Is Layer 2 Fragmentation Hurting Ethereum’s Long-Term Dominance?

Layer-2 (L2) rollups were meant to scale Ethereum, but the explosion of over 50 distinct L2 networks has splintered liquidity, hampered composability, and fragmented user experience, threatening Ethereum’s cohesion and long-term dominance. Liquidity pools spread thin across Arbitrum, Optimism, Base, and dozens of others increase slippage, reduce market efficiency, and make arbitrage harder. See The Block. Composability suffers as dApps can no longer seamlessly call each other across isolated rollups, undermining the “money lego” ethos that powered DeFi’s early growth. User experience also breaks down: juggling wallets, bridging assets, and managing multiple fee tokens turn simple actions into multi-step processes. While market forces or interoperability standards may eventually prune less-used rollups, a more immediate remedy lies in a unified liquidity infrastructure—precisely what Mitosis delivers through its cross-chain Matrix Vaults and Ecosystem-Owned Liquidity model. See LinkedIn.

The Rise and Rift of Layer-2 Ecosystems

Ethereum’s scalability struggles spurred the creation of L2 networks—optimistic rollups, zk-rollups, sidechains—each offering lower gas fees and higher throughput📈. However, these benefits came at a cost: instead of bolstering the mainnet, they’ve carved the ecosystem into siloed zones where assets, users, and liquidity rarely intermingle. Once unified under Ethereum’s L1, “vaults” and dApps now live on separate rollups, blurring the line between supplement and competitor, and raising questions about ETH’s enduring primacy. See DeFi Planet.

Liquidity Fragmentation: Slippage, Inefficiency, and MEV Drain

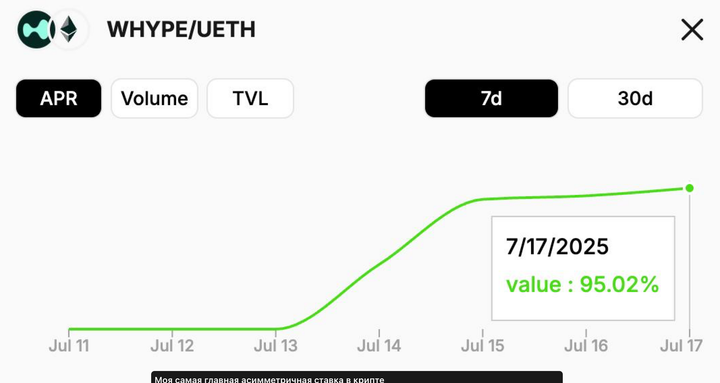

As liquidity fragments, each L2’s pools hold a fraction of the total DeFi TVL. Traders face higher slippage when moving between networks, and market-making bots struggle with thinner order books. Moreover, much of the MEV (miner/extractor value) that once flowed to Ethereum validator stakers now accrues to L2 sequencers, reducing value capture for ETH holders. Ultimately, fragmented liquidity undermines Ethereum’s network effects and drives yield-seeking activity toward standalone L2 tokens and chains with more concentrated pools. See https://www.panewslab.com/en/articledetails/usl6azo0.html?

Composability Under Siege

Loss of Universal Synchronous Composability

Ethereum’s “money lego” model depended on dApps composably interacting in real time—one contract calling another with atomicity and shared state. See Crypto Briefing. With multiple L2s, this synchronous composability breaks: bridging incurs delays and wrapped token abstractions, and cross-rollup calls require complex messaging protocols. Developers must now choose which rollup to support or build bespoke integrations, fragmenting codebases and splintering user bases.

Fractured User Experience

Bridging Overhead and Wallet Chaos

For users, fragmentation means bridging assets (and hopes) between rollups—each with unique bridges, approval flows, and transaction fees. Managing multiple wallet addresses and layer-specific gas tokens adds friction and security risk, deterring newcomers and reducing retention. See https://www.coindesk.com/opinion/2025/02/06/how-to-fix-ethereum-s-fragmentation-problem?,

Competing UX War

Chains like Solana and Cardano tout integrated, single-chain environments where users never bridge, capturing developers and liquidity attracted by simplicity. Ethereum’s L2 maze threatens to cede mindshare unless the ecosystem simplifies cross-chain flows.

Industry Paths Forward

Natural Consolidation vs. Standards

Some predict market forces will consolidate to a few “super rollups,” leaving niche chains to fade or specialize. Others advocate robust interoperability standards—universal messaging layers and hyper-bridges—to stitch disparate rollups into a unified network. See LinkedIn.

Mitosis: Unifying Liquidity & UX

Mitosis offers a unified liquidity fabric, irrespective of rollup choice. Its Cosmos-based L1, secured via EigenLayer, integrates Hyperlane messaging for permissionless, atomic cross-chain transfers—no external bridges required.

Matrix Vaults: Programmable Cross-Chain Liquidity

Matrix Vaults , let users deposit any single asset and mint miAssets that represent pooled capital. These vaults auto-allocate liquidity across multiple rollups based on community-driven parameters, ensuring deep, shared pools and minimizing slippage. Liquidity campaigns (maAssets) offer targeted yield strategies, all governed on-chain for total transparency.

Ecosystem-Owned Liquidity (EOL) Governance

Under EOL, the collective liquidity of all Matrix Vaults is managed by miAsset holders. Tokenized governance enables participants to vote on allocation strategies, reward curves, and new rollup integrations, replacing opaque bridge deals with democratic, auditable decision-making.

Conclusion

L2 rollups were meant to turbocharge Ethereum; instead, they’ve splintered its ecosystem, threatening composability, user continuity, and ETH’s value capture. Simplifying cross-rollup UX and re-aggregating liquidity is essential to preserving Ethereum’s network effects and institutional appeal. Platforms like Mitosis—via Hyperlane’s seamless messaging, Matrix Vaults’ unified liquidity, and EOL’s on-chain governance—offer a blueprint for re-knitting Ethereum’s fractured layers into a cohesive, scalable future. By combining permissionless interoperability with community-driven liquidity management, Mitosis helps ensure Ethereum’s long-term dominance in a multi-chain world.

🔗Links:

Comments ()