Investing under pressure: how to avoid becoming a victim of hype and preserve capital

Investing is no longer the preserve of Wall Street pros. Nowadays, anyone with a smartphone and some spare cash can open a brokerage account, buy stocks, invest in cryptocurrency, or even become a shareholder in a fund. But along with this accessibility comes a new danger: hype. Under the influence of big news, social networks, and “hot” advice from bloggers, people are increasingly making emotional investments without realizing the real risks.

What is investment hype

Investment hype is a massive, often irrational desire to invest in a certain asset, caused not by fundamental analysis, but rather by an information wave. Examples:

· cryptocurrency boom in 2021;

· hype around GameStop and other “meme” stocks;

· hype around IPOs of high-profile startups.

Such events are accompanied by a sharp rise in prices, which does not always have an economic justification. People buy because “everyone is buying.”

Main investment risks

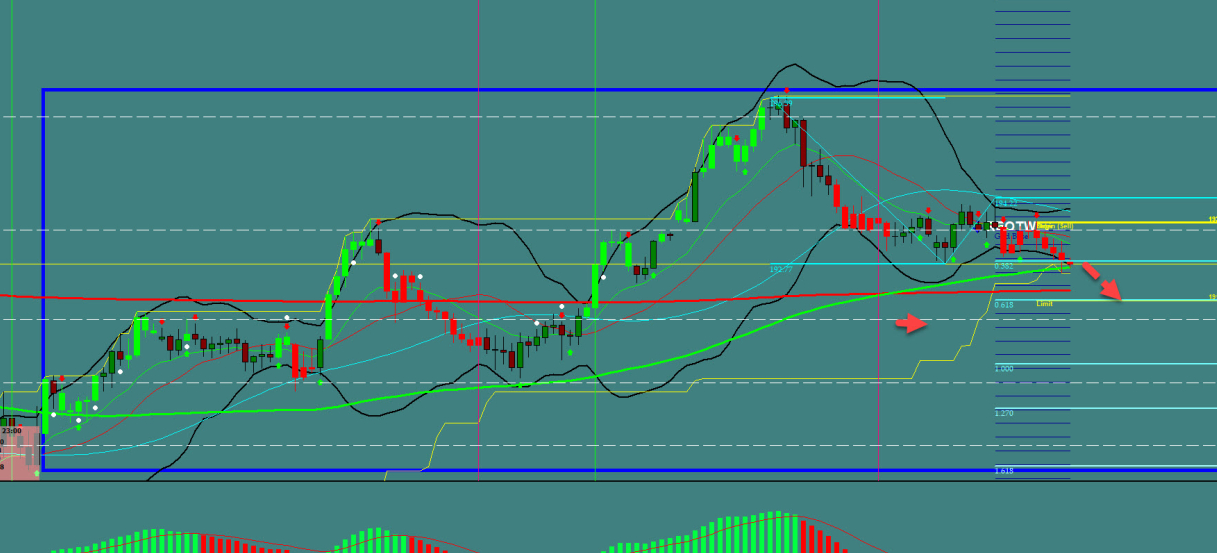

Risk of capital loss

Amid the excitement, the value of an asset can skyrocket in a matter of days, and then collapse just as quickly. At the time of purchase, a person can hit the peak price and lose most of their investment.

Liquidity

Not all assets can be quickly sold at a favorable price. In a panic, many try to exit at the same time, and the price falls even faster.

Information noise

Social networks, YouTube and Telegram channels create the illusion of understanding the market. In fact, most of these sources do not provide an objective picture, but play on emotions.

Psychological pressure

Fear of missing out (FOMO) makes people invest without analysis. Under the influence of the crowd, the ability to think rationally is lost.

Common Types of Investment Risks

|

Risk Type |

Description |

Typical Examples |

How to Mitigate |

|

Market

Risk |

Risk of

losses due to market fluctuations. |

Stock

prices dropping after economic news. |

Diversify

across sectors and asset classes. |

|

Liquidity

Risk |

Inability

to sell an asset quickly without losing value. |

Low-volume

stocks, real estate during crises. |

Avoid

illiquid assets, especially in volatile markets. |

|

Volatility

Risk |

Exposure

to large price swings over a short period. |

Cryptocurrencies,

small-cap stocks. |

Use

stop-loss orders, limit allocation to high-volatility assets. |

|

FOMO

(Emotional Risk) |

Acting

out of fear of missing out, not based on analysis. |

Buying

meme stocks during social media hype. |

Stick

to your investment plan and long-term goals. |

|

Regulatory

Risk |

Changes

in laws or government policies affecting investments. |

Ban on

crypto in certain countries. |

Stay

informed, avoid legal grey zones. |

|

Fraud/Scam

Risk |

Risk of

falling for misleading or fraudulent schemes. |

Ponzi

schemes, fake ICOs. |

Verify

platforms, avoid unregulated offers. |

|

Taxation

Risk |

Lack of

awareness of tax implications on gains. |

Unexpected

tax bills on crypto profits. |

Consult

a tax advisor before major moves. |

|

Interest

Rate Risk |

Impact

of rising/falling interest rates on fixed-income investments. |

Bond

values dropping as rates rise. |

Balance

between short- and long-duration bonds. |

Legal and tax implications

Newbie investors are often unaware of income taxation or which assets are in a legal grey area.

How to protect yourself

If some asset is growing sharply, this is not an excuse to rush out and buy it. Any investment should be justified: why are you investing, for how long, in what proportion.

Don't invest your last money

Investing is always a risk. Under no circumstances should you invest what you are not ready to lose or will not be able to get back in the near future.

Study the market, not the hype

Understand the basic principles: what are stocks, bonds, ETFs, how the crypto market works, what is P/E, volatility, diversification.

Avoid following "gurus" without analysis

Influencers often earn money from affiliate programs and advertising, not from investments. Their interests may not coincide with yours.

Plan a strategy

A clear investment plan with a horizon and goals helps to stay cool even during market turbulence.

Hype-Driven Investment Case Studies

|

Year |

Asset/Trend |

What Happened |

Why It Was Risky |

Outcome |

|

2021 |

Dogecoin |

Jumped

over 10,000% in value due to Elon Musk tweets and viral attention. |

No

intrinsic value or utility backing the price. |

Price

plummeted; many late buyers lost over 80% of their investment. |

|

2021 |

GameStop

(GME) |

Massive

short squeeze caused by Reddit community WallStreetBets. |

Driven

by social media, not fundamentals. |

Price

surged briefly, then crashed, hurting retail investors. |

|

2017 |

ICO

Boom |

Hundreds

of Initial Coin Offerings launched promising big returns. |

Many had

no product or roadmap; regulatory unclear. |

Majority

collapsed or disappeared within a year. |

|

2020 |

Zoom

Video Communications |

Skyrocketed

during pandemic as remote work surged. |

Valuation

ran ahead of fundamentals. |

Corrected

heavily after pandemic eased. |

|

2021 |

NFTs |

Digital

art and collectibles sold for millions. |

Illiquid,

speculative market with unclear long-term value. |

Market

cooled; many NFTs lost most of their value. |

|

2023 |

AI

Penny Stocks |

Surge

in tiny AI-related companies piggybacking off ChatGPT boom. |

Many

had no real AI products or revenue. |

SEC

warnings followed; prices corrected sharply. |

|

2008 |

Real

Estate Derivatives |

Complex

mortgage-backed securities traded widely. |

Hidden

risks, lack of transparency. |

Led to

global financial crisis. |

Conclusion

Investing is a powerful tool for capital growth, but only if you take a conscious approach. Hype and mass sentiment can create the illusion of easy profits, but behind this often lie risks that most are not prepared for. A cool mind, knowledge and strategy are what really protects an investor, not the crowd and emotions. Before investing, ask yourself: is this my decision or did I just succumb to pressure?

Comments ()