How Stablecoins Power the DeFi Economy

Stablecoins are the coins powering Decentralized Finance. They move billions of dollars daily, enable yield strategies, and act as the bridge between crypto and traditional money.

From USDC to DAI, FRAX, crvUSD, and the new wave of LSD-backed stablecoins, stable assets are the foundation of the DeFi economy.

Why Stablecoins Matter in DeFi

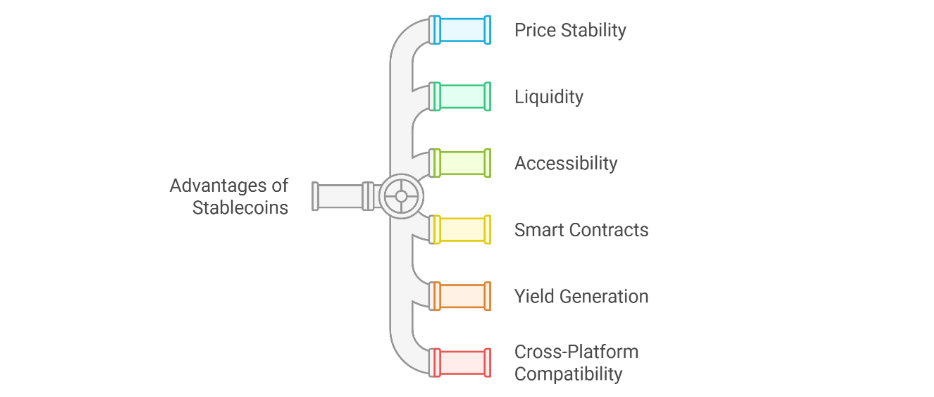

In a market where tokens can swing 20% in a day, stablecoins provide:

- Price stability for trading pairs

- Unit of account for DeFi yields

- Collateral for lending and derivatives

- On-chain settlement without touching banks

They make it possible to:

- Earn yield without price volatility

- Hedge market swings

- Move money between protocols instantly

The Big Players in DeFi Stablecoins

Let’s break down five major stablecoins shaping DeFi:

1. USDC – The Institutional Anchor

- Type: Centralized, fiat-backed

- Issuer: Circle

- Collateral: 1:1 USD reserves held in regulated banks & treasuries

- Strengths:

- High liquidity

- Regulatory compliance

- Widely integrated in DeFi & CeFi

- Weaknesses:

- Can be frozen (blacklist addresses)

- Dependent on US banking system (SVB incident in 2023 showed vulnerability)

USDC is the "digital dollar" of DeFi, trusted by institutions but with centralized risk.

2. DAI – The OG Decentralized Stable

- Type: Overcollateralized crypto-backed

- Issuer: MakerDAO

- Collateral: ETH, USDC, and RWAs (real-world assets)

- Strengths:

- Decentralized governance

- Transparent reserves on-chain

- Resilient through market crashes

- Weaknesses:

- Heavy reliance on USDC for peg stability

- Lower scalability than fiat-backed coins

DAI proved a decentralized stable could survive bear markets, but it’s evolving to integrate more RWAs to stay competitive.

3. FRAX – The Hybrid Innovator

- Type: Fractional-algorithmic

- Issuer: Frax Finance

- Collateral: Mix of USDC, RWAs, and algorithmic mechanisms

- Strengths:

- Capital-efficient peg maintenance

- Native yield generation through FraxLend & FraxETH

- Strong DeFi integrations

- Weaknesses:

- Complexity in collateral mix

- Exposure to USDC risks

FRAX set the trend for partially algorithmic stables, finding a middle ground between decentralization and scalability.

4. crvUSD – The Peg With Leverage Resistance

- Type: Overcollateralized crypto-backed

- Issuer: Curve Finance

- Collateral: Various crypto assets (ETH, wBTC, etc.)

- Unique Feature: PegKeepers + LLAMMA (automated leverage liquidation AMM)

- Strengths:

- Dynamic liquidation curves reduce market shocks

- Deep integration in Curve pools for liquidity

- Weaknesses:

- Still early in adoption

- Complex mechanisms for average users

crvUSD represents a new wave of stables optimized for capital efficiency and liquidation safety.

5. LSD-Backed Stables – Yield-Bearing Dollars

- Examples: eUSD (Lybra Finance), USDe (Ethena), mkUSD (Prisma Finance)

- Type: Overcollateralized with liquid staking tokens (LSTs) like stETH

- Strengths:

- Collateral generates staking yield (can be shared with users)

- Decentralized collateral base

- Weaknesses:

- Price risk from stETH/ETH depeg

- Smart contract complexity

LSD-backed stables are double-yield assets that is when you hold a stablecoin, but its backing earns yield in ETH staking protocols.

📊 Side-by-Side Comparison

| Stablecoin | Collateral Type | Decentralization | Yield Potential | Regulatory Risk |

|---|---|---|---|---|

| USDC | USD & Treasuries | Low | No | High |

| DAI | Crypto & RWAs | Medium | Low-Med | Medium |

| FRAX | Hybrid | Medium | Med-High | Medium |

| crvUSD | Crypto | High | Medium | Low-Med |

| LSD Stables | stETH, LSTs | Medium-High | High | Low-Med |

Risks to Watch

Even the most trusted stables carry risks:

- Centralization & freezes (USDC)

- Collateral depeg (DAI, LSD stables)

- Algorithmic failure (historical example: TerraUSD)

- Regulatory clampdowns on issuers or protocols

The Future of Stablecoins in DeFi

We’re entering a multi-stablecoin world:

- Fiat-backed stables dominate onboarding & institutional use

- Crypto-backed stables win in decentralized ecosystems

- LSD-backed stables create yield-native stable assets

- New players experiment with cross-chain & programmable stables

Stablecoins are becoming the base layer of DeFi liquidity, governance, and yield.

Final Takeaway

Every strategy, loan, and yield farm relies on stable coins. The next phase will not be about which stablecoin wins, but how they coexist, interconnect, and integrate into a truly global decentralized economy.

Comments ()