Liquidity Without Limits: How Mitosis and Hyperlane Solve DeFi's Liquidity Puzzle

The blockchain ecosystem is rapidly expanding as modular chains, rollups, and specialized networks create unprecedented opportunities for innovation and scalability. Yet this comes at a cost: fragmented liquidity and disjointed user experiences—moving between blockchains remains needlessly complex and inefficient.

Mitosis and Hyperlane are working to solve this fundamental challenge. Hyperlane enables permissionless expansion, while Mitosis leverages this infrastructure to build a network for programmable liquidity. Their synergy allows assets to flow freely across blockchain boundaries without centralized gatekeepers or complicated user interfaces.

This article explores their solution to the modular blockchain puzzle, the advantages of their permissionless architecture, and Mitosis's first major initiative: expanding liquid staked tokens beyond Ethereum’s boundaries through the Expedition campaign.

The Challenge of Blockchain Fragmentation

The rise of modular blockchains has fundamentally transformed the crypto landscape. Rather than building monolithic blockchains that handle every function—consensus, execution, settlement, and data availability—modular designs separate these concerns into specialized layers. This approach has unlocked unprecedented scalability and customization options, enabling the creation of purpose-built chains optimized for specific use cases.

However, this specialization comes with significant trade-offs as the ecosystem fragments into a myriad of chains and rollups:

- Fractured liquidity: Assets spread across multiple chains result in lower capital efficiency, worse trading prices, and reduced yield opportunities.

- Disjointed user experiences: Users must navigate different wallets, bridge interfaces, and DEXs for each chain they interact with.

- Limited interoperability: New chains often struggle to connect with existing networks, as traditional bridging solutions (e.g. Stargate, Wormhole, etc.) require manual integration and restrictive approval processes.

These challenges create substantial friction for both developers and users. For developers, it means limited access to users and liquidity. For users, it means complexity, inefficiency, and inherent risks as they navigate between isolated blockchain environments.

There are a few exceptions where protocols manage to attract liquidity despite this existing friction by implementing short-term incentive structures focused solely on increasing TVL, therefore attracting mercenary capital that is just as extractive as the short-term vision behind these campaigns.

While TVL growth is undoubtedly a key factor in a protocol's success, accessibility is equally crucial and must be prioritized. Users naturally seek alternatives when a chain feels isolated and lacks a supporting long-term vision.

What's needed is an approach that preserves the benefits of specialization while eliminating barriers between chains. This is where Mitosis and Hyperlane enter the picture, with a permissionless vision for blockchain interoperability.

Hyperlane: Reimagining Blockchain Interoperability

Traditional cross-chain messaging protocols follow a permissioned model. Chains must lobby bridge providers to gain connectivity, and these providers manually integrate networks one by one. This inevitably hinders the growth of their entire ecosystem.

Hyperlane takes a fundamentally different approach with its open interoperability framework. The key distinction lies in how chains join the network:

Traditional Bridge Model (closed interop): Bridge team decides which chains to support (and at times employs exclusivity agreements) → Manual deployment (with fees) → Limited network reach

Hyperlane Model (open interop): Any chain can independently deploy Hyperlane → No need to contact Hyperlane (unless it's preferred to do so) → Unlimited network potential

Top line use cases are quite similar. Message passing networks that enable cross chain assets and applications. But quite different approaches.

— NoSleepJon 💤⏩ (@nosleepjon) March 6, 2025

- LayerZero has a permissioned deployment queue and is known for exclusivity agreements. 6-7 figure deployment fees in some cases. At…

This permissionless architecture brings several crucial advantages: multi-VM adaptability, modular security, and future-proof connectivity.

Multi-VM Support

Beyond EVM-compatible chains, Hyperlane supports a wide range of additional execution environments thanks to its various implementations, which include:

- Sealevel for Solana Virtual Machine (live on Solana and Eclipse)

- CosmWasm, implemented by Mitosis, for Cosmos (live on Celestia, Stride, and Neutron)

- Move, implemented by Movement Labs

- And more (both live and in development)

This multi-VM support enables true cross-ecosystem communication, breaking down silos between blockchain families.

Modular Security

Hyperlane is secured by Interchain Security Modules (ISMs), smart contracts that are responsible for verifying that interchain messages being delivered on the destination chain were actually sent on the origin chain. These modules function like “security legos" that can be combined and configured to meet specific requirements. Developers are free to choose between the Hyperlane Mailbox’s default ISM or customize their own application-specific one.

This flexibility means protocols can make their own security concessions while building their security stack rather than being bound by a bridge provider's security model. Moreover, as new security innovations emerge, they can be adopted without changing the underlying interoperability infrastructure.

Future-Proof Connectivity

Perhaps most importantly, Hyperlane's architecture eliminates dependency on a central team for network expansion. As the modular ecosystem continues to grow with hundreds or thousands of specialized chains, Hyperlane can scale alongside it without constraints.

Hyperlane creates the foundation for a truly connected blockchain ecosystem. But communication alone isn't enough—assets need to flow efficiently between these connected systems. This is where Mitosis enters the picture.

Mitosis: The Cross-Chain Liquidity Layer

Mitosis builds on Hyperlane's permissionless communication infrastructure to create a unified liquidity protocol. Its mission is to enable the free flow of assets across the modular ecosystem by establishing an infrastructure where liquidity positions are transformed into programmable primitives.

The protocol introduces a novel approach to cross-chain liquidity deployment through its Mitosis Vault system. With a modular architecture built upon Cosmos which incorporates an execution layer fully EVM-compatible and Hyperlane as its core interoperability layer, Mitosis acts as a liquidity hub for all connected chains and rollups, restoring balance to the currently fractured liquidity stack.

The Mitosis Vault Infrastructure

At the heart of Mitosis lies its vault infrastructure, which transforms user’s deposit positions across multiple chains into composable assets. When users deposit assets into a Mitosis Vault on any supported chain, they receive Vanilla Assets that are 1:1 equivalent to the underlying assets deposited. These Vanilla Assets exist on the Mitosis chain and are representations of assets deposited into Vaults across the multiple chains supported by Mitosis.

Vanilla Assets are the foundation on which liquidity is made programmable. After minting, they can be locked and supplied into a MLF Vault (which mints either miAssets or maAssets depending on the framework being utilized). This is essentially how holders are able to participate in various yield-generating opportunities on selected DeFi protocols while always maintaining a tokenized representation of their positions on the Mitosis Chain.

The Cross-chain Deposit Module (CCDM) is a critical component of this infrastructure, handling the complex process of asset transfers between chains. It consists of two main parts (CCDM Host and CCDM Client), which based on the required process call specific functions that instruct the passing of messages through Hyperlane, which relays the information needed for operation.

One Protocol, Unlimited Chains

The most significant advantage for users is simplicity. By directly inheriting Hyperlane's extensive network connectivity, Mitosis eliminates the need to navigate through multiple bridges, wallets, and DEXs when moving assets between chains. Instead of learning and trusting numerous cross-chain protocols—each supporting only a handful of networks—users can access the entire modular ecosystem through a single, unified liquidity layer.

This streamlined experience makes cross-chain activities more accessible to everyday users, not just experienced crypto natives. Whether bridging assets, trading, lending, or borrowing, all interactions can be managed through a single interface without compromising on security or efficiency.

Autonomous Expansion Capabilities

The permissionless nature of Hyperlane gives Mitosis extraordinary flexibility to expand its reach. When new modular chains emerge—as they inevitably will in this rapidly evolving landscape—Mitosis can quickly integrate them without lobbying bridge providers or waiting for approvals.

This means Mitosis can extend support to frontier chains immediately after launch, bringing liquidity to new ecosystems when they need it most and providing users immediate access to those chain's capabilities without lengthy integration delays or the need to go through complex multi-step processes.

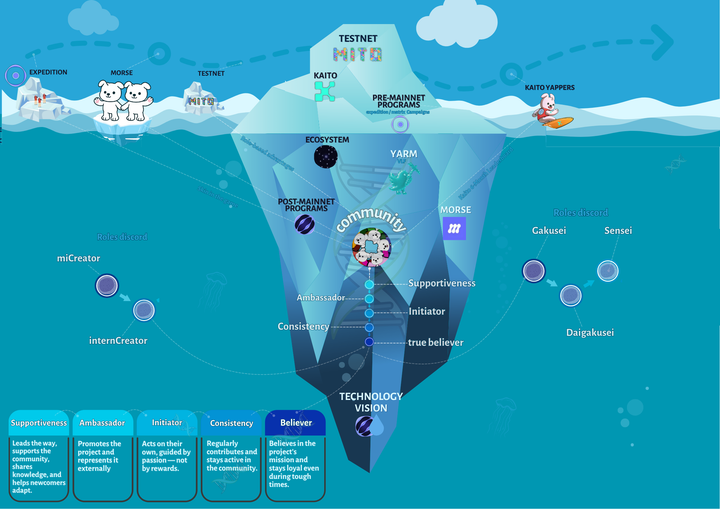

Expedition: Pioneering LRT Expansion to the Modular Ecosystem

The first major initiative for Mitosis was the Mitosis Expedition campaign (still live to this day), which focuses on liquid restaking tokens (LRTs) expansion beyond Ethereum's boundaries. This strategic choice addresses a significant market need, as LRTs represent one of the largest primitives in DeFi yet remain largely confined to their native ecosystems.

Users can deposit liquid staked tokens like eETH, weETH, and other popular LSTs into Mitosis Vaults and receive miAssets that can be used throughout the Mitosis app ecosystem.

This approach not only makes these tokens more fluid—allowing them to move seamlessly across diverse blockchains—but also creates new yield opportunities for liquidity providers who can now earn from both staking rewards and cross-chain DeFi activities simultaneously. As the modular ecosystem continues to expand, Mitosis plans to extend this model to additional asset classes (including stablecoins), progressively building towards a new infrastructure capable of pioneering the next phase of DeFi.

Liquidity hosted by Expedition will be used for the Mitosis EOL (Ecosystem-Owned Liquidity) program, in addition to retaining liquidity in the form of miAsset.

Use Case Examples

A practical example of the inner workings of EOL was demonstrated in December 2024 during the incentivized Game of MITO testnet, which showcased the functional applications of the EOL Framework.

Participants could:

- deposit their assets into Mitosis Vaults from different chains (e.g. Ethereum Sepolia, Arbitrum Sepolia, Base Sepolia, etc.)

- use those assets to opt-in to Mitosis EOL

- and use miAssets across various dApp

The tokenized LP positions became composable building blocks, which allowed various applications including:

- being used as collateral to trade perpetual futures

- provide liquidity to AMMs pools

- swap assets natively on a Mitosis DEX regardless of the original chain’s provenance

- the ability to lend, borrow, and create looped leveraged positions

A New Paradigm for Cross-Chain Liquidity

As the modular blockchain era accelerates, the demand for seamless cross-chain experiences will only grow. The traditional approach of siloed liquidity and manual integrations simply cannot keep pace with the explosion in the number of specialized chains and rollups. Mitosis and Hyperlane's solution addresses this challenge at its root by eliminating dependency on centralized approvals and creating a solution to the fractured liquidity stack.

For developers, this means access to broader liquidity and user bases without the complexity of integrating multiple cross-chain protocols. For users, it means a simplified experience where the underlying complexity of cross-chain interactions is abstracted away.

The Expedition campaign marks just the beginning of this vision, targeting liquid staked tokens as a strategic first step. As the infrastructure matures and expands to more asset classes and chains, we're moving toward a future where blockchain boundaries become invisible to the end user—where liquidity truly has no limits.

Comments ()