Let’s Talk FDV: Breaking Down MorphLayer’s Valuation in the Matrix Vaults Campaign

Over the past few weeks, there’s been a lot of chatter in the Mitosis Discord about the FDV (Fully Diluted Valuation) of projects taking part in the Matrix Vaults campaigns. Some of it sounds like genuine curiosity, but a lot feels like unnecessary pessimism — or even straight-up FUD trying to distract us from the solid progress the team’s been making.

One thing that really stood out? People tossing around absurdly low FDV numbers— some even lower than the total fundraising of the projects. Seriously, how does that make sense? Imagine a VC investing $20M for a slice of tokens when the entire FDV is projected at just $15M. Doesn’t add up.

So let’s cut through the noise and take a good look at one project in particular: Morph Network and their Matrix Vaults campaign — ZOOTOSIS.

Why Predicting FDV Is No Walk in the Park

Let’s be real: projecting a project’s FDV before launch is a tricky game. It doesn’t matter how long you’ve been in crypto, there are way too many variables to nail down a precise number. That said, we can build a reasonable framework using public data from other Ethereum Layer 2s.

Here are the main indicators worth watching:

- Current FDV

- FDV at TGE (Token Generation Event)

- TVS (Total Value Secured – similar to TVL)

- FDV/TVS Ratio

- Fundraising Amount

Sure, there are many important metrics to consider — like competitive advantages, tech stack, ecosystem size, DeFi activity, daily transactions, and many others — but for a high-level view, this is more than enough.

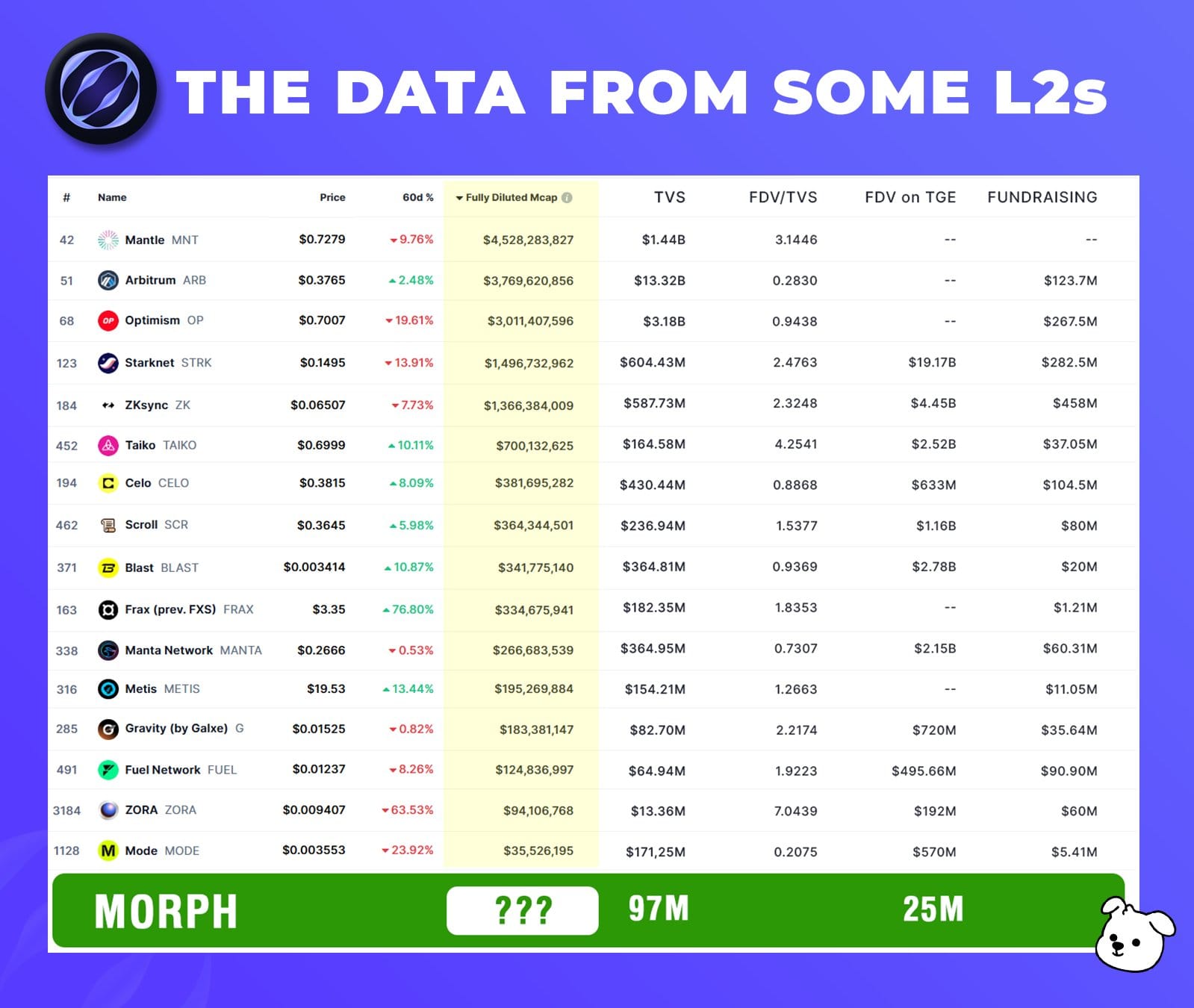

What the Data Tells Us

I pulled data from some of the top Ethereum L2s to compare, focusing on those with the highest TVS. Some key points about the data:

- Sorted by TVS, highest to lowest;

- Only included major players—there are plenty more L2s out there;

- Skipped FDV at TGE for projects that launched over 18 months ago;

- FDV at TGE was calculated using the daily close price, not those early 15-minute spikes when DEX liquidity was a mess (e.g., STRK was valued at $1.917 for this analysis, even though some sold over $4).

Here’s what stands out:

- Fundraising and TVS are important, but not everything;

- Projects and VCs often inflate token prices at TGE, but market conditions matter too;

- Most importantly: no project on the list had an FDV lower than its fundraising. So no, Morph’s FDV isn’t going to be $20M.

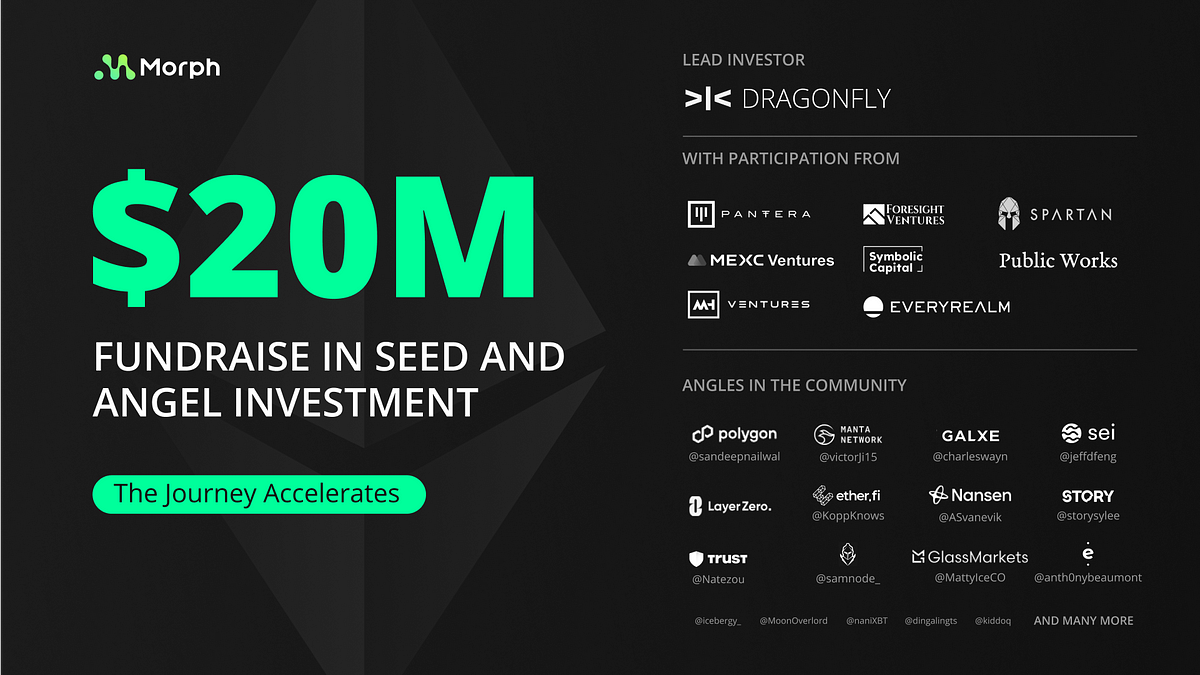

Morph Network announced two investment rounds

Seed Round | 20 Mar 2024 | Raised $20M | Lead by DragonFly Capital

Pre-Seed Round | 11 Dec 2023 | Raised $5M | Lead by Bitget

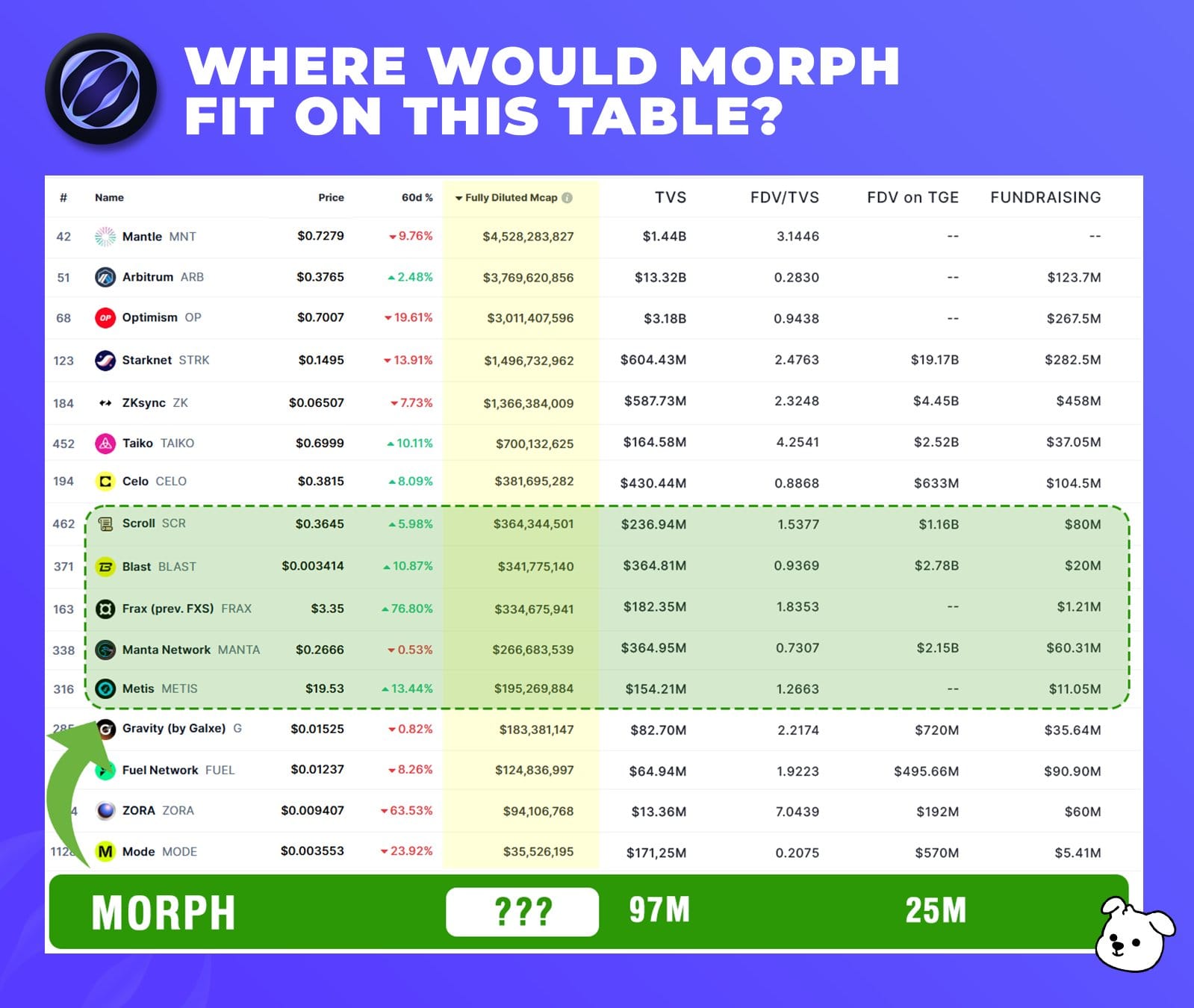

So What’s a Realistic FDV for Morph?

If Morph launched today, I’d guess the FDV would fall somewhere between $250M and $400M. Over time, like most L2s, it would likely taper down to somewhere around $100M to $150M.

Of course, this all depends on the market. If a bull run kicks off and the market 4x’s before Morph’s TGE? That FDV could shoot much higher.

On the flip side, if the market crashes or Morph’s network activity drops, FDV would slide accordingly.

What Does This Mean for Zootosis Participants?

Let’s say Morph comes out the gate with a $350M FDV. If 1% of that is allocated to Zootosis depositors via the Mitosis & Morph Network campaign, we’re talking about up to $3.5M in $Morph tokens going to participants.

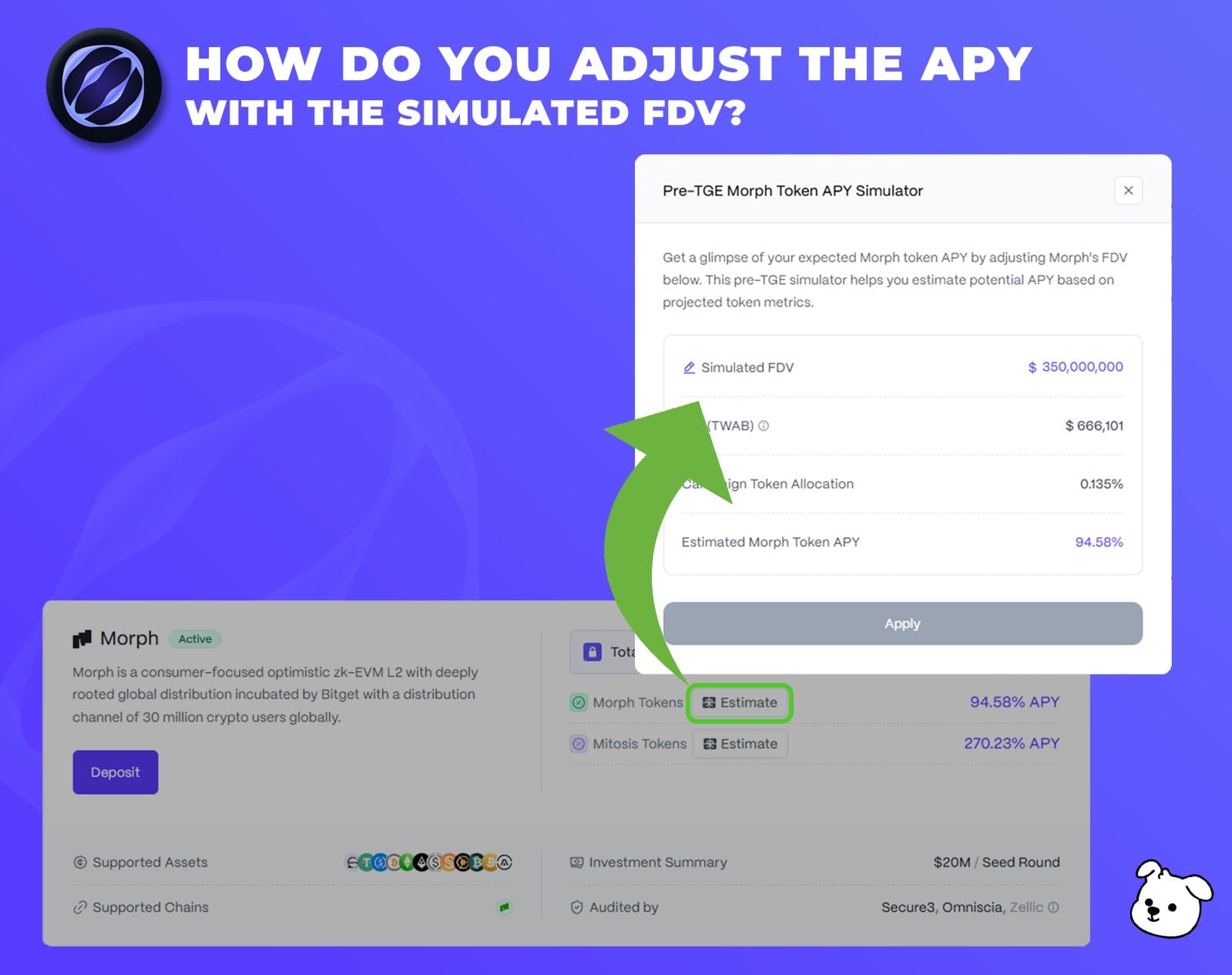

Even better: the Mitosis dashboard lets you simulate different FDV values to see how APY shifts.

- At a $350M FDV? You’re looking at around 95% APY.

- Feeling conservative and setting FDV to $200M? Still a sweet 54% APY.

Just keep in mind: as the TVL campaign grows and more people join in, the reward pie gets sliced into more pieces. So early birds really do get the best yields.

I jumped in on Day 1, and I’m adding more liquidity to this wallet to boost my deposits. Don’t sleep on this one.

Got Questions?

If you’re still unclear on how the Mitosis & Morph Network campaign works, I’ve got you covered.

Check out this full breakdown:

Day 5 of grinding with @MitosisOrg: Time to deposit into the Zootosis Matrix Vault Campaign

— febarce | DeFi 🍳🧬 (@primesoft_mkt) May 15, 2025

If you’re not up to speed, Mitosis just dropped their latest Matrix Vaults Campaign in partnership with @MorphLayer

By joining this one, you can grab up to 1% of the total $MITO supply… pic.twitter.com/nKtQJEESQa

Want an FDV Breakdown for Mitosis Too?

Now I’m wondering… should we run the same analysis for Mitosis own FDV?

The dashboard defaults to a $1B FDV for all campaigns.

Too low? Too ambitious? I’d love to hear your thoughts.

Drop a comment and if there’s interest, I’ll dive into the numbers and build out a full study just like this one.

Did you enjoy this content?

If it helped you in any way, I’d really appreciate your support!

Feel free to connect with me on Twitter/X, and if you’d like to send a Praise, my Discord is open too. 🙏

Thanks in advance for your trust and support — it means a lot! 🙌

Follow me on Twitter/X: febarce |DeFi

My Dircord: febarce |DeFi

Check out my other articles

Comments ()