Jason Choi on the Phenomenon of 'Heroic Trades,' Ego Traps, and the Hidden Side of Success

Part 1: Inspiration and Illusion of Heroism in the Crypto World

Since 2018, I have been living off cryptocurrencies, and during this time, I have witnessed countless stories of "heroic trades."

These stories are like legends—they inspire but also deceive. Someone bets everything on a coin at its bottom, with crazy leverage, catching a reversal that everyone feared to even think about. Others short at the cycle's peak, risking it all to seize a fleeting moment.

People love such stories because they offer hope: just one successful shot can change your fate. In the crypto world—and in life in general—there's a temptation to believe in the fairy tale of a hero who makes one correct move and reaches the top.

Jason Choi Link: https://x.com/mrjasonchoi

Part 2: Common Traits of 'Heroic Trades' and Their Allure

All these stories share one common trait: someone takes a contrarian position, sizes up boldly, and ends up on top.

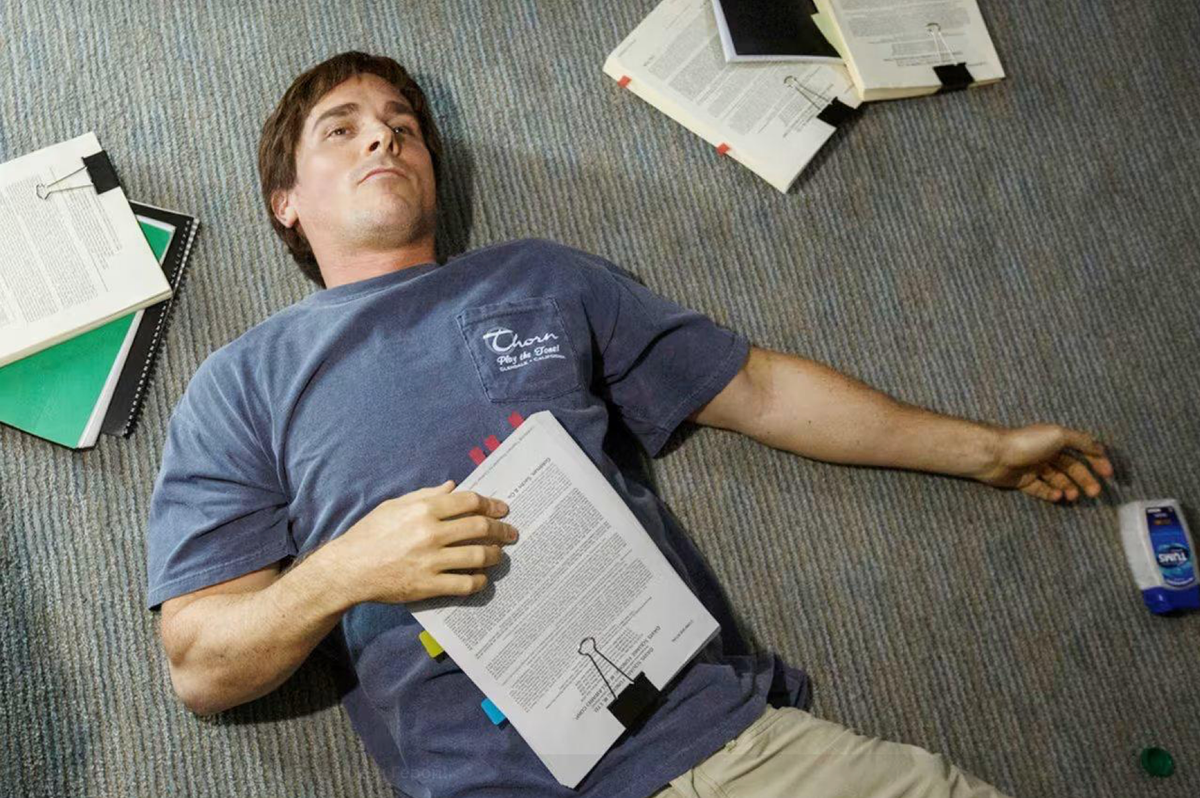

People love to believe they can become heroes overnight. This explains why such narratives are popular—they give hope that enough luck or skill can lead to quick riches. Remember the film The Big Short?

Media still loves to tell stories about market heroes—even if their successes are often mundane or exaggerated. But behind this lies danger: these stories create an illusion of an easy path to wealth.

The Big Short link: https://www.imdb.com/title/tt1596363/

Part 3: Why Most Such Stories End in Failure

However, reality is different: almost every such story has its conclusion—a wipeout or major loss. Why does this happen?

One might think that after winning big, traders become complacent or lose discipline. But deeper reasons exist: they started as underdogs, faced criticism for unpopular positions, and eventually proved themselves right. They felt "that vibe": maybe I am a hero?

Maybe I am that special person? This mindset turns trading into a personal mission; any dissent is perceived as an attack. As a result, a pattern emerges: risking large amounts to win big; developing a strong conviction that blinds judgment.

Part 4: Ego Traps and Systemic Risks

When caught in this cycle, traders stop listening to others. They no longer leave room for variability—because they see themselves as geniuses while others are fools. The outcome is always the same—a wipeout or significant loss.

People dream of stories about the giga-chad who bought Bitcoin at its COVID lows and made 10x. But reality is different: my best results aren’t from heroic trades but from hundreds of small wins and losses that form a system.

My main heroic trade is not a single legendary move but those around me—people who value truth more than ego and don’t confuse dissent with disloyalty.

Part 5: Tips for Clear Thinking and Self-Awareness

A few simple pieces of advice: play for popularity only if you want to win elections or achieve short-term success.

For long-term stability, it’s crucial to stay sober-minded and avoid turning yourself into a hero of one-sided stories.

And if you do manage your heroic trade—congratulations! But don’t mistake yourself for the main hero of that story. In crypto—or life—systemic success is built not on one heroic act but on consistency, honesty with oneself and others.

Part 6: Conclusion

This article reminds us that true value lies not in one bright triumph or legendary trade but in the ability to remain honest with ourselves even after failures.

That’s how real leaders and genuine systems of success are built.

7. Useful Mitosis Links

🌐 Website: https://mitosis.org

📖 Docs: https://docs.mitosis.org

🐦 Twitter / X: https://twitter.com/MitosisOrg

💬 Discord: https://discord.gg/mitosis

Comments ()