Intent Routing and Liquidity Execution in Mitosis: Infrastructure for the Next Wave of Yield

Introduction

DeFi in 2025 is evolving beyond bridges and swaps. Users are no longer satisfied with isolated chains and fragmented interfaces. Mitosis introduces a radically composable infrastructure where intent-based execution and cross-chain liquidity routing are native to the protocol design.

Instead of relying on siloed protocols or gas-heavy bridge hops, Mitosis routes liquidity through a shared vault layer, governed by solver networks, abstracting yield into intents — not manual transactions.

Intent-Based Liquidity: How It Works

In Mitosis, users don’t interact with individual dApps. They express intents: "Stake ETH for restaking rewards with minimal slippage." These intents are picked up by off-chain solvers who compete to fulfill them optimally.

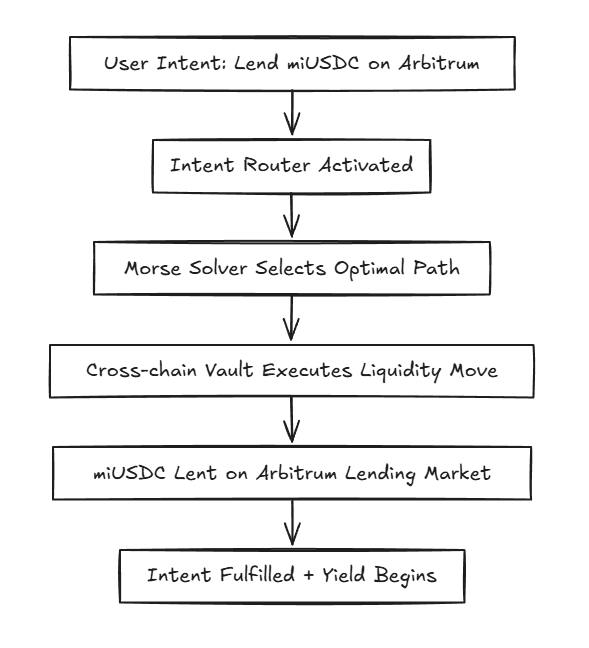

Execution Path:

- User signs an intent (e.g. provide ETH and maximize restaked yield)

- Solver matches that intent to optimal routes (e.g. EigenLayer AVS + Pendle)

- Liquidity is routed through shared Mitosis vaults

- Finalized execution is settled on-chain via Mitosis rollup settlement

Intent Lifecycle in Cross-Chain Execution

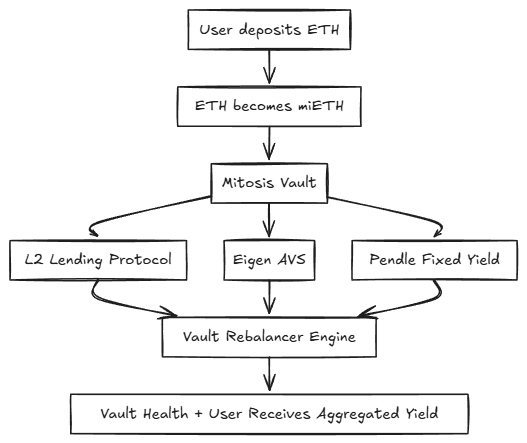

Yield Abstraction: Unified Vault Logic

Mitosis vaults are universal liquidity providers. All deposits (e.g. ETH, USDC, SOL) are abstracted into miAssets, which are routed across ecosystems.

Advantages:

- No manual bridging: assets live everywhere at once

- Yield composability: yield-bearing strategies stack by design

- Auto-rebalancing: solvers manage vault state across chains

Cross-Chain Yield Flow

Why This Model Wins

- Scalability: Users don’t need to learn every yield platform. Intents simplify UX.

- Security: MITO staking secures execution. Vaults are transparent and onchain.

- Capital Efficiency: One deposit = three strategies executed in parallel.

Comments ()