enables the creation of customized chains tailored to particular needs, which helps lower transaction fees and enhances security by isolating different functions. Ultimately, this approach makes Layer 1 blockchains better equipped to handle the high demands of NFTs and GameFi, where fast, secure, and affordable transactions are critical.

THE BENEFIT OF MITOSIS TO LAYER 1 BLOCKCHAIN AND WHY IT SHOULD BE ADOPTED

Mitosis brings several key benefits to Layer 1 blockchains, making it a compelling solution for adoption:

1) Enhanced Liquidity Efficiency: By leveraging a shared liquidity pool and Ecosystem-Owned Liquidity (EOL), Mitosis boosts capital efficiency and minimizes fragmentation, leading to better asset management and improved liquidity for users.

2) Greater Flexibility for Liquidity Providers: Rather than locking assets, liquidity providers (LPs) deposit them into smart contracts that mint derivative tokens, which they can freely trade within the network. This approach gives LPs more flexibility and greater potential for returns.

3) Scalability and Speed: Mitosis uses a Proof-of-Stake consensus mechanism, optimizing transaction speeds and ensuring instant finality. This improves transaction processing times and reduces bottlenecks, addressing scalability challenges for Layer 1 blockchains.

4) Lower Transaction Costs: By reducing liquidity fragmentation and enhancing capital efficiency, Mitosis helps cut down on overall transaction fees, an important consideration for Layer 1 blockchains facing high fees due to scalability limitations.

5) Increased Security: The Proof-of-Stake mechanism provides robust security while maintaining efficiency, creating a safe and reliable environment for transaction processing and smart contract execution.

In conclusion, adopting mitosis-like mechanisms in Layer 1 blockchains can significantly boost their scalability, efficiency, decentralization, and security. By implementing such principles, blockchain networks could better handle the growing demands of a fast-paced, transaction-intensive digital economy. This would allow blockchains to process more transactions swiftly, manage higher data volumes, and maintain security and decentralization as they expand. These enhancements are vital for the widespread adoption of blockchain technology across various industries, supporting use cases like finance, supply chain, and decentralized applications. Ultimately, embracing these innovations would ensure that Layer 1 blockchains are capable of thriving in a more interconnected and transaction-heavy global landscape.

Comments ()