How Regional Factors Affect Bitcoin Price Dynamics: A Look Ahead

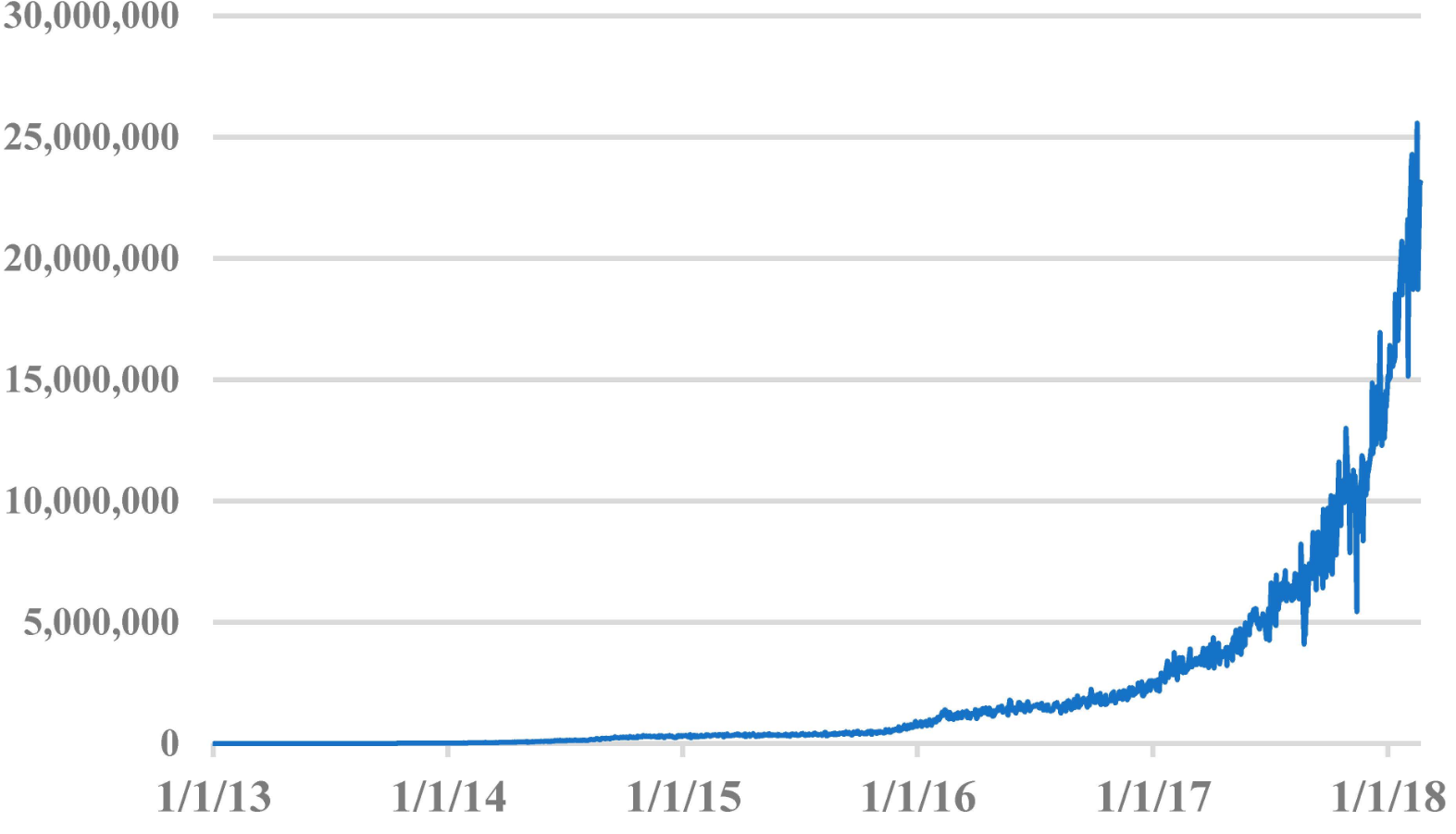

Bitcoin is the largest and most well-known cryptocurrency, whose value is determined by many factors. Often, people talk about global trends - institutional investor demand, regulatory decisions, or the general mood in the cryptocurrency market. However, regional dynamics also play an important role, which can affect the price of Bitcoin differently depending on the geographical and economic context.

Regional characteristics of supply and demand

In different regions of the world, interest in Bitcoin is formed under the influence of economic, political, and social conditions. For example, in countries with an unstable currency or high inflation risks, residents can use Bitcoin more actively as a means of saving value. This creates increased local demand, which affects regional exchanges and can form local price premiums.

At the same time, in regions with a developed financial infrastructure and wide availability of traditional investment instruments, interest in cryptocurrencies can be more speculative, which is reflected in high volatility and sharp price fluctuations.

Regulatory Impact on Regional Markets

Cryptocurrency laws and policies vary by country and region. Strict restrictions or bans on cryptocurrency transactions can dramatically reduce activity in a particular jurisdiction, holding back local demand. On the contrary, favorable regulation stimulates the influx of new investors, the growth of the number of trading platforms, and an increase in transaction volumes.

In addition, announcements of regulatory changes often lead to local price hikes, which can then spread to the global market. For example, the decision of a major state to legalize bitcoin as a means of payment causes a noticeable increase in interest in other regions.

Local economic events and geopolitics

Economic crises, currency shortages, and sanctions force the population to look for alternative ways to save capital. In such situations, bitcoin often acts as “digital gold” - a safe asset outside the traditional banking system. This leads to an increase in demand and, accordingly, can contribute to price growth in local markets.

Geopolitical events — conflicts, trade wars, sanctions — also influence regional dynamics. Growing interest in Bitcoin in unstable areas is often a reaction to restrictions on capital flows and currency risks.

Regional Factors Affecting Bitcoin Price Dynamics

|

Factor |

Description |

Impact on Bitcoin Price |

Examples/Notes |

|

Economic

Stability |

Level

of inflation, currency volatility, economic crises |

High

inflation or currency instability increases demand for Bitcoin as a store of

value |

Venezuela,

Zimbabwe, Argentina — high Bitcoin adoption during crises |

|

Regulatory

Environment |

Laws

and regulations regarding cryptocurrency trading, ownership, and taxation |

Favorable

regulations boost demand and liquidity; restrictive policies suppress

activity |

El

Salvador legalizing BTC vs. China banning crypto trading |

|

Political

Climate |

Political

stability, sanctions, geopolitical tensions |

Instability

and sanctions often increase Bitcoin usage as a safe haven |

Sanctions

on Iran and Russia leading to increased crypto adoption |

|

Financial

Infrastructure |

Availability

of banking services, payment gateways, and crypto exchanges |

Poor

traditional banking services increase crypto demand; advanced infrastructure

promotes trading volume |

Africa’s

mobile money integration vs. US advanced crypto markets |

|

Access

to Exchanges |

Number

and reliability of local and global crypto exchanges |

Greater

access improves liquidity and price discovery |

US and

Europe have numerous exchanges; limited access in some regions |

|

Technology

Adoption |

Internet

penetration, smartphone usage, digital literacy |

Higher

adoption rates lead to increased participation |

Southeast

Asia growing crypto user base due to mobile penetration |

|

Cultural

Attitudes |

Public

perception and trust in cryptocurrencies |

Positive

attitudes boost adoption; skepticism limits demand |

Japan’s

positive outlook vs. some European countries’ cautious stance |

|

Local

Economic Events |

Currency

devaluations, capital controls, inflation spikes |

Drive

spikes in Bitcoin purchases and price premiums locally |

Turkish

lira crisis boosting BTC interest in Turkey |

Impact of infrastructure and access to cryptocurrencies

The technical and financial infrastructure of a region — the availability of Internet services, crypto exchanges, exchangers — directly affects user activity and trading levels. For example, in countries with limited access to global exchanges, local exchange platforms with their own pricing features are developing more actively.

The presence of local Bitcoin ATMs, mobile applications and educational programs contributes to wider population involvement and an increase in transaction volumes, which is reflected in regional price trends.

Regional Bitcoin Price Dynamics — Key Examples and Impacts

|

Region |

Key Drivers |

Bitcoin Price Impact |

Notable Events |

Market Characteristics |

|

Latin

America |

High

inflation, currency instability, sanctions |

Often

premium prices; increased demand |

Venezuela

hyperinflation; El Salvador Bitcoin legalization |

Emerging

markets, high volatility |

|

North

America |

Institutional

adoption, regulatory clarity |

Price

influenced by institutional flows |

SEC

regulatory decisions, corporate Bitcoin purchases (Tesla, MicroStrategy) |

Large,

liquid, mature markets |

|

Europe |

Regulatory

divergence, retail adoption |

Variable

local premiums; regulatory-driven fluctuations |

EU

discussions on MiCA regulation; increased retail trading |

Developed

markets with mixed regulation |

|

Asia-Pacific |

Rapid

tech adoption, varying regulation |

High

trading volumes; localized price differences |

China

crypto ban; South Korea and Japan crypto hubs |

High

mobile penetration, dynamic markets |

|

Middle

East & Africa |

Currency

crises, limited banking access |

Increased

demand as alternative store of value |

Iran

sanctions, Nigeria capital controls |

Emerging

markets, reliance on mobile payments |

|

Russia

& CIS |

Geopolitical

tensions, capital controls |

Growth

in peer-to-peer trading; local price fluctuations |

Sanctions

and capital flight boosting crypto adoption |

Mostly

OTC and P2P markets |

Prospects and risks

The potential impact of regional dynamics on the Bitcoin price is growing as the cryptocurrency market globalizes and expands its penetration. Analysis of regional features can become an important tool for investors and traders, allowing them to more accurately predict short-term and long-term price changes.

However, high market fragmentation and differences in conditions make price dynamics unpredictable. Risks are associated with abrupt regulatory changes, access restrictions and economic shocks.

Conclusion

Regional Bitcoin price dynamics are an important, but often underestimated factor in the crypto market. Given the influence of local economic, political and technical features, understanding these processes becomes the key to deeper analysis and successful investing.

Comments ()