💧Liquidity Pools: The Heart of DeFi Trading

Ever wonder how people trade crypto on DeFi apps without banks or middlemen?

The answer is liquidity pools — they keep things running behind the scenes

In this guide, we’ll explain what liquidity pools are, how they work, why they matter in DeFi, and what to watch out for — all in easy words with simple examples.

What Is a Liquidity Pool?

A liquidity pool is a smart contract that holds a bunch of tokens.

These tokens are used to make trading possible on decentralized exchanges (DEXs).

Instead of matching buyers and sellers like in traditional markets, traders use the pool to swap tokens.

Why Is It Called a “Pool”?

Because it’s like a pool of money that anyone can dip into to trade.

People put in two tokens — like ETH and USDC — and others can swap between them using that pool. The bigger the pool, the easier it is to trade.

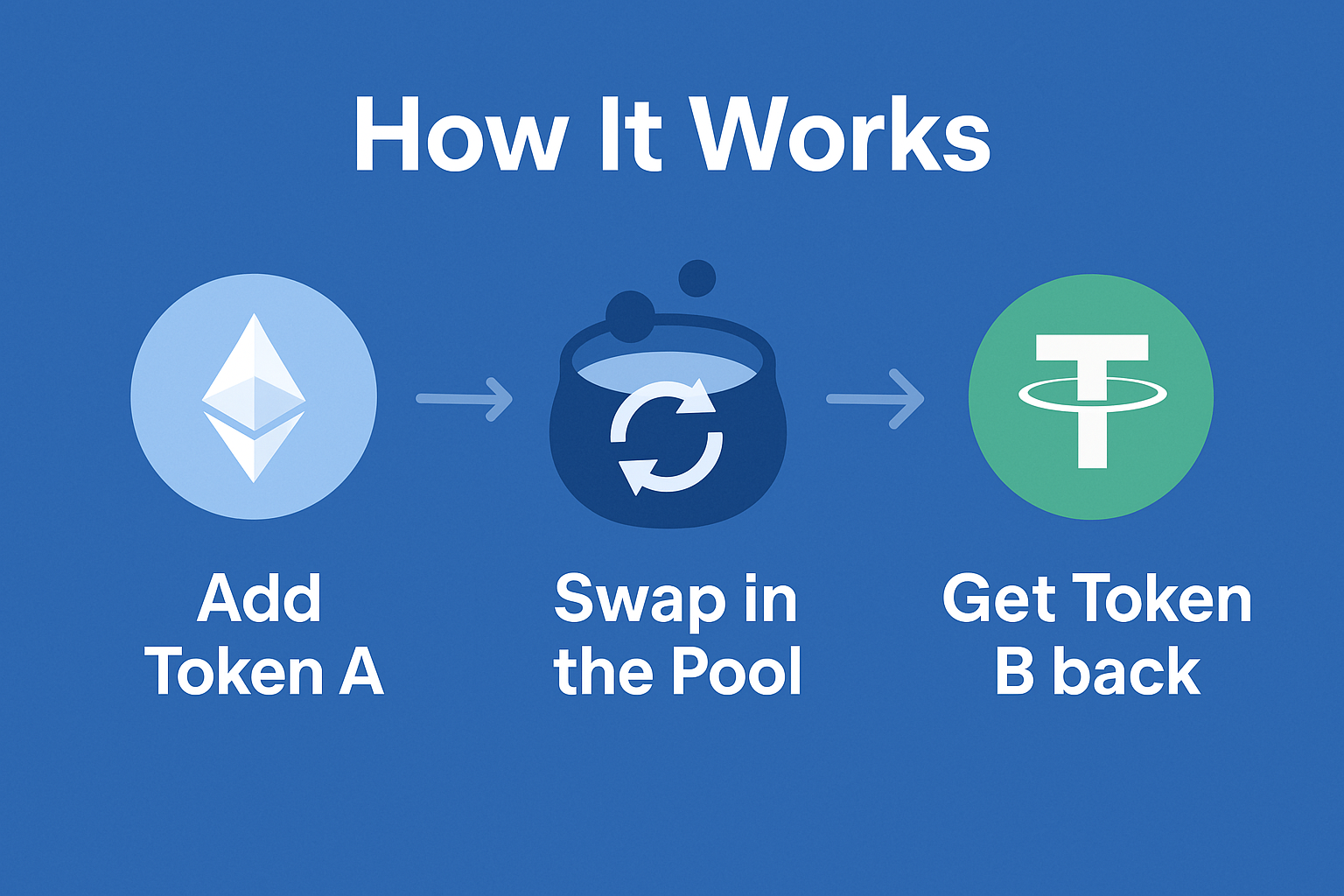

How Do Token Swaps Happen?

Let’s say a pool has ETH and USDC. You want to trade 1 ETH for USDC.

You:

- Send 1 ETH to the pool.

- The pool sends you the right amount of USDC back.

- Done!

No middlemen. Just smart contracts doing the work instantly.

Who Puts Tokens in These Pools?

Liquidity providers (LPs) do. They are users who add equal value of two tokens into a pool.

In return, they:

- Keep the system running

- Earn a share of trading fees from the pool

This is called earning yield or earning passive income.

Benefits of Liquidity Pools

Here’s why they’re useful:

✅ 1. 24/7 Trading

No waiting for a buyer or seller — just swap instantly.

✅ 2. Anyone Can Participate

You don’t need permission to trade or add liquidity.

✅ 3. Earn Rewards

LPs earn a piece of every trade made in the pool.

What Are the Risks?

Liquidity pools are powerful but not risk-free.

📉 1. Impermanent Loss

If one token changes price a lot, LPs might end up with less value than they started with.

🧨 2. Smart Contract Risks

If the smart contract has bugs or gets hacked, funds can be lost.

💧 3. Low Liquidity Issues

If a pool is too small, trades might cost more or fail due to slippage.

Example in Action

On Uniswap:

- A user adds $500 ETH + $500 USDC to a pool.

- Every time someone trades, the LP earns a small fee.

- After many trades, they might earn $30–$50 in a few days — depending on the volume.

Conclusion

Liquidity pools are the foundation of DeFi trading.

They let people swap tokens easily, earn rewards, and use DeFi without needing any third parties. If you trade in DeFi or want to earn with your crypto, liquidity pools are something you should understand.

Comments ()