Liquidity Provision Isn't Just Risk—It’s an Opportunity: Understanding Mitosis’ New Morse Criteria

Introduction

n a major win for the Morse NFT community, Mitosis.org has officially announced a confirmed airdrop allocation to Morse holders. This move signals not just a rewarding moment for loyal collectors, but also a deepening connection between NFTs and the broader decentralized finance (DeFi) ecosystem.

As projects continue to explore ways to bridge utility, ownership, and community rewards, the Mitosis airdrop stands out as a clear example of how early adopters are being recognized — and why holding the right assets is becoming more important than ever.

Overview of Morse Nfts

Morse NFTs are a collection of digital assets designed not just for art and ownership, but for active participation in the evolving mitosis ecosystem. Known for their distinct design language and tight-knit community, Morse NFTs have quickly built a reputation for being more than just profile pictures — they are gateways to broader opportunities in Mitosis, governance, and exclusive airdrops.

Each Morse NFT symbolizes a node in a growing decentralized network, offering holders early access to ecosystem expansions, community-driven projects, and, now, major rewards like the confirmed Mitosis airdrop.

With limited supply and a dedicated holder base, Morse NFTs represent a blend of digital culture, identity, and real utility — a combination that is becoming increasingly rare in today’s crowded NFT landscape.

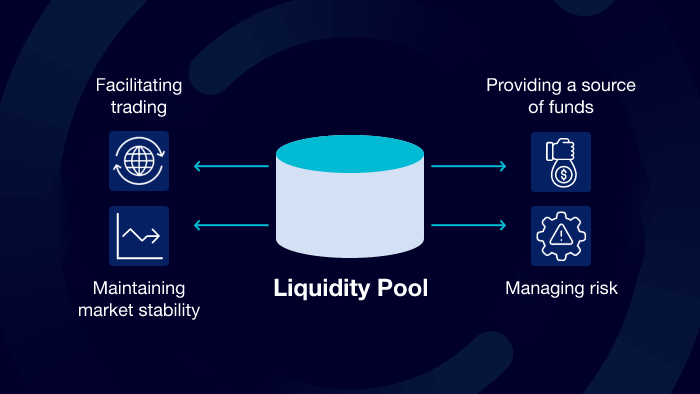

Pros of Liquidity Provision

- Earn Fees/Rewards:

Liquidity providers (LPs) earn a portion of the trading fees or incentives (like LP tokens or governance tokens). - Passive Income:

Once provided, liquidity can generate yield with minimal active management. - Token Exposure:

You maintain exposure to the assets in the pool, potentially benefiting from their appreciation. - Support Ecosystems:

Providing liquidity helps decentralized exchanges function and grow by reducing slippage for traders. - Access to Incentives:

Many platforms offer "liquidity mining" rewards as extra incentives for LPs.

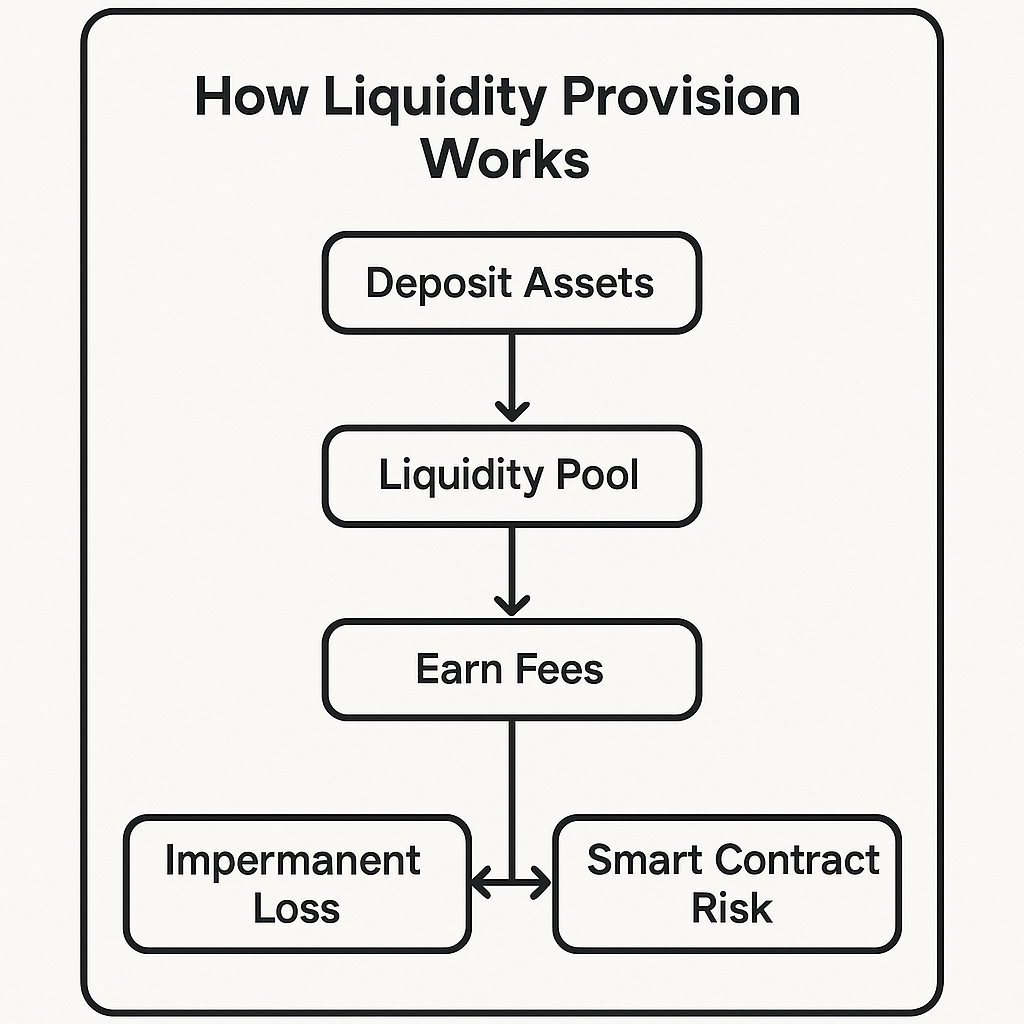

Cons of Liquidity Provision

- Impermanent Loss:

If token prices diverge significantly, LPs might end up with less value than if they just held the tokens. - Smart Contract Risk:

Bugs or exploits in the protocol’s code could lead to loss of funds. - Low Utilization Risk:

If the pool isn’t used much, rewards may not justify the opportunity cost. - Exposure to Volatile Assets:

You’re exposed to both assets in the pair, which might drop in value. - Platform Risk:

Centralized or poorly-governed DeFi platforms can pose additional risk (e.g., rug pulls, mismanagement).

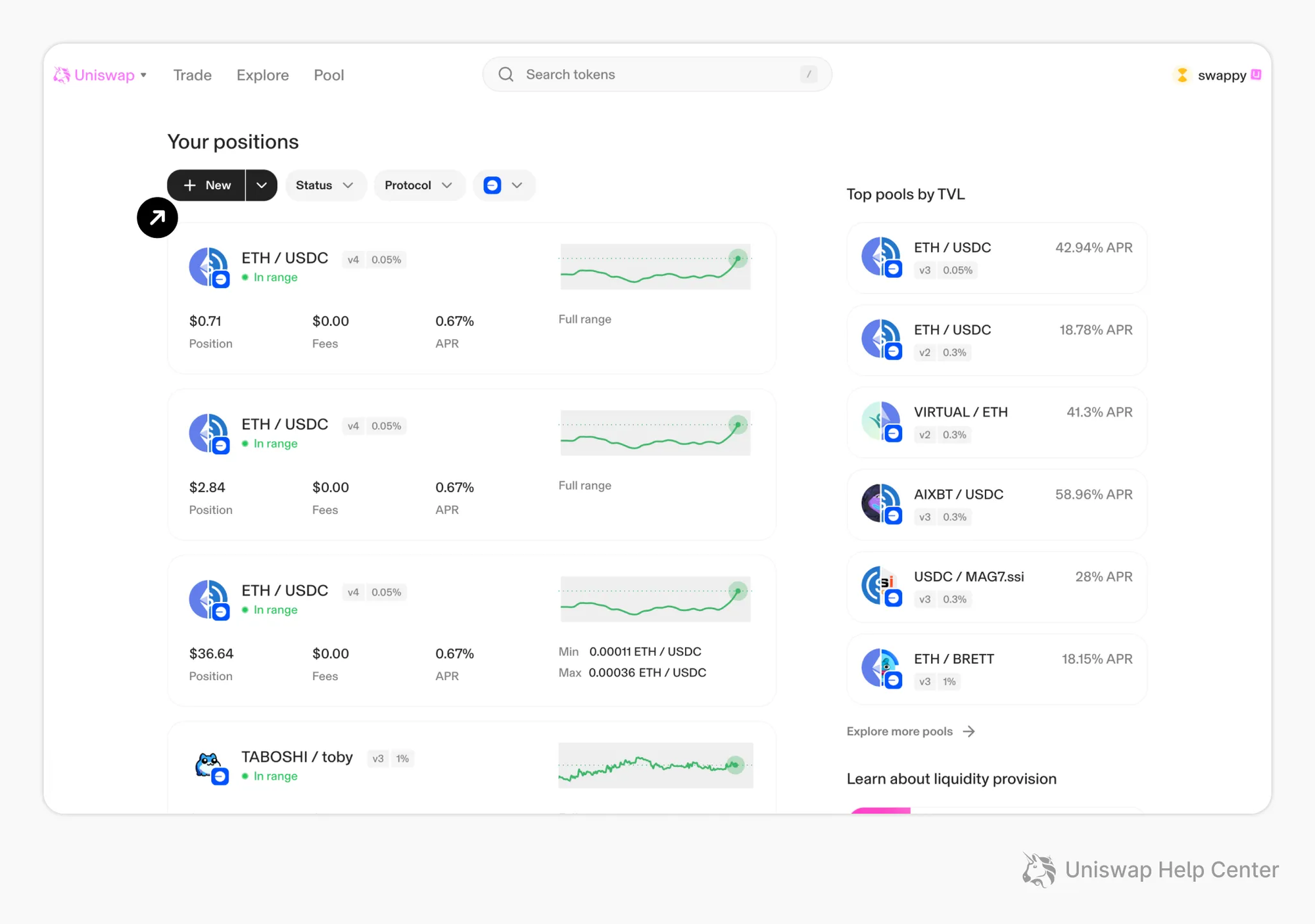

Examples Uniswap (DeFi / Crypto)

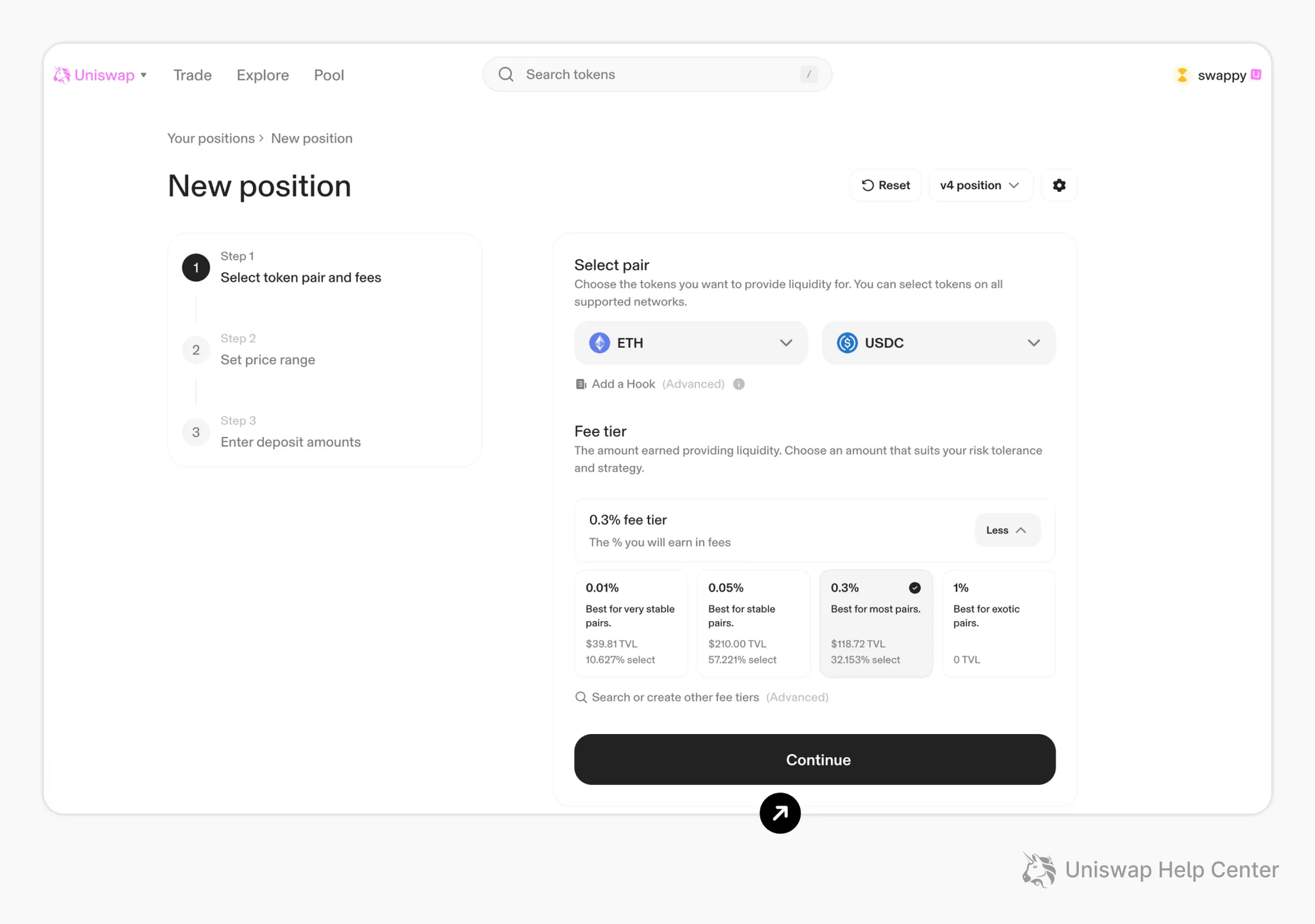

- Scenario: You provide $5,000 worth of ETH and $5,000 worth of USDC into an ETH/USDC liquidity pool on Uniswap.

- Pros:

- You earn 0.3% of every trade that happens in that pool, proportional to your share.

- If trading volume is high, those fees can stack up nicely — potentially even beating just holding ETH.

- Cons:

- If ETH's price rises sharply, you end up with less ETH and more USDC (because of the pool’s constant rebalancing).

- Even though the dollar value of your holdings grows, it grows less than if you had simply held ETH outright — this is impermanent loss.

- Plus, Uniswap smart contracts could have vulnerabilities (though it’s very battle-tested by now).

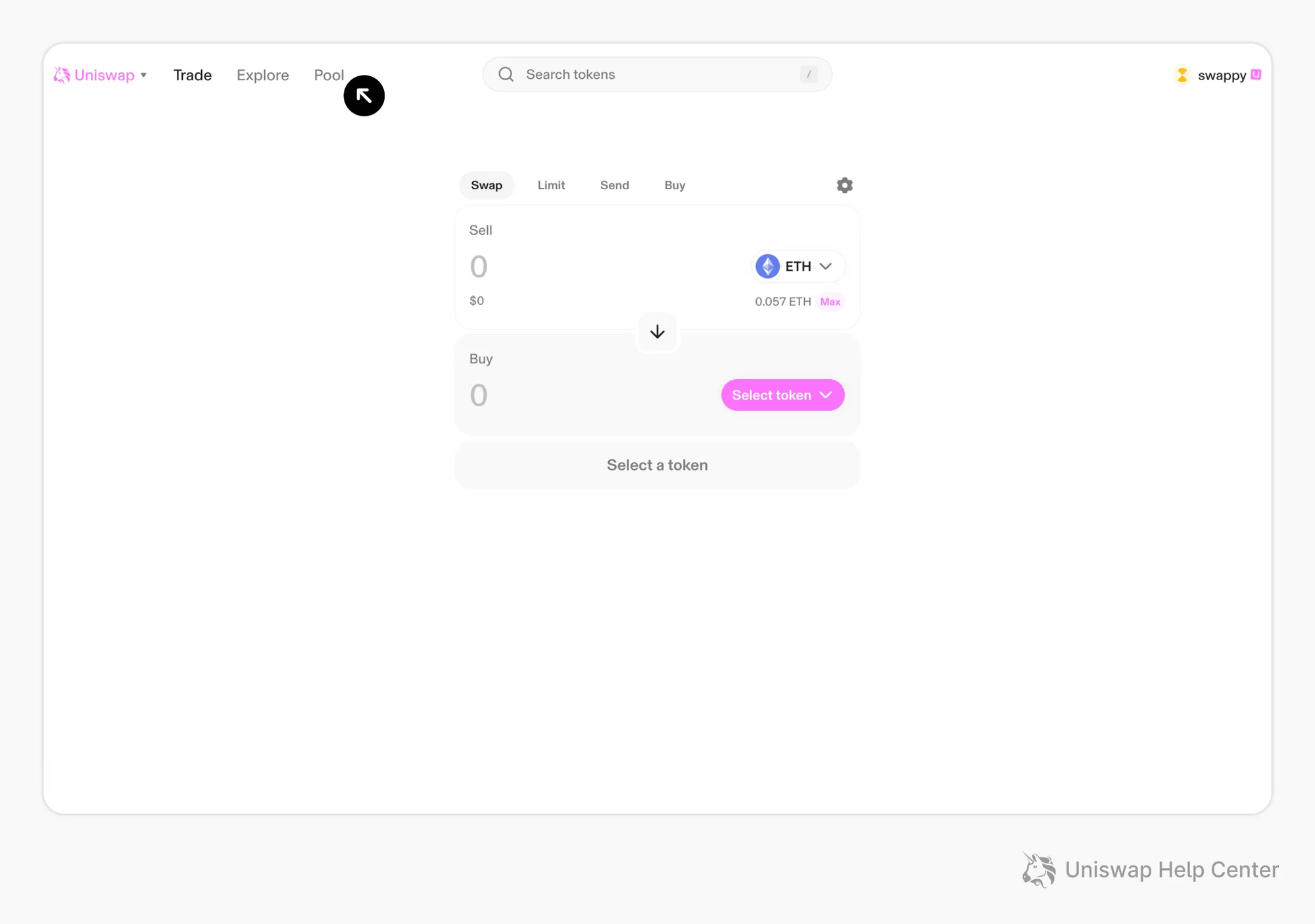

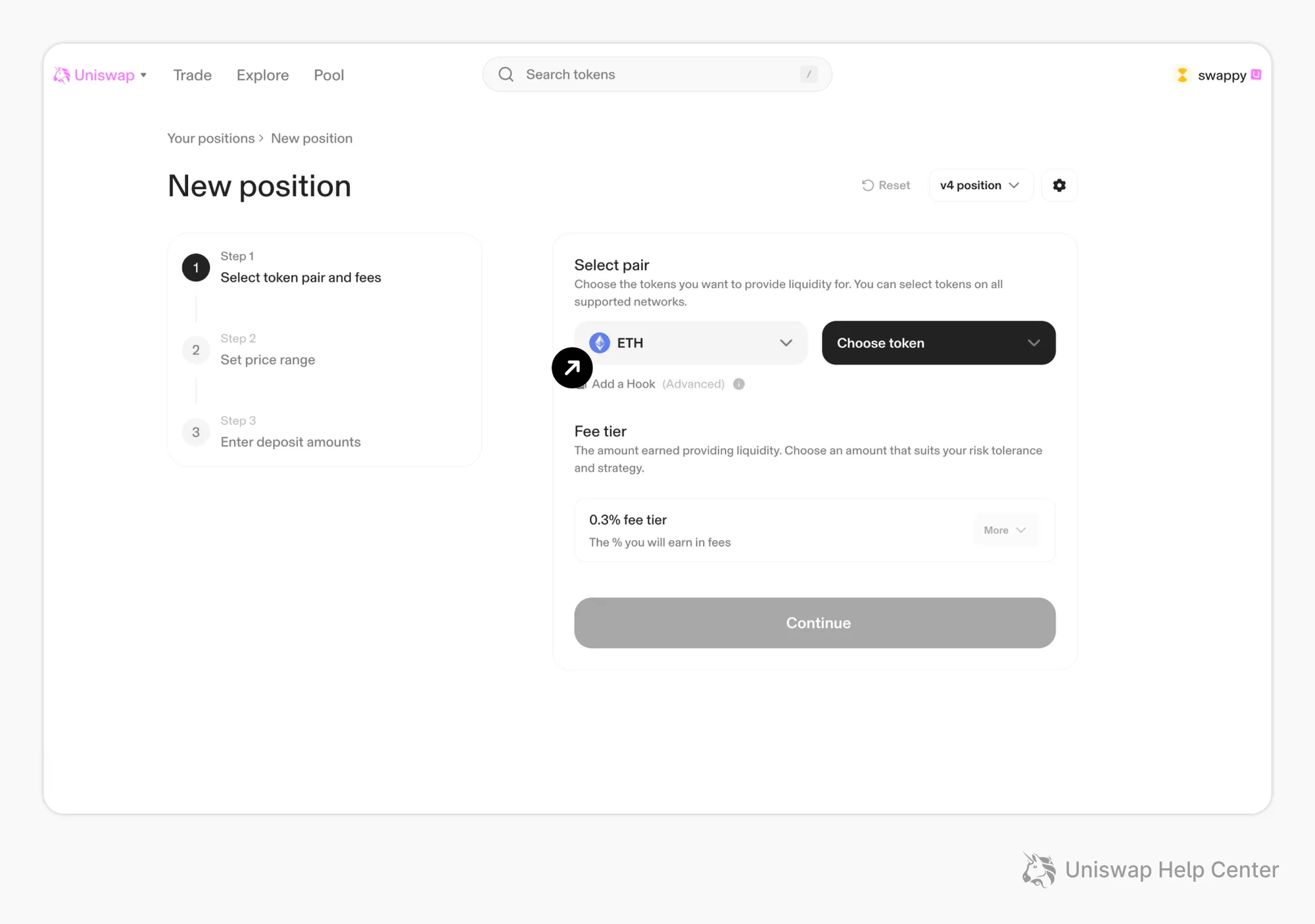

How to Provide Liquidity for $MORSE on UNISWAP

Open the webpage and connect your wallet

Select "pool" and select New

Select the token with CA

Proceed to provide liquidity with your preferred pair

Accept the transaction using Metamask by clicking “Confirm”. Mind the gas fee!

Once the first transaction is confirmed, click “Supply” and accept the transaction using Metamask. Mind the gas fee!

The transaction may take some time.

Why MITO Allocation for the Morse Community?

The Morse community has been a solid cultural root of Mitosis, not just another NFT project in the market. There were no paid mints or pre-sales. Instead, what emerged was something much rarer: The community built on lore, trust, and conviction. By allocating a portion of MITO to the Morse community, Mitosis Foundation is not simply rewarding NFT holders, but seamlessly onboarding the long-term and culturally aligned core community into the Mitosis ecosystem. This distribution ensures that the cultural and belief DNAs of Morse naturally flow into the long-term Mitosis future, aligning with the core philosophy of the Mitosis token economy: DNA. We're not distributing MITO for speculation, but distributing it to acknowledge those who stuck around and contributed, as we emphasized when announcing the DNA initiative. It's all about the ALIGNMENT.

Eligibility Criteria Preview

- Snapshot: A total of six snapshots will be used to determine eligibility and amounts. Some have already been taken. The rest will take place over time, both before and after the Mitosis mainnet launch.

- Additional Allocation Weights May Apply for Users Who:

Why Mitosis’ Morse Announcement Could Tip the Scales By tying eligibility to liquidity provision, Mitosis is flipping the script. They’re not just asking users to take on LP risks—they’re offering an additional layer of potential rewards. This shifts the dynamic from provide liquidity and hope for fees to provide liquidity and strengthen your future participation in the ecosystem. It’s about deeper alignment. If Morse becomes a key pillar of Mitosis’ growth, early liquidity providers aren’t just earning fees—they're positioning themselves for future benefits: access, governance power, and maybe even rare airdrop opportunities. And in a space where real commitment is often overlooked for fast profits, that kind of long-term thinking feels different. It feels like the future. Conclusion: Liquidity provision will never be risk-free. But when a protocol rewards the behavior that strengthens it—not just holding, but active participation—it creates an ecosystem where users and builders grow together. With Morse, Mitosis is giving users a clear message: Those who provide the roots today may harvest the fruits tomorrow. And in DeFi, that’s a bet worth understanding.

Useful Links

Comments ()