How Stablecoins Are Displacing Traditional Banks

Introduction

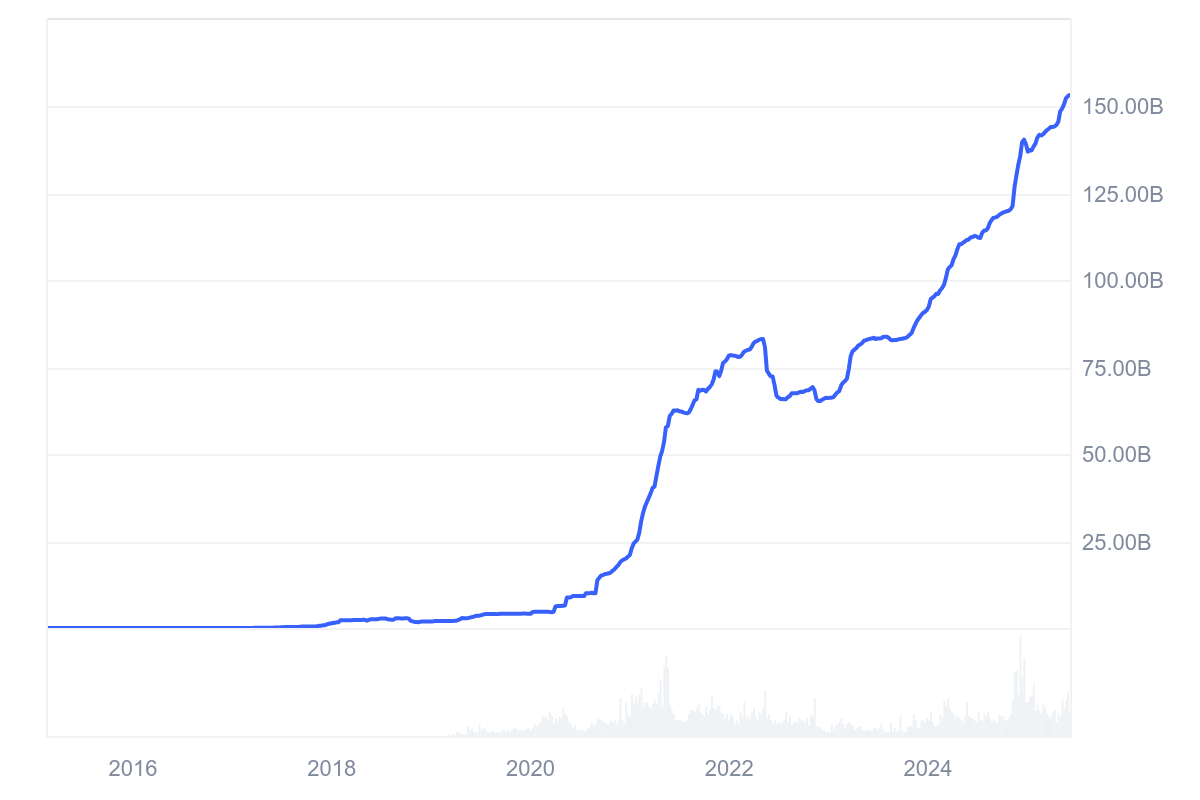

By the summer of 2025, the total market capitalization of stablecoins surpassed $250 billion. This proves that stablecoins are no longer just a niche tool for crypto traders but a full-fledged alternative to traditional banking. Stablecoins are cryptocurrencies whose exchange rate is pegged to the dollar, euro, or another asset. They combine the features of digital money and the stability of fiat currencies, allowing users to transfer funds quickly and cheaply while participating in a new financial ecosystem.

In this article, I’ll explain how stablecoins have evolved, what advantages they offer to modern users and investors, and what new risks and challenges arise with their growing adoption. I’ll touch on their integration into payment systems and DeFi protocols, their potential for generating yield, and why traditional banks are being forced to reckon with their rising importance.

The Evolution of Stablecoins

Stablecoins like Tether (USDT) were originally created primarily for crypto traders. Their purpose was to lock in profits from trading Bitcoin and altcoins and to allow quick blockchain switching in arbitrage operations. They became a kind of "digital dollar" within the crypto market, especially at a time when banks were reluctant to work with crypto exchanges and direct fiat-to-crypto conversions were difficult.

However, by 2024-2025, the situation began to change. According to researchers at Visa and Allium Labs, only $149 million out of $2.2 trillion in stablecoin transactions were “organic” payments (not trading-related).

"This indicates that stablecoins are still in the early stages of their evolution as a payment instrument," said Airwallex regional manager Pranav Sood.

Nevertheless, their benefits have become increasingly evident to a broader range of users:

- Speed and low fees. International payments via stablecoins are much faster and cheaper than standard bank transfers.

- 24/7 availability. Transactions can be conducted at any time, without bank delays or business hours.

- Freedom from restrictions. Stablecoins allow payments even under currency or regulatory constraints in traditional financial systems.

- Financial inclusion. They open access to global payments for the unbanked or those in regions with poor banking infrastructure.

The rise of decentralized finance (DeFi) since 2020 has further boosted stablecoin growth. Tokens like DAI, USDC, and USDT became the “fuel” for DeFi protocols: they’re used for lending, borrowing, liquidity provision, and yield farming. This created steady demand and drove up their capitalization, as DeFi users increasingly sought a stable medium for transactions.

Use Cases and New Financial Products

Over time, stablecoins have moved beyond crypto trading and become part of real-world financial operations.

Analysts note that by 2025, stablecoins are increasingly used for everyday payments: companies like Meta are exploring their integration into their platforms, and more users in the crypto industry rely on USDT and USDC purely for business and personal transactions.

This suggests that major players are starting to view stablecoins not just as trading instruments, but as genuine payment solutions.

At the same time, stablecoins are becoming deeply embedded in the DeFi ecosystem. The growing user base of decentralized apps has led to high demand for stablecoins for lending and investment. In May 2025, total DeFi lending volume surpassed that of decentralized exchanges (DEXs). As DEX liquidity pools become less attractive due to increasing competition and the risk of impermanent loss, simple crypto lending through DeFi protocols is becoming a more stable income source. As a result, stablecoins are used not only for payments but as tools for active financial participation: decentralized lending platforms, algorithmic yield protocols, and other innovations are all built on stablecoins.

Another emerging trend is stablecoins backed by real-world assets. A prime example is tokenized gold. The Tether Gold (XAUt) token represents one troy ounce of physical gold stored in a Swiss vault, with a market cap exceeding $830 million as of July 2025. These tokens offer all the benefits of digital assets:

- Divisibility - a single ounce can be split into small fractions;

- Convenient storage and portability - no need to transport physical gold;

- 24/7 trading on crypto exchanges (CEX) and no custody fees (unlike fiat or bullion storage).

Experts note that the appeal of gold-backed tokens lies in how they "democratize access to this asset class, making it more convenient, liquid, and widely accessible."

Investment Opportunities and Risks

In recent years, stablecoins have become not only a medium for fund transfers but full-fledged investment instruments. Many offer returns higher than traditional bank deposits.

“If, for example, EURT is a simple euro equivalent, then the stablecoin USDY (Ondo US Dollar Yield) features a built-in yield mechanism of over 4% per year.”

Even flexible USDT deposits on centralized crypto exchanges can yield up to 7% annually-compared to less than 1% in traditional banks in developing countries and about 0.4% in the U.S. as of June 2025, though some banks offer up to 5%. This allows investors to use stablecoins as an alternative to low-yield bank deposits or to leverage them as collateral for yield generation in DeFi.

The stablecoin ecosystem also offers flexible tools: decentralized exchanges (DEXs) and lending platforms allow users to earn passive income. However, higher yields always come with higher risks. As analysts rightly point out:

“The yield gap between stablecoins and bank deposits isn’t a free lunch-it’s the cost of risk.” Vulnerabilities may exist in high-risk smart contracts, and developer negligence or malicious intent can lead to losses.

Moreover, the barrier to entry in DeFi is higher: buying and swapping stablecoins requires technical knowledge of blockchain tools, whereas opening a bank deposit is just a few clicks away.

Finally, storage issues should be considered. Unlike bank accounts, where institutions and governments guarantee fund safety, cryptocurrencies require users to manage their own keys. As the crypto saying goes:

“Not your keys - not your coins.”

The term self-custody emphasizes: “you alone are responsible for your assets.” Non-custodial wallets offer full control and privacy but require caution-losing your private key or seed-phrase means losing access to your funds permanently. Thus, stablecoin users must be vigilant: securely store private keys, verify addresses and contracts, and use reputable platforms.

Conclusion

Stablecoins have evolved from a technical novelty for crypto enthusiasts into a vital part of the modern financial system. They offer a new approach to financial management: instant global payments, 24/7 access, investment instruments, and a hedge against inflation. On one hand, they pose serious competition to traditional banks, forcing the latter to adapt their services for the digital age. On the other hand, stablecoins still carry risks-technological, regulatory, and custodial.

- How will traditional banks adapt to compete with stablecoins and DeFi?

- Can regulators ensure stability and user protection amid mass adoption of stablecoins?

The answers to these questions will determine how and how quickly stablecoins will "displace" traditional banks. Regardless of the outcome, one thing is clear: we are witnessing the beginning of a new era in finance, with stable cryptocurrencies playing a central role.

Comments ()