Layer 1 and Mitosis: Synergistic Approaches to DeFi Challenges

Could you imagine waking up one day and suddenly realizing that the cars traveling through the roads connecting each city in the world have been substituted with high-speed bullet trains? Suddenly everything is fast, smooth and so much more connected. And that’s the next level kind of change when Layer 1 blockchains partner with Mitosis. This isn't your routine tech partnership; it's essentially a lagging moment for DeFi. Why does this matter? All right, consider: today, DeFi is a bit of a maze of random trails — your assets are locked up there, opportunities are over there, and it can be a pain to get from point A to B. Liquidity is fragmented, governance is a mess, and innovation? Sometimes the systems suppress what is designed to uphold it. But on the other hand, integrate Mitosis in the game with Layer 1 chains, and not only do you solve those issues above, you’re essentially creating a brand new highway system for DeFi.

This is important as it would enable DeFi to be more available for users beyond the crypto literate. It could mean your investments do more work, moving easily across chains to snag the best yields. And it would allow you to have a real voice in the way these ecosystems develop, effectively turning passive holders into active participants. And there’s so much potential for alternative financial tools that might change our systems of saving, investing and transacting. In this article, we will unpack how this fusion can unleash super-scalability, grant communities unprecedented power, and unlock a range of deliverables we are only now starting to dream of. If you’ve ever wondered what DeFi looks like in all its glory, stick around — this is the future we’re working toward.

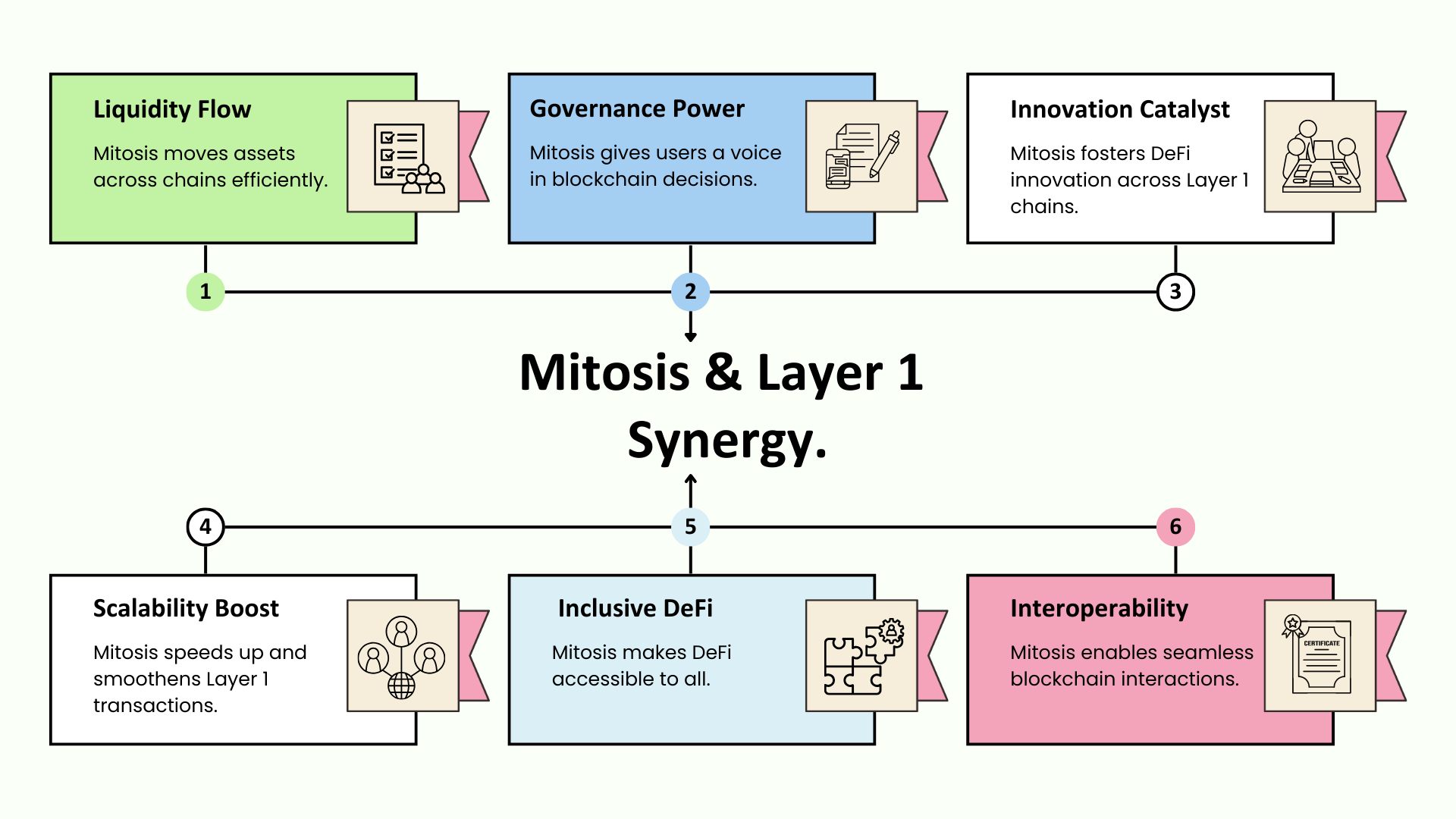

Alright, now that we've set the stage, let's dig into the meat of the discussion. We'll break this down into six key sections, each tackling a different piece of the puzzle. Think of this as your roadmap to understanding why this could be such a big deal.

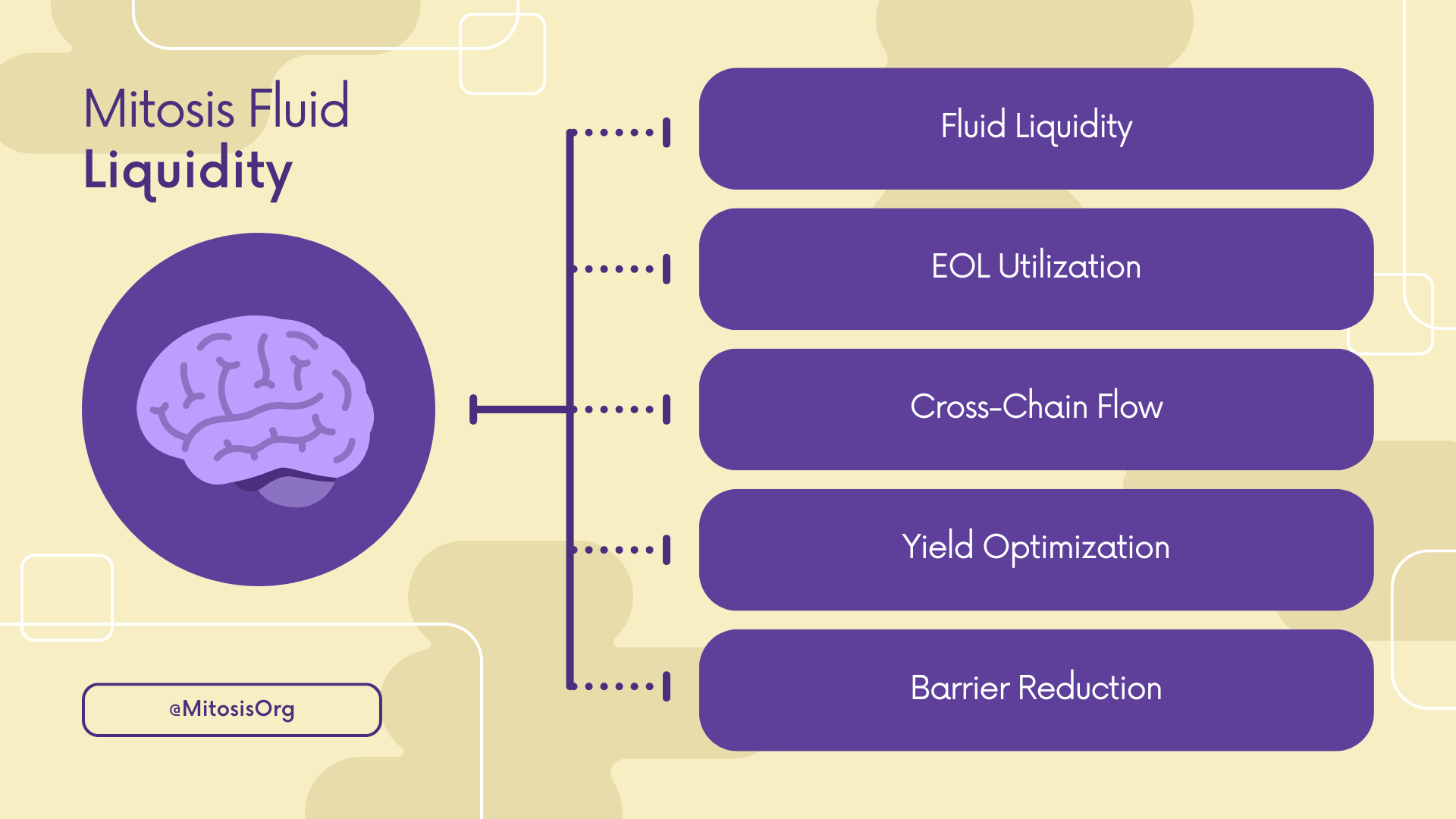

Mitosis Fluid Liquidity Management ✦

If you ever tried moving assets between different blockchains then you know that it sometimes feels like navigating a maze with a blindfold on. However, Mitosis is the solution not only to make liquidity move, but to transform the dance of liquidity all over all L1 chains, particularly in the EVM ecosystem. Mitosis I see as a smart irrigation system for your DeFi garden. But thanks to Ecosystem-Owned Liquidity (EOL), Mitosis might help your assets float effortlessly from Ethereum to chains like Polygon, harvesting yield without the same tolls of gas fees. Imagine now: you are yield farming on Ethereum, proceeds are coming in, and Mitosis enables you to transfer to a golden opportunity on Polygon as easily as flipping tracks on your playlist without skipping a beat.

We will use Ethereum and Binance Smart Chain (BSC) as test network. Ethereum experience high gas fees for low-cost meal movement and top dining for DeFi, while BSC is lower, but fewer offerings. Enter mitosis, the bridge that writes the flow of liquidity between them. Its modular liquidity pools may allow you to keep your assets on Ethereum but also stick a toe in the waters of BSC yield pools without the typical hassle.

Why is this a game-changer? Because your money is not just lying around, awaiting your next puzzle—the money’s already on the road, working harder, not smarter. Over $10 billion worth of liquidity is stuck across DeFi platforms because of fragmentation, a recent report from Chainalysis claimed. Now imagine enabling even a fraction of that potential. Mitosis is not merely Shift to the Liquidity, it's Release the Liquidity to run wild and prosper, this is where Cross Chain Yield will be your second nature.

DeFi Llama data showcases how lowering these barriers could help establish much larger Cross Chain Yield strategies, changing the very nature of liquidity in the face of DeFi.

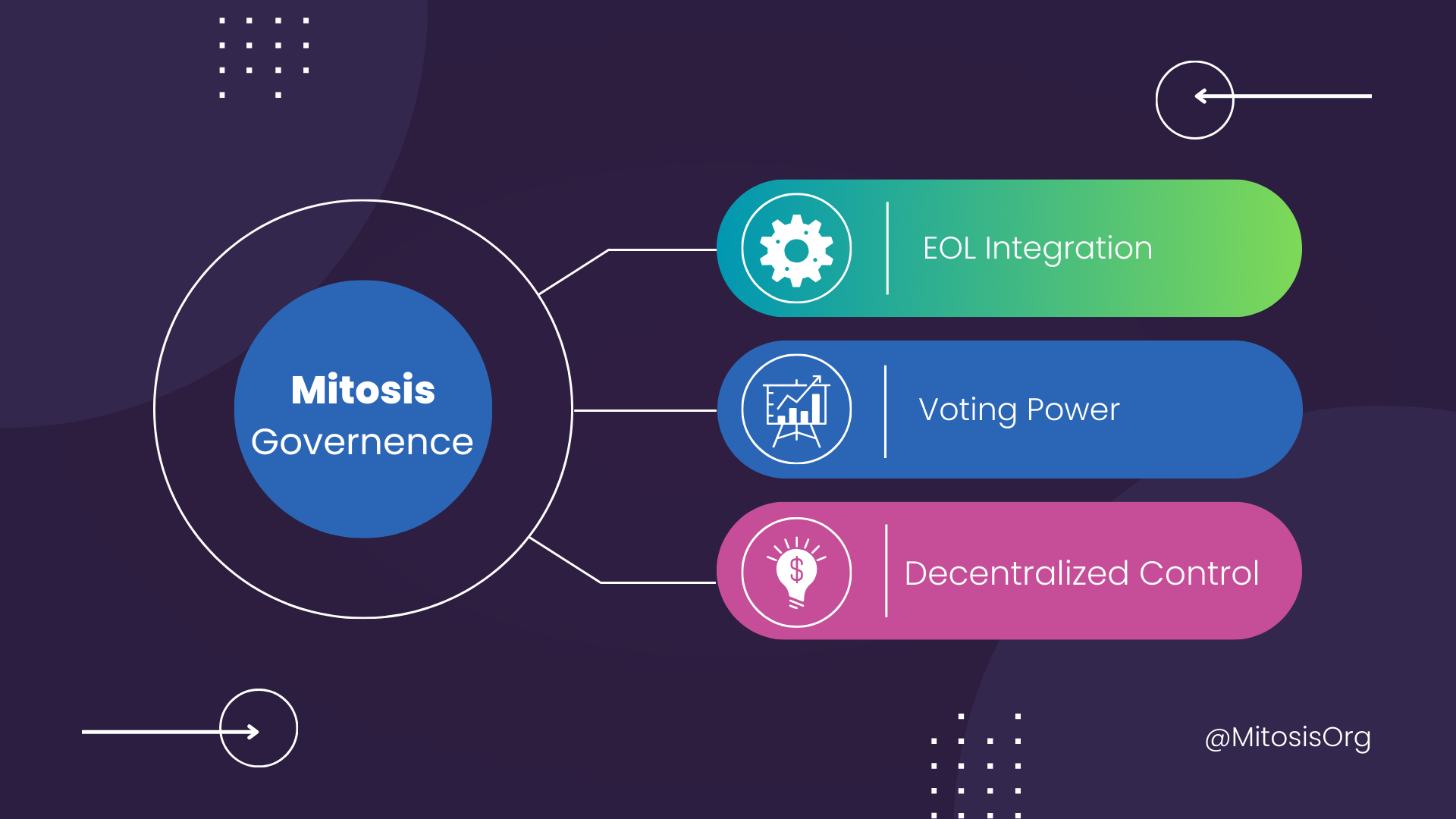

Empowering Governance at the Core ✦

The truth is, governance in DeFi can feel a lot like you're trapped in a high school election or even worse, a power grab by the cool kids. But Mitosis? By flipping the script with its Ecosystem-Owned Liquidity (EOL), you pair it with Layer 1 chains you have a match made in DeFi heaven, Polkadot or Cosmos we're talking.

Consider, for example, the "parachain" model of Polkadot. This is community governance, so this is what we're talking about, right? Be that as it may, with respect to where liquidity flows, a lot of the time it appears all the big shots are the ones pulling the strings. Mitosis might alter that calculus, making a more democratized version of the process possible by giving every liquidity provider — both whales and minnows — a say in how their assets get deployed. Envision a Polkadot campaign, where the community decides to allocate funds to a new DeFi project that resonates with their shared vision. That is not mere governance; that is empowerment.

Ever feel like you are the backup singer in the DeFi concert? With Mitosis, you're suddenly the frontman. Therefore, in collaboration with governance-first chains, Mitosis puts the mic in your hand, enabling you to do so much more than dictate where your capital flows by also helping to define the sound of the collective blockchain symphony. We’re not discussing the casting of votes toward the next largest DeFi anthem, we’re discussing co-authoring the score. It’s like a band where each musician is allowed to add their riff to the set list.

Now here's where it gets kinda spicy—research linked to the Harvard Business Review goes deeper into decentralized governance, bringing up the idea that with everyone having skin in the game, projects start to mirror real-world values more authentically, which may lead to more ethical and sustainable DeFi Lending models. With Mitosis, you will no longer be the passive observer, you will be in the driver seat for DeFi. Building on top of governance-centric chains enhances this community power. It’s not just like you’re going to a festival, you’re like, ‘I’ll ride the ride, I’ll go with the tunes I’ll go with how this adds up.

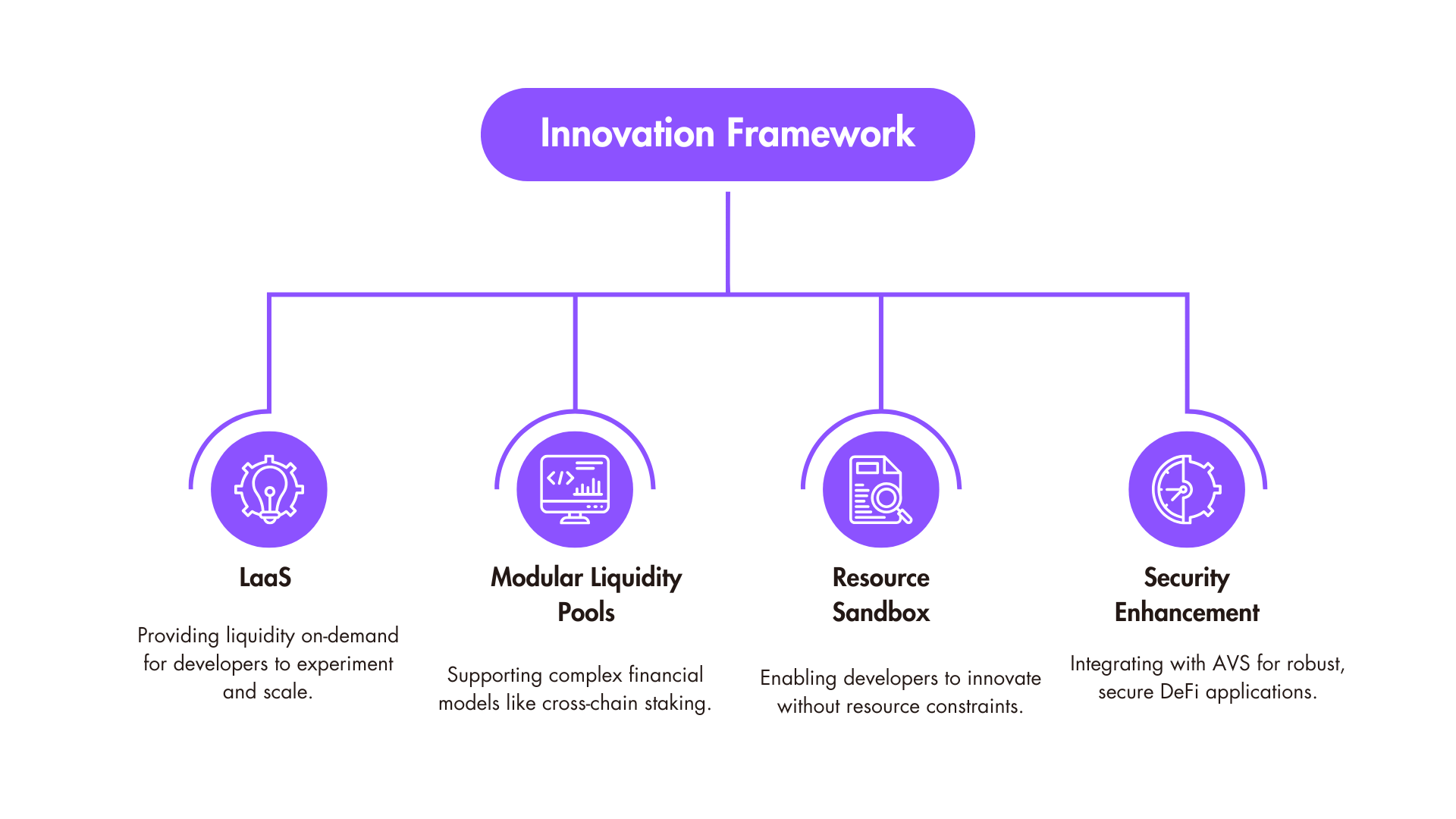

Mitosis Can Spark Financial Innovation ✦

Layer 1 chains are the birthplace for the most innovative ideas of DeFi, from Ethereum’s smart contracts to Tezos’s self-evolving blockchain. But to put these ideas into motion you need fuel, that’s where Mitosis comes in with its innovative liquidity architecture. Consider the case of NEAR Protocol, which is highly geared toward developers. Developers can use the Mitosis ecosystem to experiment with their projects through a community-driven liquidity model. Just launched a new lending platform? Through its community engagement, Mitosis's ecosystem can facilitate the liquidity needed. How about a cross-chain staking model? The modular pools of Mitosis’s ecosystem can realize that vision, providing better interoperability and liquidity between chains.

Then breaks the interesting part: No only they find the way to put the money needed so far; But they create this innovation sandbox whitch challenge developer to keep them exploring and not focus on resources. Which is kind of like giving an artist infinite paints, but instead of painting, draining a couple red lines to sketch out the future of finance. With DeFi’s market cap already exceeding 100 billion according to CoinGecko, the soil is fertile for new ideas not only to seed but flourish.

We are not talking about an ordinary funding mechanism here, Mitosis is a launchpad for innovative financial primitives. By providing a dynamic and accessible Liquidity Provision framework. We speak about DeFi apps that are as powerful as they are simple to use, as your lead mobile apps. And what if you could build security on top of them with Actively Validated Services (AVS) from EigenLayer, making these creations as reliable as they were creative? A Chainalysis report highlights the importance of user-centric design as a driving force for adoption in DeFi, putting Mitosis in the middle of this evolutionary leap.

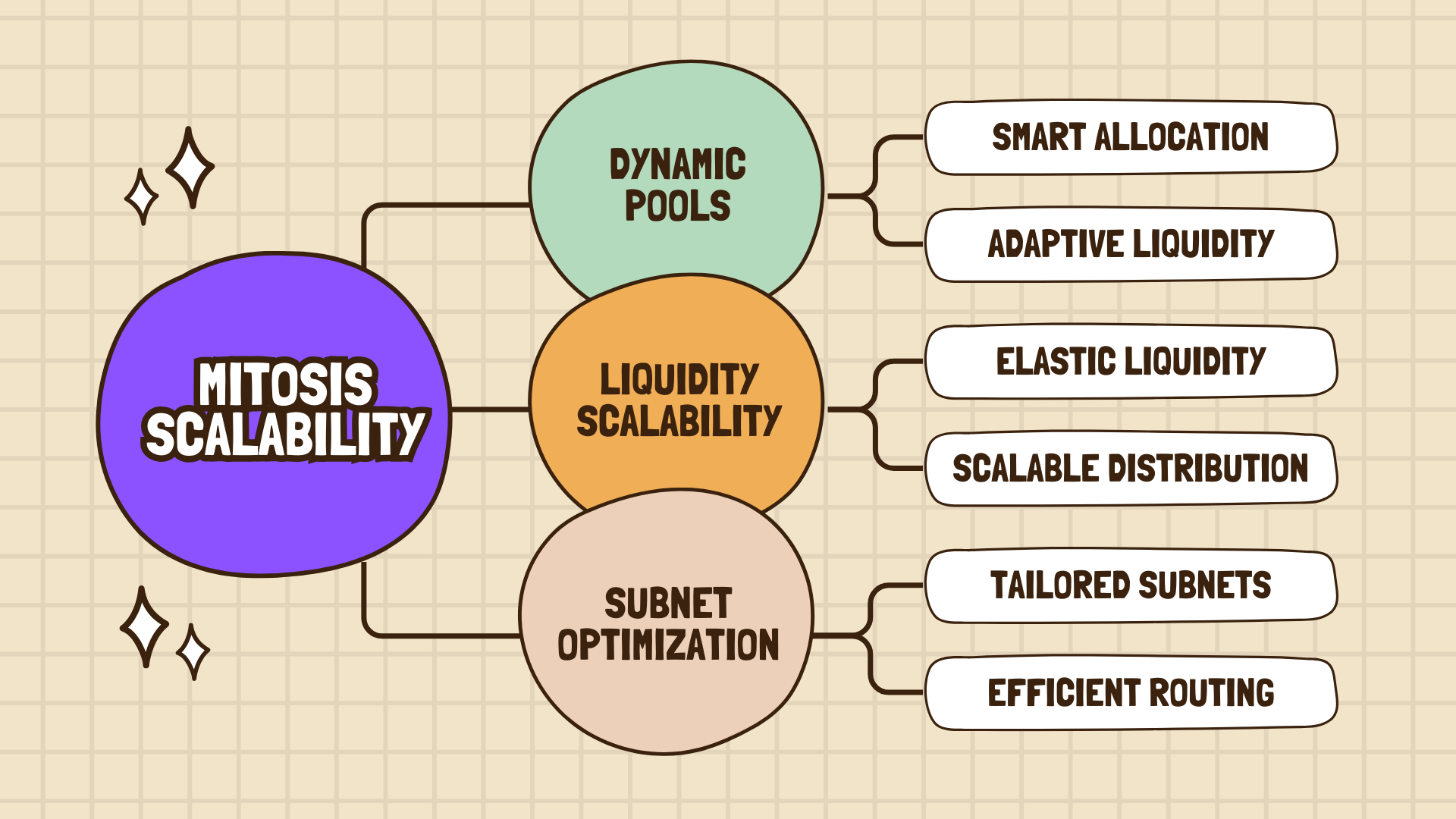

Scalability on Steroids: Supercharging Layer 1 Performance with Mitosis ✦

Layer 1 blockchains such as Solana and Avalanche are already the Usain Bolts of the blockchain world, but they too can hit a wall when DeFi gets hot. Enter Mitosis, operating as a turbocharger, optimizing the flow of liquidity between these networks.

Take Solana, which is capable of an eye-popping 65,000 transactions per second. It’s impressive, no argument there, but when everyone is trying to mint that new NFT or get involved in the latest DeFi fad, things can get squeezed. This is where Mitosis excels, actively moving the liquidity around, and intelligently routing it to where the action is.

Capitalize on liquidity No one is talking about what Mitosis really enables, we are not just talking about 50x faster transaction; we are talking about Mitosis enabling liquidity scalability. Imagine if you were on a highway and an extra lane suddenly appeared just as you entered during rush hour. Which set Layer 1 chains up to not only be faster but, thicker when the pressure is on, like what Mitosis could do.

On Avalanche, where its subnet structure prioritises scalability, Mitosis may just be your climbing boots in the epic ascent to the Peak of DeFi. Custom liquidity pools offer more efficiently maintained trails between the base (subnet) and summit (the main subnet) for optimal speed. This could enable not only faster but less congested transactions for DeFi, something that you use everyday out of necessity rather than a tech toy.

These improvements could make all the difference in helping DeFi breach into the mainstream and transition from a niche interest into a tool of the masses, according to The Block Research. By Mitosis, we envision a future in which Layer 1 chains are no longer a competition solely of how many transactions can be handled, but are the difference in the way transactions are handled, making DeFi as easy as a trip to the local coffee shop.

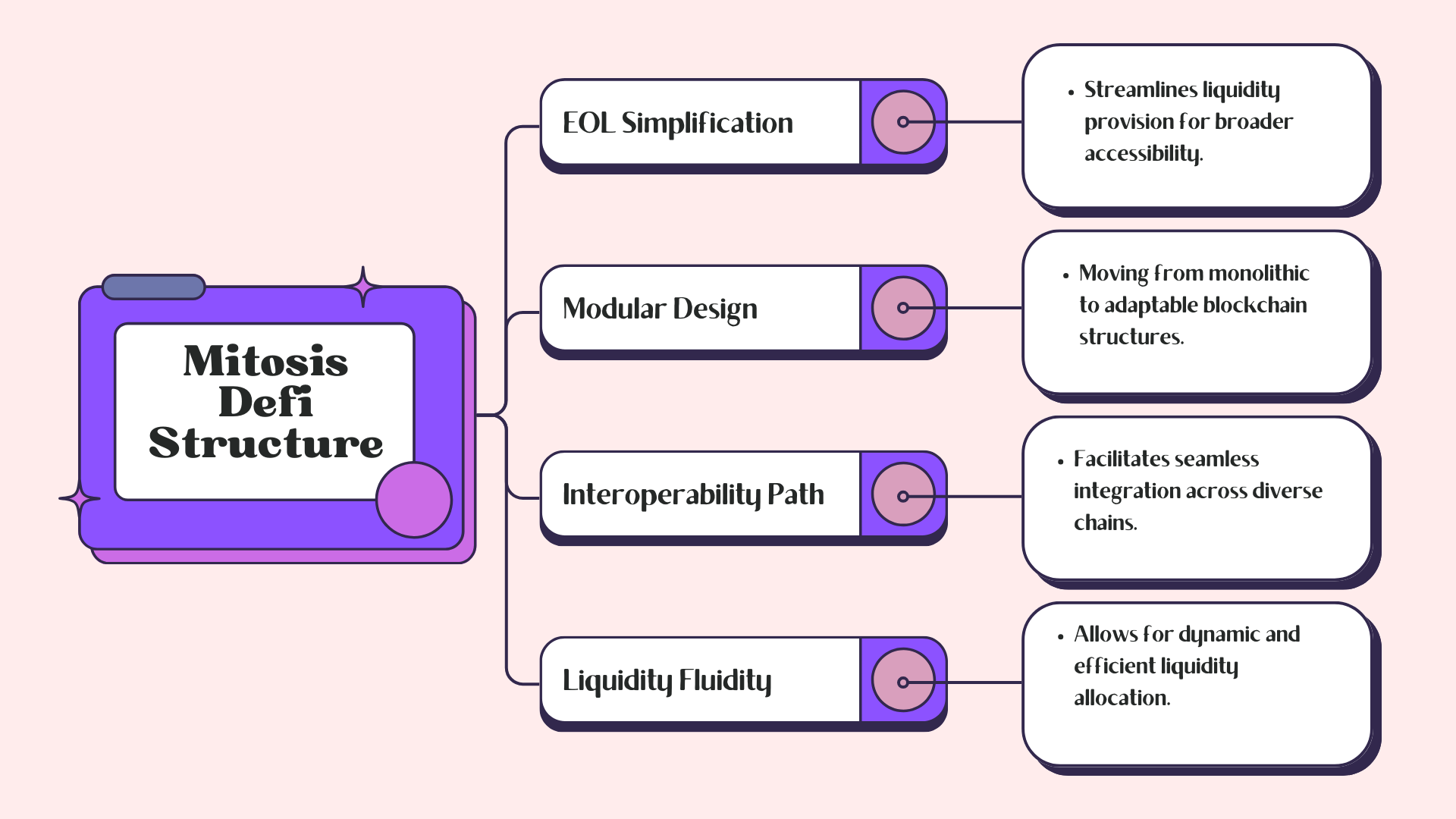

Mitosis Crafting an Inclusive, Modular DeFi Future ✦

At the core of Mitosis, we are about dismantling the ivory towers of DeFi, bringing it to you easier than going to your neighborhood bank. A world where you wouldn’t have to be steeped in years of blockchain tech learnings to go enjoy the DeFi open bar. With Mitosis, you could enter DeFi as easily as you would a banking app, where Liquidity Provision and governance are democratized for all. Because this isn’t just about simplifying DeFi; this is about making a space at the table for your grandmother, and your children, to build a financial future that is as innovative as it is inclusive.

As also noted by McKinsey regarding the accessibility of tech, once platforms are this user-centric, adoption is not simply a steady increase, but rather explosive growth that can lead to DeFi being as accessible as the banking platforms we have come to know today. However, Mitosis goes beyond simple DeFi usability; we’re also talking about completely rethinking how to structure a blockchain.

We are not discussing just an upgrade, but a transition of the scalable Monolithic Blockchain into scalable, Modular Blockchain. For now Mitosis is exploring the EVM sandbox, but (like its namesake) its principles could serve as a beacon for non-EVM chains as well, creating more interoperability than ever. Projects such as Celestia, which focuses on modular data availability, also fall under this vision, where Mitosis could potentially be the glue pulling these systems together. The Celestia Airdrop is the effective proof that such an experience can be possible when chains work collaboratively, creating a more connected DeFiverse implementation that offers a seamless liquidity allocation experience, simply a reflection of the market nuances in general.

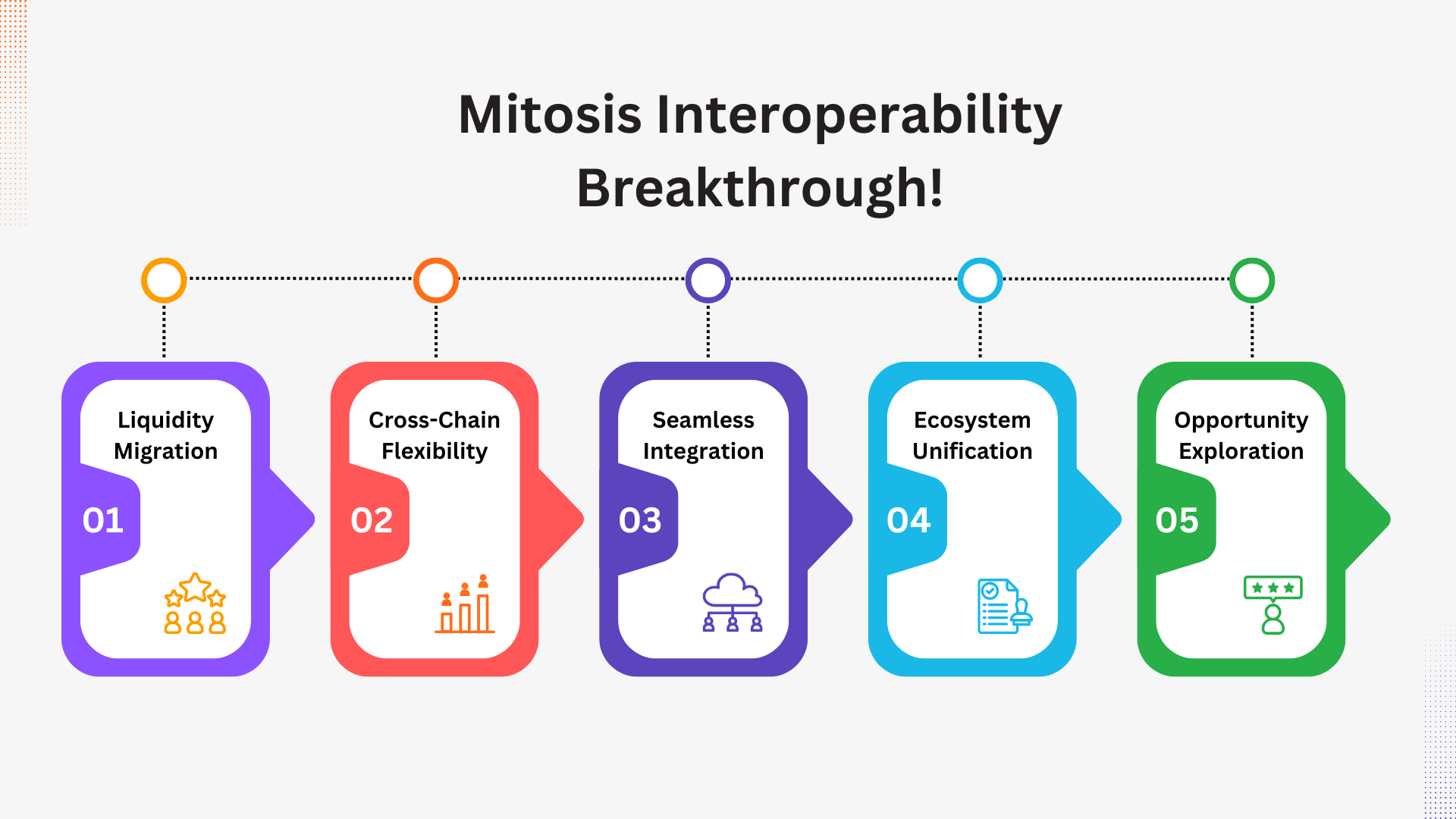

Interoperability Made Real with Mitosis and Hyperlane ✦

If there is one word that can get any blockchain lover’s heart fluttering it’s “Interoperability.” Chains like Cosmos and Chainlink are already laying the groundwork, but it's Mitosis, coupled with Hyperlane, that takes it to the stratosphere.

It's kind of like water flowing through a stream — with Mitosis bringing that inter-chain liquidity migration on-chain with Hyperlane, your assets now flow as seamlessly from one blockchain to the next. Imagine shifting your capital from Cosmos’s IBC-friendly networks straight into Ethereum’s defi juggernaut, pursuit of yields or prospects without lifting a finger. It is not just about transferring tokens; it is the creation of an ecosystem in which your liquidity can flow across chains like a bee on its way to the best flower — hunting for opportunities.

Here’s why this is a big deal: Interoperability has been the holy grail of the blockchain world, but the glue to bind it all together has always been absent — liquidity. Mitosis (via its integration with Hyperlane) is that missing piece, stitching these ecosystems together into a seamless fabric where chain borders become as irrelevant as borders between states on a map. This vision culminates in a DeFi landscape where multi-chain investments are unencumbered by the restrictions of a single blockchain and can navigate towards the strengths of several.

Research done by Messari on Blockchain Interoperability illustrates the disruptive nature of such a system, but stresses that liquidity is paramount to the realization of cross-chain assets. This isn't just about a future where your deposits are no longer shackled to a single blockchain with Mitosis — it's about a world in which they're liberated to capitalize on whatever a multi-chain future has in store, providing opportunities for financial efficiency and earnings that have previously only existed in imagination. In other words, it could reshape DeFi into a liquid continent versus an island of islands.

Some more possible synergies for Mitosis:

Decentralized Identity: SSI or DIDs integration for advanced privacy and security

Oracle Layer: We can have other oracles like Tellor or Band apart from Chainlink for data reliability.

NFT Mobility: Unlocking NFT use-cases across different blockchains.

Zero-Knowledge Proofs: Adding ZKPs for Private Transactions.

AI/ML — Optimization: Making smarter DeFi moves with AI/ML.

RegTech Compliance: KYC/AML tools for appeals to regulated markets

Stablecoin Interoperability: Allowing stablecoins to transfer across chains.

Cross-Chain Lending: Lending/Borrowing across different chains.

These synergies would extend Mitosis's capabilities, complementing Mitosis’s role in the DeFi ecosystem.

Conclusion ✦

We’ve traversed an ecosystem where Layer 1 blockchains and Mitosis might enable DeFi to evolve from a system of independent paths to a fast-moving, interwoven network. Here are the big ideas from what we’ve learned:

Fluid Liquidity Management: With Mitosis, your assets are free to migrate from chain to chain like water through a well setup irrigation system, maximizing yield and lowering costs. This isn't a theory, data from DeFi Llama show this could open up a huge Cross Chain Yield potential.

Empowering Governance: Mitosis helps democratically disperse decision-making, positioning yourself from a spectator to a conductor in the DeFi symphony, fostering alignment between projects and community values, in line with Harvard Business Review research on decentralized governance.

Catalyzing Financial Innovation: Mitosis is the canvas upon which developers can build the next generation of user-friendly DeFi tools that benefit from Actively Validated Services (AVS) from EigenLayer for better security, a fact emphasized by Chainalysis reports.

Scaling Supercharged: The Block Research has highlighted how Mitosis could be the turbo of Layer 1 chains, taking the strain of peak loads, and providing more seamless and efficient DeFi.

Mitosis Defining the Future: From this moment on, UX that even a 4-year-old could understand, from Indigents to Wealthy → Everyone can participate in DeFi. McKinsey analyzed and pointed to a tsunami of adoption as tech becomes this accessible. In addition, Mitosis foresees a move towards modular blockchains, with projects like Celestia showcasing this future.

Interoperability Made Real: By transmuting the dream of interoperability between blockchains into reality, Mitosis would allow liquidity to flow across chains. Messari explored this in a recent study, highlighting the architecture of liquidity as a linchpin for the practical realities of cross-chain functions.

Practical Takeaways:

Invest and Participate: Explore how Mitosis can improve your DeFi strategy or participation in governance as a native token holder of Mitosis.

Stay Updated: Keep your ears on the ground for any movement on Layer 1 chains and Mitosis for potential investment or project opportunities.

Promote Innovation: Build up or interact with projects that use Mitosis to develop easier access to DeFi products.

Future Implications:

Can this collection of dissimilar tools working together across blockchains in a way similar to apps on your phone create a DeFi ecosystem?

What new ethics will no-code bring to the DeFi space with everyday users empowered?

What new financial models or tools might arise from this new level of interoperability and liquidity fluidity?

As we stand at the edge of this new world, the question weighs heavy on our minds: Is the future of finance truly one without economic borders where DeFi becomes as instinctively intuitive, all-inclusive and creative as the internet has become? We are not speculating, we are building that future with Mitosis and Layer 1 blockchains in action.

Comments ()