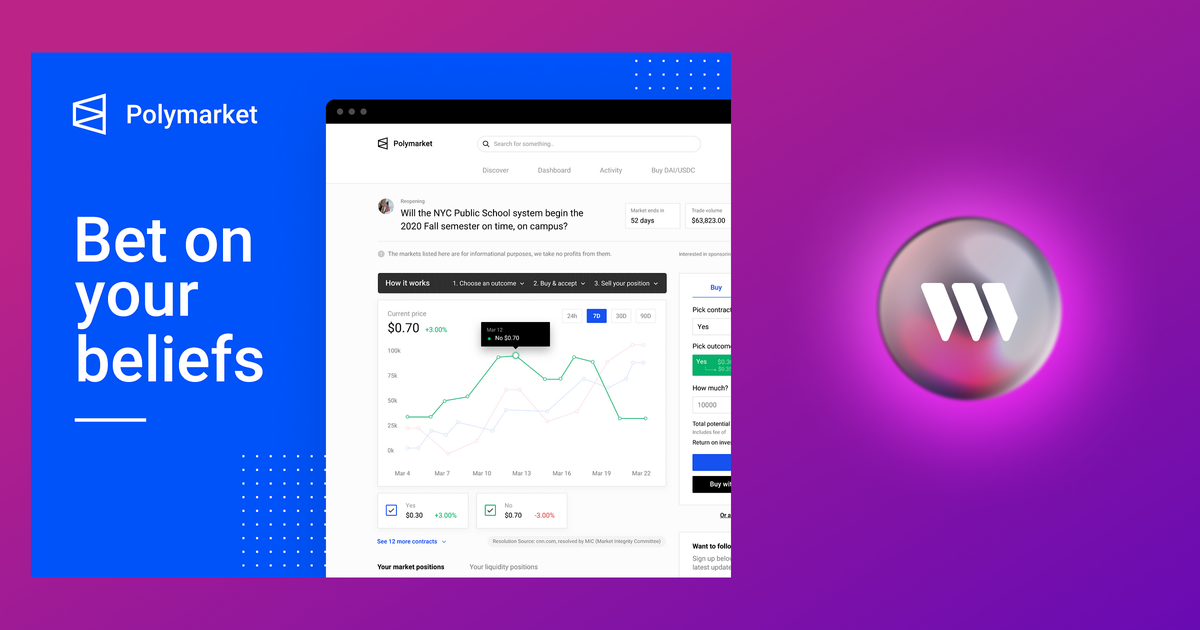

Inside Polymarket: The Future of Forecasting with Crypto

Introduction

In a world full of uncertainty—elections, economic swings, cultural shifts—people have always searched for ways to predict what’s coming. From ancient oracles to modern pollsters, the tools have changed, but the desire for foresight remains. Enter Polymarket: a decentralized prediction platform built on blockchain, harnessing the power of crypto and collective intelligence to forecast real-world events. Since launching in 2020, Polymarket has become a leader in Web3 prediction markets, offering a transparent, user-driven alternative to traditional forecasting. This article explores how Polymarket works, its impact, the challenges it faces, and its potential to reshape how we understand the future.

What Is Polymarket?

Polymarket is a crypto-based prediction market platform headquartered in Manhattan and built on Polygon, an Ethereum layer-2 solution. Founded by Shayne Coplan, the platform lets users speculate on outcomes of real-world events—everything from U.S. elections and sports to crypto prices and celebrity news—using USDC, a stablecoin pegged to the U.S. dollar.

Unlike traditional betting platforms, Polymarket is non-custodial and decentralized: it doesn’t hold users' funds, and all trades are powered by smart contracts, ensuring transparency, automation, and security.

Key Features:

- Decentralized Infrastructure: Built on Polygon, Polymarket leverages smart contracts to automate trades and record-keeping without a central authority.

- Binary Outcome Markets: Markets typically ask yes-or-no questions, resolved by decentralized oracles like UMA.

- Outcome Shares: Users buy shares priced between $0.01 and $1.00. If correct, each share pays $1.00; if wrong, it’s worthless.

- No KYC: Users don’t need identity verification, allowing global participation while preserving privacy.

- Liquidity Incentives: A rewards program encourages users to provide liquidity by placing limit orders, ensuring tighter spreads and better market depth.

By late 2024, Polymarket had reached over 90,000 monthly active users, with $473 million in trading volume in August alone—a 60x increase from the previous year. Its 2024 U.S. election markets even caught the attention of mainstream platforms like Bloomberg Terminal.

How Polymarket Works

Polymarket blends blockchain, economics, and the wisdom of the crowd. Here's how a typical prediction unfolds:

- Market Creation: Users or the platform create a question (e.g., “Will Kamala Harris win the 2024 U.S. presidential election?”) with verifiable outcomes—typically "Yes" or "No".

- Trading Shares: Users connect a crypto wallet (like MetaMask or Backpack), deposit USDC, and buy outcome shares. If “Yes” shares cost $0.60, the market implies a 60% chance.

- Price Movement: Prices shift as traders react to news, debates, or data. It’s a live, real-time measure of public sentiment.

- Resolution: After the event, oracles like UMA confirm the outcome based on public sources. Winning shares are redeemed at $1.00. Losers get nothing. Disputes go through on-chain resolution.

- Fees: Polymarket charges a 2% fee on net winnings. There are no deposit or withdrawal fees.

This structure incentivizes accurate predictions. Unlike polls, Polymarket’s users have money on the line—creating what economists call “skin in the game.”

The Economic Theory Behind It

Polymarket is rooted in economic theories of information aggregation. Nobel laureate Friedrich Hayek argued that markets are powerful information processors, with prices serving as signals. Robert Shiller extended this idea to financial markets, showing they can reveal and hedge against collective expectations.

Polymarket turns forecasts into financial positions. If you’re right, you profit; if you’re wrong, you lose. This filtering mechanism often produces forecasts that outperform polls. Research by Alex McCullough found that Polymarket was 90% accurate a month out, and 94% accurate hours before resolution—though biases like herd mentality and thin liquidity still exist.

Polymarket’s Impact on Forecasting

1. Real-Time Sentiment

Unlike polls, which lag behind events, Polymarket updates instantly. After the June 27, 2024, presidential debate, for example, the odds of Biden withdrawing surged from 20% to 70%—weeks before he officially exited the race.

2. High Accuracy

Polymarket consistently outperformed traditional forecasting during the 2024 election cycle. Its accurate odds surrounding Biden’s departure earned it credibility, with mainstream media and analysts referencing its data.

3. Growing Legitimacy

With over $3.3 billion wagered on the 2024 election and endorsements from figures like Nate Silver and Elon Musk, Polymarket has expanded beyond crypto circles. Its integration with Bloomberg Terminal signals mainstream adoption.

4. Wide-Ranging Markets

Beyond politics, Polymarket hosts markets on everything from crypto prices and economic indicators to sports and pop culture. Its $54 million market on Gavin Newsom’s presidential chances correctly predicted his non-entry—a major forecasting win.

Challenges and Controversies

Despite its rise, Polymarket faces serious hurdles:

1. Regulatory Pressure

In 2022, the CFTC fined Polymarket $1.4 million, forcing it to block U.S. users and move offshore. Its unregistered status blurs the line between forecasting and gambling, especially during political events.

2. Manipulation Concerns

In October 2024, a French trader ("Fredi9999") reportedly wagered $30 million on Trump, sparking accusations of wash trading. Though Polymarket found no wrongdoing, it exposed risks in low-liquidity markets where single traders can sway odds.

3. Community Bias

The user base—mostly crypto-native, male, and politically libertarian—may skew market sentiment, especially in political markets.

4. Liquidity Gaps

Markets with low participation can be volatile and unreliable. Polymarket’s liquidity rewards help, but scaling liquidity across niche markets remains tough.

5. Historical Limitations

Prediction markets failed to foresee events like Brexit and Trump’s 2016 win. Even with real-time pricing, biases and overconfidence can limit accuracy—especially when participants rely too heavily on market odds as truth.

The Role of Crypto

Polymarket thrives on crypto’s infrastructure:

- Stablecoins (USDC): Keep value stable while enabling global, fast transactions.

- Smart Contracts: Automate trades, enforce rules, and reduce middlemen.

- Decentralized Oracles (UMA): Provide transparent, tamper-proof resolution of outcomes.

- Global Access: No centralized gatekeeping; anyone with a wallet can participate.

It’s a model aligned with Web3’s ideals: trustless, open, and permissionless.

What’s Next for Polymarket?

1. Diversifying Markets

Polymarket plans to expand beyond politics and sports to cover science, weather, corporate performance, and more—broadening appeal and utility.

2. Regulatory Strategy

Appointing ex-CFTC Commissioner J. Christopher Giancarlo to its advisory board shows Polymarket wants to engage, not avoid, regulation. Clearer U.S. crypto laws could re-open the American market.

3. Monetizing Data

Polymarket’s trading data offers rich insights into public expectations—valuable to journalists, hedge funds, and policymakers alike.

4. DeFi Integration

There’s potential for advanced features like hedging, insurance, or leverage through DeFi protocols—though Polymarket remains cautious to preserve simplicity.

5. AI-Driven Forecasting

Polymarket is building tools for AI agents to trade prediction markets, enabling more sophisticated forecasting models through open-source collaboration.

6. Rising Competition

Platforms like Azuro, Hedgehog, and Drift’s BET are emerging. BET even beat Polymarket in daily volume on August 29, 2024, leveraging Solana’s low fees. To stay ahead, Polymarket must diversify and retain users post-election.

A Critical Look

Despite its strengths, Polymarket’s unregulated, offshore model raises ethical concerns. Large, anonymous trades can distort markets, especially during sensitive events like elections. Its conservative-leaning user base may also skew predictions. And while UMA's oracles are decentralized, no system is immune to error.

Still, defenders argue Polymarket is just a transparent reflection of public sentiment—where money motivates accuracy. Its success in forecasting Biden’s withdrawal shows it can complement, not replace, traditional tools.

Conclusion

Polymarket is redefining how we forecast the future—blending blockchain transparency, crypto infrastructure, and market-based incentives into a real-time prediction engine. With $776 million wagered by September 2025 and near- 94% accuracy in short-term forecasts, it’s proven its worth.

References

Comments ()