Institutional DeFi & Cross-Chain Ecosystems: The Next Phase of Web3

Introduction

Decentralized finance (DeFi) has grown from a niche experiment in 2020 into a multi-billion-dollar ecosystem. In 2025, DeFi is poised to enter its institutional phase. Enterprises, banks, and financial institutions are beginning to adopt blockchain-based finance, while new cross-chain technologies are making it possible to move assets and data seamlessly across multiple blockchains.

This convergence is setting the stage for DeFi 2.0: an era where traditional finance (TradFi) and decentralized finance meet on a global, interoperable network.

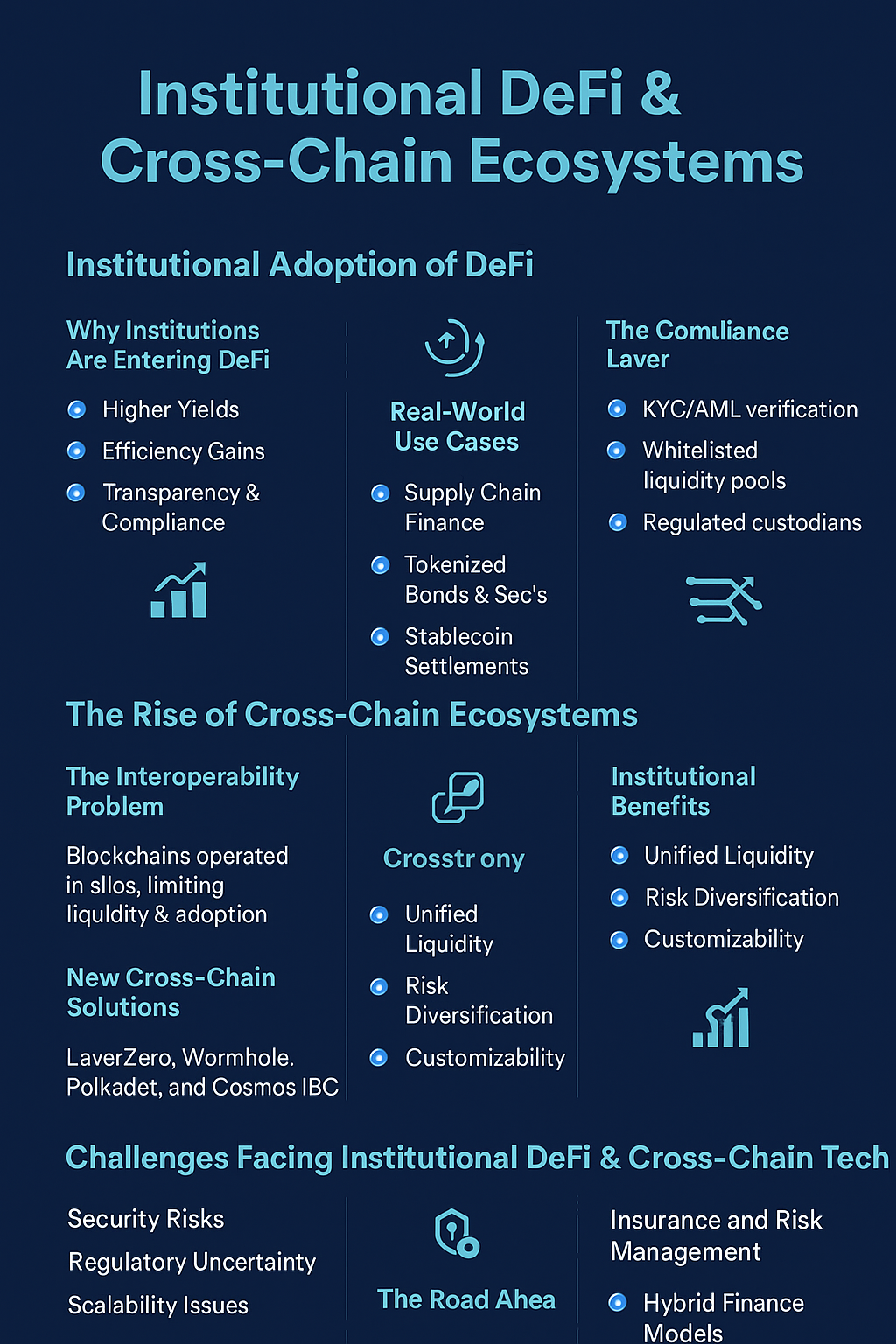

Institutional Adoption of DeFi

1. Why Institutions Are Entering DeFi

- Higher Yields: Tokenized assets, on-chain lending, and liquidity pools often provide better returns than traditional banking products.

- Efficiency Gains: Smart contracts reduce intermediaries, lowering settlement costs and processing times.

- Transparency & Compliance: On-chain activity creates immutable records that can improve auditing and reporting.

2. Real-World Use Cases

- Supply Chain Finance: Enterprises are using blockchain-based lending to finance suppliers in real time, reducing cash flow bottlenecks.

- Tokenized Bonds & Securities: Banks are experimenting with issuing tokenized debt and equity instruments that can be traded on-chain.

- Stablecoin Settlements: Multinational corporations are adopting stablecoins for faster, cheaper cross-border payments.

3. The Compliance Layer

For institutions, regulatory compliance is non-negotiable. This has led to the rise of permissioned DeFi protocols that include:

- KYC/AML verification for institutional users.

- Whitelisted liquidity pools are restricted to verified participants.

- Regulated custodians for digital asset storage.

The Rise of Cross-Chain Ecosystems

1. The Interoperability Problem

Until recently, blockchains operated in silos; Ethereum, Solana, Cosmos, and others lacked native ways of communication, which limited liquidity and user adoption.

2. New Cross-Chain Solutions

- LayerZero, Wormhole, Polkadot, and Cosmos IBC are enabling cross-chain communication and asset transfers.

- Cross-Chain DEXs allow traders to swap assets across multiple networks, eliminating the need for centralized exchanges.

- Interoperable Smart Contracts can execute actions across chains, opening doors for multi-chain dApps.

3. Institutional Benefits

- Unified Liquidity: Institutions can tap into liquidity across ecosystems, improving capital efficiency.

- Risk Diversification: Assets spread across chains reduce systemic risks tied to a single network.

- Customizability: Enterprises can choose blockchains that fit their regulatory or technical needs, while still interacting with others.

Challenges Facing Institutional DeFi & Cross-Chain Tech

- Security Risks: Cross-chain bridges remain one of the biggest targets for hacks (over $2B stolen between 2022–2024).

- Regulatory Uncertainty: Jurisdictions differ on how they treat tokenized assets and DeFi protocols.

- Scalability Issues: Even with L2s, transaction throughput may bottleneck institutional-scale adoption.

- Interoperability Standards: Without universal frameworks, fragmentation and incompatibility could slow adoption.

The Road Ahead

- Hybrid Finance Models

- Expect to see “CeDeFi” platforms that merge decentralized finance with compliance and oversight tailored for institutions.

- Institutional Liquidity Pools

- Banks may run regulated pools where they lend or borrow using tokenized fiat and securities.

- Cross-Chain Financial Infrastructure

- Multi-chain settlement layers will allow enterprises to move money and assets globally with near-instant finality.

- Insurance and Risk Management

- DeFi-native insurance markets will expand to protect institutional players against hacks and smart contract exploits.

Conclusion

Institutional DeFi and cross-chain ecosystems represent the next frontier in Web3. By merging enterprise-grade trust and compliance with decentralized efficiency and innovation, they could reshape global finance.

The winners in this space will be those who solve the trust gap: building interoperable, secure, and regulation-friendly platforms that allow institutions to confidently step into DeFi.

In short: DeFi 2.0 will not just be decentralized, it will be institutional, interoperable, and global.

Comments ()