Legacy vs. SegWit: Technical Evolution or Preparation for a Big Sale

Since the introduction of the SegWit (Segregated Witness) update to the Bitcoin network in 2017, the crypto community has been debating whether to switch from the outdated Legacy address format to the more modern SegWit. Interest in this debate has increased in recent months, with a surge in activity on old addresses being recorded in the blockchain, and analysts talking about the possible sale of accumulated bitcoins. What is actually happening: a simple technical migration or a harbinger of a large-scale exit of major players?

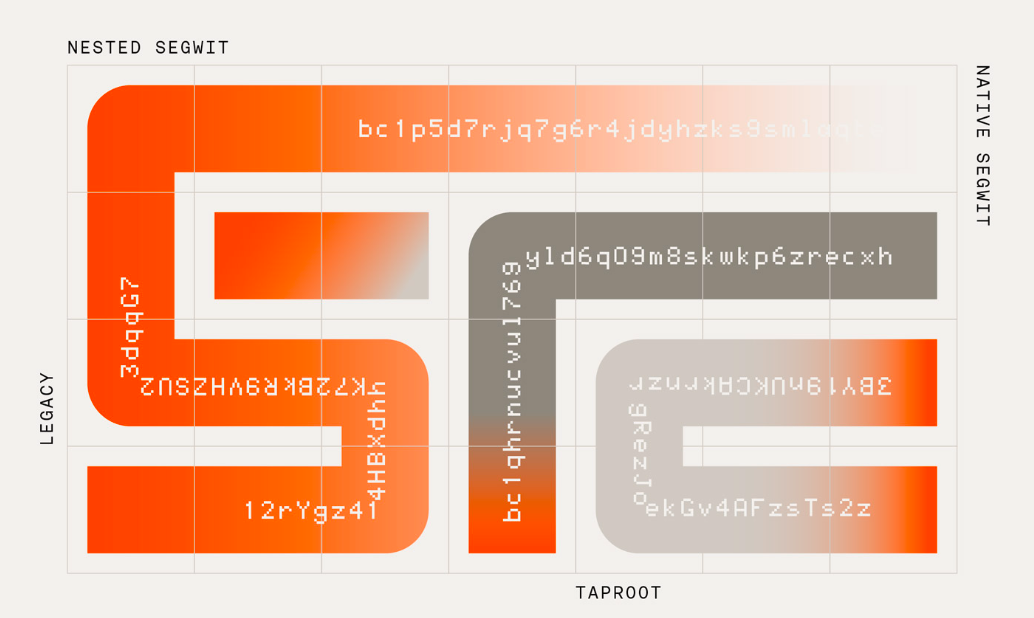

What is Legacy and SegWit?

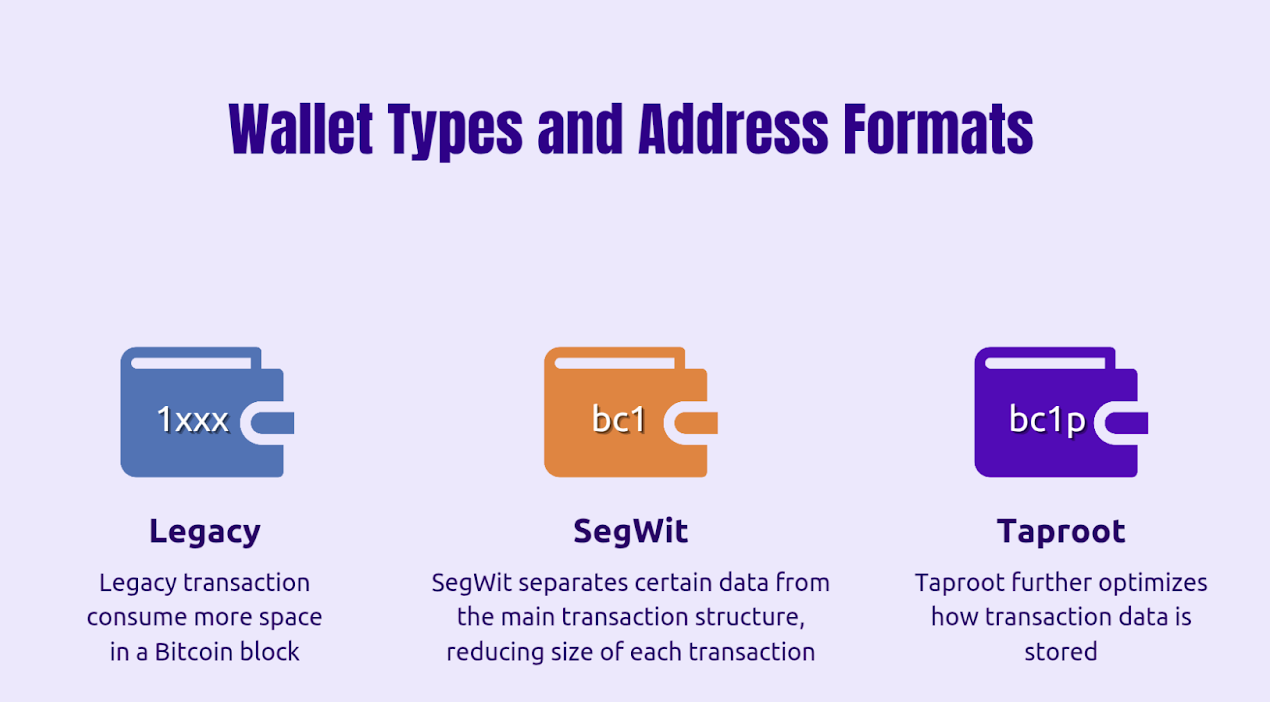

Legacy (P2PKH) is the original Bitcoin address format, starting with "1". It has been used since the network launched in 2009.

SegWit (P2SH, bech32) is an improvement to the protocol, the purpose of which was to increase network throughput and reduce fees. bech32 addresses begin with "bc1".

The difference between them lies in the transaction structure: SegWit moves signatures (witness data) outside the main block, thereby freeing up space. This allows more transactions to be carried out for a lower fee.

Comparison Between Legacy and SegWit Address Formats

|

Feature |

Legacy (P2PKH) |

SegWit (P2SH / bech32) |

|

Address

Prefix |

Starts

with 1 |

Starts

with 3 (P2SH) or bc1 (bech32) |

|

Introduced

in |

2009 |

2017 |

|

Transaction

Size |

Larger |

Smaller |

|

Transaction

Fee |

Higher |

Lower |

|

Adoption

Level |

Declining |

Increasing |

|

Compatibility |

Universally

supported |

Some

older systems may not support |

|

Security

Benefits |

Standard |

Better

protection against malleability |

|

Block

Space Efficiency |

Lower |

Higher |

|

Taproot

Compatible |

No |

Yes

(for bech32 only) |

Why SegWit hasn't completely replaced Legacy?

Despite the obvious advantages of SegWit, mass migration from Legacy did not happen immediately. The reasons include:

1. Technical inertia - many wallets, exchanges and custodial services were slow to adapt;

2. Distrust of changes - part of the community was afraid of forks and changes in consensus;

3. Financial caution - large Bitcoin holders preferred not to move coins stored for years.

But time goes by, and now even the oldest players are forced to reconsider their asset storage and transfer strategy.

What's happening now: mass migration or an alarming signal?

Over the past year, analytical platforms have begun to record a sharp increase in transactions coming from Legacy addresses. Some of them have been activated for the first time in 5-10 years. The reasons for this may be as follows:

Technical optimization

Owners of large wallets simply transfer funds to SegWit addresses to save on fees and speed up transactions. This is especially relevant under high network loads.

Updating custody solutions

Exchanges and funds are switching to more modern security protocols, which requires migration of funds.

Preparing for implementation

Amid unstable macroeconomic factors and a falling Bitcoin exchange rate, some holders may use migration as an opportunity to quietly "unpack" old stocks.

Possible Interpretations of Legacy Wallet Movements

|

Observation |

Possible Reason |

Market Implication |

|

Old

wallets becoming active |

Wallet

maintenance or migration |

Neutral,

but raises curiosity |

|

High-value

transactions with high fees |

Urgent

processing or OTC deals |

Could

hint at large institutional moves |

|

Coins

moved to SegWit addresses |

Technical

upgrade for lower fees |

Bullish

sign for infrastructure modernization |

|

Coins

moved to exchanges |

Preparation

to sell |

Bearish

sentiment if trend continues |

|

Consolidation

into fewer addresses |

Portfolio

optimization or reorganization |

Neutral

unless followed by exchange deposits |

|

Coin

mixing or privacy-enhancing patterns |

Security

or anonymity reasons |

May

spark FUD (fear, uncertainty, doubt) |

Is this really a harbinger of implementation?

There is no clear answer. Moving funds is not yet a sale. However, history suggests that every time old wallets start to move, the market reacts cautiously. Especially when it comes to the so-called "whales" holding tens of thousands of BTC.

Possible interpretations:

1. Reassessment of strategy — hedge funds that received BTC in 2014-2016 may be ready to take profits or reduce their share in the portfolio.

2. Market psychology — even rumors of movement of old coins can provoke anxiety and lead to short-term sell-offs.

3. Institutional over-the-counter (OTC) trades — often large movements occur within private trades, not directly affecting market quotes, but creating background anxiety.

Technical side: what does the blockchain say?

Analysis shows that:

· The number of transactions with high commissions has increased — a sign of urgency;

· A new exit structure is being used — possible preparation for asset splitting between wallets;

· Addresses with "sleep coins" have become more active — crypto assets that have not been touched since 2010-2013.

This indicates a targeted preparation: either for consolidation or for sale.

Conclusion: evolution or implementation?

The transition from Legacy to SegWit is a logical and expected step in the development of the Bitcoin infrastructure. But in a world where the movement of every major transaction is tracked in real time, even a technical upgrade becomes a reason for market panic.

Today's events may be the beginning of a large-scale migration to a more efficient protocol. Or they may be a prelude to sales against the backdrop of market fatigue. In any case, careful monitoring of the blockchain remains a vital tool for all participants in the crypto economy.

Comments ()