Leveraging miAssets for Dynamic Trading Portfolios

The year is 2025, and traders are increasingly seeking tools that offer flexibility, capital efficiency, and multi-chain exposure. Mitosis, a pioneering Layer 1 blockchain, introduces miAssets, a tokenized representation of liquidity positions within its Ecosystem-Owned Liquidity (EOL) model. These miAssets empower traders to construct dynamic, cross-chain portfolios that adapt to market conditions, maximize yields, and maintain liquidity for opportunistic trades.

Mitosis is designed as an Ecosystem-Owned Liquidity (EOL) layer 1 blockchain, aiming to tokenize liquidity positions and enable seamless integration into its ecosystem. The EOL model redefines the relationship between liquidity providers (LPs) and protocols, maximizing LP capital efficiency in a multi-chain DeFi setting. It involves EOL Vaults on each network and the Mitosis L1 chain, where LPs deposit assets and receive miAssets in return. These miAssets are yield-bearing tokens that represent their share of the protocol’s overall liquidity, accruing yields from cross-chain activities in a rebase format, meaning the balance automatically increases over time without active management.

The EOL model is governed by the community, with miAsset holders participating in periodic gauge votes to determine liquidity allocation across chains and dApps. This governance-driven approach contrasts with traditional DeFi, where liquidity is often managed centrally or locked in isolated pools, limiting flexibility.

What Are miAssets?

miAssets are central to the EOL model, minted at a 1:1 ratio when users deposit assets, such as weETH, into Mitosis Vaults. They signify ownership stakes and generate returns through staking, lending, and participating in liquidity pools. Key features include:

- Yield-Bearing: Fees from cross-chain transactions accumulate in Mitosis Vaults, distributed to miAsset holders, providing passive income.

- Programmable and Composable: miAssets can be used in various DeFi applications on Mitosis’s Layer 1 or compatible chains, such as lending, borrowing, or yield farming, while retaining liquidity positions.

- Cross-Chain Mobility: Backed by permissionless interoperability via Hyperlane, miAssets allow seamless asset movement across chains like Ethereum, Arbitrum, and Optimism, reducing fragmentation.

This programmability and composability make miAssets a versatile tool for traders seeking to optimize their portfolios.

Benefits of miAssets for Traders

miAssets offer several advantages for traders, enhancing portfolio adaptability:

- Cross-Chain Exposure: Mitosis’s permissionless interoperability, facilitated by partnerships like Hyperlane, allows miAssets to be moved across different chains without manual bridging. This reduces liquidity fragmentation and enhances capital efficiency, enabling traders to chase yields across multiple networks.

- Passive Yield Generation: Fees from cross-chain transactions are accumulated in Mitosis Vaults and distributed to miAsset holders, providing a steady stream of passive income. This is particularly appealing for traders who prefer automated, low-maintenance strategies.

- Governance Participation: miAssets grant holders voting power in the EOL governance process, where they can influence liquidity allocation across chains. This participatory approach ensures that liquidity is directed toward high-yield opportunities, aligning with the community’s interests. For instance, an LP holding 3% of all miweETH can allocate 3% of ecosystem-owned weETH in Mitosis Vaults, as detailed in Mitosis Narrative - A New Primitive for Open Liquidity Marketplace.

- Composability: miAssets can be used as collateral in lending protocols, staked in yield farming, or traded on decentralized exchanges, offering traders a wide range of strategies to diversify their portfolios. This is supported by Expedition: The Mitosis LP Campaign, which emphasizes miAsset-based DeFi on Mitosis L1.

Governance and Influence

One of the most compelling features of miAssets is the governance power they confer to holders. Through the EOL model, miAsset holders can participate in periodic gauge votes to determine how the ecosystem-owned liquidity is allocated across different dApps and chains. The process involves forum discussions, signaling proposals, and gauge proposals, all voted on by LPs using their miAssets. For example, protocols initiate discussions on the Mitosis Forum, and LPs vote to opt-in EOL to the protocol, followed by gauge votes on the allocation ratio, as outlined in Ecosystem-Owned Liquidity: Redefining LP Asset Management.

LPs can also delegate their voting power to dApps by depositing miAssets, allowing those protocols to influence liquidity allocation while retaining the ability to reclaim voting rights. This model fosters a more decentralized and community-driven approach to liquidity management, contrasting with traditional DeFi, where decisions are often centralized.

Use Cases for miAssets in Trading

The evidence leans toward miAssets enabling a variety of trading strategies, enhancing portfolio flexibility:

- Yield Farming: Traders can stake their miAssets in various DeFi protocols on Mitosis’s ecosystem to earn additional rewards, amplifying their overall yield. For instance, staking miweETH can earn EigenLayer points, as mentioned in What is Mitosis Ecosystem?.

- Lending and Borrowing: By using miAssets as collateral, traders can borrow other assets to engage in leveraged trading or arbitrage opportunities across different chains. This is facilitated by the composability of miAssets, allowing them to be used in lending protocols like Aave, as noted in Mitosis Narrative - A New Primitive for Open Liquidity Marketplace.

- Arbitrage: The ability to move miAssets seamlessly across chains enables traders to exploit price discrepancies between different markets, potentially generating significant profits. This is particularly effective given Mitosis’s native asset movement, reducing costs and delays.

- Governance and Staking: Participating in EOL governance not only allows traders to influence the direction of the ecosystem but also potentially earns them additional rewards through staking miAssets. The Mitosis Expedition campaign, for example, allows users to earn MITO Points by holding miAssets, granting access to $MITO governance token airdrops, as detailed in Expedition: The Mitosis LP Campaign.

Comparison with Traditional DeFi

In traditional DeFi, liquidity positions are often locked in isolated pools, limiting their utility and flexibility. Traders must manually bridge assets between chains, which can be time-consuming, costly, and risky, as noted in the article What is Mitosis Ecosystem? on Gate.io Learn. miAssets, on the other hand, offers a unified liquidity pool that can be accessed across multiple chains, providing a more efficient and user-friendly experience. The governance aspect of miAssets ensures that liquidity is managed collectively, reducing reliance on centralized entities and enhancing decentralization.

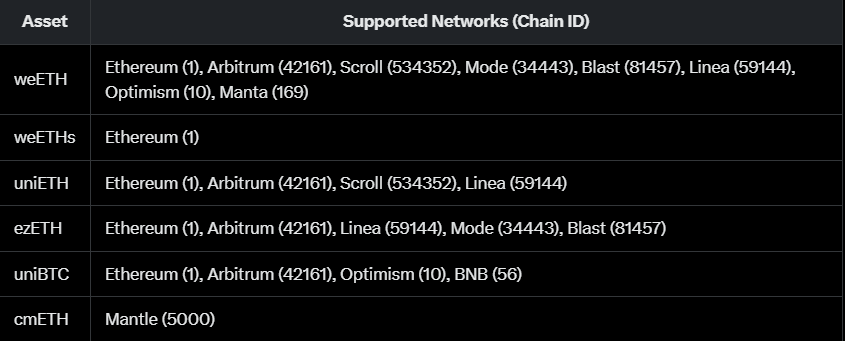

Supported Assets and Networks

Mitosis supports a range of assets across multiple networks, enhancing its cross-chain capabilities. The following table lists the supported assets and their respective networks, as per What is Mitosis Ecosystem?:

This extensive network support underscores Mitosis’s ability to unify liquidity, benefiting traders with diversified exposure.

Future Potential and Ongoing Developments

Mitosis is continuously developing its ecosystem, with upcoming features like Matrix Vaults promising to offer advanced DeFi opportunities. These developments will likely further enhance the utility of miAssets, providing traders with more tools to build sophisticated, high-yield strategies. The platform has already achieved over $80 million in TVL within three months, as reported in What is Mitosis - A Comprehensive Overview, indicating strong growth potential. Additionally, the Mitosis Expedition campaign, which allows users to earn MITO Points by depositing and holding miAssets, is set to gamify participation, potentially increasing adoption. Check out Expedition: The Mitosis LP Campaign.

Conclusion

miAssets represent a groundbreaking innovation in DeFi, offering traders the ability to build dynamic, cross-chain portfolios with unparalleled flexibility and efficiency. By leveraging the EOL model, traders can maximize their yields, participate in governance, and adapt to the ever-changing DeFi landscape. As Mitosis continues to grow and evolve, miAssets are poised to become a cornerstone of multi-chain trading strategies, promising lower costs, higher yields, and greater control over liquidity.

You can keep in touch with MITOSIS by following:

WEBSITE || X (Formerly Twitter) || DISCORD|| DOCS

Comments ()