Layer 2 Solutions: Scaling Blockchain for Mass Adoption

Imagine a bustling city where every transaction buying coffee, paying rent, or sending money to a friend requires a notarized document to be hand-delivered across town.

The system works, sure, but it’s slow, expensive, and utterly impractical for a population of millions. Now picture a sleek network of drones zipping above the chaos, delivering those documents in seconds for pennies. That’s the promise of Layer 2 solutions in the world of blockchain game-changing fix to the scalability problem that’s been holding back crypto’s dream of mass adoption.

Blockchain technology, the backbone of cryptocurrencies like Bitcoin and Ethereum, has long been hailed as a revolutionary force. It’s decentralized, secure, and transparent, but there’s a catch: it’s painfully slow and costly when millions try to use it at once. Layer 2 (L2) solutions are the drones in our city analogy innovative technologies built on top of existing blockchains to make them faster, cheaper, and ready for the mainstream. In this deep dive, we’ll unpack what Layer 2 solutions are, why they matter, and how they’re paving the way for a blockchain-powered future. Buckle up; this is going to be a wild ride.

The Blockchain Bottleneck: Why Layer 1 Struggles

To understand Layer 2, we first need to grasp why blockchains often called Layer 1 struggle to scale. Picture a blockchain as a massive, shared ledger where every transaction is recorded in a “block” and linked to the previous one, forming a chain. Miners or validators ensure these transactions are legitimate, but this process is deliberately rigorous to maintain security and decentralization.

Take Ethereum, the world’s second-largest blockchain by market cap. It’s a global computer running smart contract self-executing agreements that power everything from decentralized finance (DeFi) to non-fungible tokens (NFTs). But Ethereum, in its base form, can only process about 15–30 transactions per second (TPS). Compare that to Visa, which handles up to 24,000 TPS, and you see the problem. When demand spikes like during a hot NFT drop or a DeFi boom Ethereum’s network clogs up. Transaction fees, known as “gas,” skyrocket, sometimes costing $50 or more for a single transfer. For buying a $5 coffee? Forget it.

Bitcoin faces similar issues. Its proof-of-work consensus, while secure, limits it to about 7 TPS. These constraints stem from the blockchain trilemma, a concept coined by Ethereum co-founder Vitalik Buterin. The trilemma says a blockchain can only optimize for two of three qualities: security, decentralization, or scalability. Most Layer 1 blockchains prioritize the first two, leaving scalability as the weak link.

Scaling Layer 1 directly isn’t easy. Increasing block sizes or reducing confirmation times risks centralization or security breaches. It’s like trying to widen a highway during rush hour you might cause more chaos than you solve. Enter Layer 2 solutions, which take the pressure off Layer 1 by handling transactions off-chain while still leveraging its security. Think of Layer 1 as the foundation of a skyscraper and Layer 2 as the floors above, where all the action happens.

What Are Layer 2 Solutions?

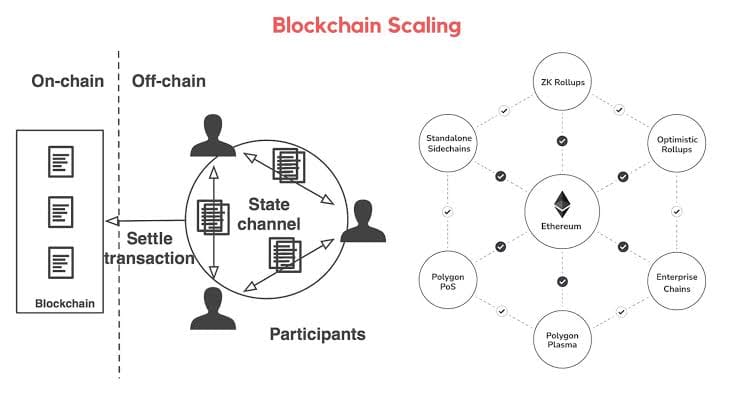

Layer 2 solutions are protocols built on top of a blockchain to boost its throughput and reduce costs without altering the base layer. They process transactions off the main chain, batch them, and periodically settle the results back to Layer 1. This approach keeps the main blockchain lean while enabling thousands—or even millions of transactions per second.

L2 solutions come in various flavors, but they all share a common goal: make blockchain usable for everyday applications. Whether you’re trading tokens, playing a blockchain-based game, or sending micro-payments, Layer 2 ensures it’s fast and cheap while still secure. Let’s explore the main types of Layer 2 solutions reshaping the crypto landscape.

1. Rollups: The Workhorses of Layer 2

Rollups are the rockstars of Layer 2, dominating the Ethereum ecosystem. They “roll up” hundreds or thousands of transactions into a single bundle, process them off-chain, and submit a compressed summary to Layer 1. This slashes costs and boosts speed while inheriting Ethereum’s security.

There are two main types of rollups:

- Optimistic Rollups: These assume transactions are valid by default (hence “optimistic”) and only verify them if challenged. They’re like trusting a friend to pay you back but keeping a receipt just in case. Popular optimistic rollups include Arbitrum and Optimism, which power many DeFi and NFT platforms. Arbitrum, for instance, processed over 1 million transactions daily in early 2025, with fees often under $0.10.

- Zero-Knowledge Rollups (ZK-Rollups): These use cryptographic proofs called zero-knowledge proofs to validate transactions instantly. They’re like showing a bouncer a digital ID that proves you’re over 21 without revealing your birthdate. ZK-Rollups, such as zkSync and StarkNet, are more complex but offer higher privacy and efficiency. StarkNet’s STARK technology, for example, can handle thousands of TPS with near-instant finality.

Rollups are versatile, supporting everything from token transfers to complex smart contracts in Decentralized finance. They’ve become the go-to for DeFi apps like Uniswap and Aave, which now run smoothly on Arbitrum or Optimism, saving users from Ethereum’s gas woes.

2. State Channels: Micro-Transactions Galore

State channels are like opening a private tabs at a bar. Instead of paying for each drink individually, you and the bartender track your tab off-chain and settle the total when you’re done. State channels let two or more parties conduct unlimited transactions privately, only recording the final state on the blockchain.

The Lightning Network, Bitcoin’s flagship Layer 2, is a state channel. It enables instant Bitcoin payments for fractions of a cent, perfect for buying that $5 coffee. Ethereum’s Raiden Network works similarly. State channels shine for microtransactions, like streaming payments for music or pay-per-second video, but they’re less suited for complex smart contracts.

3. Plasma: The OG Scalability Solution

Plasma, proposed by Ethereum’s co-founder Vitalik Buterin and Joseph Poon in 2017, creates “child chains” linked to the main Ethereum chain. These chains handle transactions independently and periodically submit summaries to Layer 1. Plasma is like a franchise model: each child chain runs its own store but reports back to the corporate HQ (Ethereum) for oversight.

While Plasma inspired early projects like OMG Network, it’s been largely eclipsed by rollups due to challenges like long withdrawal times periods. Still, it’s worth mentioning for its historical significance and niche use cases in high-throughput apps.

4. Sidechains: Parallel Universes

Sidechains are independent blockchains pegged to a Layer 1 blockchain, with their own rules and consensus mechanisms. They’re like a separate city with its own traffic laws but connected by a bridge to the main hub. Polygon’s Proof-of-Stake chain, for example, is a sidechain to Ethereum, offering low-cost transactions with its own security trade-offs.

Sidechains are fast and flexible but don’t inherit Layer 1’s full security, making them ideal for gaming or testing apps. Polygon, for instance, hosts thousands of daily transactions for games like Axie Infinity and Decentraland.

Why Layer 2 Is the Key to Mass Adoption

Layer 2 solutions aren’t just technical upgrades they’re the gateway to making blockchain a part of everyday life. Here’s why they’re critical for mass adoption:

1. Affordable Transactions

High fees are blockchain’s biggest barrier. In 2021, Ethereum gas fees hit absurd levels, pricing out small transactions. Layer 2025, Layer 2s like Arbitrum and zkSync offer fees under $0.05, even during network peaks. This makes blockchain viable for micropayments, remittances, or even in-game purchases, opening doors to billions of users in regions with lower purchasing power.

2. Lightning-Fast Speeds

Speed matters. ZK-Rollups can hit 2,000+ TPS today, with projects like zkSync eyeing 100,000 TPS by 2026. This rivals traditional payment systems like PayPal, enabling real-time experiences like decentralized social media or instant DeFi trades.

1. User-Friendly Experiences

Layer 2s abstract away complexity. Wallet apps like MetaMask now seamlessly switch to Arbitrum or Polygon, and users barely notice. New tools like social logins (e.g., “Log in with TwitterX”) make onboarding effortless, turning crypto from geeky to grandma-friendly.

4. Environmental Benefits

Proof-of-Work-workchains like Bitcoin guzzle energy, drawing flak from environmentalists. Layer 2s reduce the number of transactions hitting Layer 1, cutting energy use. Ethereum’s 2022 Merge to proof-of-Stake proof-of-stake, combined with rollups, slashed its carbon footprint by 99%.9%. Layer 2s amplify this, making blockchain greener.

5. Enabling Web3’s Vision

Web3 a decentralized internet where users own their data relies on blockchain. But without scalable infrastructure, it’s a pipe dream. Layer 2s power Web3 apps like Lens Protocol (social media) and The Sandbox (metaverse), delivering smooth, affordable experiences that rival Web2 giants like Instagram or Roblox.

Real-World Impact: Layer 2 in Action

Layer 2 isn’t just hype it’s already transforming industries. Let’s look at a few examples:

- DeFi on Arbitrum: Uniswap, the leading decentralized exchange, thrives on Arbitrum, processing $1 billion in trades daily with fees under $0.10. This makes yield farming and token swapping accessible to retail investors, not just whales.

- Gaming on Polygon: Games like Axie Infinity and Sunflower Land use Polygon’s low-cost transactions to let players mint NFTs or trade in-game assets instantly. Polygon processed 2.5 billion gaming transactions in 2024 alone.

- Payments via Lightning Network: In El Salvador, where Bitcoin’s legal tender, the Lightning Network powers instant Bitcoin payments at Starbucks and local markets, proving crypto can work for daily purchases.

- NFT Marketplaces on zkSync: Platforms like Zora use zkSync to mint NFTs for pennies, democratizing digital art for creators in Africa and Asia, where high Ethereum fees were once a dealbreaker.

These success stories show Layer 2 bridging the gap between blockchain’s potential and real-world utility.

Challenges and Trade-Offs

Layer 2 isn’t a magic wand. Challenges remain:

- Complexity: Developers must build apps for specific L2 protocols, which can fragment ecosystems. A dApp on Arbitrum might not work on zkSync without tweaks.

- Security Trade-Offs: While rollups inherit Layer 1 security, sidechains like Polygon rely on their own validators, introducing risks. In 2022, Polygon’s bridge was exploited for $2M, highlighting vulnerabilities.

- User Experience: Despite improvements, wallets and bridges can still confuse newbies. Accidentally sending funds to the wrong chain is a common headache.

- Liquidity Fragmentation: Splitting assets across multiple L2s can dilute liquidity, making DeFi less efficient. Cross-chain bridges aim to solve this but add complexity.

- Centralization Risks: Some L2s rely on centralized operators (e.g., Arbitrum’s Arbitrum’s sequencer) in their early stages, raising decentralization concerns. Most plan to decentralize over time.

Despite these hurdles, the benefits far outweigh the growing pains. Projects are iterating fast, and tools like chain-agnostic wallets are smoothing the edges.

The Future of Layer 2: What’s Next?

Layer 2 is just the beginning started. Here’s what’s on the horizon:

- ZK-Rollup Dominance: Advances in zero-knowledge proofs will make ZK-rollups faster and cheaper. StarkNet’s 2025 roadmap promises 10,000 TPS, rivaling centralized systems.

- Interoperability: Protocols like LayerZero and Axelar are building cross-chain bridges to unite L2 ecosystems, letting users hop between Arbitrum, Optimism, and Polygon seamlessly.

- AI Integration: AI-driven optimizations could make L2 protocols smarter, predicting congestion to minimize fees or automating smart contract audits.

- Mainstream Adoption: By 2026, expect wallets to feel like Venmo, with L2s powering apps you didn’t even know were blockchain-based. Starbucks might accept Lightning payments globally; your social media likes might earn micro-tokens on zkSync.

- Conclusion: The Road to a Billion Users

Layer 2 solutions are the unsung heroes of blockchain toward mass adoption. They’re turning clunky, expensive networks into sleek, user-friendly platforms that can handle the world’s transactions without breaking a sweat. From DeFi to gaming to micropayments, L2s are unlocking use cases that make blockchain as indispensable as the internet.

The journey isn’t over. Challenges like interoperability, security, and user education remain, but the trajectory is clear: Layer 2 is blockchain’s ticket to the big leagues. As Vitalik Buterin once quipped, “If you’re not impressed by a blockchain that can handle a million transactions per second, you’re not paying attention.” Layer 2 is making that vision real, one rollup at a time.

So, next time you mint an NFT for pennies or send Bitcoin instantly for a friend, tip your hat to Layer 2. It’s the drone zipping through the blockchain city, delivering the future we’ve all been waiting for.

Comments ()