Institutional Capital Floods In: Q2 2025 Crypto Venture Funding Highs & S&P DJI’s Tokenized Index Venture

Introduction

The second quarter of 2025 delivered a jolt of optimism to the crypto world. Investors poured over $10 billion into blockchain startups, marking the strongest VC quarter since early 2022. At the same time, S&P Dow Jones Indices (S&P DJI) teamed up with Centrifuge to bring the iconic S&P 500 on‑chain—opening a direct bridge between traditional finance and decentralized protocols.

Taken together, these developments signal a shift from niche experimentation toward institutional embrace. In this 1,000‑word deep dive, we’ll unpack:

- Q2 2025 funding surge: What drove the $10 billion inflow and which sectors led the charge

- The S&P 500 on‑chain: How S&P DJI’s tokenized index venture works—and why it matters

- Mainstream implications: What this wave of capital and product innovation means for Web3’s next growth phase

Whether you’re a DeFi builder, an institutional allocator, or simply curious about where crypto goes next, this guide will clarify why smart money—and the world’s most trusted benchmark—are now staking their futures on blockchain.

Q2 2025 Funding Surge: Back in the Winner’s Circle

After months of tepid investment, Q2 2025 saw crypto venture capital rebound spectacularly. According to CryptoRank data, companies raised $10.03 billion from April through June—the highest quarterly total since Q1 2022—and June alone pulled in $5.14 billion Cointelegraph.

Driving Forces Behind the Inflow

- Bitcoin-centric strategies: With spot Bitcoin ETFs finally live and regulatory clarity improving, several funds raised large rounds specifically to build sophisticated Bitcoin investment vehicles.

- Real‑World Asset (RWA) tokenization: Startups like Securitize (which captured a $400 million round) highlight growing interest in bringing bonds, real estate, and commodities on‑chain BeInCrypto.

- AI and infrastructure: As AI and blockchain increasingly intersect, protocols offering on-chain compute, data oracles, and modular rollups attracted significant backing.

Sector Highlights

- Layer‑1 and modular chains: Projects advancing data availability and modular architecture (e.g., Celestia, Avail) secured substantial pre‑ and post‑TGE funding.

- DeFi primitives: Automated market makers, lending aggregators, and yield‑optimizers saw renewed interest—especially those demonstrating real yield and protocol revenue.

- Institutional‑grade tooling: Custody solutions, compliance frameworks, and auditing platforms raised multi‑million dollar rounds to service enterprise clients re‑entering crypto.

This influx reflects two trends: a return of risk appetite among VCs and the recognition that long‑term infrastructure and institutionally compliant products underpin sustainable growth.

S&P 500 On‑Chain: Bridging TradFi & DeFi

On July 1, 2025, S&P DJI announced a collaboration with Centrifuge to bring the venerable S&P 500 Index on‑chain. Through a licensing deal, Centrifuge will mint tokens representing direct exposure to the index, governed and traded via smart contracts—and backed by official S&P DJI data News Release Archive.

How the Tokenized Index Works

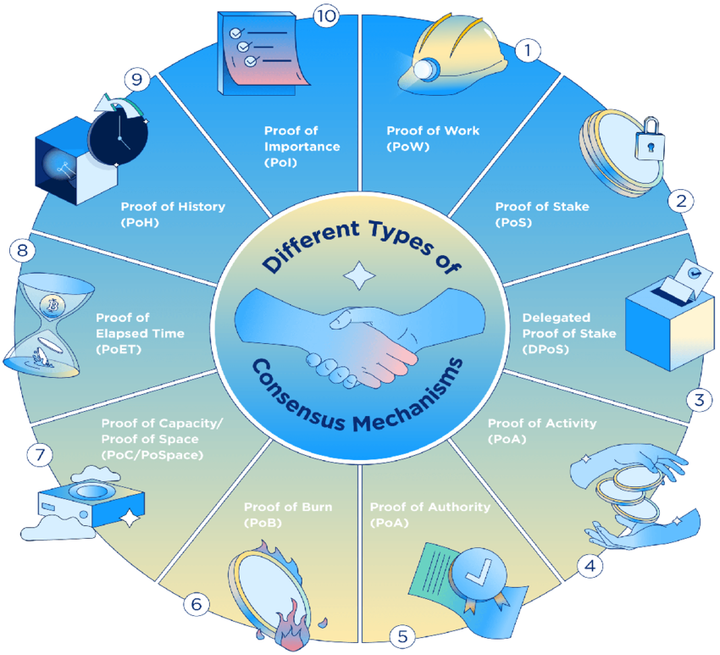

- Proof‑of‑Index Infrastructure

Centrifuge’s platform fetches daily index files from S&P DJI, generating an on‑chain “proof” that each token accurately mirrors the index composition. - Asset Manager Integration

Web3‑native Anemoy Capital—and sub‑advised by Janus Henderson—will manage the first tokenized S&P 500 fund, ensuring institutional‑grade oversight and regulatory alignment S&P Global. - Programmable Exposure

Token holders gain 24/7, permissionless access to S&P 500 performance. They can trade, stake, or even use these tokens as collateral in DeFi protocols, all in a transparent, immutable ledger. - Future Embedding

Beyond the initial fund launch, S&P DJI plans to license its indices to other DeFi protocols—opening possibilities for tokenized bond indices, sector baskets, or real‑time algorithmic strategies.

This initiative isn’t just a novelty: it represents the first time one of Wall Street’s most trusted benchmarks is directly programmable on blockchain—a milestone likely to reshape how institutional portfolios are structured and accessed.

Mainstream Implications: Adoption on the Horizon

1. Lowering the On‑Ramp for Institutions

Tokenized indices remove many traditional frictions—custody, settlement windows, broker relationships—by packaging index exposure into a simple token. Institutional allocators can now integrate the S&P 500 into on‑chain strategies, automated trading desks, and composable DeFi products without rewriting their playbooks.

2. Deepening Liquidity & Market Efficiency

With billions flowing into infrastructure and core protocols, liquidity across DEXs and tokenized assets should deepen. Tokenized blue‑chip indices reduce slippage for large trades and anchor a new on‑chain price reference—potentially smoothing volatility in related markets like tokenized ETFs and synthetic derivatives.

3. Catalyzing Regulatory Clarity

As major index providers and licensed asset managers launch on‑chain products, regulators face mounting pressure to formalize digital‑asset rules. Clear frameworks around tokenized securities, KYC/AML standards, and cross‑border custody are likely to emerge—benefiting the entire ecosystem.

4. Accelerating Product Innovation

The marriage of venture dollars and tokenized benchmarks lays a foundation for novel offerings:

- On‑chain retirement and pension vehicles that auto‑rebalance against the S&P 500

- Programmable structured products—like options and leveraged index tokens—built directly on smart contracts

- Tokenized dividend streams and real‑time yield distribution mechanisms

For DeFi builders, the S&P DJI venture validates the plausibility of embedding traditional finance products natively on blockchain.

Challenges & Considerations

While these trends point to growth, hurdles remain:

- Custodial Risk: Ensuring the underlying asset exposures and proof‑of‑index mechanisms are airtight is crucial. Any data feed manipulation could undermine token integrity.

- On‑Chain Governance: As institutions hold major stakes in tokenized indices, protocols must balance robust governance with decentralization—avoiding undue concentration of voting power.

- Regulatory Divergence: Different jurisdictions may treat tokenized securities unevenly, potentially creating fragmentation or limiting cross‑border flows.

- Technology Complexity: Interfacing legacy index data with decentralized networks requires sophisticated middleware—any lapse in interoperability could disrupt price feeds or settlement processes.

Addressing these concerns through thorough audits, transparent oracles, and clear legal frameworks will be key to scaling tokenized index products beyond early adopters.

Conclusion

Q2 2025’s $10 billion + venture capital surge and the S&P 500 on‑chain collaboration mark a turning point: crypto is no longer an insider’s game—it’s courting the mainstream. As capital floods into infrastructure, regulatory clarity improves, and traditional benchmarks become programmable tokens, we stand on the cusp of a new era:

- Institutions gain low‑friction on‑chain exposure to iconic indices.

- Retail investors access blue‑chip performance through familiar DeFi portals.

- Builders unlock fresh innovation, weaving tokenized benchmarks into retirement plans, structured products, and automated portfolio managers.

The convergence of deep-pocketed VC interest and tokenized index ventures suggests that real‑world finance is entering Web3 with more conviction than ever. If past cycles hold, today’s experiments will become tomorrow’s standards—setting the stage for blockchain to underlie not just digital‑native assets, but the broad spectrum of global finance.

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()