Investor’s Dilemma: Choosing Between Mitosis and Competing Platforms — What Really Sets Them Apart?

Sometimes decisions making before investments are challenging while looking at perks/rewards attached but the DNA of Mitosis is establishing a moment where you don't need to worry about competitive rewards

Introduction

As we move deeper into the multi-chain era, the battleground for investor attention has shifted dramatically. Gone are the days when Ethereum and Bitcoin monopolized long-term conviction today, emerging ecosystems and innovative Layer 1 solutions are commanding the spotlight, investors can build portfolio or provide LP and earn on-chain incentives.

Among them, Mitosis has started to generate significant buzz. Its focus on cross-chain operability and community-led contribution models gives it a unique edge in a space saturated with hype-driven launches and sustainable tokenomics.

But with dozens of platforms promising scalability, yield, and decentralization, how does an investor decide where to place their conviction?

What are specific perks Mitosis is offering that attracts every investor?

This article isn’t just about Mitosis vs. another chain. It’s about the deeper metrics that should guide long-term investments in this rapidly evolving crypto landscape from architecture and incentives to community culture and risk management.

Notable Mitosis Perks for investors

Mitosis have been known for community focused perks since the epoch 1 investment of the Mitosis expendition.

Major perks were designed to give the community a profitable LP provision opportunity, major interesting perks are:

Mitosis expendition

• Flexibility on deposited assets

• Protocol Benefits from Partners

• Mito points (Expedition participants get MITO Points by depositing assets and holding miAssets. Accumulating MITO Points grants eligibility for Mitosis governance token airdrops.)

The Matrix Vault

• Theo Tokens incentive

• Mito Points

• High Yield returns

• No long lockups

What Sets Mitosis Apart: Utility Beyond the Yield

In our world of DeFi platforms promising high returns, Mitosis stands out not just for what it pays, but for how it pays and what it unlocks beyond the typical incentives.

1. No Long Lockups, More Flexibility

Most protocols force users into long-term commitments to chase rewards. Mitosis flips that narrative. Investors can deposit and withdraw without restrictive lockups, giving them freedom without sacrificing returns. In volatile markets, that flexibility becomes an edge and not a luxury.

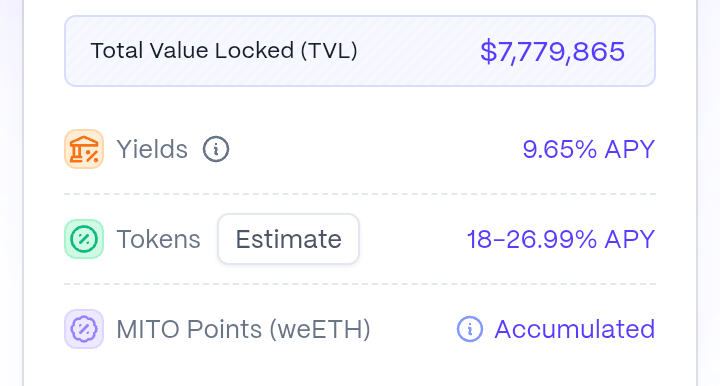

2. Yield That Actually Works for You

While many platforms offer inflated yields backed by unsustainable token emissions, Mitosis provides high and real yields on deposited assets optimized through active on-chain strategies rather than speculative inflation, which is the major considerable perk every investor look out for.

3. Protocol Benefits That Compound Value

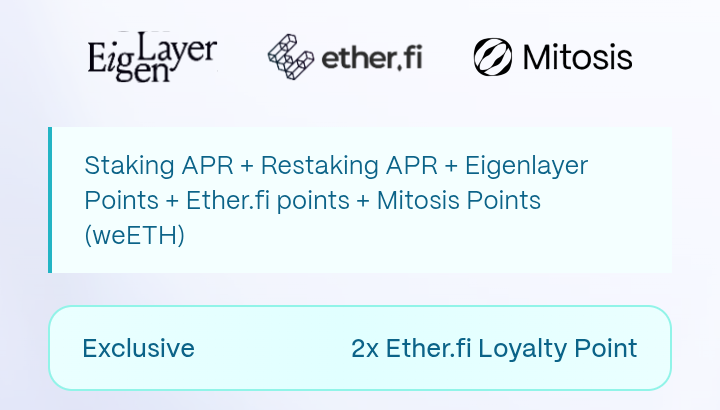

The real game-changer? Interoperable protocol perks. When you deposit in Mitosis, you don’t just earn Mitosis-native rewards. You become eligible for stackable benefits from other ecosystems like:

- EigenLayer: Secure restaking yields

- Scroll: Points for ecosystem contribution

- Other emerging partners offering cross-incentives

It’s yield farming reimagined one that integrates utility, multiplies perks, and lowers user friction.

Ecosystem & Community Strength In crypto, flashy tech and high APYs attract users but it’s ecosystems and communities that retain them. This is where Mitosis quietly excels. 1. Builder-Focused, Not Just User-Farmed Many platforms inflate their metrics with mercenary users who vanish after incentives dry up. Mitosis takes a different route: it’s building a sustainable foundation by incentivizing contribution over extraction. Developers, designers, content creators, and community moderators are actively rewarded and not sidelined. This has attracted a base of real contributors, not just yield farmers. And that matters when evaluating a chain’s long-term resilience. 2. Community as Infrastructure The Morse NFT community which is one of Mitosis' early contributor circles has shown what community-as-infrastructure looks like. With a relatively small holder count (under 3,000), they’ve driven content, awareness, and culture around the protocol. That’s organic reach, not paid promotion. Add to that a growing number of protocol partnerships, integrations, and ongoing grants and Mitosis starts to look less like an experiment and more like an emerging L1 movement. 3. Aligned Incentives, Long-Term Thinking with the established DNA program What sets this ecosystem apart is alignment: users, builders, and the protocol all benefit when value flows through Mitosis. This reduces short-term churn and creates a network effect where growth feels earned not inflated.

With the establishment of the Mitosis DNA program, it's certain long term believers will win.

Tokenomics & Rewards through the DNA program: Incentivizing Depth, Not Just Hype A project’s tokenomics often reveals its true priorities. Is it designed for quick pumps and short-term speculation? Or does it reward real contribution and long-term alignment? Mitosis leans toward the latter crafting a model that incentivizes sustained ecosystem growth without compromising investor trust. 1. Real Yield, Real Utility Mitosis offers yield on deposited assets, but not through endless token printing. Instead, rewards are tied to actual protocol activity and integrations, ensuring that value isn’t just recycled from new users. It’s a healthier loop one where staking and participation generate protocol-wide benefits. 2. Multi-Layered Incentive Design Depositing into Mitosis isn’t just about earning native rewards. Thanks to its multi-protocol integration, users may accumulate: Mito Points: A loyalty metric potentially tied to future airdrops or deeper access Partner Protocol Points: Like EigenLayer, Scroll, and others increasing cumulative value from a single deposit Token-based perks: Eligibility for incentives from upcoming launches or aligned DAOs,just the Matrix vault collaboration with THEO Network is accumulating some supply of $THEO tokens to ma-Assets holders. This creates a stacked reward structure, where a user’s commitment gets amplified across multiple ecosystems. 3. No Hidden Dilution or Surprise Lockups What you see is what you get. Mitosis keeps things transparent: no hidden vesting cliffs, no sudden emissions. Every details of your investments are stated And unlike many platforms, it respects liquidity avoiding forced lockups that often turn enthusiasm into exit pressure.

Real Use Cases & Adoption In Web3, plenty of platforms sound great in theory but very few translate that into real usage. Mitosis is starting to bridge that gap. 1. Native Infrastructure That Powers Builders Mitosis isn't just a place to deposit assets, it's becoming a core infrastructure layer for other protocols to build on. With modules supporting restaking, cross-chain liquidity, and customizable yield strategies, developers are finding it a flexible backend for DeFi, NFT, and infra applications. Projects building on or integrating with Mitosis benefit from its shared yield model, contributor ecosystem, and composable structure, all of which reduce launch friction and speed up product-market fit. 2. Active Contributor-Led Growth One of the most unique aspects of Mitosis adoption is how much of it is community-generated. From user-created dashboards and tools to art-driven narratives (via Morse NFT holders), growth here isn’t led solely by the core team, it’s decentralized by design. This user-led adoption creates stickier engagement and a more antifragile ecosystem. 3. Early Integration Momentum We're already seeing early integrations with restaking platforms (like EigenLayer), L2 networks (like Scroll), and ecosystem-native apps. As the protocol matures, these relationships could expand — turning Mitosis into a hub, not just a spoke, in the broader modular crypto.

The Mitosis Edge: A Long-Term Bet? an industry defined by cycles of hype and disillusionment, Mitosis offers something refreshing: a protocol that rewards patience, contribution, and strategic positioning. 1. Designed for Cross-Ecosystem Growth Mitosis isn’t trying to win the game alone, it’s designed to plug into the broader modular crypto stack By enabling users to earn from multiple ecosystems through a single deposit, it aligns itself with the future of composability. This cross-protocol alignment is rare. Most chains silo their rewards, limiting user value. Mitosis, instead, multiplies it. 2. Leaning Into Contribution Culture Airdrops used to reward engagement. Mitosis is trying to bring that back, but smarter. Instead of encouraging bots and multi-wallets, it’s building systems that recognize high-signal users ;those who build, contribute, educate, and support. The result is a growing cohort of aligned participants who aren't just looking for an exit, they’re invested in the chain’s success. 3. The Optionality of Early Adoption In the early phases of any network, optionality is the alpha. Users who participate now aren’t just earning short-term perks — they’re positioning for potential governance, protocol privileges, and cross-chain synergies that can’t be quantified yet. If you’re playing the long game, Mitosis might be a high-conviction bet —not because of what it is today, but because of what it's structurally prepared to become.

Choose Conviction in a Crowded Market

The Layer 1 landscape is more competitive than ever. Everywhere you look, new protocols are offering fast transactions, high yields, and ambitious roadmaps. But beneath the surface, only a few are actually laying the foundation for a sustainable future.

Mitosis makes a strong case not just through its tech or tokenomics, but through a design philosophy that centers users, rewards contributors, and unlocks cross-ecosystem value.

For investors evaluating their next move, the question isn’t just “what has traction today?” but “what’s structurally positioned to thrive in the next market phase?”

Whether you’re a builder, validator, or long-term DeFi user, Mitosis offers a rare alignment of incentives and vision. It’s not trying to win the race with noise, it's doing it through network depth, modularity, and community ownership.

And in a world full of over-engineered solutions, that clarity may be the ultimate advantage.

Useful links

Choose whatever that benefits you most, Get seated at Mitosis 😌

Comments ()