Layer 2 Token Launches: Speed, Scalability, and Market Adoption Explained

The blockchain world is buzzing with innovation, and at the heart of this transformation are Layer 2 (L2) networks. As blockchain adoption skyrockets, these scaling solutions have become the go-to launchpads for new tokens, offering faster transactions, lower fees, and seamless scalability without compromising the security of their underlying Layer 1 (L1) blockchains, like Ethereum or Bitcoin. Whether you’re a DeFi protocol, an NFT project, or a social app, launching a token on a Layer 2 network is a strategic move that unlocks new possibilities for user growth, liquidity, and market reach. In this article, we’ll explore why Layer 2 solutions are dominating token launches in 2025, how their infrastructure supports high-performance rollouts, and what successful projects like Velodrome, Friend.tech, and zkSync Era reveal about getting it right. Buckle up for a deep dive into the world of Layer 2 token launches and why they’re shaping the future of crypto.

Why Layer 2 for Token Launches?

The crypto landscape has evolved dramatically since Bitcoin’s debut in 2008. While Layer 1 blockchains like Ethereum and Bitcoin laid the foundation for decentralized systems, their scalability limitations–high fees and slow transaction speeds—have become glaring bottlenecks. Bitcoin processes just 7 transactions per second (TPS), and Ethereum’s Layer 1 manages around 15 TPS, compared to Visa’s 20,000 TPS. These constraints make it tough for dApps to handle high transaction volumes, especially during market surges when gas fees can soar into the hundreds of dollars. Enter Layer 2 solutions, which process transactions off-chain while leveraging the security of the L1 blockchain for final settlement. This approach slashes costs, boosts speed, and makes projects more accessible to users and developers alike.

For token launches, Layer 2 networks are a game-changer. They offer:

- Lower Transaction Fees: By processing transactions off-chain, L2s drastically reduce gas costs, making it affordable for users to interact with new tokens.

- Faster Transactions: With TPS in the thousands, L2s enable near-instant transactions, ideal for DeFi, gaming, or social apps.

- Scalability: L2s handle high transaction volumes without clogging the main chain, ensuring smooth user experiences.

- Security: By settling transactions on the L1 blockchain, L2s inherit the robust security of networks like Ethereum or Bitcoin.

These advantages make Layer 2 networks the ideal platform for launching tokens, whether for DeFi protocols, NFT marketplaces, or Web3 applications. But not all L2s are created equal, and understanding their differences is key to choosing the right one for a token launch.

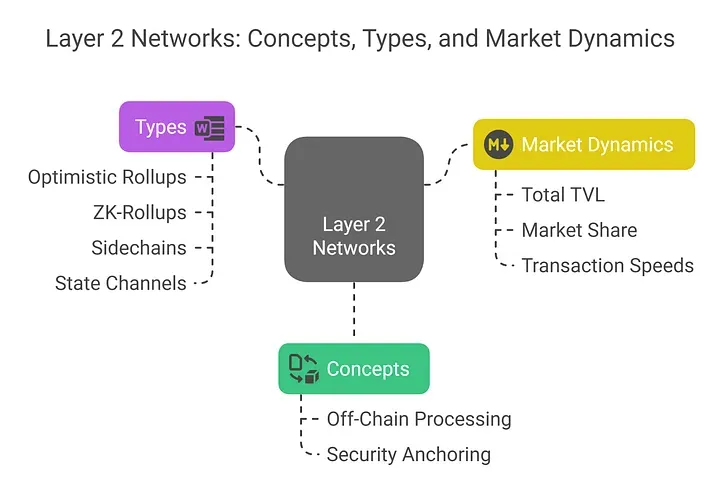

Types of Layer 2 Solutions

Layer 2 solutions come in various flavors, each addressing scalability and cost-efficiency in unique ways. Here’s a breakdown of the main types and how they support token launches:

• Optimistic Rollups

Optimistic Rollups, like Arbitrum and Optimism, assume transactions are valid unless challenged, offering high compatibility with Ethereum’s Virtual Machine (EVM). This makes them a top choice for DeFi protocols and governance tokens, as developers can port Ethereum-based dApps with minimal changes. For example, Arbitrum’s ARB token, launched in 2023, powers governance and transaction fees, benefiting from the platform’s ability to process thousands of TPS at a fraction of Ethereum’s gas costs. Optimistic Rollups are user-friendly but have slower finality due to a challenge period, which can delay withdrawals.

• Zero-Knowledge Rollups (ZK-Rollups)

ZK-Rollups, such as zkSync and Starknet, use cryptographic zero-knowledge proofs to validate batches of transactions, offering faster finality and enhanced security. They’re ideal for projects requiring high throughput and privacy, like NFT marketplaces or gaming dApps. zkSync Era, for instance, supports EVM-compatible smart contracts, making it a hotspot for token launches like ZKS, which saw significant adoption in 2024 due to its low-cost, high-speed environment. However, ZK-Rollups are more complex to develop, which can pose challenges for smaller teams.

• Sidechains

Sidechains, like Polygon’s PoS chain, operate as independent blockchains linked to the main chain via bridges. They offer flexibility and high throughput, making them popular for projects like Polygon’s POL token, which supports governance and staking. Sidechains are less dependent on L1 for every transaction, but their security relies on the sidechain’s consensus mechanism, which may not match the main chain’s robustness.

• State Channels

State Channels, like Bitcoin’s Lightning Network, enable off-chain transactions between parties, settling only the final state on-chain. They’re perfect for microtransactions, such as in-game purchases or social tipping, but less suited for complex smart contract-based tokens due to limited functionality.

Each type of L2 solution caters to specific needs, from DeFi to gaming to SocialFi. Choosing the right one depends on a project’s goals, technical requirements, and target audience.

The Infrastructure Behind Successful Token Launches

Launching a token on a Layer 2 network requires a robust infrastructure to ensure speed, scalability, and user adoption. Here’s how L2s make it happen:

• Scalable Transaction Processing

L2s bundle thousands of transactions into a single batch (or “rollup”) before submitting them to the L1 blockchain, reducing congestion and gas fees. For example, Optimism’s OP Stack processes up to 4,000 TPS, enabling projects like Velodrome a DeFi protocol to handle high-frequency trading without breaking the bank. This scalability is critical for token launches, as it ensures users can interact with the token (e.g., trading, staking, or minting) without delays or exorbitant costs.

• EVM Compatibility

Many L2s, like Arbitrum and zkSync, are EVM-compatible, allowing developers to reuse Ethereum’s tools and codebases. This lowers the barrier to entry for new projects, as they can launch tokens without rewriting smart contracts from scratch. For instance, Friend.tech, a SocialFi platform, leveraged Optimism’s EVM compatibility to launch its token, enabling seamless integration with Ethereum-based wallets and dApps.

• Interoperability

L2s often include bridges for cross-chain asset transfers, allowing tokens to move between Ethereum, Solana, or other chains. Polygon’s cross-chain messaging protocol, for example, enables atomic swaps, making its POL token a hub for DeFi and NFT ecosystems. Interoperability attracts liquidity and users from multiple chains, boosting a token’s market reach.

• Governance and Community

Many L2 tokens, like ARB and MNT, double as governance tokens, empowering holders to vote on protocol upgrades. This fosters community engagement and aligns incentives, driving adoption. Mantle’s modular structure, for instance, allows MNT holders to govern a network tailored for gaming and metaverse projects, creating a vibrant ecosystem.

Case Studies: Successful Layer 2 Token Launches

Let’s look at three projects that nailed their Layer 2 token launches, showcasing the power of L2 infrastructure:

• Velodrome (Optimism)

Velodrome, a decentralized exchange on Optimism, launched its VELO token in 2022 to incentivize liquidity providers and governance. By leveraging Optimism’s low-cost, high-speed rollups, Velodrome offered traders near-instant swaps at minimal fees, attracting over $100 million in total value locked (TVL) within months. The token’s success came from its alignment with Optimism’s ecosystem, which provided a scalable, EVM-compatible environment for DeFi. Velodrome’s governance model, where VELO holders vote on fee distribution, further drove community adoption, proving that L2s can create thriving token ecosystems.

• Friend.tech (Optimism)

Friend.tech, a SocialFi platform, launched its token on Optimism in 2023, capitalizing on the network’s low fees and fast transactions to power decentralized social media. Users could buy “keys” (tokens) tied to creators’ profiles, enabling monetized interactions. Optimism’s EVM compatibility allowed Friend.tech to integrate with Ethereum wallets, while its high TPS supported real-time engagement. The token launch saw massive hype, with daily active users spiking to 50,000, showing how L2s can enable innovative use cases beyond traditional finance.

• zkSync Era (ZK-Rollup)

zkSync Era’s ZKS token, launched in 2024, powered a scalable, EVM-compatible ZK-Rollup network. With a focus on DeFi and NFT applications, zkSync Era offered sub-second transaction finality and gas fees as low as $0.01. The ZKS token, used for governance and staking, attracted developers building high-throughput dApps, leading to a TVL of $500 million by mid-2025. zkSync’s success highlights the potential of ZK-Rollups for token launches requiring speed, security, and scalability.

These case studies show that L2s provide the infrastructure for tokens to thrive, whether through low costs, fast transactions, or community-driven governance.

Challenges and Risks of Layer 2 Token Launches

While Layer 2 networks offer immense benefits, they’re not without challenges. Here are some hurdles projects face when launching tokens on L2s:

• Centralization Risks

Some L2s, like sidechains, rely on centralized mechanisms for consensus or bridging, which can undermine decentralization. For example, early criticism of Polygon’s PoS chain centered on its validator set, though upgrades to Polygon 2.0 have addressed this with decentralized governance via POL tokens.

• Bridge Security

Bridges connecting L2s to L1s are prime targets for hackers. Billions have been lost to bridge exploits, as seen in cross-chain attacks in 2022 and 2023. Projects launching tokens must ensure robust bridge security to protect user funds.

• Fragmented Ecosystems

L2s can operate as isolated silos, complicating interoperability. For instance, a token launched on Arbitrum may struggle to interact with Solana-based dApps without complex bridging solutions. Projects like LayerZero aim to solve this with cross-chain protocols, but fragmentation remains a challenge.

• Adoption Barriers

While L2s reduce fees, user adoption can lag due to technical complexity. Casual users may struggle with setting up L2 wallets or navigating bridges, as seen with Bitcoin’s Lightning Network. Projects must prioritize user-friendly interfaces to drive mainstream adoption.

• Market Volatility

L2 tokens, like IMX or OP, have faced significant price volatility in 2024, with some losing over 60% of their year-to-date highs. Market corrections and bearish trends can dampen enthusiasm for new token launches, requiring projects to time their releases carefully.

The Future of Layer 2 Token Launches

As we look to 2025 and beyond, Layer 2 networks are set to play a pivotal role in the crypto ecosystem. The rise of real-world asset (RWA) tokenization, NFTs, and DeFi will drive demand for scalable, cost-effective platforms. Here’s what’s on the horizon:

• Technological Advancements

Innovations like Starknet’s staking mechanism and Stacks’ Nakamoto upgrade will enhance L2 performance. For example, Stacks aims to decouple its block production from Bitcoin’s, solving congestion issues and making STX a more attractive token for DeFi and NFT launches.

• Mainstream Adoption

With over 500 million crypto users in 2024 and projections of 1 billion by 2030, L2s will be critical for onboarding the next wave of users. Projects like Polygon, with 220 million unique addresses and 2.45 billion transactions, are already paving the way for mass adoption.

• Integration with Traditional Finance

L2s are bridging crypto with traditional finance. Initiatives like IOVLabs’ $2.5 million grant program for Rootstock-based DeFi projects show how Bitcoin L2s can support financial inclusion. Tokens launched on these networks could power new fintech products, from tokenized bonds to micro-lending.

• Layer 3 and Beyond

The emergence of Layer 3 solutions, built on top of L2s, will further enhance scalability and application-specific use cases. For example, a Layer 3 gaming dApp could leverage Immutable’s zkEVM for zero-gas NFT trades, creating a seamless experience for players. These advancements will make L2 token launches even more versatile.

Conclusion

Layer 2 networks are rewriting the rules of token launches, offering a potent mix of speed, scalability, and cost-efficiency that’s hard to beat. By processing transactions off-chain while leveraging the security of Layer 1 blockchains, L2s like Arbitrum, Optimism, and zkSync Era are empowering projects to reach new heights. From Velodrome’s DeFi dominance to Friend.tech’s SocialFi innovation, these platforms show how L2s can turn a token launch into a market sensation.

But success isn’t guaranteed. Projects must navigate challenges like bridge security, ecosystem fragmentation, and market volatility to stand out. Choosing the right L2 whether an Optimistic Rollup for DeFi, a ZK-Rollup for gaming, or a sidechain for interoperability—is critical to aligning with a project’s goals. As blockchain adoption accelerates, Layer 2 networks will remain the backbone of the next generation of tokens, driving innovation and bringing crypto closer to mainstream use.

For developers, investors, and enthusiasts, the message is clear: Layer 2 is where the action is. Whether you’re launching the next big DeFi protocol or building a decentralized social app, L2s offer the tools to make it happen faster, cheaper, and at scale. As we move deeper into 2025, keep an eye on these networks and their tokens. They’re not just scaling blockchains—they’re scaling the future of decentralized innovation.

Comments ()