Innovation Is Not a Business Model: What Blockchain Needs to Succeed

Abstract

Blockchain technology has captivated the tech world with its promise of decentralization, security, and innovation. However, the question remains: Is superior technology alone sufficient to ensure economic profitability in the volatile blockchain and cryptocurrency industry? This article explores the multifaceted factors influencing financial success, including tokenomics, product-market fit, user adoption, regulatory compliance, and sustainable business models. By examining protocol-level developments, the Web3 creator economy, emerging decentralized applications (DApps), and real-world case studies, we highlight that while "good tech" is essential, it must be paired with strategic execution to achieve lasting economic value.

Introduction: Technology vs. Profit in Blockchain

Many believe that advanced technology is the main driver of success in blockchain. But in reality, turning innovation into profit is more complex. Often, blockchain tech evolves faster than users, markets, or regulations can keep up, creating a gap between its potential and actual value.

In May 2022, Terra/Luna, a blockchain heralded for its innovative stablecoin algorithm, crashed spectacularly, wiping out $40 billion in value and shaking investor confidence. This collapse ask a critical question: Is "good technology"—defined as advanced blockchain protocols, scalable Layer 2 solutions, and secure smart contracts—enough to guarantee economic success in the blockchain industry? (Tech in Asia). From Asia’s crypto trading boom to Europe’s regulatory push, blockchain’s economic challenges are universal, often outpacing market understanding, user adoption, and regulatory frameworks, creating a gap between technological potential and realized value (Wing Venture Capital).

Success in blockchain requires more than just good technology. Key factors include:

- Tokenomics: How a token’s design and incentives work.

- Product-Market Fit: Solving real user problems.

- Community Engagement: Strong, active communities and good governance.

- Go-to-Market Strategy: Clear plans to attract users.

- Timing and Narrative: Launching at the right time with a strong story.

- Regulatory Compliance: Meeting legal standards.

- Business Model: Long-term revenue beyond token sales.

The industry is moving away from hype toward real-world use, strong product-market fit, and sustainable business models. Many early projects failed because they focused only on tech, ignoring adoption and sustainability. Now, with "crypto winters" weeding out weak projects, investors are prioritizing solid strategies and proven value (CV VC).Venture capital now emphasizes go-to-market strategies and real-world solutions. This article examines whether technology alone drives profit, exploring protocols, creator economies, DApps, and case studies, while considering whether rare cases like Bitcoin’s tech-driven success challenge this view.

This article explores whether technology alone can lead to profit by looking at blockchain layers, creator tools, ecosystem trends, and real-world examples.

The Protocol Layer: Building Economic Value

Development Models: From Foundations to New Structures

a16z suggested in one of their major publications that blockchain protocol development should evolve from non-profit foundations to organizational models, sparking a debate about how to align innovation with economic sustainability. (a16z crypto).

The Foundation Era: Idealism Meets Reality

Early projects like Ethereum adopted non-profit foundations to promote decentralization, neutrality, and ecosystem growth while navigating regulatory ambiguity. The Ethereum Foundation (EF) exemplifies this model, supporting Ethereum’s development despite challenges. Foundations offered credible neutrality, long-term focus, and regulatory flexibility, aligning with the U.S. Securities and Exchange Commission’s early decentralization tests (a16z Crypto).

Critiques of the Foundation Model

Venture capital firm Andreessen Horowitz (a16z) argues that foundations can hinder progress due to:

- Incentive Misalignment: Lack of profit motives may disconnect spending from outcomes.

- Operational Inefficiencies: Separating development, business, and marketing slows innovation.

- Legal Constraints: Restrictions on commercial activities limit network benefits.

- Centralized Control: Foundations may become gatekeepers, contradicting decentralization (a16z Crypto).

Ethereum Foundation’s Restructuring (June 2025)

In June 2025, the EF announced a major restructuring, rebranding its R&D division as "Protocol" and laying off staff to focus on scaling Ethereum’s Layer 1 (L1), expanding Layer 2 (L2) blobspace, and improving user experience (UX) (Crypto Rank). New co-executive directors Hsiao-Wei Wang and Tomasz Stanczak were appointed, allowing co-founder Vitalik Buterin to focus on visionary research (DL News). The community had mixed reactions, with some praising increased agility and others criticizing layoffs and potential centralization. Core developer Péter Szilágyi’s departure, citing the removal of "decentralized" from Ethereum’s roadmap, underscored tensions.

Alternative Models

To address foundation shortcomings, new structures are emerging:

- For-Profit Companies: Better capital deployment, talent retention, and market responsiveness.

- Public Benefit Corporations (PBCs): Balancing profit with public good (a16z Crypto).

- Network Revenue Sharing & Milestone-Vesting: Tying compensation to network success (a16z Crypto).

- Decentralized Unincorporated Nonprofit Associations (DUNAs) & BORG Tooling: Legal legitimacy for DAOs with transparent on-chain governance (a16z Crypto).

This shift suggests that protocol profitability depends on commercial acumen and strategic execution, not just technological elegance.

Ethereum’s Scaling Strategy: L1 vs. L2 and Economic Impact

Ethereum’s scaling strategy illustrates the challenge of translating technology into economic value, compared to competitors like Solana (Grayscale).

Fat Protocol vs. Fat App Thesis

The "Fat Protocol" thesis posits that L1 protocols like Ethereum capture most value due to token activity and shared security. However, the "Fat App" thesis argues that L2s and applications are increasingly capturing user activity and value, potentially commoditizing L1s. Ethereum’s rollup-centric roadmap aligns with the Fat App thesis, optimizing L1 for settlement and data availability while L2s handle execution (Crypto APIs).

Ethereum’s Technical Roadmap

Ethereum’s 2025 upgrades aim to enhance scalability and UX:

- Pectra Upgrade (May 2025):

- Fusaka Upgrade (Late 2025/Early 2026):

- PeerDAS: Increases blob capacity, lowering L2 fees.

- Verkle Trees: Enhances state efficiency for stateless clients.

- EVM Object Format (EOF): Simplifies contract deployment and reduces gas costs.

- Glamsterdam Upgrade: Focuses on UX and L1/L2 interoperability.

- Vitalik’s Vision: Targets single-slot finality, statelessness, privacy, and 10x L1 capacity (Vitalik.eth.limo).

Native and Based Rollups

"Ultrasound Rollups" integrate L2s tightly with L1:

- Based Rollups: Use L1 validators for sequencing, enhancing decentralization (Antier Solutions).

- Native Rollups: Leverage L1 for execution verification, inheriting full security (Cointelegraph).

- Benefits: Increased L1 revenue, security, and composability (Cointelegraph).

- Challenges: L1 complexity and consensus requirements (Bankless).

Major L2s like Optimism and Arbitrum support these designs, recognizing long-term ecosystem benefits.

Tokenomics and Revenue

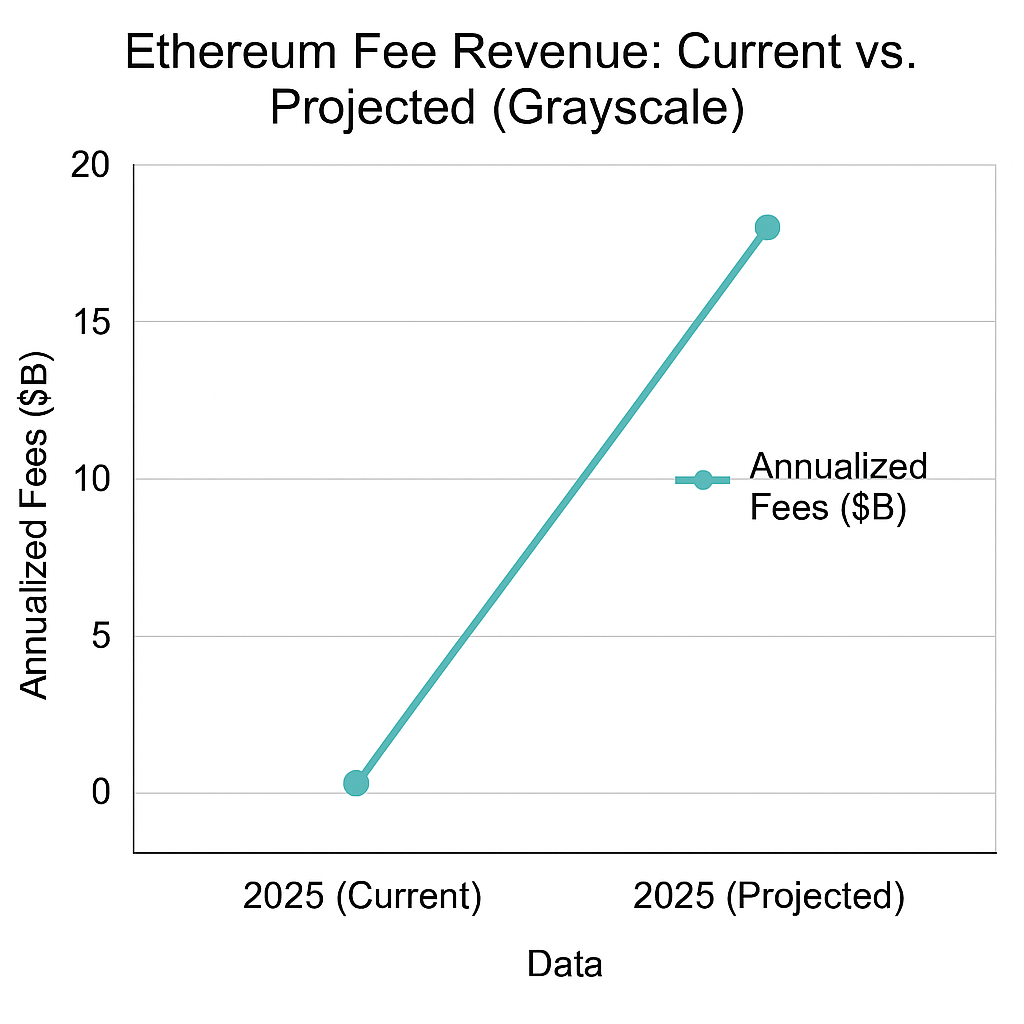

Ethereum’s revenue comes from transaction fees, with base fees burned (EIP-1559) and priority fees paid to validators. In 2025:

- L1 processes 35-40 million transactions monthly, with L2s handling 400 million (Grayscale).

- L1 secures $46 billion in Total Value Locked (Grayscale).

- Annualized fees were $1.7 billion, with recent 30-day fees at $46.3 million (Token Terminal).

The "L2 Conundrum" risks reducing L1 fees as L2s optimize. Native rollups aim to align L2 activity with L1 value (The Defiant). Grayscale projects $20 billion annual fees if Ethereum succeeds (Grayscale).

Table 1: Ethereum’s 2025+ Upgrades and Their Economic Implications

| Upgrade Name | Key Technical Features | Primary Goals | Impact on L1 Value Accrual | Impact on L2 Economics |

|---|---|---|---|---|

| Pectra (Deployed May 2025) | - EIP-7251: Validator cap raised to 2048 ETH - EIP-7702: Account abstraction for smart wallets & gas sponsorship - EIP-7691: More blobs (data availability) - Misc. EVM and tooling improvements | - Simpler wallet UX - Boost validator efficiency - Lower L2 costs via more blob space | - More ETH burned (higher L2 volume) - Encourages large-stake validators → more secure L1 | - Lower L2 fees due to more blobs - Better UX (gasless txs, batched actions) - Stronger adoption potential |

| Fusaka (Expected Late 2025 / Early 2026) | - PeerDAS: Massive blob scaling (48–72 blobs) - Verkle Trees: Stateless clients - EOF: Cleaner, cheaper, safer contracts | - Scale L2 throughput - Enable lightweight full nodes - Improve dev experience | - More L2 activity → higher base fees - Lower node cost → greater decentralization & security | - Near-zero L2 data fees - Enables microtransactions, high-frequency DeFi - New L2 use cases |

| Native / Based Rollups (Proposed / Experimental) | - Based rollups: L1 handles sequencing - Native rollups: L1 verifies L2 transitions - Fully integrated L2 security | - Tighten L1-L2 alignment - Boost L2 security & decentralization - Enable unified composability | - L1 earns directly from L2 (seq. + exec. fees) - Counteracts “L2 Conundrum” - Strengthens ETH’s role | - Fairer MEV distribution - Greater trust & composability - Easier rollup deployment |

| Vitalik’s Vision: Overall L1 UX & Scaling | - Single-slot finality: ~12s finality - Verkle Trees: Stateless nodes - ZK Privacy + Stealth: Enhanced privacy - Gas limit increase: 10x L1 capacity | - Faster confirmation times - Privacy for users - Scale to support L2s - Preserve decentralization | - Higher tx volume from privacy, speed - ETH more useful for tx and store of value - Greater institutional confidence |

Ethereum’s Fee Revenue Growth Potential

The Web3 Creator Economy

Opportunities: Empowering Creators

Web3’s creator economy, valued at approximately $2 billion in 2025 and projected to grow 20% annually, offers tools for monetization and ownership, surpassing Web2 (NASSCOM Community; no direct market size source, inferred from trends).

NFTs for Art, Music, and Beyond

Non-Fungible Tokens (NFTs) enable ownership and royalties, bypassing intermediaries. Examples:

- Kings of Leon’s NFT album: $2 million (Lup.lub.lu.se).

- Grimes’ "WarNymph": $5.8 million (Lup.lub.lu.se).

- Shawn Mendes’ wearables: $600,000 (Lup.lub.lu.se).

- 3LAU’s "Ultraviolet": $11.6 million (Lup.lub.lu.se).

- Stoner Cats: $8 million, with governance (FinPR Agency).

NFTs expand to real-world assets and Play-to-Earn games.

Decentralized Publishing Platforms

Mirror.xyz and Nuance offer crypto payments and NFT sales, enhancing IP control. Cory Doctorow sold a story for 24 ETH ($63,000), and Mirror raised 134 ETH ($351,400) (Graeme). Nuance uses "reverse gas fee" models (HackerNoon). Lens Protocol enables social content monetization via NFTs (TDeFi Blogs).

Social Tokens & DAOs

Social tokens like Aluna’s $FEVER grant exclusive access (OSL). DAOs, like Holly Herndon’s for fan content, enable community funding (Media Evolution). Gitcoin Grants and MolochDAO fund public goods (Frontiers).

Collaboration Economy

Web3 fosters co-creation, blurring creator-consumer lines (E27).

Ethical Considerations

NFTs faced environmental criticism, mitigated by Ethereum’s proof-of-stake shift. Equitable access for creators in developing regions remains challenging (Freename).

Challenges: Barriers to Profitability

Web3’s $174,000 average creator payout masks disparities, with top earners dominating (NASSCOM Community).

Unfulfilled Promises

"NFT 1.0" lacked utility and clear ownership, disappointing buyers. Royalty cuts in 2022 demotivated artists, and metaverse underdelivery hurt NFTs.

Persistent Challenges

- Technological Complexity: Wallet setup and fees deter users.

- Market Volatility: Hype-driven values cause instability.

- Creator Burnout: Constant engagement exhausts creators.

- Economic Disparity: Top creators capture most revenue.

Legal and Regulatory Risks

- IP Rights: NFT ownership doesn’t grant copyright, sparking disputes.

- Consumer Protection: Hacks and deceptive marketing pose risks.

- Market Manipulation: Wash trading (93% of Meebits volume) distorts markets (ResearchGate).

- DAO Governance: Low participation concentrates power.

Insight: Holistic Success Factors

Profitability requires user-centric design, sustainable tokenomics, clear legal frameworks, and effective governance.

Ecosystem Trends and Adoption Challenges

Emerging DApp Categories in 2025

DApps diversify beyond DeFi and NFTs, with only 5% of internet users engaging, highlighting adoption gaps (Forbes; Freename).

DeFi 2.0

Focuses on sustainable yield farming and decentralized credit (Debut Infotech).

GameFi

Evolves with sustainable tokenomics and DePIN integration (ChainCatcher).

Decentralized Social (DeSoc)

Farcaster and Lens Protocol emphasize data ownership (TDeFi Blogs).

DePIN

Decentralizes infrastructure like Helium and Filecoin, projected at $32 billion by 2025 (MapMetrics). DePIN could power DeSoc, enhancing ecosystems (HackerNoon).

AI Integration

AI enhances DeFi trading, content creation, and market research (The Cryptonomist).

NFTs Beyond Art

Tokenized real estate and supply chain tracking.

Decentralized Identity & Privacy

DIDs and zero-knowledge proofs support secure identity.

Future Outlook

By 2030, DePIN may dominate infrastructure, and DeSoc could challenge Web2 if UX improves (Forbes).

Adoption Hurdles

- Scalability: L1 congestion impacts UX.

- User Experience: Complex interfaces deter adoption.

- Regulatory Ambiguity: Evolving laws challenge compliance .

- Market Education: Limited understanding hinders adoption.

Insight: Practical Utility is Key

DApps must solve real-world problems with superior UX to achieve profitability.

Case Studies: Successes and Failures

Success Stories

- Music NFTs: Kings of Leon ($2M) and 3LAU ($11.6M) leveraged fanbases (Lup.lub.lu.se).

- Stoner Cats: Raised $8M with celebrity-backed governance (FinPR Agency).

- Mirror.xyz: Enabled Cory Doctorow’s $63,000 NFT sale (Mirror.xyz).

- Foundation.app & Zora.co: Curated and decentralized NFT platforms.

- Bitcoin’s Tech-Driven Success: Bitcoin’s secure protocol drove adoption with minimal marketing, a counterargument to the tech-insufficiency thesis, though its simplicity limits broader application.

Failures and Challenges

- Voyage Finance: Failed due to flawed economic assumptions (Tech in Asia).

- NFT Hype Cycle: Lacked utility, disappointing buyers (Fuelarts).

- Nike RTFKT Lawsuit: Faces $5M lawsuit for unfulfilled promises (Fuelarts).

- Tory Lanez NFT Album: Sold $1M but lacked secondary market value (Lup.lub.lu.se).

- EOS Protocol: Failed due to centralized governance despite scalable tech.

Lessons Learned

- Product-Market Fit: Conduct iterative MVP testing (Wing Venture Capital).

- Sustainable Tokenomics: Design for long-term value (Tech in Asia).

- Clear IP Rights: Use licenses like Creative Commons (PatentPC).

- Community Engagement: Foster loyalty (FinPR Agency).

- Adaptability: Pivot during market shifts (Tech in Asia).

Conclusion:

Blockchain’s technological foundation—scalable protocols, secure smart contracts, and decentralized architectures—is essential but insufficient for profitability. The collapse of Terra/Luna and the uneven outcomes of NFT projects underscore that tech alone cannot guarantee economic success. While Bitcoin’s rise is often cited as a counterexample, its trajectory remains an exception shaped by timing, simplicity, and narrative alignment rather than replicable strategic planning.

For the vast majority of blockchain ventures, lasting profitability hinges on aligning technology with economic realities. This means prioritizing product-market fit, designing sustainable and incentive-aligned tokenomics, simplifying user experience, ensuring legal clarity, and building resilient communities. The most successful projects today invest as much in go-to-market execution, regulatory strategy, and UX design as they do in technical innovation.

The future of blockchain profitability lies not in chasing the next protocol breakthrough, but in delivering practical utility at scale. Projects that combine technological excellence with strategic, user-focused execution will define the next wave of blockchain adoption—and reshape industries far beyond crypto.

References

- a16z Crypto, https://a16zcrypto.com/posts/article/end-foundation-era-crypto/

- Antier Solutions, https://www.antiersolutions.com/blogs/based-rollups-explained-how-they-work-and-why-they-matter/

- Bankless, https://www.bankless.com/read/native-rollups-based

- Bybit Learn, https://learn.bybit.com/crypto/ethereum-fusaka-upgrade/

- Cointribune, https://www.cointribune.com/en/the-ethereum-foundation-lays-off-and-renames-its-core-team/

- Coinspeaker, https://www.coinspeaker.com/guides/next-1000x-crypto/

- Cointelegraph, https://cointelegraph.com/magazine/dummies-guide-to-native-rollups-l2s-as-secure-as-ethereum-itself/

- Crypto APIs, https://cryptoapis.io/blog/309-ethereum-foundations-2025-pivot-what-it-means-for-scalability-and-user-experience

- CryptoRank, https://cryptorank.io/news/feed/9d7e0-ethereum-foundation-announces-layoffs-and-restructuring-to-boost-scalability-and-user-experience

- CV VC, https://www.cvvc.com/blogs/where-vcs-are-investing-in-2025-blockchain-vs-ai-funding-trends

- Debut Infotech, https://www.debutinfotech.com/blog/best-defi-platforms

- DL News, https://www.dlnews.com/articles/defi/ethereum-foundation-restructures-protocol-research-team/

- E27, https://e27.co/how-web3-will-transform-the-creator-economy-into-the-collaboration-economy-by-2025-20250102/

- FinPR Agency, https://finpr.agency/tpost/562s93a8b1-web3-storytelling-101-narrative-is-king

- Forbes, https://www.forbes.com/councils/forbesbusinesscouncil/2025/01/15/five-web3-trends-to-watch-in-2025-ai-depins-rwas-and-beyond/

- Freename, https://freename.io/web3-adoption-technical-challenges-solutions/

- Frontiers, https://www.frontiersin.org/journals/blockchain/articles/10.3389/fbloc.2025.1538227/epub

- Grayscale,https://research.grayscale.com/reports/ethereum-the-og-smart-contract-blockchain1

- HackerNoon, https://hackernoon.com/web3-is-disrupting-the-publishing-industry

- Lup.lub.lu.se, https://lup.lub.lu.se/student-papers/record/9179003/file/9179004.pdf

- Milk Road, https://milkroad.com/daily/the-end-of-blockchain-dominance-%F0%9F%AA%A6/

- Mirror.xyz, https://mirror.xyz/latomatomo.eth/6LSB8tTrhJsz3CFxbzJa3Q6O5Fil-kSVpCkL4ZNIIZM

- NASSCOM Community, https://community.nasscom.in/communities/blockchain/rethinking-creator-economy-age-web3

- SoluLab, https://www.solulab.com/9-best-nft-ideas-and-examples/

- TDeFi Blogs, https://tde.fi/founder-resource/blogs/advisory/how-web3-is-redefining-content-creation/

- Tech in Asia, https://www.techinasia.com/shut-web3-startup-6-months-part-1

- The Cryptonomist, https://en.cryptonomist.ch/2025/06/03/top-ai-crypto-coins-set-to-dominate-the-market-in-2025/

- The Defiant, https://thedefiant.io/news/infrastructure/ethereum-based-rollups-l2-scaling

- Token Terminal, https://tokenterminal.com/explorer/projects/ethereum

- Vitalik.eth.limo, https://vitalik.eth.limo/general/2024/10/17/futures2.html

- Wing Venture Capital, https://www.wing.vc/docs/product/product-market-fit/stories-of-pmf-failure-and-lessons-learned

Similar Articles

The Ethics of Immutability: "Code is Law" and Its Consequences

🔒 Smart Contracts: Redefining Trust Through Code

From Anarchy to Autonomy: Reimagining Society Through Blockchain and Web3

Navigating GDPR and Public Blockchain: Challenges and Solutions

Privacy vs. Transparency: Balancing Blockchain’s Open Ledgers with Personal Rights

Tokenization of Real World Assets (RWA): How Blockchain Is Opening the Doors to Traditional Finance

The Tokenization of Everything: A New Paradigm for Value, Ownership, and Access

Blockchain as a Catalyst for Societal Change: Utopian Visions vs. Dystopian Realities

Comments ()