Liquidity Isn’t Sticky Unless It’s Alive: How Mitosis Built Living Liquidity

In DeFi, liquidity is mercenary. It comes for yield, and it leaves when the next shiny protocol shows up. Billions slosh around bridges, vaults, and AMMs without allegiance. The result? High TVL, low utility. Yield wars, not real growth.

Mitosis takes a completely different approach: It doesn’t just attract liquidity it animates it.

Welcome to Living Liquidity the beating heart of the Mitosis. Let’s break down what makes it stick:

The Old Framework: Dead Liquidity

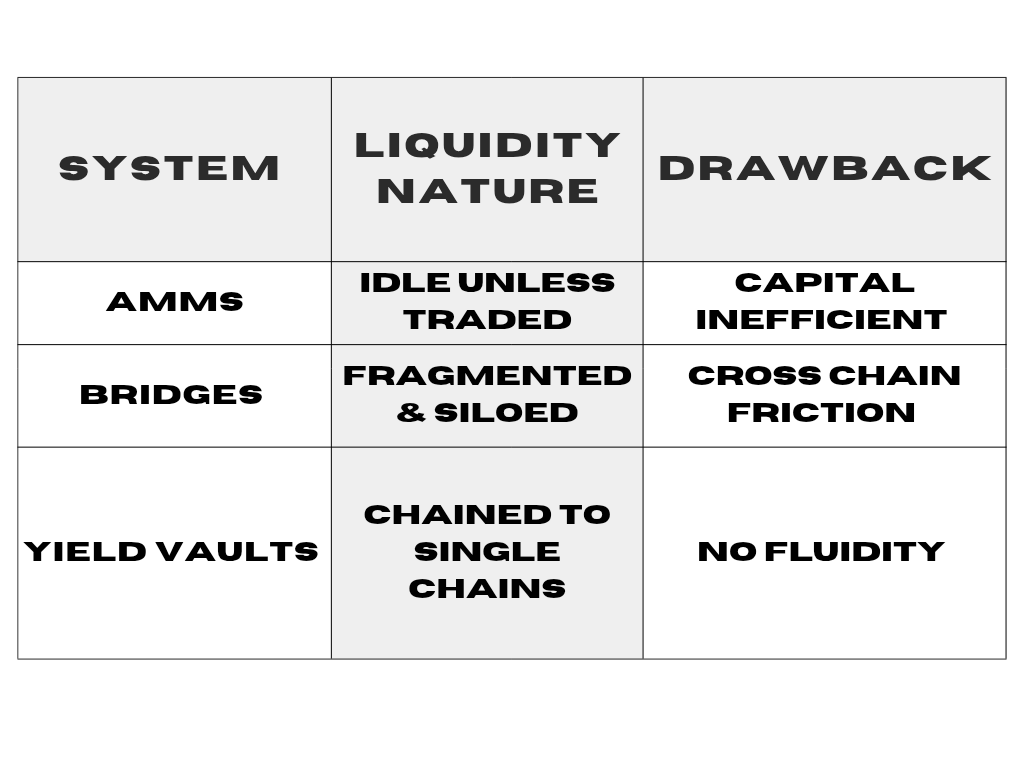

Most DeFi liquidity in static:

These systems treat liquidity like a static number: $X TVL. But in Mitosis, liquidity is a dynamic agent, not a passive stat.

Smart Liquidity Routing (Matrix Framework)

Mitosis invented the Matrix Framework a real time routing brain that: • Monitors yield, depth, and bridge demand across chains • Actively repositions assets into the most impactful locations • Makes liquidity responsive to the entire cross chain DeFi stack. Think of it like a decentralized traffic control system for capital.

Synthetic Liquidity, Rewired

Using miAssets (LRT wrapped liquid tokens) and maAssets (SynthCell minted synthetic counterparts), Mitosis creates: AssetBacking Role miAssets Real LRTs (e.g. eETH, mETH)Base layer value maAssets Overcollateralized synths Cross chain deployment. This dual structure lets Mitosis anchor liquidity in reality, while giving it synthetic freedom to flow where needed. Result: Mitosis can teleport liquidity into any ecosystem without bridging, using SynthCells and Hyperlane for settlement.

EOL (Ecosystem Owned Liquidity): Liquidity That Wants to Stay

Protocols usually rent liquidity via emissions. Mitosis changes this: • With EOL, protocols own shares of the liquidity system itself: • By holding maAssets/miAssets • By integrating into Matrix Framework. • By participating in MITO point weighted governance This makes liquidity sticky by design. Protocols aren’t just users they’re co owners.

The Endgame: Autonomous, Regenerative Liquidity

Mitosis is building toward autonomous liquidity markets: • Self rebalancing cross chain positions. • AI managed MLF vaults. • No bridging, just dynamic flow It’s not a bridge, It’s not a chain, It’s not a vault. It’s a living liquidity system. A basic so fundamental, it might become the backbone of modular DeFi itself.

Why It Matters

Liquidity isn’t just a number. It’s the energy of DeFi. And energy, left idle, dies. Mitosis doesn’t just preserve energy it animates it. DeFi’s future isn’t about where liquidity is, It’s about how alive it is.

Official links.

Mitosis University Explore Mitosis Now Mitosis Documentation blog Join the Mitosis Discord Follow Mitosis on Twitter (X)

Comments ()