L2 Turf War: How Arbitrum, Optimism & Base Are Scrambling for a Slice of the $52 B DeFi Pie

Introduction

Here’s a deep‐dive comparison of how Arbitrum, Optimism, and Base are competing for Total Value Locked (TVL) and developer mindshare in the post‐Ethereum‐merge era—complete with key data, analysis, and internal links to our Glossary and related Mitosis University resources.

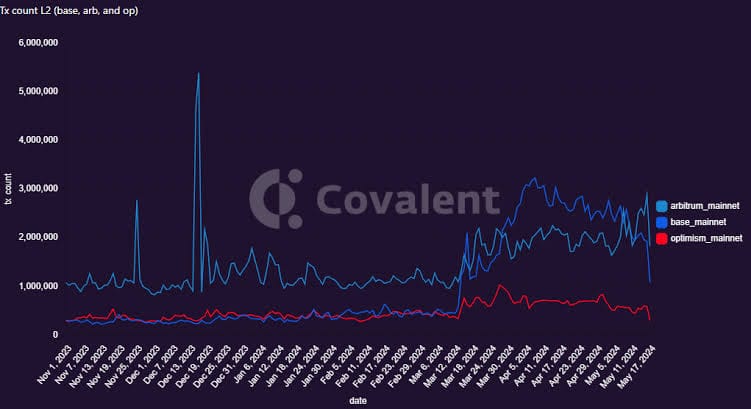

In brief, Base currently leads L2 developer activity with 4,287 monthly active devs, followed by Arbitrum at 3,450 and Optimism at 2,416—a sign that Coinbase’s launchpad is rapidly galvanizing builders Blockworks. On the liquidity front, Arbitrum holds about $2.28 billion TVL, Base roughly $3 billion, and Optimism around $7.6 billion (as of April 2024)—though Optimism’s Superchain transaction share has risen to over 60% of Ethereum L2 throughput by early 2025 DefiLlamaProtos. This battle for the $52 billion DeFi pie reflects diverging design priorities: Arbitrum’s strong EVM compatibility, Optimism’s modular “Superchain” vision, and Base’s consumer‐friendly integration with Coinbase.

TVL Turf War: Dollars on the Line

Arbitrum’s Anchored Liquidity

Arbitrum’s TVL stands at $2.278 billion, making it one of the largest rollup ecosystems in DeFi DefiLlama. Its strength lies in mature Ecosystem‐Owned Liquidity and broad DApp support, from Aave to Uniswap. As a result, capital efficiency on Arbitrum remains high, with bridged TVL exceeding $11 billion according to DefiLlama DefiLlama.

Optimism’s Superchain Strategy

Optimism, the progenitor of the OP Stack, reported ≈ $7.6 billion TVL as of April 2024—roughly 18% of all Ethereum L2 value RocketX Exchange. By early 2025, its “Superchain” framework (including Base and Worldchain) processes over 60% of Ethereum L2 transactions, underscoring its vision of modular growth and shared security RocketX Exchange.

Base’s Coinbase‐Powered Surge

Launched in August 2023, Base quickly amassed ≈ $3 billion TVL and $14 billion bridged TVL, buoyed by sub‐$0.01 fees and Coinbase’s user base Protos. Its emphasis on seamless fiat‐crypto onramps and smart wallets positions it as the most consumer‐friendly L2, driving rapid adoption.

For deeper definitions of TVL and L2 concepts, see our Total Value Locked (TVL) and Layer-2 Scaling Solution glossary entries.

Developer Mindshare: Where Builders Go

Active Developer Rankings

According to Electric Capital’s 2024 Developer Report, Base leads with 4,287 active monthly developers, closely followed by Arbitrum (3,450) and Optimism (2,416) Blockworks. This shift illustrates that while Arbitrum and Optimism boast early‐mover advantage, Base’s Coinbase pedigree is winning over new and seasoned builders alike.

Ecosystem Growth & Tools

- Arbitrum: ~975 monthly active Repos, 6.7 M commits, driven by robust tooling like Nitro and Nitro TV Developer Report.

- Optimism: Expanding via OP Stack SDKs, its governance “workstream” model is attracting community contributors.

- Base: Leveraging Coinbase’s Rust‐centric SDK and Smart Wallet abstractions, Base offers one of the shortest onramps from idea to deployment.

Community initiatives—such as Hackathons on Mitosis’s Developer Portal—further accelerate innovation across these chains.

What This Means for DeFi

- Fragmentation vs. Interoperability

- Risk: Capital splintering across too many L2s can create liquidity vacuums.

- Opportunity: Cross‐chain bridges and shared tooling (e.g., Hyperlane, Nomad) are emerging to knit TVL together.

- Innovation Hotspots

- Arbitrum excels in DeFi primitives and RWA tooling.

- Optimism pioneers modular rollups and community governance.

- Base focuses on mass‐market UX and regulatory alignment for institutional on‐ramps.

- The Road Ahead

- Will TVL consolidate around a few dominant L2s, or will niche chains flourish?

- How will governance models and liquidity mining evolve in 2025–26?

For broader context on fundamentals, see our DeFi Foundations and Market Insights sections.

Conclusion

The $52 billion DeFi pie is far from static. As Arbitrum, Optimism, and Base sharpen their value propositions—TVL optimization, modular growth, and consumer on‐ramping respectively—the L2 landscape is entering a true Turf War. Developers and capital will follow the chains that best align with their needs: technical sophistication, community governance, or user experience. Ultimately, this competition will drive better scaling solutions, richer DeFi primitives, and—most importantly—more accessible financial systems for all.

❓ Where do you see the biggest opportunities in 2025? Share your thoughts in the Mitosis Discord or Telegram group!

Internal Links

- Liquidity TVL Glossary

- Expedition Boosts

- Straddle Vault

- Mitosis University

- Mitosis Blog.

- Mitosis Core: Liquidity Strategies.

Key References

- Arbitrum TVL & metrics DefiLlama

- Base TVL & bridged TVL Protos

- Optimism TVL & Superchain share RocketX Exchange

- Developer counts (Base, Arbitrum, Optimism) Blockworks

- Arbitrum dev repos & commits

Comments ()