How to Boost Your $MITO Allocation: A Complete Guide to Providing Liquidity with $MORSE on Ethereum

Getting well-positioned for a strong $MITO allocation isn’t just about holding tokens — it’s about taking action. In this guide, we’re diving into one of the first and most impactful ways to contribute to Mitosis: providing liquidity to the $MORSE/$ETH pair on Ethereum.

Whether you’re a seasoned DeFi user or just starting your journey with Mitosis, this step-by-step breakdown will help you maximize your contribution and understand the strategies behind smart liquidity provision.

Let's get started.

What You’ll Need Before Adding Liquidity

Breaking down the basic setup: minimum token amount, gas considerations, and important warnings.

- You’ll need $ETH and $MORSE tokens. I think you’ll need at least around $300, since this is happening on mainnet.

- Even if gas is cheap right now, keep in mind that the market could heat up again — and we could easily see 40 gwei per transaction or more. You’ll need gas not just to open the LP, but also to claim fees, reposition your LP, etc.

⚠️ Be careful when handling $MORSE so you don’t accidentally burn your Morse NFT. (Leave a comment if you’re unsure.)

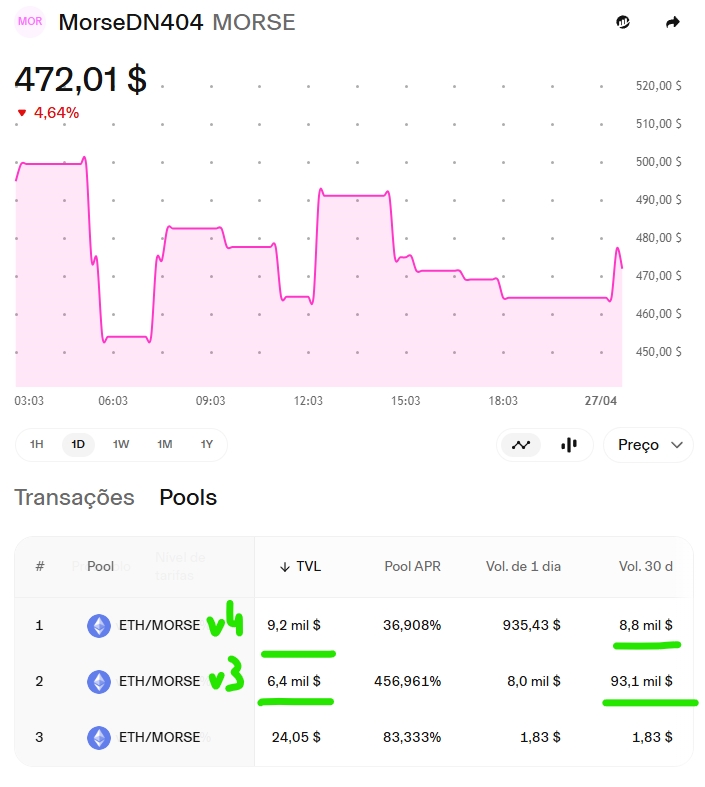

Analyzing the $MORSE Price Charts

The way I manage my LPs, the first step before adding liquidity is analyzing the chart and checking a few important points: support levels, resistance levels, and trendlines (either up or down).

Right now, there are two main pools on Uniswap. For this initial analysis, I’ll use the older pool to get a broader view of the chart.

$MORSE price in dollars

What we can see:

- The token just broke a long-term downtrend that had been respected since Jan/25.

- ATH was $1,250 in Dec/24.

- ATL was $92 in Nov/24.

$MORSE priced against $ETH — this is the actual pool where we’ll add liquidity.

Key points:

- Against $ETH, $MORSE tends to stay trapped in long sideways ranges — which is amazing for LPs.

- ATH was 0.372 (Dec/24).

- ATL was 0.0299 (Nov/24).

Sideways channel ranges:

- Orange: ~0.0329 to ~0.143

- Blue: ~0.143 to ~0.281

- Green: ~0.281 to ~0.372 (maybe)

Defining Your Liquidity Strategy

After marking these key points on the chart, the next step is using your own judgment.

Are you bullish on $MORSE?

Think it already pumped a lot after the announcement and might now go sideways? Worried it might reject at the resistance of the blue channel?

Either way, in my view, it’s from the combination of chart analysis, fundamentals, and hype around the project that you should decide where to position your liquidity.

Here’s my take: I’m bullish.

The team has been killing it — DAO creation for the collection, $MITO token allocation — lots of great moves bringing back attention to $MORSE.

So I’m gonna position my liquidity between the blue and green channels (~0.14 to ~0.375). I know there's strong support around 0.14, and even with good news, it's possible that $MORSE won’t gain more against $ETH since it’s hitting a resistance zone.

That said, nothing stops $MORSE from shooting up against $USDC to ~$600–$800 — or even reclaiming its ATHs across both charts. Anything can happen in crypto.

Also: even though Uniswap v4 upgraded its UI (similar to Ambient Finance with price charts), I still like using good old TradingView for charting.

And I access pools directly via Gecko Terminal: https://www.geckoterminal.com/pt/eth/pools/0xdd3905b883ce1d037cbbbb588c0b51d20426db68

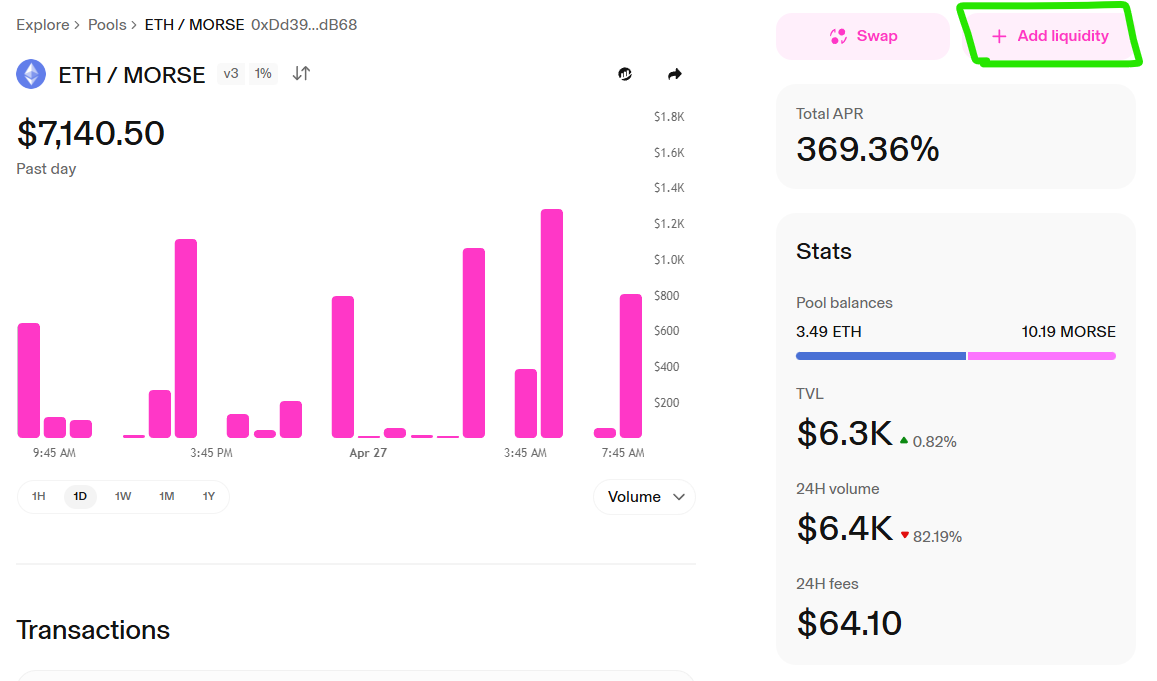

Current Liquidity Pools Analysis (v3 vs v4)

Now that we know where we want to position our liquidity, let’s look at the available pools.

Liquidity Pools (Uniswap data):

- $MORSE / $ETH | Uni v4 | 1% | TVL $9,200 | 30d Vol $8,800

- $MORSE / $ETH | Uni v3 | 1% | TVL $6,400 | 30d Vol $93,100

We can see that v3 is still performing much better right now — over 10x more volume with less TVL to split the fees.

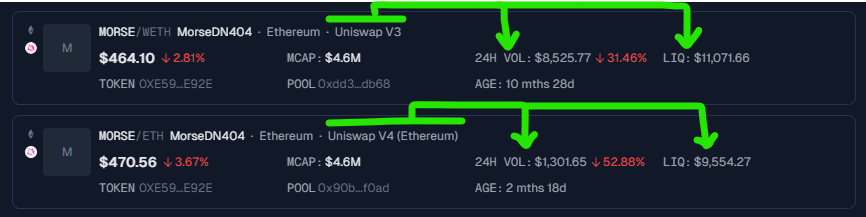

But heads up: these numbers might have some delay. On Gecko Terminal, TVL and volumes are higher — makes sense after the $MORSE believers announcement.

Liquidity Pools (GeckoTerminal data):

- $MORSE / $ETH | Uni v4 | 1% | TVL $9,554 | 1d Vol $1,301

- $MORSE / $ETH | Uni v3 | 1% | TVL $11,071 | 1d Vol $8,525

Despite the numbers, long-term I believe v4 will dominate.

For now, I’ll start with v3 and keep monitoring for a future move to v4.

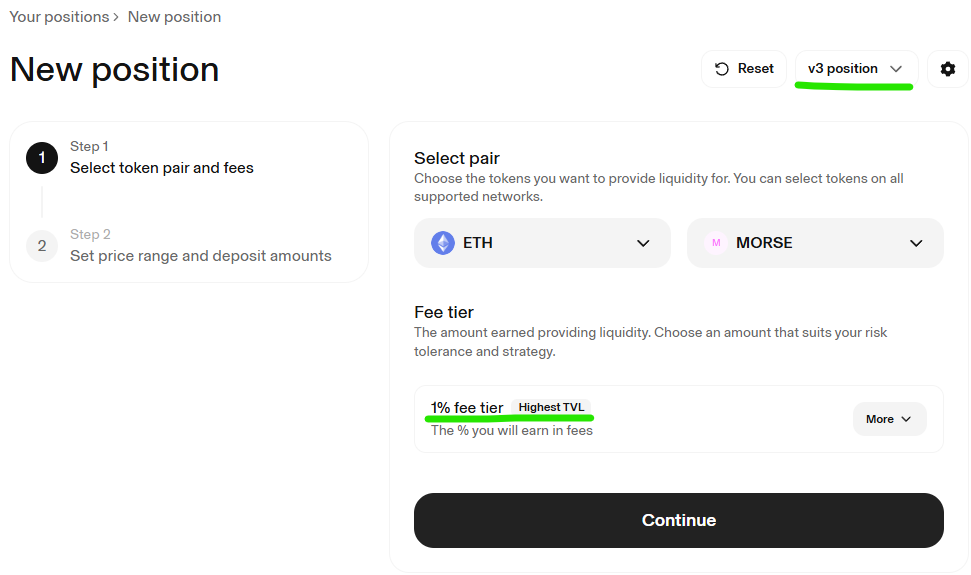

Simulating Token Amounts for Your Liquidity Position

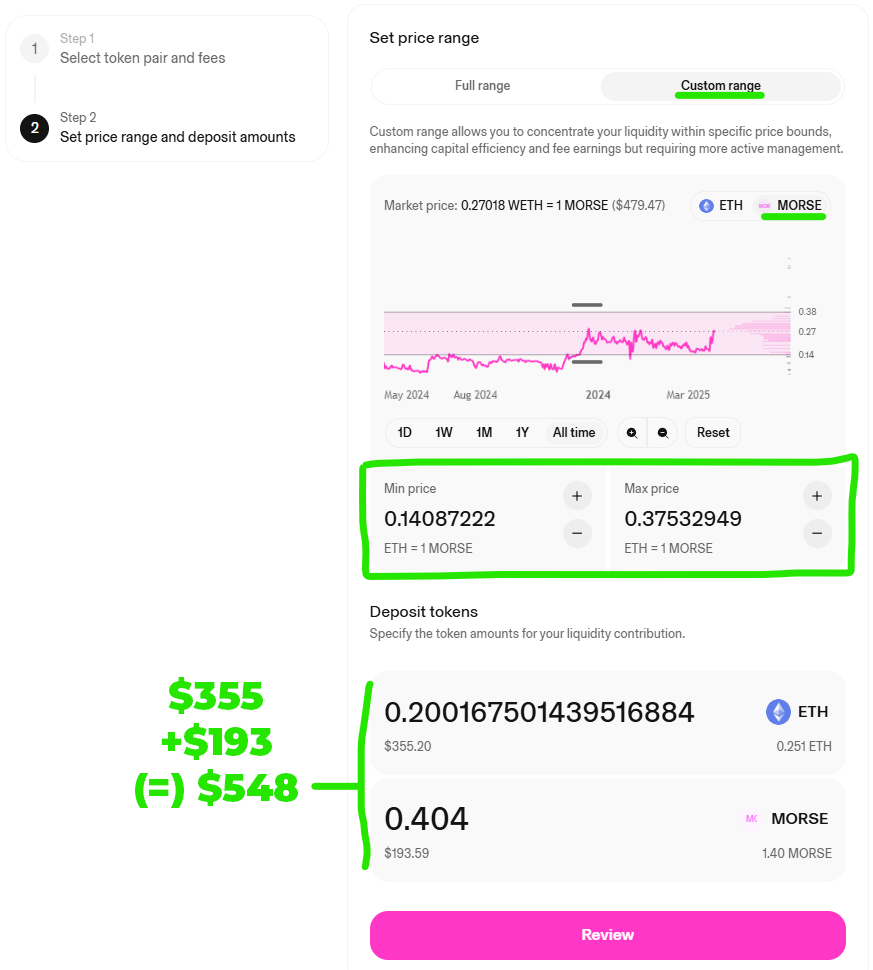

With the liquidity pool selected, let’s simulate the token amounts.

This is a step-by-step guide to setting the LP range and calculating how much $MORSE and $ETH you need to allocate.

Steps:

- Hit "Add Liquidity."

- Make sure you're on Uni v3, 1% fee tier.

- Select "Custom Range" and set it based on $MORSE prices.

- Pick your LP range.

- Simulate the token amounts you’ll need.

Here’s my example:

I’m adding ~$550 worth of $ETH and $MORSE.

After setting everything, the sim shows I’ll need around 0.2 $ETH and 0.404 $MORSE — totaling ~$548, super close to what I prepped.

Perfect. Now I’ll just do a swap to match these quantities exactly.

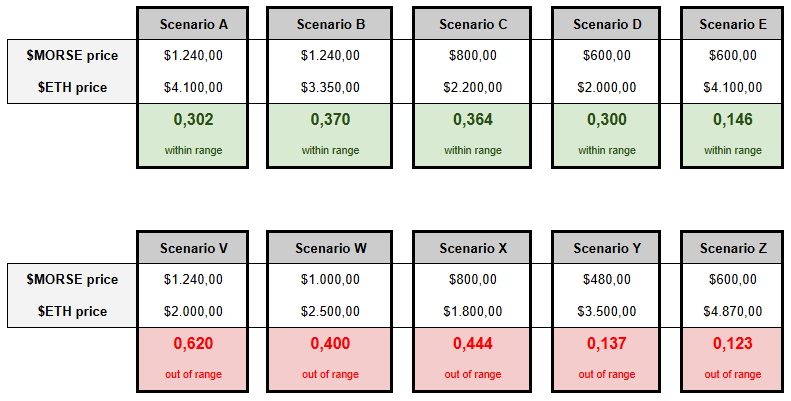

Projecting Different Price Scenarios

Simulating bullish and bearish market scenarios to understand how your LP would behave under different outcomes.

Time for scenario projections:

Scenario A: ATH

- $MORSE returns to $1,240

- $ETH hits $4,100

- Price = 0.302 (inside our LP range)

Scenario E: $ETH ATH

- $MORSE stalls at ~$600

- $ETH hits $4,100

- Price = 0.146 (still inside)

Scenario V: $MORSE ATH

- $MORSE pumps to $1,240

- $ETH stuck at ~$2,000

- Price = 0.62 (out of range)

Scenario Z: $ETH ATH

- $MORSE stuck at ~$600

- $ETH hits $4,870

- Price = 0.123 (out of range)

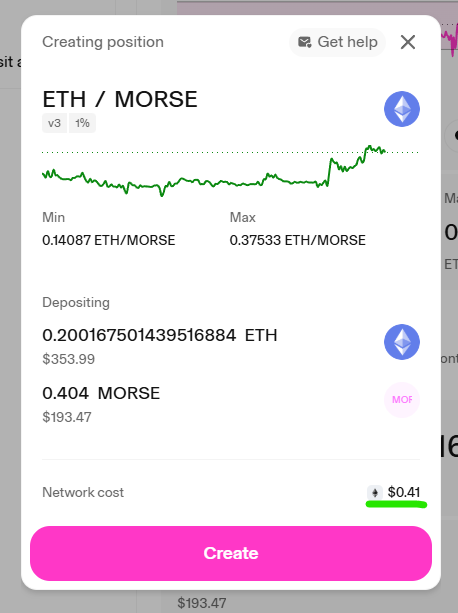

Confirming and Opening Your Liquidity Position

Reviewing all steps, double-checking settings, and confirming the transaction while gas is still cheap.

Now just confirm everything. Double-check your preview before submitting:

- Correct amounts

- Correct range

- Correct pool

Gas fees are still super cheap (~$0.41). Take advantage of this window!

Important notes:

- If $MORSE pumps and breaks above 0.375, your LP will convert 100% to $ETH and move out of range (no more fees, exposed to impermanent loss).

- If $MORSE dumps below 0.138, your LP will become 100% $MORSE and also move out of range.

Manage expectations accordingly!

Understanding the Risk of Impermanent Loss

Explaining how price divergence causes impermanent loss, and why good planning can help minimize it.

When you LP, you’re exposed to price divergence:

- You deposit $ETH and $MORSE.

- If one pumps/dumps against the other, your pool balance shifts.

- Your final combined value is less than if you had just HODLed.

Why “impermanent”?

- As long as you don’t withdraw, the loss might shrink or disappear if prices revert.

- Plus, LP fees help offset the loss.

That’s why picking smart ranges based on strong support/resistance helps minimize the damage. But remember: impermanent loss is part of the game — especially with concentrated liquidity pools.

Final Thoughts

What did you think?

Ready to add more liquidity to the pool and increase your Mitosis interactions?

Got something to add? Drop it in the comments.

I'll soon post more interactions I think are important — whether you’re a hardcore contributor or just getting started with Mitosis, I’m sure you’ll find something useful here.

Follow along and let’s ride this journey together! 🚀

Did you enjoy this content?

If it helped you in any way, I’d really appreciate your support!

Feel free to connect with me on Twitter/X, and if you’d like to send a Praise, my Discord is open too. 🙏

Thanks in advance for your trust and support — it means a lot! 🙌

Follow me on Twitter/X: febarce |DeFi

My Dircord: febarce |DeFi

Check out my other articles

Comments ()