Layer 1 Synergy with Mitosis: The Key to Unlocking Blockchain Scalability?

Blockchain technology has come a long way since the inception of Bitcoin, but scalability remains one of the most pressing challenges. As the demand for decentralized applications (dApps) grows, Layer 1 solutions like Mitosis are emerging as key players in addressing these challenges. Mitosis, with its unique architecture and focus on interoperability, has the potential to synergize with other Layer 1 projects to create a more scalable, secure, and interconnected blockchain ecosystem.

In this article, we’ll explore the synergy potential between Mitosis and other leading Layer 1 projects like Ethereum, Solana, etc, examining how these collaborations could reshape the future of blockchain technology.

What Makes Mitosis Unique?

Before diving into synergy potential, it’s important to understand what sets Mitosis apart from other blockchain scaling solutions.

At its core, Mitosis is a purpose-built Layer 1 blockchain secured by Ethereum through EigenLayer. Its architecture is designed to serve as the central hub for cross-chain liquidity, enabling sophisticated DeFi applications and innovative financial instruments. The two key components of Mitosis are:

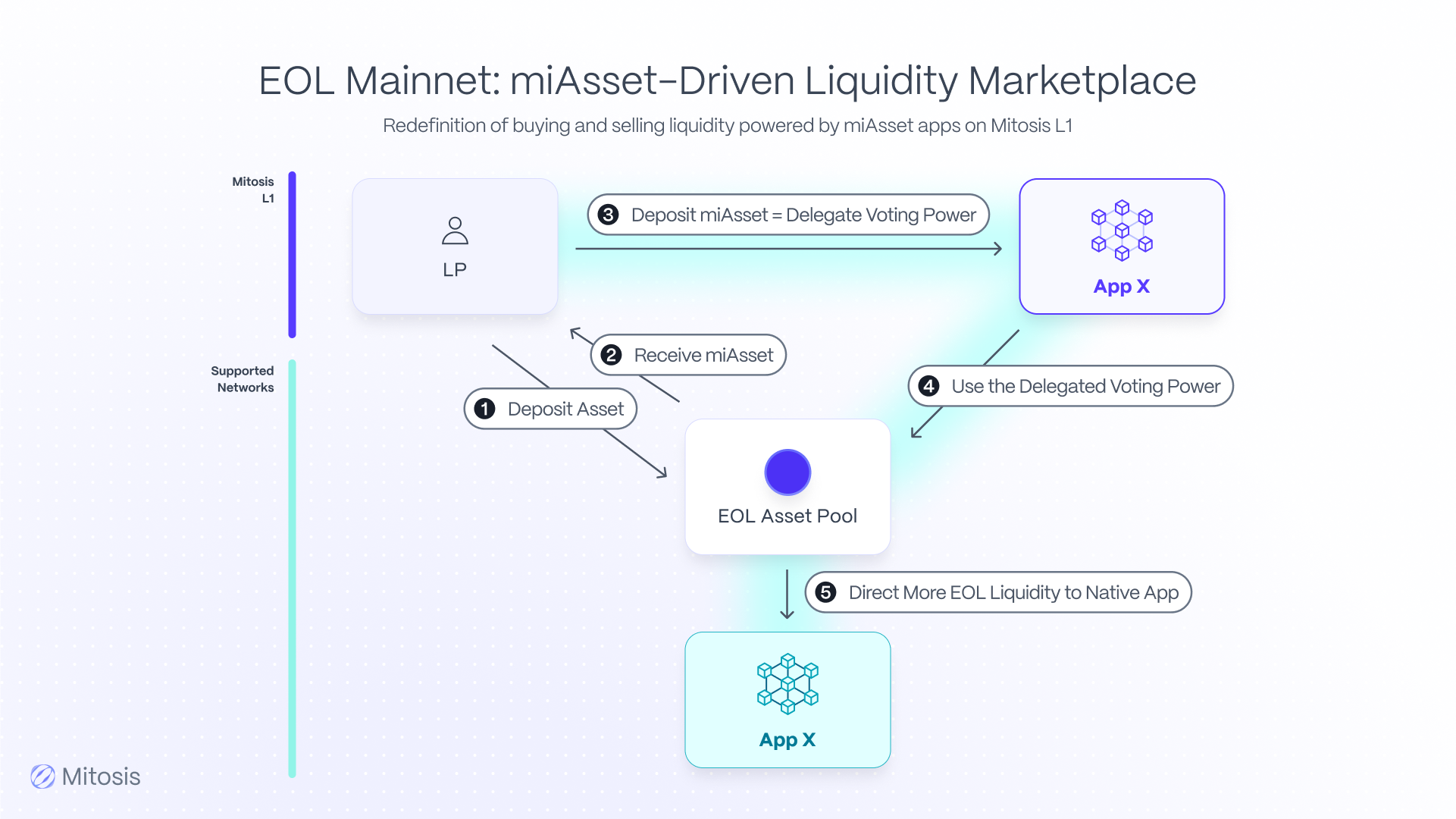

- Ecosystem-Owned Liquidity (EOL): EOL allows liquidity providers to deposit assets into Mitosis Vaults across various chains, converting them into miAssets—yield-bearing tokens that represent shares in the protocol’s total liquidity. Allocation decisions are made collectively through periodic Gauge votes, ensuring transparency and market-driven efficiency.

- Mitosis L1 and miAssets: The Mitosis L1 chain facilitates the conversion of Vanilla Assets (representative assets from various chains) into miAssets. These yield-bearing tokens enable users to participate in governance and earn returns from multi-chain yield strategies, while also serving as building blocks for advanced DeFi applications.

By transforming static deposits into dynamic, yield-generating assets, Mitosis enhances capital efficiency and creates new opportunities for liquidity providers and protocols alike.

Picture a vast ocean, divided into countless isolated lagoons. Each lagoon represents a Layer 1 blockchain—Ethereum, Solana, Avalanche, and other blockchains—teeming with life but cut off from the others. In this metaphor, liquidity is the water that sustains these ecosystems. However, the water in each lagoon is stagnant, trapped by the walls that separate them. Protocols within each lagoon must strike private deals with whales—large liquidity providers—to keep the water flowing. These deals are often opaque, unstable, and exclusionary, leaving smaller participants stranded on the shores.

This is the reality of DeFi today, liquidity is fragmented, and the process of acquiring it is inefficient and inequitable. Mitosis, however, offers a solution: it breaks down the walls between the lagoons, creating a unified ocean where liquidity flows freely and transparently. But how does this work, and why should other Layer 1 projects care?

Layer 1 Projects with Synergy Potential

The integration of Mitosis with other Layer 1 projects offers significant benefits, enabling these ecosystems to leverage unified liquidity while retaining their unique strengths. Below, we examine the synergy potential between Mitosis and several prominent Layer 1 blockchains.

1. Ethereum:

Ethereum, the most secure and widely adopted blockchain, faces scalability challenges that result in high gas fees and network congestion. By integrating with Mitosis, Ethereum can offload liquidity management to the Mitosis L1 chain, which is secured by Ethereum through EigenLayer. This allows Ethereum to maintain its focus on providing a robust security foundation while Mitosis optimizes liquidity allocation across chains.

2. Solana:

Solana is renowned for its high throughput and low transaction costs, but its reliance on a few large liquidity providers raises concerns about centralization. Mitosis can address this by providing Solana with access to a broader, more decentralized liquidity pool. This integration ensures that Solana’s speed and efficiency are complemented by deep, sustainable liquidity, enhancing its overall ecosystem resilience.

3. Avalanche:

Avalanche’s subnets and custom blockchains offer unparalleled scalability, but they often struggle with fragmented liquidity. Mitosis can serve as a unifying layer, enabling seamless liquidity flow across Avalanche’s subnets. This integration enhances interoperability and capital efficiency, allowing Avalanche to fully realize its potential as a scalable, multi-chain ecosystem.

4. Cosmos:

Cosmos, with its Inter-Blockchain Communication (IBC) protocol, is a pioneer in blockchain interoperability. However, maintaining consistent liquidity across its ecosystem remains a challenge. Mitosis can synergize with Cosmos, ensuring that assets can move freely between chains without friction.

The Broader Implications

The synergy between Mitosis and other Layer 1 projects extends beyond technical integration; it represents a fundamental shift in how liquidity is managed and utilized in DeFi. Below are the key implications of this collaboration:

- Increased Capital Efficiency: Mitosis’ miAssets transform passive deposits into active, yield-generating assets. For example, a user’s miETH can earn yields from EOL strategies while also being utilized in lending or liquidity provision on the Mitosis L1 chain. This dual utility maximizes the productive potential of every deposited asset.

- Transparent and Democratic Governance: EOL’s Gauge voting mechanism ensures that liquidity allocation decisions are made collectively by the ecosystem. This replaces opaque private deals with a transparent, market-driven process that aligns the interests of protocols and liquidity providers.

- Scalable Participation: Mitosis’ delegation system allows users to delegate their governance rights to trusted applications, making DeFi participation more accessible and efficient. This unlocks the vast pool of passive liquidity that has remained underutilized in the DeFi ecosystem.

The Future of DeFi: A Unified and Inclusive Ecosystem

The integration of Mitosis with other Layer 1 projects marks a significant step toward a more unified and efficient DeFi ecosystem. By addressing the challenges of fragmented liquidity and opaque governance, Mitosis enables a future where liquidity is no longer a barrier but a bridge to innovation and growth.

As Layer 1 projects embrace Mitosis, they will find themselves part of a larger, more interconnected DeFi landscape. This collaboration fosters transparency, inclusivity, and scalability, paving the way for mass adoption and sustainable growth. Together, Mitosis and its Layer 1 partners can unlock the full potential of decentralized finance, creating a future where liquidity flows freely and efficiently across the entire blockchain ecosystem.

In conclusion, the synergy between Mitosis and other Layer 1 projects represents a transformative opportunity for DeFi. By leveraging Mitosis’ innovative liquidity model, these projects can enhance their ecosystems, drive capital efficiency, and contribute to a more interconnected and resilient blockchain landscape. The future of DeFi is collaborative, and Mitosis is at the forefront of this evolution.

Comments ()