How Programmable Liquidity Works in Mitosis: Transforming DeFi's Frozen Assets into Flowing Capital

Programmable liquidity represents a paradigm shift in decentralized finance, solving one of DeFi's most persistent challenges: the inefficient use of locked capital. In traditional DeFi systems, when users provide liquidity to protocols, their assets become static and illiquid—frozen like ice in isolated pools. Mitosis transforms this dynamic by creating programmable liquidity that flows like water, capable of being redirected, reused, split, and adapted for multiple use cases simultaneously.

The Problem with Traditional DeFi Liquidity

Current DeFi systems suffer from fundamental inefficiencies that limit both user

returns and capital efficiency:

- Static Capital Allocation: Once assets are committed to a protocol, they remain locked and cannot be effectively utilized elsewhere, creating opportunity costs for users.

- Exclusive Access Barriers: The most profitable yield opportunities are often reserved for large investors who can negotiate private agreements, creating an uneven playing field that mirrors traditional finance inequities.

- Fragmented Liquidity: Users must manually deploy capital across multiple protocols, leading to inevitable liquidity fragmentation and suboptimal returns.

- Limited Composability: Traditional liquidity positions cannot be easily used as building blocks for more sophisticated financial strategies.

Mitosis's Programmable Liquidity Solution

Mitosis addresses these challenges through a systematic approach that makes liquidity both programmable and accessible. Let's follow the journey of 1 ETH through the Mitosis ecosystem to understand how programmable liquidity works in practice.

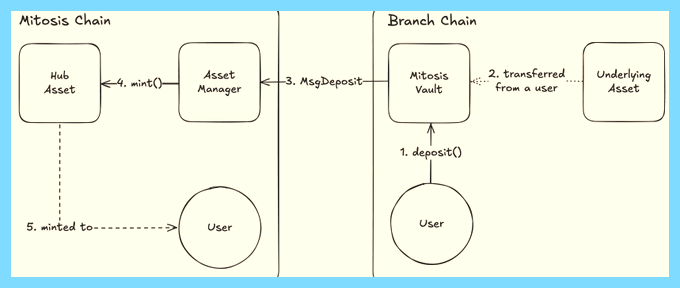

Stage 1: Secure Asset Storage and Hub Asset Creation

Hub Asset Minting: On the Mitosis Chain, you receive a 1:1 representation of that ETH called a Hub Asset. This is like receiving a ticket that represents your water in the reservoir. You can now move and use this ticket across the entire Mitosis ecosystem without ever touching the original water.

Key Benefits:

- 1:1 Backing: Each Hub Asset is fully backed by underlying assets with guaranteed deposit/withdrawal ratios

- ERC20 Standard: Hub Assets follow ERC20 standards, maintaining the same symbol as underlying assets for seamless integration

- Cross-Chain Representation: Your assets on different branch chains are unified under a single Hub Asset on Mitosis Chain

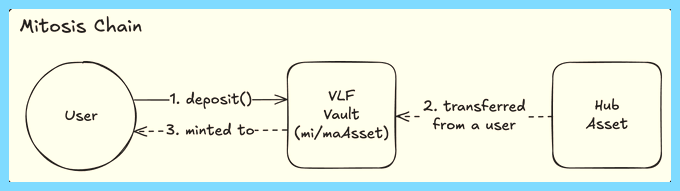

Stage 2: Vault Liquidity Frameworks (VLFs) - The Programmable Engine

Transforming Static to Dynamic: When you supply your Hub Assets to a Vault Liquidity Framework (VLF Vault), you receive VLF tokens such as miAssets (for EOL) or maAssets (for Matrix). This is where the magic of programmability begins.

- Trade on DEXs: Function as standard tokens in decentralized exchanges

- Serve as Collateral: Be used in lending protocols for additional capital efficiency

- Decompose into Components: Split into yield and principal components for advanced strategies

- Combine into New Instruments: Create sophisticated financial products through composition

Yield Generation: VLF tokens automatically accrue yield from underlying strategies while maintaining their programmable properties. Unlike traditional DeFi where you must choose between liquidity and yield, Mitosis provides both simultaneously.

Security Through Delayed Reclaim: Withdrawals go through a secure waiting queue with a minimum 7-day period. This protects the system from flash exits and speculation while ensuring strategists have time to properly unwind positions.

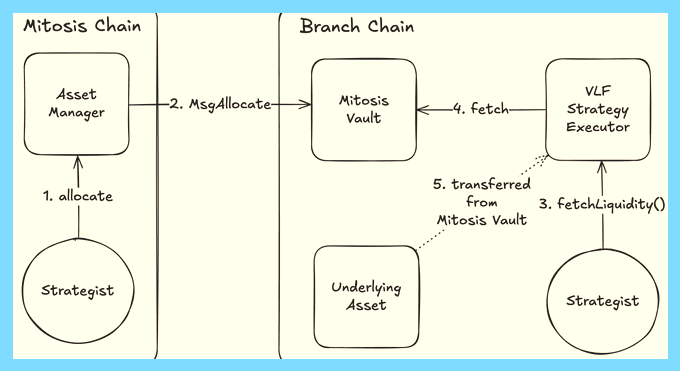

Stage 3: The Strategist - Master Engineer of Liquidity Flow

The Strategist serves as the system's master engineer, making critical decisions about how liquidity flows through the ecosystem:

Strategic Analysis:

- Continuously analyze yield opportunities across different branch chains

- Assess risk-adjusted returns and market conditions

- Identify optimal allocation strategies for maximum efficiency

Liquidity Management:

- Decide how much liquidity to allocate to active strategies versus keeping idle for withdrawals

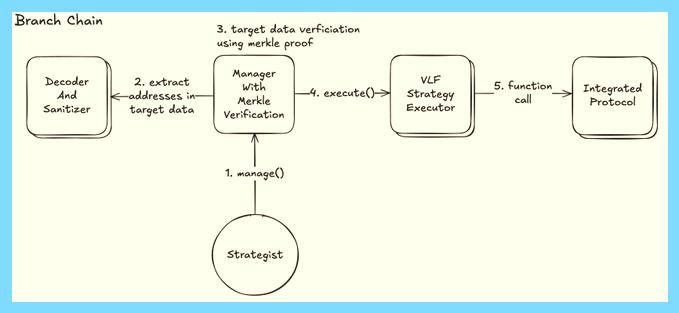

- Execute only pre-approved strategies using cryptographic Merkle proof verification

- Ensure sufficient reserves are maintained for user withdrawal requests

Security Framework:

- All strategies must be approved via governance (gMITO holders decide)

- Each function call is cryptographically verified via Merkle proofs

- Unauthorized or risky actions are impossible—the system validates everything before execution

Stage 4: Asset Manager - The Central Coordinator

The Asset Manager maintains a comprehensive ledger of liquidity across all branch chains and coordinates cross-chain operations:

Unified Ledger Management:

- Tracks both allocated and idle liquidity for each VLF Vault

- Maintains real-time visibility into liquidity distribution across all chains

- Ensures synchronization between branch chains and Mitosis Chain

Cross-Chain Coordination:

- Manages cross-chain messaging for deposits, withdrawals, and strategy execution

- Coordinates liquidity allocation and deallocation across multiple networks

- Ensures secure transmission of settlement information

Liquidity Allocation Process:

- Strategist Decision: Analyzes opportunities and determines optimal allocation

- Validation Checks: Asset Manager confirms sufficient idle liquidity and branch chain capacity

- Ledger Updates: Converts idle liquidity to allocated liquidity with specific chain assignment

- Cross-Chain Execution: Transmits allocation information to target branch chain for strategy deployment

Stage 5: Settlement System - Transparent Performance Tracking

The settlement system ensures accurate tracking and distribution of returns through three distinct mechanisms:

Yield Settlement: When VLF strategies generate profits in the same asset type, new Hub Assets are minted to increase VLF asset value proportionally.

Loss Settlement: If strategies experience losses, Hub Assets are burned from the VLF Vault to decrease VLF asset value, ensuring accurate reflection of performance.

Extra Rewards Settlement: When strategies generate rewards in different tokens (like governance tokens from protocols), these are converted to Hub Assets and distributed fairly among participants.

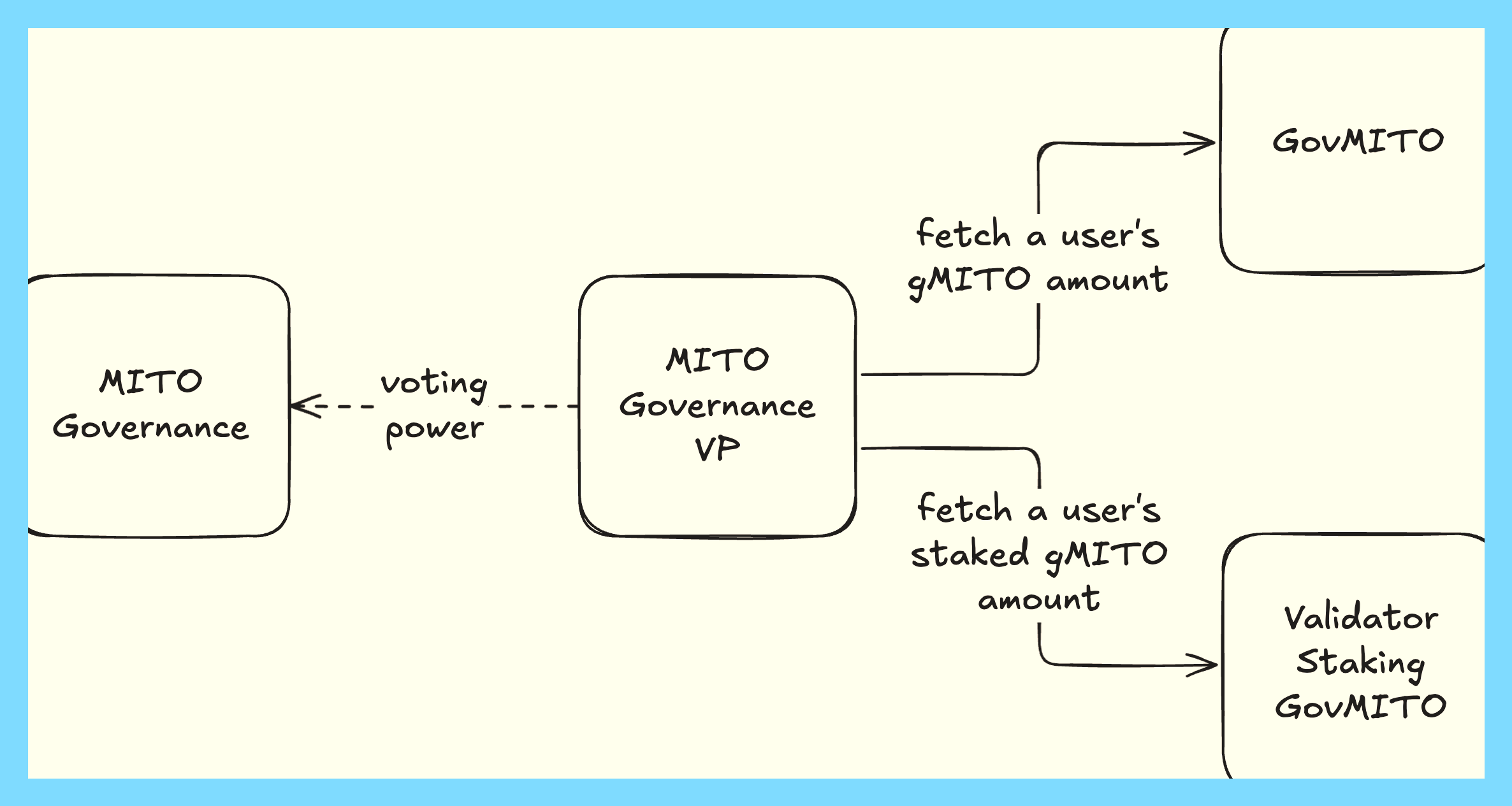

Stage 6: Governance - Democratic Control

The entire system operates under democratic governance using gMITO tokens:

Governance Scope:

- Vote on new strategies and protocol integrations

- Decide resource allocation and risk parameters

- Approve or reject proposed changes to the system

- Control parameters across Mitosis Chain, branch chains, and consensus layer

Multi-Layer Control: Governance decisions can affect:

- Smart contracts on Mitosis Chain

- Contracts on branch chains via cross-chain messaging

- Consensus layer modules through specialized governance mechanisms

Advanced Features and Capabilities

Liquidity Allocation Flexibility

Dynamic Reallocation: The Strategist can dynamically reallocate liquidity between different strategies and chains based on changing market conditions and opportunities.

Risk Management: The system implements sophisticated risk management through:

- Minimum waiting periods for withdrawals

- Leverage limits on validator voting power

- Cryptographic verification of all strategy executions

- Governance oversight of all major decisions

Cross-Chain Composability

Unified Asset Representation: Hub Assets provide a unified representation of assets across multiple chains, enabling seamless cross-chain strategies.

Branch Chain Integration: The hub-and-spoke architecture allows integration with diverse DeFi ecosystems while maintaining security and coordination.

Scalable Architecture: New branch chains can be added to expand the ecosystem's reach and opportunity set.

Financial Engineering Capabilities

Programmable Building Blocks: VLF tokens serve as programmable components for sophisticated financial engineering:

- Yield Stripping: Separate yield and principal components for different risk profiles

- Structured Products: Create complex financial instruments through token composition

- Derivatives: Enable the creation of various derivatives based on VLF token performance

- Collateral Optimization: Use VLF tokens as collateral while maintaining yield generation

Economic Incentives and Alignment

Collective Bargaining Power

By aggregating individual deposits, Mitosis provides all participants access to preferential yields previously reserved for large-scale providers. This democratization of access is reinforced through:

Transparent Price Discovery: Standardized frameworks ensure everyone can accurately value their positions and understand market terms.

Economies of Scale: Pooled liquidity can access opportunities that would be unavailable to individual users.

Reduced Barriers: Lower minimum requirements and simplified access to complex strategies.

Stakeholder Alignment

Validator Incentives: Validators earn rewards for honest operation while risking their own collateral, aligning their interests with network security.

User Protection: Stakers face no slashing risk, encouraging broader network participation while maintaining security through validator collateral.

Governance Participation: gMITO token holders have direct influence over capital allocation decisions, ensuring democratic control over the system.

Technical Infrastructure

Security Architecture

Multi-Layer Security: The system implements security at multiple levels:

- Cryptographic verification of all strategy executions

- Time-delayed withdrawals to prevent flash attacks

- Governance oversight of strategy approvals

- Collateral-backed validator security

Cross-Chain Security: Secure cross-chain messaging ensures coordination between branch chains and Mitosis Chain without compromising security.

Scalability and Performance

Modular Design: The separation of execution and consensus layers enables high performance while maintaining security.

EVM Compatibility: Complete EVM compatibility allows developers to deploy existing Ethereum dApps instantly or create new ones using familiar tooling.

Efficient Settlement: The settlement system efficiently handles yield, loss, and extra reward distribution across multiple chains.

Real-World Applications and Use Cases

For Individual Users

- Yield Optimization: Automatically access the best yield opportunities across multiple chains without manual management.

- Capital Efficiency: Use the same capital for multiple purposes simultaneously through programmable VLF tokens.

- Risk Management: Benefit from professional strategy management while maintaining control over asset allocation.

For Protocols

- Liquidity Access: Tap into deep, stable liquidity from the Mitosis ecosystem.

- User Acquisition: Offer exclusive terms to attract Mitosis users to their protocols.

- Long-term Partnerships: Build sustainable relationships with the Mitosis community through Matrix campaigns.

For Developers

- Building Blocks: Use VLF tokens as programmable components for new financial applications.

- Infrastructure: Leverage Mitosis's cross-chain infrastructure for multi-chain applications.

- Innovation: Create novel financial products that weren't previously possible in traditional DeFi.

The Future of Programmable Liquidity

Mitosis establishes a new paradigm for DeFi liquidity where positions are not just stores of value but programmable components in a sophisticated financial system. This transformation enables:

- Enhanced Capital Efficiency: The same capital can serve multiple purposes simultaneously, maximizing returns while maintaining liquidity.

- Democratized Access: All users gain access to institutional-grade opportunities and strategies.

- Financial Innovation: Programmable liquidity enables entirely new categories of financial products and strategies.

- Sustainable Growth: The system's governance and incentive structures promote long-term sustainability and continuous improvement.

Conclusion

Programmable liquidity in Mitosis represents a fundamental evolution in how we think about and use capital in decentralized finance. By transforming static, frozen assets into flowing, programmable components, Mitosis creates infrastructure for a more efficient, equitable, and innovative DeFi ecosystem.

The water analogy perfectly captures this transformation: where traditional DeFi creates ice—frozen and inflexible—Mitosis creates flowing water that can be channeled, redirected, and optimized for maximum utility. Through the coordinated efforts of the Strategist, Asset Manager, settlement system, and governance, users' assets become active participants in a dynamic, yield-generating ecosystem while maintaining security, transparency, and user control.

This programmable approach to liquidity doesn't just solve current DeFi inefficiencies; it creates the foundation for entirely new possibilities in financial engineering and capital optimization. As the ecosystem grows and evolves, programmable liquidity will enable innovations we can only begin to imagine today.

For more detailed information, check out:

- Mitosis Documentation 👉 https://docs.mitosis.org/learn/introduction/what-is-mitosis

- Mitosis Twitter 👉 https://x.com/MitosisOrg

- Official Website 👉 https://mitosis.org/

Follow the author on Twitter 👉 https://x.com/mEden2452

Comments ()